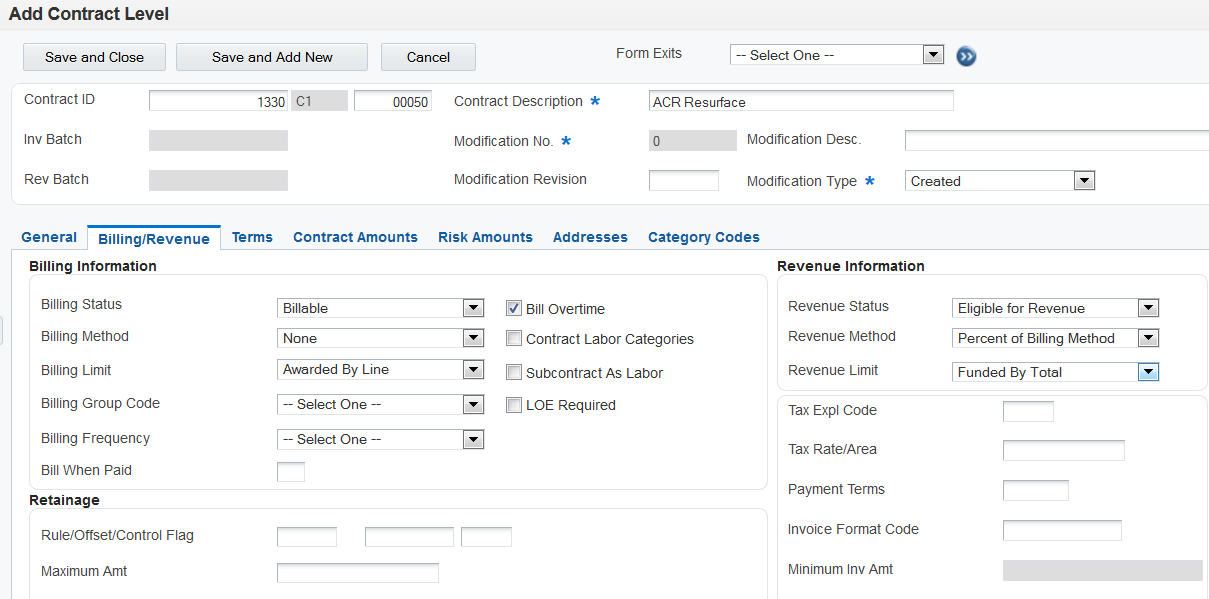

Billing and Revenue Information

Select the Billing/Revenue tab on the Add Contract Level form.

- Billing Status

Select a value from UDC table 52G/BS. Values include Awaiting Final Bill, Billable, Billing Complete, Do Not Bill, and On Hold.

- Billing Method

Select a value from UDC table 52G/BM to specify the billing method for the funding level. Values include:

Cost Plus: Bill the base cost plus the applied burdens, plus any specified fee.

Fixed Price: Bill based on specific contract terms, for example, percent complete, milestone, and so on.

None: Do not bill.

Time and Materials: For labor transactions, bill the labor hours multiplied by the T and M (time and materials) billing rate/markup table. For non-labor transactions, either bill the base cost plus applied burdens, plus any specified fee, or bill the base cost plus a specified markup percentage, plus any specified fee.

These values are hard-coded.

When you create billing lines, the system generates a warning if the billing line type does not match the billing method in the funding level.

- Billing Limit

Select a value from UDC table 52G/LM. Values include:

Awarded By Line: The system uses the awarded amounts and applies limits separately to the cost amount, fee amount, and award fee amount.

Awarded By Total: The system uses the awarded amounts and applies limits to the total of the cost amount, plus the fee amount, plus the award fee amount.

Funded By Line: The system uses the funded amounts and applies limits separately to the cost amount, fee amount, and award fee amount.

Funded By Total: The system uses the funded amounts and applies limits to the total of the cost amount, plus the fee amount, plus the award fee amount.

No Limit: The contract does not use limit processing.

These values are hard-coded.

- Billing Group Code

Select a value from UDC table 52G/BG. You can use billing group codes in the data selection for the Invoice Generation program (R52121) to process groups of contracts at the same time.

The values in UDC table 52G/BG are not hard-coded.

- Billing Frequency

Select a value from UDC table 52G/BF to specify the frequency to bill the customer. You can use this field in the data selection for the Invoice Generation program (R52121) to narrow the selection of records for processing.

The values in UDC table 52G/BF are not hard-coded.

- Bill When Paid

Select to indicate that you can bill only supplier invoices that have been paid. If you do not select this check box, you can bill for supplier invoices that are either paid or unpaid.

- Rule

Select a rule to use for calculating retainage. You define retainage rules in the Retainage Rules Table program (P5204).

See Setting Up Retainage Rules for Advanced Contract Billing Contracts.

- Offset

Enter the code to designate the offset accounts for retainage, for example RETN or 1225. You set up the code as an automatic accounting instruction (AAI).

For JD Edwards EnterpriseOne Contract Billing, the hierarchy to determine the business unit (BU) for the retainage account is as follows:

The system retrieves the RCRETN AAI using the company number and uses the BU, object account (OBJ), subsidiary (SUB) specified in the RCRETN AAI.

If the RCRETN AAI has a blank BU, the system uses the host BU for the RCRETN retainage account.

If no host BU is defined on the contract master, the system uses the project number on the contract billing line for the retainage entry.

Note: Do not use code 9999. This is reserved for the post program and indicates that offsets should not be created.See Setting Up Retainage Rules for Advanced Contract Billing Contracts.

