Working with Tax History Integrity

To verify tax history integrity, run the Tax History Integrity report. This report identifies missing, inaccurate, or incomplete information in the Taxation Summary History table (F06136). You should regularly verify the integrity of your taxation history to ensure that the correct information prints on your quarterly tax reports and employees' year-end forms.

To identify taxation integrity errors, you first run the Tax History Integrity report in proof mode so that you can research errors and enter any manual corrections before updating the table. When you run the integrity report in proof mode, the system identifies possible errors without changing any information in the history table. Running the integrity report in update mode automatically corrects some errors.

To help determine the action that you must take to correct integrity errors, review an explanation of the error code in the tax history integrity error code list that the Payroll system provides.

To correct taxation integrity errors, use history revision screens to enter manual corrections, and then run the Tax History Integrity report in update mode. When you run an integrity report in update mode, the system corrects information in the F06136 table and prints a report listing the errors that it cannot correct. Review all errors, correct them, and rerun the integrity report until there are no errors. (Some entries on the report might reflect valid conditions for your data.)

To simplify the process of regularly verifying your payroll history integrity, you can set up the integrity reports to run during the final update step of each payroll cycle. The versions of these reports that you run during final update should be set up to run in proof mode. You should also run these reports monthly, quarterly, and before you begin year-end processing.

To complete the tax history integrity tasks, you must run the integrity report at least three times to:

Identify errors

Correct the errors

Verify that the system performs all of the updates

Wage and Tax History

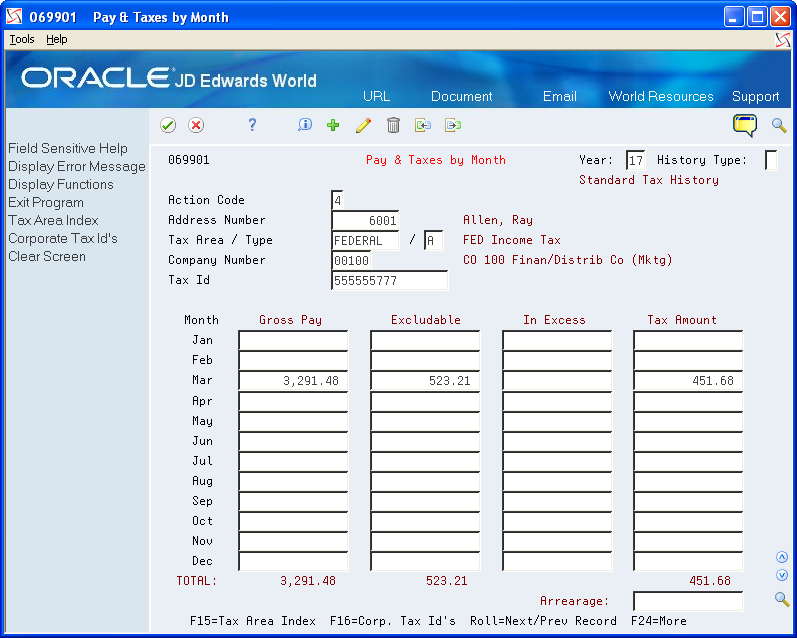

The Taxation Summary History table (F06136) contains the wage and taxation history. The information includes tax area, tax type, company, tax ID, year, and history type. You can access this information in the Pay and Taxes by Month program on the Integrity, Rollover & Repost menu (G072471).

You can review information on the Pay and Taxes by Month screen. If you find tax area or corporate tax ID errors, you can choose the appropriate function to display forms that allow revisions.

The value in the History Type field defines the type of year-end form the system generates. The following table includes the types of history the system generates, according to the tax method that you use to set up an employee.

Tax Method |

Description |

History Type |

Year-End Form |

|---|---|---|---|

blank |

Regular |

blank |

W-2 |

N/A |

Third Party Sick Pay |

1 |

W-2 (separate) |

A |

Non-Resident Alien |

blank |

W-2 |

B |

NR Alien FICA/Medicare Exempt |

4 |

W-2 (separate) |

C |

Contract |

C |

1099-MISC and 1099-NEC |

P |

Pension |

2 |

1099-R |

4 |

Medicare Qualified |

3 |

W-2 |

5 |

FICA/Medicare Exempt |

4 |

W-2 |

6 |

Railroad |

blank |

W-2 |

R |

Regular - Puerto Rico with Tax Area=72 |

R |

499R-2 |

The Pay and Taxes by Month screen also includes any arrearage for tax types that are set up to arrear. Arrearage amounts on Federal Tax Types D or P print in Box 12 of the W-2 form as Uncollected FICA or Medicare.

