Consolidated Income Statement Case Study: Add Additional Sections to the Layout

If you have completed the steps in the Consolidated Income Statement Case Study: Set Up Layout Sections and Consolidated Income Statement Case Study: Format the Columns in the Layout Tables sections, you have completed the setup for the Revenue section of your statement. You now need to set up the remaining sections of your income statement.

The steps described in the Consolidated Income Statement Case Study: Set Up Layout Sections and Consolidated Income Statement Case Study: Format the Columns in the Layout Tables sections described how to set up a section that includes a data type row definition. You will follow those steps, except the steps for reversing the sign in a column, for the other sections that contain a data type row definition.

The steps to set up a layout section that contains a subtotal type row definition are slightly different. You will use the list of tasks in the Consolidated Income Statement: List of Tasks for Subtotal Sections section to set up those sections.

The following list describes the sections that you need to set up after you set up the Revenue section, and describes which set of steps to follow to set up the layout section:

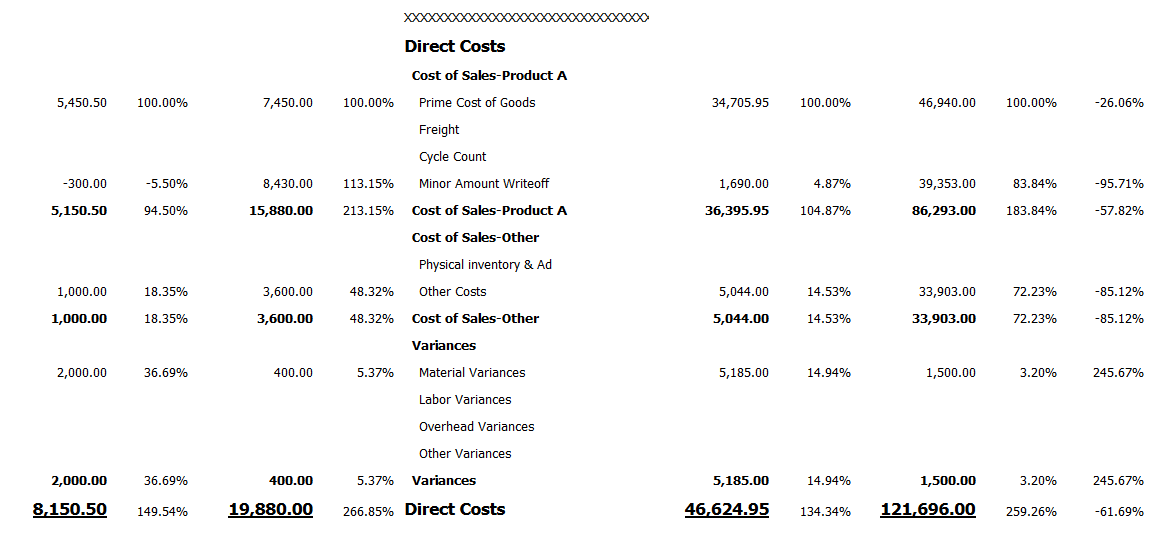

Direct Costs section

Place this section immediately following the Revenue section in your layout. This section is similar to the Revenue section. Use the steps listed in the Consolidated Income Statement: List of Tasks for Non-Subtotal Sections to create this layout section.

The following image shows the Direct Costs section in the layout:

Gross Margin section

Place the Gross Margin section immediately following the Direct Costs section. The Gross Margin section is based on a subtotal row definition. The One View Financial Statements process generated the subtotal amounts for the Current Period Actual, Last Year Current Period Actual, Year to Date Actual, and Last Year to Date Actual columns, but you must set up the Percent of Revenue and Percent Change columns in the layout.

Use the steps listed in the Consolidated Income Statement: List of Tasks for Subtotal Sections section to create this layout section.

The following image shows the Gross Margin section in the layout:

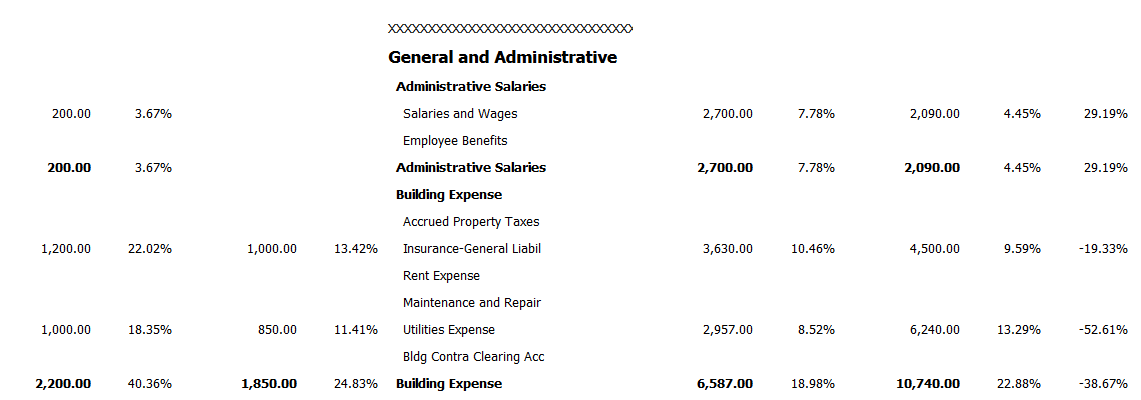

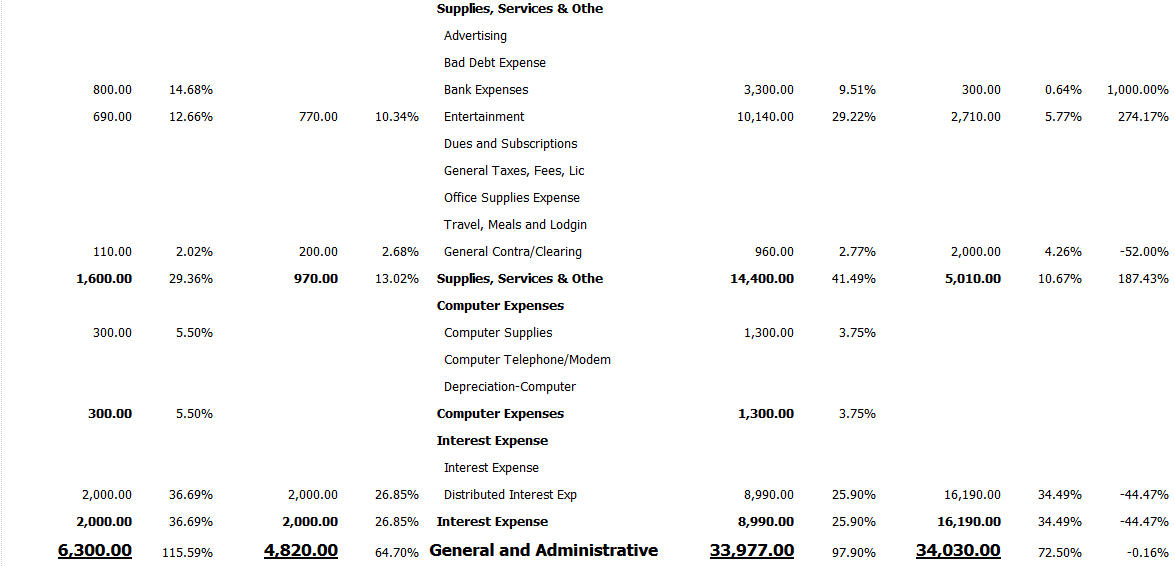

General and Administrative Costs section

Place the General and Administrative Costs section immediately following the Gross Margin section. The General and Administrative Costs section is similar to the Revenue and Direct Costs sections. Use the steps listed in the Consolidated Income Statement: List of Tasks for Non-Subtotal Sections to create this layout section.

The following image shows the first part of the General and Administrative section in the Consolidated Income Statement layout:

Operating Income section

Place the Operating Income statement immediately after the General and Administrative section. The Operating Income section is based on a subtotal section in the statement definition. Use the steps listed in the Consolidated Income Statement: List of Tasks for Subtotal Sections section to create this layout section.

The following image shows the Operating Income section in the Consolidated Income Statement layout:

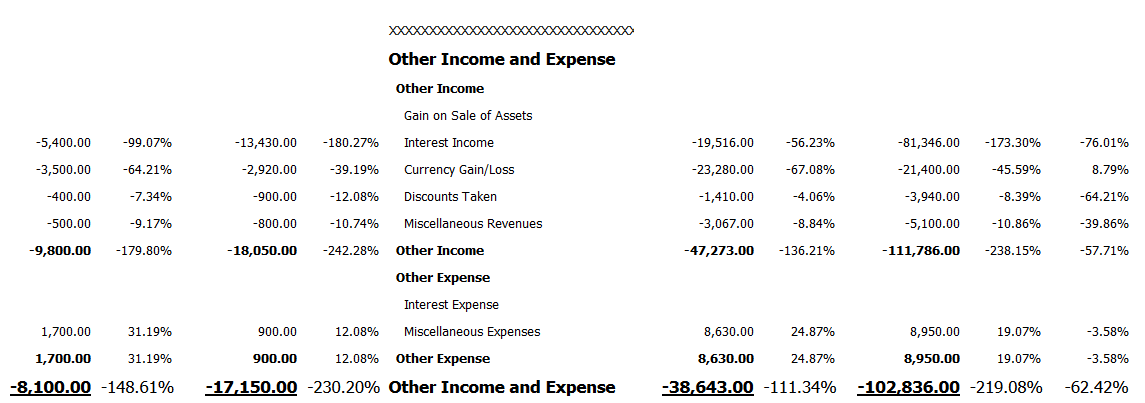

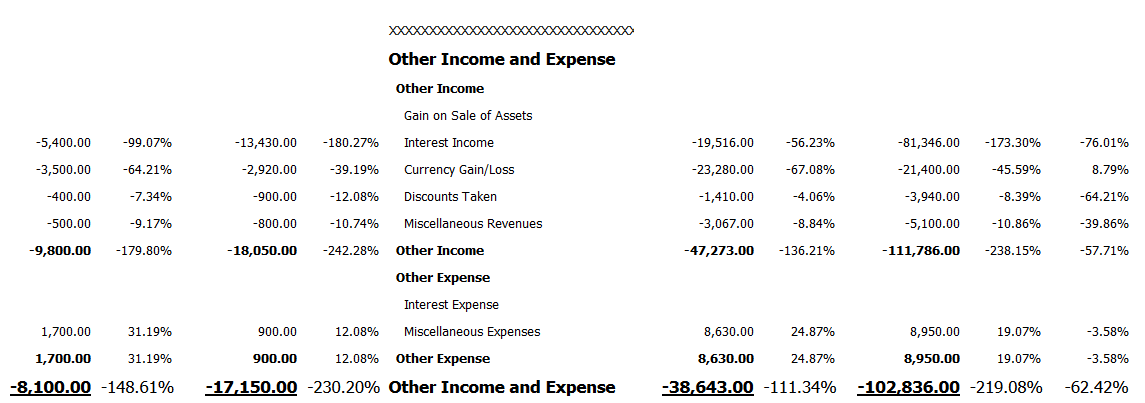

Other Income and Expense section

Place the Other Income and Expense section immediately after the Operating Income section. The Other Income and Expense section is similar to the Revenue section. Use the steps listed in the Consolidated Income Statement: List of Tasks for Non-Subtotal Sections to create this layout section.

The following image shows the Other Income and Expense section in the Consolidated Income Statement layout:

Net Profit Before Tax section

Place this section directly after the Other Income and Expense section. The Net Profit Before Tax section is based on a subtotal section in the statement definition. Use the steps listed in the Consolidated Income Statement: List of Tasks for Subtotal Sections section to create this layout section.

The following image shows the Net Profit Before Tax section in the Consolidated Income Statement layout:

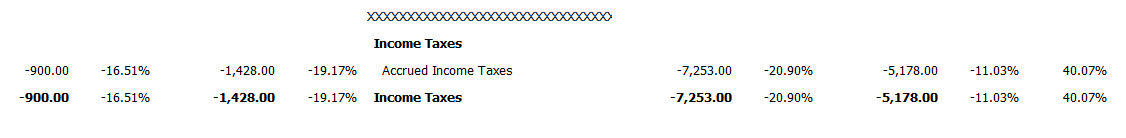

Income Taxes section

Place the Income Taxes section immediately after the Net Profit Before Tax section. The Income Taxes section is similar to the Revenue section. Use the steps listed in the Consolidated Income Statement: List of Tasks for Non-Subtotal Sections to create this layout section.

The following image shows the Income Taxes section in the Consolidated Income Statement layout:

Other Income and Expense section

The Other Income and Expense section is based on a subtotal section in the statement definition. Use the steps listed in the Consolidated Income Statement: List of Tasks for Subtotal Sections section to create this layout section.

The following image shows the Other Income and Expense section in the Consolidated Income Statement layout:

Net Profit or Loss section

The Net Profit or Loss section is based on a subtotal section in the statement definition. Use the steps listed in the Consolidated Income Statement: List of Tasks for Subtotal Sections section to create this layout section.

The following image shows the Net Profit or Loss section in the Consolidated Income Statement layout: