Understanding Revenue Performance Obligations in JD Edwards EnterpriseOne Job Cost

Business processes and financial standards outline when you can recognize revenue for the amounts you bill to customers. Per accounting standards, you cannot recognize revenue for billed amounts associated with the billing amount until the performance obligation to the customer is satisfied.

To learn more about the revenue recognition process and requirements in JD Edwards EnterpriseOne, review the following information.

When working in the JD Edwards EnterpriseOne Job Cost system specifically, the system enables you to manage and report on performance obligations at the project, job, sub ledger or revenue performance obligation level for any job. A revenue performance obligation (RPO) is a record that consists of a set of accounts used to track costs and revenue associated with specific tasks within a job.

Project managers can identify multiple revenue performance obligations within a single job, associate a range of accounts with a revenue performance obligation, update related percent complete, and make revenue and cost adjustments to the revenue performance obligations (similar to single job adjustments). You can accurately recognize revenue for multiple revenue performance obligations on a single job using the Revenue Performance Obligation Profit Recognition Process (with the resulting over and under billing adjustments), which is based on the existing Profit Recognition process.

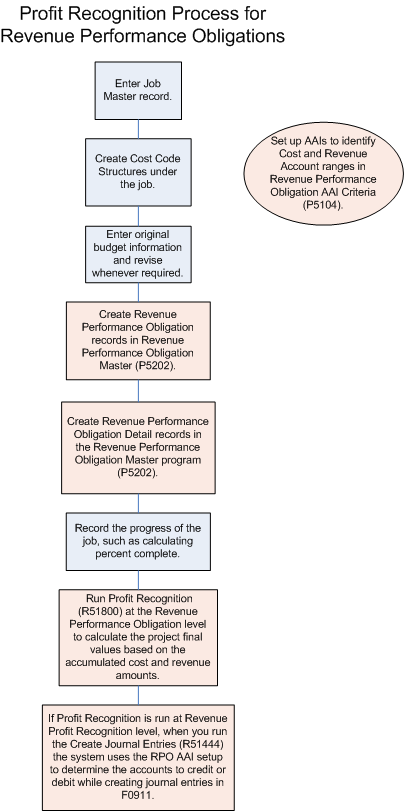

The following flowchart shows how the Profit Recognition Process has been updated to accommodate RPOs:

The following list outlines the steps of the Profit Recognition Process for revenue performance obligations and provides links as to where you can find additional information for each task:

Enter a job.

See Setting Up Jobs.

Create cost code structures under a job.

Set up RPO AAIs to identify cost and revenue account ranges.

Set up an RPO.

Select accounts for the RPO.

See Associating Accounts with a Revenue Performance Obligation.

Generate Profit Recognition Data for an RPO.

See Generating Profit Recognition Data for Revenue Performance Obligations.

Adjust revenue and cost amounts for an RPO.

See Revising Profit Recognition Records for Revenue Performance Obligations.

Create profit recognition journal entries at RPO level.

See Creating Profit Recognition Journal Entries for Revenue Performance Obligations.

Report on performance obligation status.

See Reviewing the Profit Recognition Job Status Report (R51445) for Revenue Performance Obligations.