Working with PDBA History Integrity

To ensure that the correct information prints on your quarterly tax reports and employees' year-end forms, you should regularly verify the integrity of your pay type, deduction, benefit, and accrual (PDBA) history. To verify PDBA history integrity, run the PDBA History Integrity report. This report identifies missing, inaccurate, or incomplete information in the Payroll Month PDBA Summary History table (F06146).

To identify PDBA history integrity errors, you first run the PDBA History Integrity report in proof mode so that you can review errors and enter any manual corrections before updating the table. When you run the integrity report in proof mode, the system identifies possible errors without changing any information in the history table. Running the integrity report in update mode automatically corrects some errors.

Use the tax history integrity error code list to help determine the action that you must perform to correct integrity errors.

To correct PDBA history integrity errors, run the PDBA History Integrity report in update mode or use history revision screens to enter manual corrections. When you run an integrity report in update mode, the system corrects information in the F06146 table and prints a report listing the errors that the system could not correct. Review all errors, correct them, and run the integrity report until it does not produce any errors.

You should run integrity reports monthly, quarterly, and before you begin year-end processing.

To complete these tasks, you must run the integrity report a minimum of three times to:

Identify errors

Correct the errors

Verify that you correct the errors

Working with PDBA history integrity includes the following tasks:

Identify PDBA history integrity errors

Review error codes for the PDBA history integrity report

Correct PDBA history integrity errors

Before You Begin

Create a backup table of the Employee Transaction History Summary table (F06146). The Payroll Month PDBA Integrity report does not automatically create a backup of the information in this table when you run the report in update mode.

Enter N in the Select Report Processing Mode processing option for the Payroll Month PDBA Integrity report to print the report without updating the table.

Identifying PDBA History Integrity Errors

To ensure that the correct information prints on your quarterly tax reports and employees' year-end forms, you should regularly verify the integrity of your pay type, deduction, benefit, and accrual (PDBA) history. To verify PDBA history integrity, run the PDBA History Integrity report. This report identifies missing, inaccurate, or incomplete information in the Payroll Month PDBA Summary History table (F06146).

Navigation

From Integrity, Rollover & Repost (G072471), choose Payroll Month PDBAs Report

Processing Options

Data Selection

Enter the last two digits of the current year in the data selection.

Data Sequence

Do not change the data sequence of the report.