Working with tax history integrity includes the following tasks:

Identify tax history integrity errors

Review error codes for the tax history integrity report

Correct tax history integrity errors

Identifying Tax History Integrity Errors

You use the Tax History Integrity report to identify errors in the Taxation Summary History table (F06136). You use the information in this table to produce government year-end forms for employees. Keeping this table error-free simplifies your year-end processing tasks.

Running integrity reports in proof mode identifies possible integrity errors without changing any information in the history tables. Run integrity reports in proof mode so that you can research errors before correcting and updating the appropriate tables.

The Taxation History Integrity report identifies three types of information:

Errors that you must correct manually.

Errors that the program corrects when you run the report in update mode.

Information that appears to be an error, but is not. For example, zero federal tax withheld might be a valid condition for a low-wage earner.

Each time that you run the Tax History Integrity report in update mode, it creates a backup table (F06136W2) of the F06136 table from the previous run. Therefore, if you run a report in update mode and receive unexpected results, you can restore your data prior to running the update. The system recreates this table each time that you run the integrity procedure in proof mode. The system also creates a backup of the F06136 table when you delete records such as invalid records that contain negative amounts. JD Edwards World strongly recommends that you call technical support for help restoring the backup table.

Before You Begin

Set the processing options for the Taxation History Integrity report to print the report without updating the table.

On the Corporate Tax IDs screen, remove dashes or spaces from the tax ID for the Federal A tax area.

See:Setting Up Corporate Tax IDs in the Time Accounting Guide

Enter the appropriate tax earnings limitations and rates in the processing options. Without these figures, the system cannot identify certain types of errors.

Navigation

From Integrity, Rollover & Repost (G072471), choose Taxation History Report

Processing Options

Data Selection

Enter the last two digits of the current year in the data selection.

If all companies within your organization have the same paymaster, do not include the home company in your selection criteria.

Data Sequence

Do not change the data sequence for this report.

