Reviewing Employee Form Information

You review employee form information online to evaluate how the information displays on the actual form before you print it.

Reviewing employee form information includes the following tasks:

Reviewing and changing employee W-2 information

Reviewing employee wage adjustments

Reviewing employee wage allocations

Reviewing W-2 special handling information

Reviewing employee 1099 and 499R-2 information

Printing a single year-end form

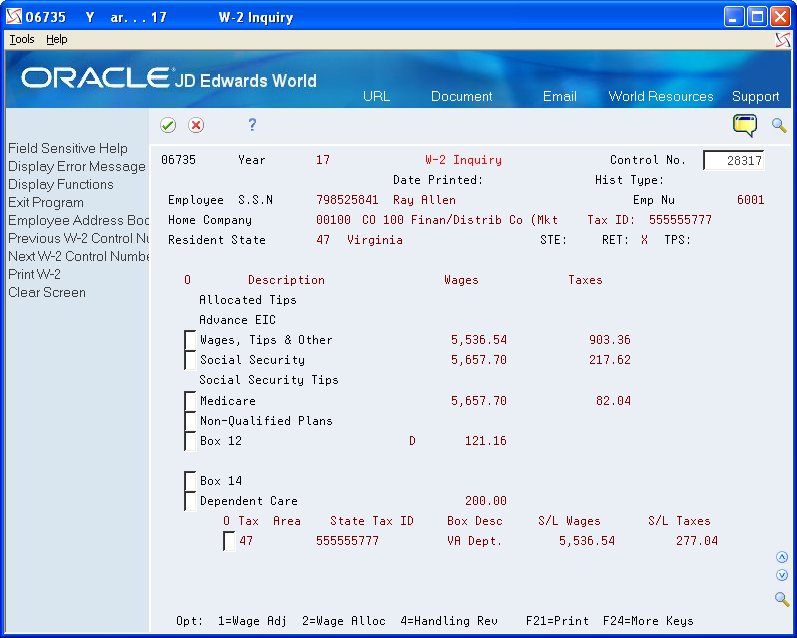

Reviewing and Changing Employee W-2 Information

You review employee W-2 information to evaluate how the information displays on the actual form before you print it.

If the employee works in more than one state and all federal wages are to print on one form, the system displays the following message: Federal wages printed on another W-2 for all state and local forms on which the system does not include federal wages.

If you set up box 1 to allocate wages and taxes to the states, the system displays only part of the wages and tax with a message that indicates that allocation has occurred.

To review and change employee W-2 information

Navigation

From Year End Processing (G07247), choose Form W-2

On Form W-2, complete the W-2/1099 ID field.

On W-2 Inquiry, enter the control number of the employee whose W-2 information you want to review in the Control No field.

If you do not know the employee's control number, use Field Sensitive Help (F1) to access the Control Window.

To review and change an employee's mailing address so that you can print a new form, choose Exit to Address Book (F11).

Field |

Explanation |

|---|---|

Control No |

The number assigned to each W-2 by the W-2 Workfile Build. |

Processing Options

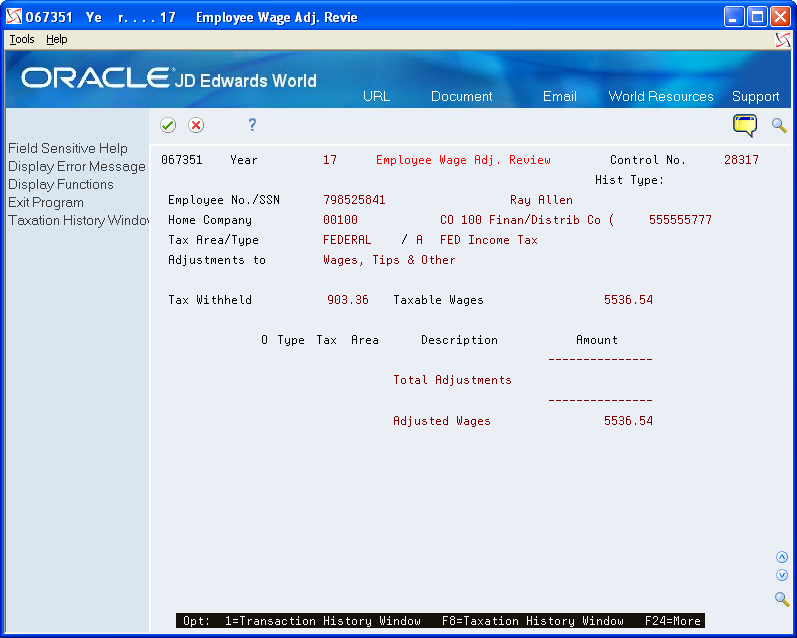

Reviewing Employee Wage Adjustments

You review employee wage adjustments to view adjustments to specific types of wages, such as Social Security or Medicare wages.

