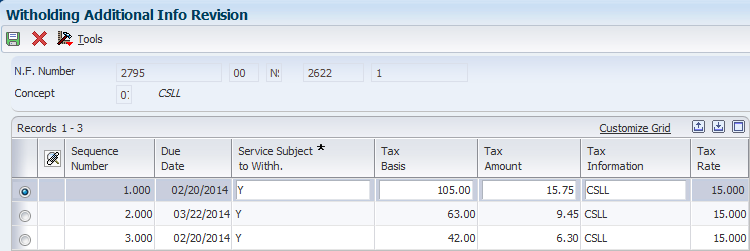

Entering and Modifying Withholding Information for PIS, COFINS, and CSLL

Access the Withholding Additional Info Revisions form.

You use the Withholding Additional Info Revisions form to work with PIS, COFINS, and CSLL withholding only. If no withholding was calculated, you must select the Subject To check box for the withholding type on the Withholding Additional Info form before you can access the Withholding Additional Info Revisions form from the Form menu options on the Withholding Additional Info form.

You cannot add withholding lines. You can only modify existing lines.

- Service Subject to Withh. (service subject to withholding)

Enter Y (yes) if withholding applies for the line.

If you change the value from Y to N (no), and then exit the field, the system deletes the withholding information from the line.When you exit the form, the system saves your changes to the F76B424 and F76B429 tables.

- Tax Basis

Enter the amount that is taxed.

- Tax Amount

Enter the tax amount, which is the tax basis multiplied by the tax rate.

- Tax Information

Enter a value from the Tax Code table (F76B0401).