Sample Tax History Integrity Report

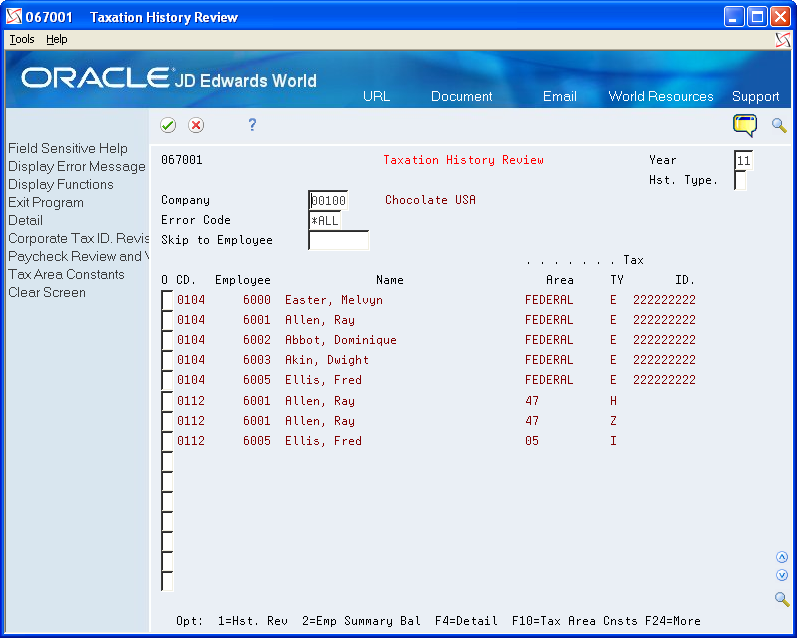

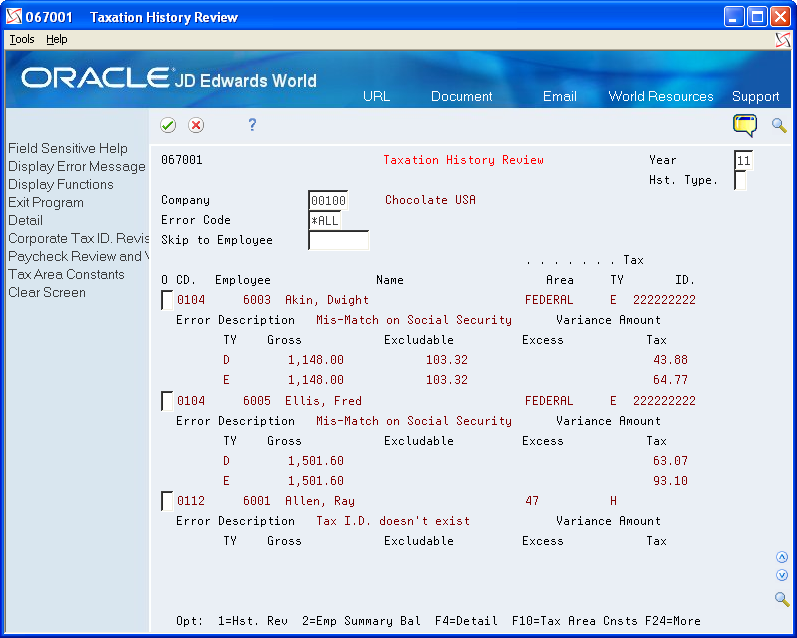

Reviewing Errors on the Tax History Integrity Report

After you run the Tax History Integrity report in proof mode, you must review and research each error that prints on the report. The Payroll system provides an error code list that describes each type of payroll history integrity error. Use this error code list to determine the action, if any, that you must perform to correct each error. You must correct these errors so that your quarterly reports and year-end forms are accurate.

If you run a report in update mode and receive unexpected results, you can use the F06136W2 table to restore your data as it was prior to running the update. This table is a backup of the Taxation Summary History table (F06136) that the system creates every time you run the report in proof mode.

The following table includes the error, error number, a description of the error, and possible solution. The payroll error codes are in UDC table 07/IX.

Error Code |

Description |

|---|---|

0101 -- Taxable wage less than tax |

The amount of taxable wage [Gross - (Excludable + In Excess)] is less than the amount of tax withheld or paid on the same earnings. Determine whether taxable wages should be less than tax. For example, the amount might include a refunded tax or voided check from a prior year. If an error occurs, do one of the following:

|

0102 -- Sign mismatch on gross/tax |

A mismatch exists between the taxable wages and tax. Either the taxable wages are positive and the tax is negative, or the taxable wages are negative and the tax is positive. Determine why a sign mismatch exists between the two numbers and decide which amount is correct. For example, someone might have entered the tax as a negative number. If an error exists, do one of the following:

|

0103 -- Sign mismatch on earnings |

A mismatch exists between the various wage fields in the F06136 table. One or more of the wage fields is positive and the other is negative. Determine why a sign mismatch exists between the earnings fields and decide which amount is correct. For example, someone might have entered the wage as a negative number. Three options are available, you can:

|

0104 -- Mismatch on Social Security (OASDI) amount |

A difference exists between the Federal/D wage or tax amount, and the Federal/E wage or tax amount. That is, the employee portion differs from the employer portion. Determine why a mismatch exists between the Federal/D record and the Federal/E record, and determine which amount is correct. For example, an interim check might have an override of the employee tax but not the employer tax. Similarly, a pay type, deduction, or benefit might be set up as exempt from one tax type, but not the other. Three options are available, you can:

|

0105 -- Mismatch on Medicare |

A difference exists between the Federal/P wage or tax amount and the Federal/Q wage or tax amount. That is, the employee portion differs from the employer portion. Determine why a mismatch exists between the Federal/P record and the Federal/Q record and determine which amount is correct. For example, an interim check might have an override of the employee tax but not the employer tax. Similarly, a pay type, deduction, or benefit might be set up as exempt from one tax type, but not the other. Three options are available, you can:

|

0106 -- Mismatch on Tier I |

A difference exists between the Federal/R wage or tax amount and the Federal/S wage or tax amount. That is, the employee portion differs from the employer portion. Determine why a mismatch exists between the Federal/R record and the Federal/S record and determine which amount is correct. For example, an interim check might have an override of the employee tax but not the employer tax. Similarly, a pay type, deduction, or benefit might be set up as exempt from one tax type, but not the other. Three options are available, you can:

|

0107 -- Tax area not on record |

No tax area exists on the Taxation History record. Delete this erroneous transaction from the F06136 table. If you include this record when you build the W-2 workfile, the program ends abnormally with an array index error. |

