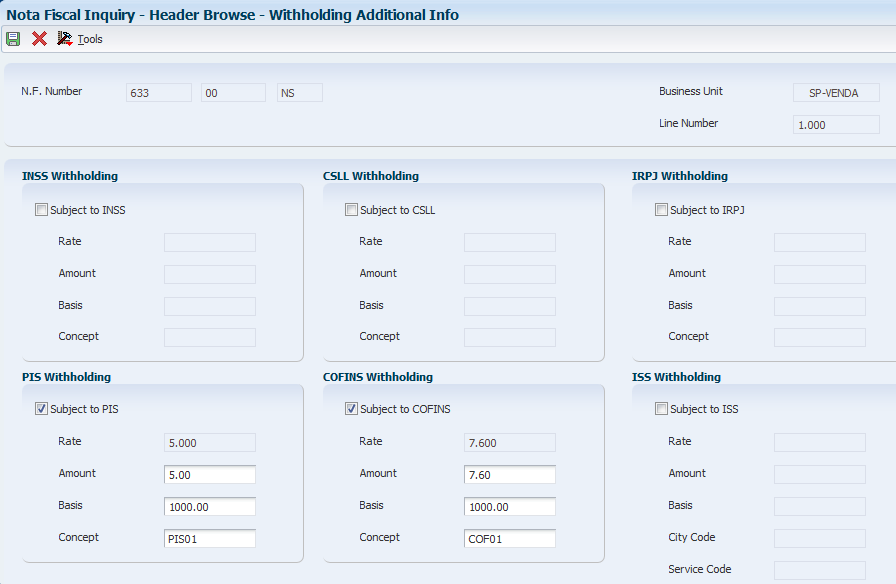

Entering and Modifying Withholding Information for IRPJ, INSS, and ISS

Access the Withholding Additional Info form.

Select the check box for the withholding type that you want to modify. Options are:

INSS

IRPJ

ISS

PIS

You can select this option only when PIS withholding was not applied to the sales order. If one or more records exist for PIS withholding, you use the Withholding Additional Info Revisions form to access the records and make changes.

COFINS

You can select this option only when COFINS withholding was not applied to the sales order. If one or more records exist for COFINS withholding, you use the Withholding Additional Info Revisions form to access the records and make changes.

CSLL

You can select this option only when CSLL withholding was not applied to the sales order. If one or more records exist for CSLL withholding, you use the Withholding Additional Info Revisions form to access the records and make changes.

Complete the following fields, as necessary, for the withholding types that you selected:

Amount

Basis

Concept

For ISS withholding, complete these fields as applicable:

City Code

Service Code

Sales Code

Click OK.