Entering Rollover Information for DBAs

For most types of DBAs, such as retirement plan benefits and medical plan deductions, the system carries forward year-end balances when you run the standard year-end rollover programs.

For some DBAs, such as those that track vacation and sick time, employees can earn or hold balances that the system must calculate before it can roll over the balance from one year to the next. When you set up these DBAs, you must enter rollover information so that the system can calculate the balance to roll over.

The system rolls over DBAs that have any of the following:

Remaining balances

Remaining periods

An inception-to-date limit

An annual carryover limit

Deduction amounts due

Arrearages

You also enter rollover information to specify the table in which the system stores history for the DBA, either in the Fiscal and Anniversary Year History table (F06147) or the Payroll Month PDBA Summary History table (F06146).

You can set up vacation and sick DBAs in either of the following ways:

When an employee accrues time that becomes available at a later date, you set up two DBAs. The first DBA accrues the time. The second DBA tracks the amount of that accrued time which is available to the employee.

When an employee can take time as they earn it, you set up a single DBA to track accrued, or available, time.

Either of these scenarios might also involve a limit to the number of hours that an employee can carry forward into the following year.

Example: Limit on Vacation or Sick-Leave Rollover

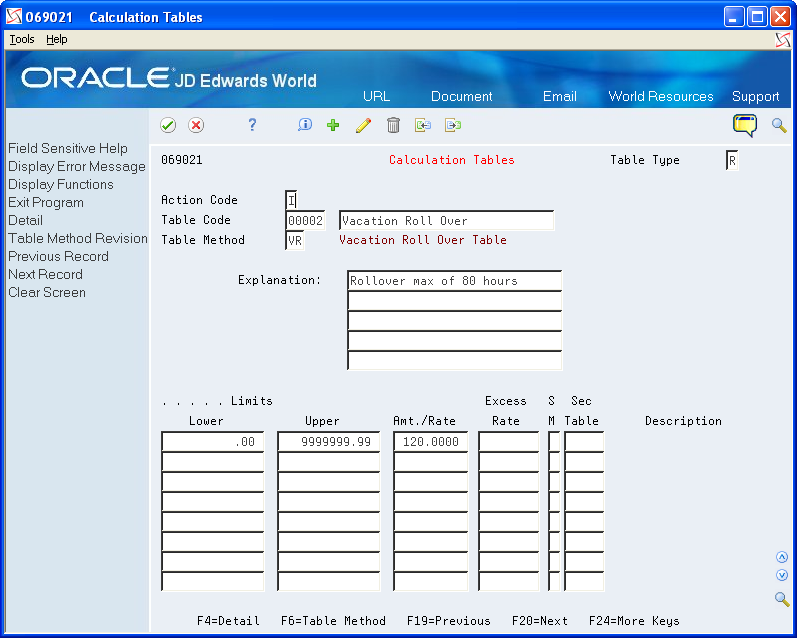

Your organization's vacation or sick-leave policy might state that employees cannot carry forward more than 80 hours from one year to the next.

To administer this policy, you set up a calculation table that allows only 80 hours to roll over into the following year. This table works in conjunction with the DBA that tracks availability.

The available amount might include a beginning balance from a prior year as shown in the following screen.

The system compares the balance with the limit in the table. Any amount that is over the limit does not roll over into the new year.