0108 -- State wages greater than federal |

The total of the wages for State/C Federal Unemployment Insurance (FUI) records is greater than the Federal/C wages. Review the transactions and each State/C record to determine whether these totals should balance to the Federal/C balance. For example, if an employee lives in one state and works in another, the system updates both records with total gross wages. You must manually adjust the discrepancy, using the Pay and Taxes by Month program on the Integrity, Rollover & Repost menu (G072471). |

0109 -- Invalid tax ID number |

The corporate tax ID number on the tax areas with tax types of F through N (State or Local) is blank. For these types of taxes, the tax ID must be numeric and from two to nine characters in length. Verify that the corporate tax ID is set up using the Corporate Tax IDs program (P069081) on the Taxes & Insurance menu (G0744). Then rerun the Tax History Integrity report in update mode. |

0110 -- Employee number is invalid |

The employee number does not exist in the Employee Master table (F060116). Add the employee number to the master table. Then run the Tax History Integrity report in update mode. |

0111 -- Tax area doesn't exist |

The tax area code on the record does not exist in the Tax Area Constant table (F069016). Add the tax area using the Tax Area Information program on the Taxes & Insurance menu (G0744). Then run the Tax History Integrity report in update mode. |

0112 -- Tax ID doesn't exist |

The corporate tax ID on the record does not exist in the Corporate Tax ID Constant table (F069086). Add the corporate tax ID using the Corporate Tax IDs program (P069081) on the Taxes & Insurance menu (G0744). Then run the Tax History Integrity report in update mode. |

0113 -- Tax ID doesn't match |

The corporate tax ID in the record does not match the corporate tax ID in the F069086 table. Verify that the corporate tax ID is correct using the Corporate Tax IDs program (P069081) on the Taxes & Insurance menu (G0744). You might have made a change to this ID, but history records exist with the prior number. If the tax ID is incorrect, change it, and then run the Tax History Integrity report in update mode. Note: W-2 forms do not print correctly when the Federal A Corporate Tax ID in the Taxation Summary field contains punctuation or spaces. The Federal A tax area is the tax area that has been set up as the default federal tax area. If this tax area contains punctuation or spaces, you will not be able to print year-end forms for employees. |

0114 -- School district code missing |

A school district code is not present in the school district taxation history record. At the present time, the Tax History Integrity report does not utilize this error code. |

0115 -- Uncollected taxes |

Uncollected payroll taxes exist for the tax area and type. This condition, which is most common in an environment in which employees earn tips, could occur if you have set up the system for tax arrearage. The system adjusts the tax to make net pay equal to zero. Determine whether you should be placing taxes in arrears. If so, this error informs you that uncollected taxes exist and that these amounts print on the W-2 if the tax types are FICA or Medicare (Box 12). |

0116 Mismatch on Social Security tax |

This error displays if either:

You must enter two rates, one for employee and one for employer. Use Processing Option 3 to enter the rates. |

0120 -- Social Security Over/Under withheld |

The amount of Social Security was overwithheld or underwithheld. To correct the overwithheld or underwithheld tax, enter an interim check for the adjustment amount. The system changes the tax withheld to match the FICA taxable wage. Alternatively, you can report the amount on the employee's W-2, and the employee becomes responsible for recording an overpayment or underpayment on the 1040 tax return. |

0121 -- Medicare Over/Under withheld |

The amount of Medicare withheld exceeds the annual maximum that the IRS specifies or is underwithheld. To correct the overwithheld or underwithheld tax, enter an interim check for the adjustment amount and the system corrects the tax. Alternatively, you can report the amount on the employee's W-2, and the employee becomes responsible for recording an overpayment or underpayment on the 1040 tax return. |

0122 -- Tier I overwithheld |

The amount of Tier I tax withheld exceeds the annual maximum that the IRS specifies or it does not equal the taxable wage the system multiplies by the tax rate. To correct the overwithheld tax, enter an interim check for the adjustment amount, and the system corrects the tax. Alternatively, you can report the amount on the employee's W-2, and the employee becomes responsible for recording an overpayment on the 1040 tax return. |