- Control Flag

Specify whether the system stores the retainage amount in the JD Edwards EnterpriseOne Accounts Receivable system or the JD Edwards EnterpriseOne General Accounting system, and whether the system tax is calculated on the whole amount, including the retainage, or on each amount as it is billed. Values are:

Blank: The retainage is stored in the JD Edwards EnterpriseOne Accounts Receivable system, and the tax is calculated from the total taxable amount.

1: The retainage is stored in the JD Edwards EnterpriseOne Accounts Receivable system, and the tax on the retainage amount is calculated and then subtracted from the total tax amount. This tax on retainage is deferred until the retainage is released

2: The retainage is stored in the JD Edwards EnterpriseOne General Accounting system, and the tax is computed from the total taxable amount.

3: The retainage is stored in the JD Edwards EnterpriseOne General Accounting system, and the tax on the retainage amount is calculated and then subtracted from the total tax amount. This tax on retainage is deferred until the retainage is released

- Maximum Amt (maximum amount)

Specify a maximum amount that can be held for retainage.

- Maximum Foreign Amt (maximum foreign amount)

If the contract is entered in a foreign currency, specify the maximum amount that can be held for retainage in the foreign amount.

- Bill Overtime

Select to indicate that overtime is billable. This field is used for informational purposes only and does not control whether overtime is billed.

- Contract Labor Categories

Select to indicate that the contract requires you to use labor categories.

- Subcontract as Labor

Select to indicate that subcontractor labor is to be treated as labor on a contract. If you select this check box, the system requires that you enter hours and contract-specific labor categories (if applicable) and validates them for all associated transactions.

- LOE Required (level of effort required)

Select to indicate that level of effort requirements apply to this contract.

- LOE Target Hrs (level of effort target hours)

Enter the total number of hours that you must deliver to earn the specified fee amount for the contract. The system displays this field only when you select the LOE Required check box.

The system uses the hours that you specify when you set up fee billing lines using the LOE at funding level method.

- Variance Pct (variance percentage)

Specify a percentage to indicate a variance from the target LOE hours. If the hours that you book towards this funding level are within this percentage of the target LOE hours, you can still earn the fee. You specify the target LOE hours in the LOE Target Hrs field.

- Revenue Status

Select a value from UDC table 52G/RS to indicate whether the contract is eligible for revenue recognition. Examples include:

Eligible for Revenue, Not Eligible for Revenue, On Hold, and Revenue Complete

These values are not hard-coded.

The processing options for the Journal Generation program (R48132) use the value in this field to determine which transactions to include for revenue processing.

- Revenue Method

Select a value from UDC table 52G/RM to indicate the revenue method for the contract. When you enter billing lines, the system generates a warning if the billing line type does not match the revenue method in the funding level. Values are:

Cost Plus: The system calculates revenue by adding the base cost plus the applied burdens, plus any specified fee.

Fixed Price: The system calculates revenue based on specific contract terms, for example, percent complete, milestone, and so on.

None: The system does not calculate revenue for this contract.

Percent of Billing Method: The system calculates revenue by multiplying the revenue percent by the schedule of values less any previously recognized revenue.

Revenue Percent Method: The system calculates revenue by multiplying the percent complete by the cumulative billed amounts prior to retention. You specify the percent complete in the billing line type.

Time and Materials: For labor transactions, the system calculates revenue by multiplying the labor hours by the T&M billing rate/markup table. For non-labor transactions, the system either adds the base cost plus applied burdens, plus any specified fee, or adds the base cost plus a specified markup percentage, plus any specified fee.

These values are hard-coded.

- Revenue Limit

Select a value from UDC table 52G/LM. Values include:

Awarded By Line: The system uses the awarded amounts and applies limits separately to the cost amount, fee amount, and award fee amount.

Awarded By Total: The system uses the awarded amounts and applies limits to the total of the cost amount, plus the fee amount, plus the award fee amount.

Funded By Line: The system uses the funded amounts and applies limits separately to the cost amount, fee amount, and award fee amount.

Funded By Total: The system uses the funded amounts and applies limits to the total of the cost amount, plus the fee amount, plus the award fee amount.

No Limit: The contract does not use limit processing.

These values are hard-coded.

- Tax Expl Code (tax explanation code)

Select a code from UDC table 00/EX to assign to billing lines for the contract. The tax explanation code controls the algorithm that the system uses to calculate tax and G/L distribution amounts. The system uses the tax explanation code in conjunction with the tax rate area and tax rules to determine how the tax is calculated.

The system assigns this value to the transactions in the Billing Detail Workfile table (F4812) and uses the code to calculate tax amounts for invoices.

- Tax Rate/Area

Select a code to specify the tax rate/area to assign to billing lines for the contract. Tax rate/areas identify a tax or geographic area that has common tax rates and tax authorities. The system validates the code you enter against the Tax Areas table (F4008). The system uses the tax rate area in conjunction with the tax explanation code and tax rules to calculate tax and G/L distribution amounts when you create an invoice or voucher.

The system assigns this value to the transactions in the Billing Detail Workfile table (F4812) and uses the code to calculate tax amounts for invoices.

- Payment Terms

Select a code to identify the terms of payment, including the percentage of discount available if the invoice is paid by the discount due date. The system validates the code that you enter against the Payment Terms table (F0014).

The system assigns this value to billing lines for the contract and to the resulting transactions in the Billing Detail Workfile table (F4812).

- Invoice Format Code

Select a code that uniquely identifies the report and version of the invoice that you print for this contract. You define format codes in the Invoice Print Version Cross Reference program (P48S58).

- Minimum Invoice Amt (minimum invoice amount)

Specify the minimum amount required for the contract. If the billing amount is less than the amount in this field, the system does not generate an invoice.

- Minimum Foreign Inv Amt (minimum foreign invoice amount)

Specify the minimum foreign amount if you have entered a foreign amount in the Base Curr field on the Terms tab at the contract level.