To review employee wage adjustments

Navigation

From Year End Processing (G07247), choose Form W-2

On Form W-2, complete the W-2/1099 ID field and click Enter twice.

On W-2 Inquiry, enter 1 in the Option field for the employee whose wage type adjustments you want to review.

The system displays Employee Wage Adj. Review.

Reviewing Employee Wage Allocations

Review employee wage allocations to view the taxable (reported) wages for the taxing authority. These wages include the taxable wages and the total of the adjustments.

If you allocate federal wages to each state, you can view the exact detail of that allocation.

The system also displays each state in which the employee worked, along with the respective allocation percentage. From these percentages, the system allocates federal wages to the state level. In addition, the system displays state wages and taxes.

To review employee wage allocations, you must choose to allocate federal wages when you build your year-end workfile.

To review employee wage allocations

Navigation

From Year End Processing (G07247), choose Form W-2

On Form W-2, complete the W-2/1099 ID field and click Enter twice.

On W-2 Inquiry, enter 2 in the Option field for the employee whose wage allocations you want to review.

On Employee Wage Allocations, review the information and make any necessary changes.

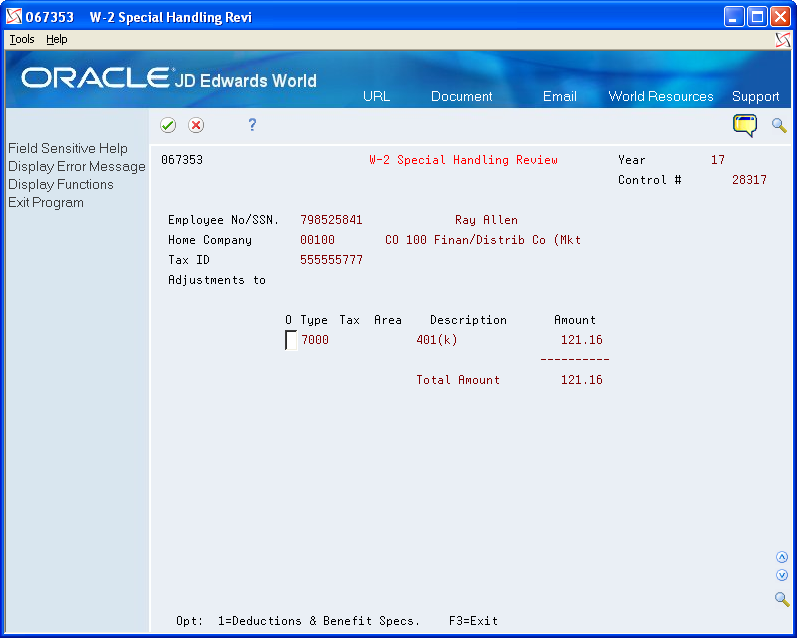

Reviewing W-2 Special Handling Information

You review W-2 special handling information to check the DBAs that compose the amounts in boxes 10, 11, 12, and 14. Each DBA displays with its tax area (if applicable), description, and amount.

To review W-2 special handling information

Navigation

From Year End Processing (G07247), choose Form W-2

On Form W-2, complete the W-2/1099 ID field and click Enter twice.

On W-2 Inquiry, enter 4 in the Option field for the special handling code that you want to review.

On W-2 Special Handling Review, to view specifications for a DBA, choose Deductions and Benefit Specifications.

On Basic DBA Information, review the PDBA specifications.

Reviewing Employee 1099 and 499R-2 Information

Before you print 1099 and 499R-2 forms, review the employee information that displays on these forms and verify that it is correct.

Reviewing employee 1099 and 499R-2 information includes the following tasks:

Review employee 1099-MISC information

Review employee 1099-R information

Review employee 499R-2 information

Verifying Employee Names and Addresses for more information about entering an employee's mailing address

To review employee 1099-MISC information

Navigation

From Year End Processing (G07247), choose Form 1099-Misc.

On Form 1099-Misc, complete the 1099 Version field and click Enter twice.

On 1099-Misc. Inquiry, complete the Employee Number field.

To review and revise an employee's mailing address so that you can print a new form, choose Exit to Address Book (F11).

On 1099-Misc. Inquiry, choose Print 1099 (F21) to print a single 1099 form.