0123 -- Tier II overwithheld |

The amount of Tier II withheld exceeds the annual maximum that the IRS specifies or it does not equal the taxable wage the system multiplies by the tax rate. To correct the overwithheld tax, enter an interim check for the adjustment amount and the system corrects the tax. Alternatively, you can report the amount on the employee's W-2, and the employee becomes responsible for recording an overpayment on the 1040 tax return. |

0131 -- Record contains no dollars ($) |

All of the amounts in the Taxation Summary History table are blank (zero dollars). Delete each of these records from the table using the Pay & Taxes by Month program on the Integrity, Rollover & Repost menu (G072471). |

0140 -- State taxable wage, NO TAX |

Taxable wages exist for the employee, but no tax was withheld. This might occur because of reciprocal agreements between states or because the employee claims enough exemptions to cause no tax calculation. In the current software, the system cannot identify which states should or should not have tax amounts. You must determine which records are valid and which are not. If you decide that the transactions are invalid, you must manually delete the records using the Pay & Taxes by Month program on the Integrity, Rollover & Repost menu (G072471). |

0141 -- Tax in non-taxing state |

The state on the report is a non-taxing state, in UDC 07/TA; but the system withheld tax due to an interim check tax override. Remove the tax amount from the non-taxing state record or enter a tax refund through the interim check feature. If you manually adjust the record, you should add the amount you adjust to another state that withholds state income tax. |

0150 -- Negative gross wage amount |

The gross wage amount contains a negative value. Determine whether a negative balance is acceptable for the tax area and tax type. If it is not acceptable, adjust the balance using the Pay & Taxes by Month program on the Integrity, Rollover & Repost menu (G072471) or repost the detail transactions to the summary table. In either case, run the Tax History Integrity report to verify that no other errors exist. |

0152 -- Negative excludable wage amount |

The excludable wage amount contains a negative value. Determine whether a negative balance is acceptable for the tax area and tax type. If not, adjust the balance by using the Pay & Taxes by Month program on the Integrity, Rollover & Repost menu (G072471) or repost the detail transactions to the summary table. In either case, run the Tax History Integrity report to verify that no other errors exist. |

0154 -- Negative paid-in-excess wage amount |

The paid-in-excess wage amount contains a negative value. Determine whether a negative balance is acceptable for the tax area and tax type. If it is not, adjust the balance by using the Pay & Taxes by Month screen on the Integrity, Rollover & Repost menu (G072471) or repost the detail transactions to the summary table. In either case, run the Tax History Integrity report to verify that no other errors exist. |

0156 -- Negative tax paid amount |

The tax withheld or paid amount contains a negative value. Determine whether a negative balance is acceptable for the tax area and tax type. If it is not, adjust the balance by using the Pay & Taxes by Month program on the Integrity, Rollover & Repost menu (G072471) or repost the detail transactions to the summary table. In either case, run the Tax History Integrity report to verify that no other errors exist. |

0199 -- History record deleted |

This error indicates that the program deleted the taxation history record from the table. Determine whether the record should have been deleted. If it should not have been deleted, restore the backup of the taxation history table. JD Edwards World strongly recommends that you contact technical support for assistance with restoring the backup. |

0250 -- No federal tax taken |

Federal taxable wages exist for the employee, but no tax was withheld. This might occur because the employee claims enough exemptions to cause calculations without tax. If you determine that the federal transactions are invalid, you must manually change the records using the Pay & Taxes by Month program on the Integrity, Rollover & Repost menu (G072471). |

0251 -- Work state, county, city mismatch tax area |

The tax area on the Taxation Summary record does not match the work state, work county, or work city fields on the same record. Determine whether the tax area in the Taxation Summary History record matches the tax area in the F069016 table. If the tax area is correct, run this report again in update mode to correct the work state, work county, or work city fields. |

0252 -- Invalid statutory code |

The statutory code on the Taxation Summary record does not match the statutory code in the F069016 table. Verify that the statutory code is correct using the Tax Area Information program on the Taxes & Insurance menu (G0744). If not, correct it and then run the Tax History Integrity report in update mode. |

0253 -- Invalid century field |

The Century field in the Taxation Summary record is blank. Run the Tax History Integrity report in update mode to correct the Century field in the Taxation Summary record. |

999 -- Invalid |

The error code is not set up in user defined code table 07/IX. |

Correcting Tax History Integrity Errors

After you run the Tax History Integrity Report (R067011) in proof mode, review and research the errors, you must correct these errors so that your quarterly reports and year-end forms are accurate.