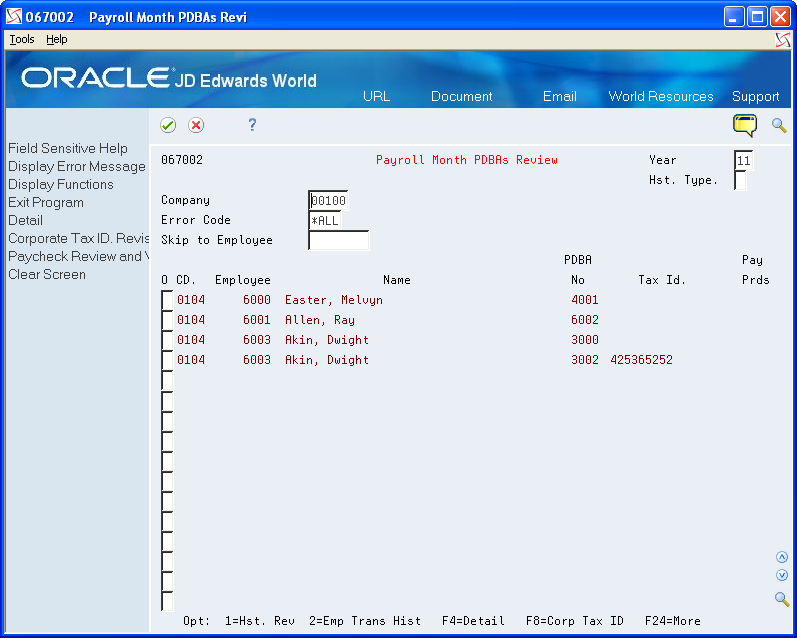

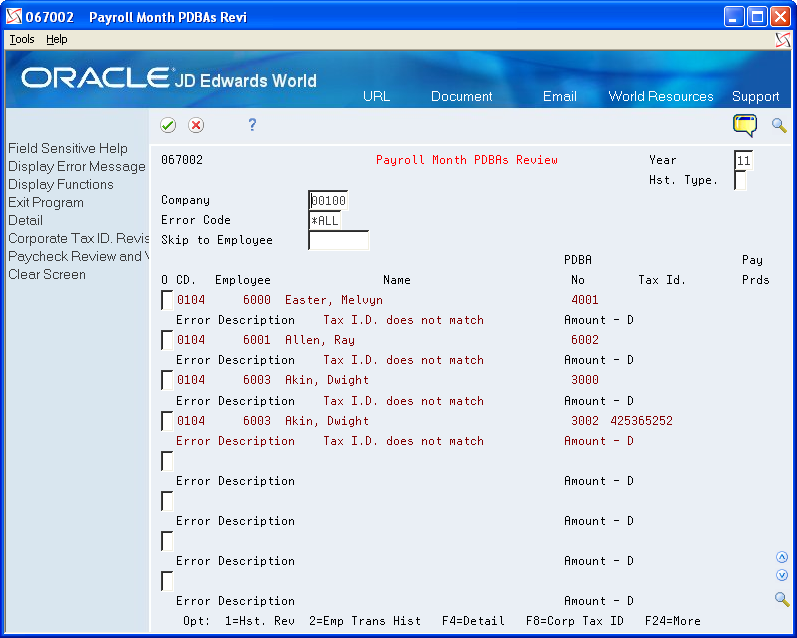

Sample PDBA History Integrity Report

Reviewing Error Codes for the PDBA History Integrity Report

After you run the PDBA History Integrity report in proof mode, you must research each error that prints on the report. The following error code list from the Payroll system describes the types of PDBA history integrity errors and the actions you must perform to correct the errors so that your quarterly reports and year-end forms will be accurate.

The following table includes the error, error number, a description of the error, and possible solution. These error codes are in UDC 07/IT.

Error |

Description |

|---|---|

0101 -- Employee number is invalid |

The employee number does not exist in the Employee Master table (F060116). Add the employee number to the master table, and then run the PDBA History Integrity report in update mode. |

0102 -- Pay, deduction, or benefit type doesn't exist |

The Pay type, Deduction, Benefit, or Accrual number does not exist in the Transaction Parameters table (F069116). Add the pay type, deduction, benefit, or accrual number using the DBA Setup program or the Pay Type Setup program on the Pay/Deductions/Benefits Setup menu (G0742). Run the PDBA History Integrity report in update mode. |

0103 -- Tax ID doesn't exist |

This is a common error in which the corporate tax ID in the record does not exist in the Corporate Tax ID Constant table (F069086). Add the corporate tax ID using the Corporate Tax IDs program on the Taxes & Insurance menu (G0744). Run the PDBA History Integrity report in update mode. Running the report in update mode corrects this error by automatically correcting the tax ID for a number of forms. |

0104 -- Tax ID doesn't match |

The corporate tax ID in the record does not match the corporate tax ID in the F069086 table. Verify that the tax ID is correct using the Corporate Tax IDs program on the Taxes & Insurance menu (G0744). If the tax ID is not correct, correct it and run the PDBA History Integrity report in update mode. Note: W-2 forms do not print correctly if the Federal A Corporate Tax ID contains punctuation or spaces. Running the report in update mode corrects this error by automatically correcting the tax ID for a number of forms. |

0105 -- Amount due invalid |

There is an amount due on the DBA, but the record for the DBA states that an amount due should not occur on the transaction. Change either the Amount Due field to allow amounts due or manually adjust the amount due to zero using the DBA Additional Information screen. |

0106 -- Number Periods invalid |

A value exists in the Number of Periods field on the DBA, but the record for the DBA states that using the Number of Periods field is not allowed. Change either the value in the Number of Periods field to allow periods or manually adjust the periods to zero using the DBA Additional Information screen. |

Correcting PDBA History Integrity Errors

After you run the PDBA History Integrity report in proof mode and review the errors, you must correct the errors so that your quarterly reports and year-end forms are accurate.