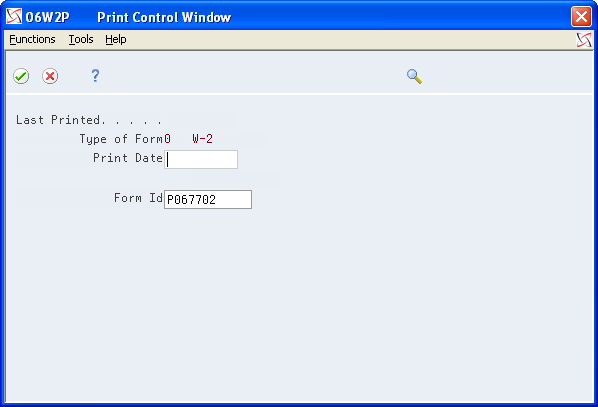

On Print Control Window, review the values in the following fields:

Form Size

Form Id

Make changes, if necessary.

Choose Submit (F6).

Processing Options

See Processing Option for 1099-Misc. (P06737).

To review employee 1099-R information

Navigation

From Year End Processing (G07247), choose Form 1099-R

On Form 1099-R, complete the 1099 Version field and click Enter twice.

On 1099-R Inquiry, complete the Employee Number field.

To review and revise an employee's mailing address so that you can print a new form, choose Exit to Address Book (F11).

On 1099-R Inquiry, choose Print 1099 (F21) to print a single 1099 form.

On Print Control Window, review the values in the following fields and make changes, if necessary:

Form Size

Form Id

Choose Submit (F6).

Processing Options

See Processing Option for 1099-R (P067371).

To review employee 499R-2 information

Navigation

From Year End Processing (G07247), choose Form 1099-R

On Form 499R-2, complete the ID field and click Enter twice.

On 499R-2 Inquiry, in the Employee field, enter the employee number of the employee whose 499R-2 information you want to review.

If you do not know the employee's number, use the Field Sensitive Help function in this field to display the Control Window.

To review and change an employee's mailing address so that you can print a new form, choose Exit to Address Book (F11).

Printing a Single Year-End Form

You can print a single W-2, 1099-R, 1099-MISC, or 499R-2 form for an individual employee. You might print a single year-end form to determine whether the information prints correctly, instead of running the mass print program to print forms for all of the employees who are in the workfile build.

When you print individual W-2 forms, you have the option of choosing the print program during the print process.

If you enter a print date for a W-2 form and need to reprint the form, you must either reset the print date or print a W-2c form.

When you print an employee's form as a test, you should remove the date from the Print Date field so that when you run the mass print program, the system disregards the test print scenario and allows a reprint of the employee's W-2.

Printing a single year-end form includes the following tasks:

Print a single W-2 form

Print a single 1099-MISC form

Print a single 1099-R form

Print a single 499R-2 form

To print a single W-2 form

Navigation

From Year End Processing (G07247), choose Form W-2.

On Form W-2, complete the W-2/1099 ID field and click Enter twice.

On W-2 Inquiry, complete the Control Number field.

Choose Print W-2 (F21).

On Print Control Window, review the values in the following fields:

Print Date

Form Id

Make changes, if necessary.

Choose Submit (F6).

After the system processes the job, the system displays W-2 Inquiry.

To print a single 1099-MISC form

Navigation

From Year End Processing (G07247), choose Form 1099-Misc.

On Form 1099-Misc., complete the 1099 Version field and click Enter twice.

On 1099-Misc. Inquiry, complete the Employee field.

Choose Print 1099 (F21).

After the system processes the job, the system displays 1099-Misc. Inquiry.

To print a single 1099-R form

Navigation

From Year End Processing (G07247), choose Form 1099-R

On Form 1099-R, complete the 1099 Version field and click Enter twice.

On 1099-R Inquiry, complete the Employee field.

Choose Print 1099-R (F21).

After the system processes the job, the system displays 1099-R Inquiry.

To print a single 499R-2 form

Navigation

From Year End Processing (G07247), choose Form 499 R-2

On Form 499R-2, complete the ID field and click Enter twice.

On 499R-2 Inquiry, complete the Employee field.

Choose Print 499R-2 (F21).

On Print Control Window, review the values in the following fields:

Print Date

Form Id

Make changes, if necessary.

Choose Submit (F6).

After the system processes the job, the system displays 499R-2 Inquiry.

Field |

Explanation |

|---|---|

Form ID |

The DREAM Writer form ID for the program to execute. You can choose from: P067701 - Print Laser W-2s, 2-part P067702 - Print laser W-2s, 4-part P06771L - Print Laser W-2c P06772L - Print Laser 499R-2 |