Running the integrity report in update mode automatically corrects certain errors, such as an invalid statutory code. To correct other errors, such as an incorrect tax ID, you must manually revise your payroll data before you run the report in update mode. Some entries that appear on the report might not be errors for your data. For example, taxation error 0250 - No Federal Tax Taken might appear for a low-wage earner for whom no federal tax should be withheld.

After you run the Tax History Integrity Report in update mode, you should run it again to produce an error-free report. When the system finds no errors, it generates only the cover page.

If the Tax History Integrity Report does not generate errors, the review screen does not allow you to review information. You use this screen only to review and revise errors that the report generates.

Correcting tax history integrity errors includes the following tasks:

Correcting tax history integrity errors manually

Correcting tax history integrity errors automatically

To correct tax history integrity errors manually

After you run the Tax History Integrity Report (R067011) in proof mode and review the errors, you must correct these errors so that your quarterly reports and year-end forms are accurate.

Running the integrity report in update mode automatically corrects certain errors, such as a missing tax ID code. To correct other errors, such as an invalid number of periods, you must manually revise your payroll data before you run the report in update mode.

Use the tax history integrity error code list to help you determine the actions that you must perform to correct each payroll history error that displays on the Tax History Integrity Report. You might need to revise history records manually, tax area information, or corporate tax IDs before running another integrity report in update mode. For example, you might need to make the following corrections:

Delete a record that contains zero dollars.

Change a tax ID number.

Correcting tax history ensures that the correct information displays on your quarterly tax reports and year-end forms.

This program must have the highest level of system security.

Be aware of the following when you revise payroll history manually: The system does not update the General Accounting system. You must manually enter the appropriate journal entries. The system does not create an audit trail of the changes that you enter when you revise payroll history manually. The summary totals do not equal the detail totals.

Journal Entries in the U.S. Payroll I Guide

Setting Up Corporate Tax IDs in the Time Accounting Guide

Setting Up Tax Area Information in the Time Accounting Guide

Voiding Payments in the U.S. Payroll Guide

Reviewing Tax History in the U.S. Payroll I Guide

Navigation

From Integrity, Rollover & Repost (G072471), choose Taxation History Review

On Taxation History Review, complete the following fields:

Year

Company

To limit your search, complete the following field:

Error Code

Choose Detail (F4) to review the error code in the employee record.

Perform any of the following:

To enter or correct a corporate tax ID number, choose Corporate Tax ID Revisions (F8).

To void a paycheck, choose Paycheck Review and Void (F9).

To enter or correct a tax area, choose Tax Area Constants (F10).

To review or revise an employee's taxation history, enter 1 in the Option field to access Tax History Revisions.

On Tax History Revisions, enter any necessary corrections.

To correct taxation history integrity errors automatically

After reviewing the Taxation History Integrity report and making manual corrections, run the report in update mode to update the Taxation Summary History table (F06136) with the corrections. When you run the report in update mode, the system corrects some errors automatically and updates all history records with the correct information.

You can correct the following errors automatically by running the Taxation History Integrity report in update mode:

0109 -Invalid Tax ID number

0112 -Tax ID doesn't exist

0113 -Tax ID doesn't match

0251 -Work State, County, City mismatch tax area

0252 -Invalid Statutory Code

0253 -Invalid Century Field

Error codes 0251, 0252, and 0253 are for fields in the table only. They are not visible from any review screens.

For example, if you have applied for a tax ID in a state in which your organization's employees are working for the first time, you can set up your corporate tax ID as "applied for" on the Corporate Tax IDs screen until you receive the tax ID. When you generate payroll using the "applied for" tax ID, the system generates employee history records using the "applied for" code. When you receive a tax ID from the tax authority, you can replace the "applied for" tax ID with the new corporate tax ID number on the Corporate Tax IDs screen. When you run the report in update mode, the system updates all history records that contain the "applied for" code with the new tax ID.

Before You Begin

Enter Y in the Select Report Processing Mode processing option for the Tax History Integrity report to print the report and update the table.

Navigation

From Integrity, Rollover & Repost (G072471), choose Taxation History Report