Running the integrity report in update mode automatically corrects certain errors, such as a missing tax ID code. To correct other errors, such as an invalid number of periods, you must manually revise your payroll data before you run the report in update mode.

After you run an integrity report in update mode, you should run it again in proof mode to produce an error-free report. When the system finds no errors, it generates only the cover page.

If the PDBA History Integrity report does not generate errors, the review screen does not allow you to review information. You use this screen only to review and revise errors that the report generates.

To correct PDBA history integrity errors manually

After you run the PDBA History Integrity report, you might need to enter some manual corrections before you run the report again. Use the PDBA history error code list to help you determine the actions that you must perform to correct each payroll history error that prints on the report. You might need to correct the history manually before running another integrity report in update mode. Correcting the history ensures that the correct totals print on your quarterly tax reports and year-end forms. For example, you might need to modify the gross pay amount for one month for a particular pay type.

You can correct certain payroll history errors by revising the monthly history for a pay type, deduction, benefit, or accrual. To revise monthly PDBA history, use the Payroll Month PDBAs Review program. This program updates the Payroll Month PDBA Summary History table (F06146).

This program should have the highest possible level of system security. Be aware that when you revise payroll history manually: The system does not update the General Accounting system. You must manually enter the appropriate journal entries. The system does not create an audit trail of the changes that you enter when you revise payroll history manually. The summary totals do not equal the detail totals.

Entering Journal Entries in the General Accounting Guide

Setting Up Corporate Tax IDs in the Time Accounting Guide

Navigation

From Integrity, Rollover & Repost (G072471), choose Payroll Month PDBAs Review

On Payroll Month PDBAs Review, complete the following fields:

Year

Company

To limit your search, complete the following field:

Error Code

Access the detail area to review the error code in the employee record.

Perform one of the following:

To enter or correct a corporate tax ID number, choose Corporate Tax ID Revisions (F8).

To void a paycheck, choose Paycheck Review and Void (F9).

To review or revise an employee's tax history, enter 1 in the Option field to access Transaction History Revisions.

On Transaction History Revisions, enter any necessary corrections.

To correct PDBA history integrity errors automatically

The system automatically corrects errors either when you run an integrity report in update mode or when you run the integrity report in update mode after entering an appropriate correction. Consult the PDBA history error code list for the actions you need to perform to correct errors before running the integrity report in update mode.

Correcting PDBA errors automatically differs from correcting errors manually. When the system automatically corrects PDBA errors, it locates all of the records that need changes and makes the necessary corrections at one time. When making the same corrections manually, you must change each record individually.

For example, suppose that you have applied for a tax ID from a state in which your organization's employees are working for the first time. Until you receive the tax ID, you set up your corporate tax ID as "applied for" on the Corporate Tax ID screen. When you generate payroll using the "applied for" tax ID, the system generates employee history records using the "applied for" code. When you receive a corporate tax ID from the tax authority, you can replace the "applied for" tax ID with the new corporate tax ID number on the Corporate Tax IDs screen. When you run the PDBA History Integrity report in update mode, the system updates all history records with the new tax ID.

After reviewing the PDBA History Integrity report and making any corrections, you run the report in update mode to update the Payroll Month PDBA Summary History table (F06146) with the correct information.

After you make the necessary corrections for each error, you can correct the following errors by running the PDBA History Integrity report in update mode:

0103 - Tax ID does not exist

0104 - Tax ID does not match

Before You Begin

Enter Y in the Select Report Processing Mode processing option for the Payroll Month PDBA Integrity report to generate the report and update the table.

Navigation

From Integrity, Rollover & Repost (G072471), choose Payroll Month PDBAs Report