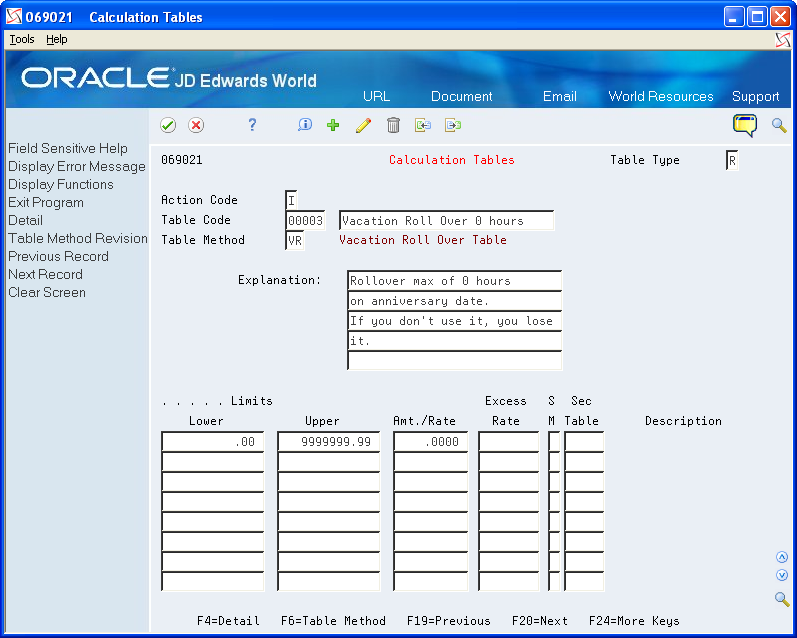

Alternatively, your organization's vacation or sick-leave policy might state that employees cannot carry hours forward from one year to the next. To administer this policy, you define zero as the limit in the rollover calculation table, as shown in the following screen.

Example: Vacation Rollover for Time Not Immediately Available

Your organization's vacation policy might state the following:

Employees accrue vacation time at the rate of four to ten hours per month, based on years of employment.

Employees can take vacation time in the calendar year following the year in which they earn the time.

To administer this vacation policy, you set up the following:

A pay type (such as 815, Vacation Pay) that tracks the vacation time that an employee takes.

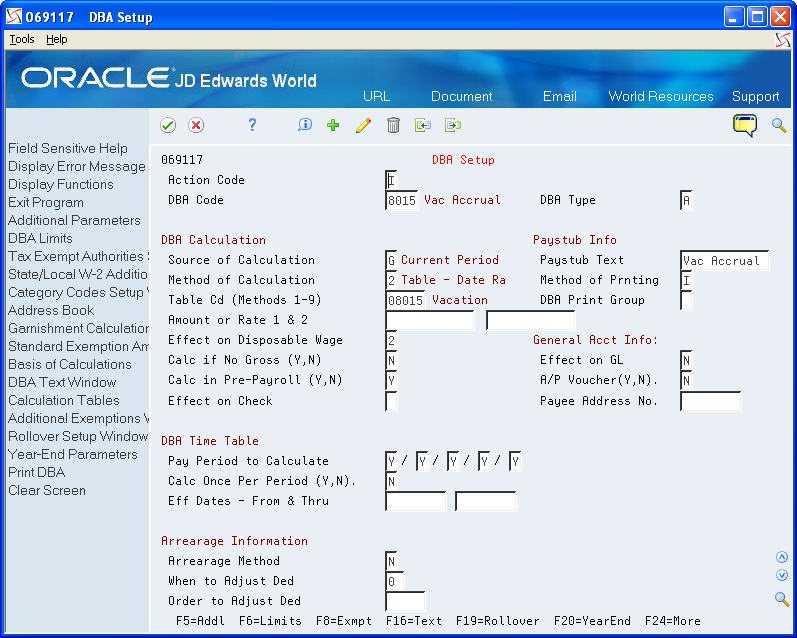

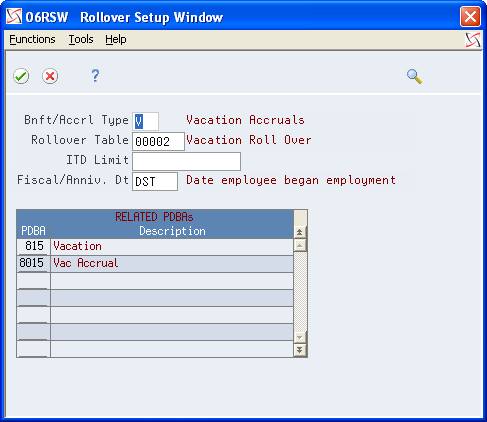

An accrual (such as 8015, Vacation) that tracks the vacation time that an employee earns. The accrued time rolls over to a second DBA that tracks the available vacation time. Accrued time is not available until it rolls over. The following screen illustrates the set up for this type of accrual:

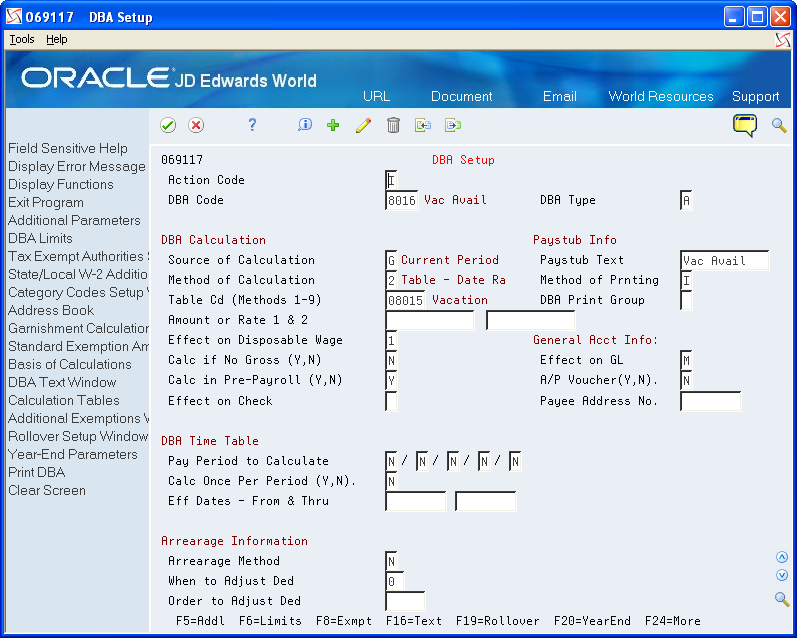

An accrual (such as 8016, Vacation Available) that tracks the vacation time that is available to the employee. The accrual rollover table that you associate with the second DBA establishes the limit on the amount of vacation time that can roll over into the following year. The following screen illustrates the set up for this type of accrual:

When you set up accrual 8016, Vacation Available, you enter the following rollover information:

In the Bnft/Accrl Type field, enter V (Vacation Pay).

In the Rollover Table field, enter the table code of the table that you created so that the mandated amount rolls over.

In the Related PDBA field, enter the number of the pay type that you use for vacation pay.

In the Related PDBA field, enter the DBA number of the accrual that represents accrued but not yet available hours.

When you run the rollover program, the system calculates the balance to roll over by adding the accumulated and available balances, and then subtracting the vacation time taken.

You do not enter any information on the Rollover Setup Window for accrual 8015.

You can create as many pay types and accruals as you need. For example, you can have many accrual DBAs that roll over to a single available DBA. You can also have many pay types that relate to a single available DBA. However, you cannot relate a pay type to multiple DBAs that are based on different rollover years. For example, your organization might use the following vacation accruals:

One accrual for office workers, which rolls over balances at the end of the standard year

One accrual for factory workers, which rolls over balances on employees' hire dates

To record employees' vacation time taken, you must use separate pay types for each of these accruals.

Example: Vacation Rollover for Time Immediately Available

Your organization's vacation policy might state the following:

Employees can take vacation time as they earn the time.

Employees accrue vacation time at the rate of four to ten hours per month, based on years of employment.

Employees cannot accumulate more than 80 vacation hours from the start to the end of the DBA (the calendar or fiscal year) unless the employee takes the time during the term of the DBA.

To administer this vacation policy, you set up the following:

A pay type (such as 811, Vacation Pay) that tracks the vacation time that an employee takes

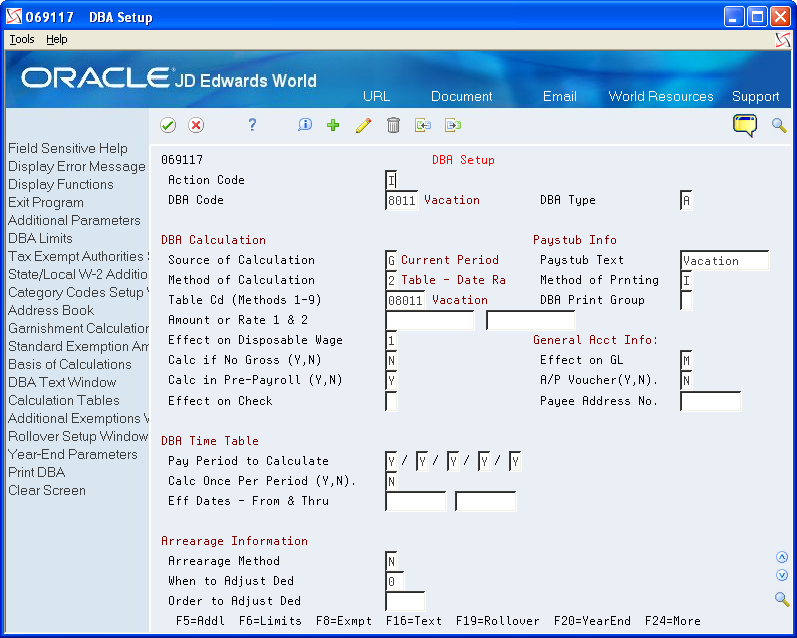

An accrual (such as 8011, Vacation) that tracks the vacation time that an employee earns. The following screen illustrates this accrual.

When you set up accrual 8011, you set up the following information:

In the Benefit/Accrual Type field, enter V (Vacation Pay).

In the Rollover Table field, enter the table code of the table that you created so that the mandated amount rolls over.

In the Related PDBA field, enter the number of the pay type that you use for vacation pay (811).

In the Related PDBA field, enter pay type 811 as the pay type that the system uses to calculate the balance for accrual 8011.

When you run the rollover program, the system calculates the balance to roll over by subtracting the vacation time taken from the vacation time earned.

Before You Begin

Set up the pay types to calculate the balance for the DBA that requires rollover information.

To enter rollover information for DBAs

Navigation

From Pay/Deductions/Benefits (G0742), choose DBA Setup

On DBA Setup, complete the steps for setting up an accrual.

Choose Rollover Setup Window (F19).

On Rollover Setup Window, choose Rollover Table from the Functions menu to define carryover limits.

On Calculation Tables, enter R in the following field:

Table Type

Enter VR in the following field:

Table Method

In the following fields, enter the number of months of service from the original hire date:

Lower Limit

Upper Limit

Complete the following fields and Click Add:

Table Code

Amount/Rate

Access the Rollover Setup Window.

On Rollover Setup Window, complete the following fields:

Benefit/Accrual Type

Rollover Table

PDBA

Field |

Explanation |

|---|---|

Table Type |

A code that defines the purpose of the table. Valid values are: D – The system uses the table to calculate DBAs. R – The system uses the table to determine limits for rolling over sick and vacation accruals. |

Table Method |

A user defined code (00/UM) that specifies any unit of measure that is appropriate for an employee's time and pay. |

Table Code |

A numeric code that identifies this table in the Generic Table Constants table (F069026). |

Amt./Rate |

The amount or rate the system uses to calculate a DBA. When you enter 1, 2, 3, 4, 5, or 6 as the method of calculation, you must enter a value in this field to use in the calculation in conjunction with the basis table. For example, if you create a calculation table for vacation rollovers and enter 80 in this field, any amount that exceeds 80 does not roll over to the following year. An employee might have 92 hours of available vacation at the end of the year, but the employee loses 12 hours of vacation and begins the new year with 80 hours of vacation. |

Bnft/Accrl Type |

A user defined code (07/SV) that specifies whether the benefit or accrual type is sick, vacation, holiday, leave, or other. The system uses this code to print sick and vacation accrual balances on the payment stub. |

Rollover Table |

The identification number of the rollover table that the system uses to limit the amount rolled over for an accrual. For example, you can base the limit on an employee's months of service. You can set up the table so that an employee with 0 through 12 months can roll over up to 40 hours at year end and an employee with 13 through 999 months can roll over up to 80 hours. |

PDBA |

The number and description of the PDBA that you want the system to use to calculate the corresponding PDBA. This number is the beginning number in the range that is the basis of the calculation. Screen-specific information For rollover setup, this is the number and description of the PDBA that the system uses to calculate a remaining balance, for example, a pay type that deducts from the current balance. The remaining balance becomes the beginning balance for the new year. |