Verifying Employee Information

You verify employee information to ensure accuracy when you process employee names, addresses, and other reportable employee information for year end.

Before you build the year-end workfile, you need to verify that employee names and addresses in the Address Book system are set up properly for W-2, 1099, 499R-2 forms, and for electronic filing.

In box 13 on the W-2 form, you can report miscellaneous information that the government requires. An example of miscellaneous information is whether an employee is an active participant in a retirement plan.

When you set up employee information, you might need to set up your system to report year-end information for employees who work in multiple states, and for contract or pension employees.

Verifying employee information includes the following tasks:

Verifying employee names and addresses

Setting up information for box 13

Setting up a statutory employee

Setting up an employee who is an active participant in a retirement plan

Setting up employees who work in multiple states

Setting up employees who work in Puerto Rico

Setting up contract and pension employees

Verifying employee social security numbers

Verifying Employee Names and Addresses

When you build the year-end workfile, the system uses employee names and addresses from the Address Book system. Therefore, before you build the year-end workfile, you should verify that employee names and addresses in the Address Book system are set up properly for W-2, 1099, 499R-2 forms, and for electronic filing.

Although JD Edwards World does not provide a report to verify employee information for year-end reporting, you can run the Employee Roster to print employee names and addresses.

The employee name that displays on the W-2 form and in the W-2 electronic file is a concatenation of the following three fields from the Address Book - Who's Who table (F0111):

Given Name (GVNM)

Middle Name (MDNM)

Surname (SRNM)

When you update the Alpha Name field (ALPHA) in the Address Book Master table (F0101), the system updates the F0111 table.

The employee name that displays on the 1099 electronic file, 1099 forms, and 499R-2 forms is from either the Alpha Name field or the Mailing Name field, depending on which field you specify in the workfile build program.

Employee names must comply with the format that government taxing authorities require. If you do not format the names of your employees correctly, government agencies do not accept your year-end information. To ensure that employee names meet government formatting requirements, you can use a conversion utility. To access this utility, choose F0111 File Conversion - EFW2 from menu G97U23. This conversion utility updates the Given Name (GNNM), Middle Name (MDNM), and Surname (SRNM) fields in the Address Book - Who's Who table (F0111) with the information in the Alpha Name field (ALPHA) in the Address Book Master table (F0101).

Contact Global Support Services for help with this procedure.

For the employee address, the system prints the first two address lines for electronic reporting and the last three nonblank lines for printed forms, plus the city, state, and postal code fields. The system can print a maximum of 30 characters per line on the printed forms and can include a maximum of 22 characters per line on electronic file. The information prints on these lines is as follows:

Name

Address

For electronic file, the first two address lines (up to 22 characters each)

For forms, the last three nonblank address lines (up to 30 characters each)

City, state, and postal code

Therefore, in order to ensure that all necessary address information is in both the electronic file and on printed forms, JD Edwards World suggests that you enter the employee's address information using a maximum of 22 characters on each of the first two address lines.

If you enter the street address, along with the apartment information on one line, the system does not include the complete address in the electronic file.

The following example illustrates which line you should use to enter each piece of address information:

Bob Smith

1055 East Main Street (enter this information on address line 1)

Apartment 2A (enter this information on address line 2)

Denver, CO 80218

To ensure that address information is complete on both printed and electronic file year-end information, JD Edwards World recommends that you enter all of the necessary address information using the format in the previous example. If you are not processing electronic filing, you can use up to three lines to enter an employee's address. However, if in the future you plan to process the information using electronic files, you might need to edit your address book records to avoid reporting incomplete information in the electronic files.

Setting up Information for Box 13

On the W-2 form, box 13 contains miscellaneous categories that the government defines for reporting information. To enter information in box 13, you must set up values in various parts of the Payroll system.

Box 13 contains the following categories:

Statutory employee

Retirement plan

Third-party sick pay

Setting up a Statutory Employee

Miscellaneous information that the government requires on the W-2 form includes the category for employees that are a statutory employee. A statutory employee is not subject to federal income tax withholding, but is subject to Social Security and Medicare tax.

To set up a statutory employee

Navigation

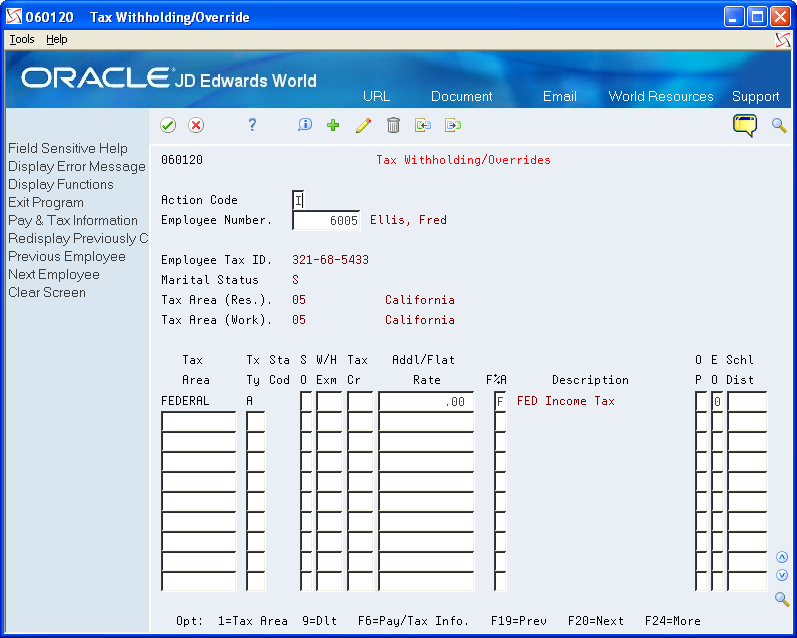

From Employee Information (G0711), choose Tax Withholding/Overrides

On Tax Withholding/Overrides, locate the employee.

Enter 0 (zero) in the following field:

Addl/Flat Rate (Additional Withholding)

Enter F in the following field and Click OK:

F%A

Field |

Explanation |

|---|---|

Additional Withholding |

An additional amount to be withheld over and above the calculated withholding. This could also represent a flat withholding amount in situations in which the employee elects to completely bypass the calculated amount. The authority to which each element relates is determined by the tier code of the tax authority. Whether the amount is to be an additional amount or a flat withholding is specified in the employee's master file record. |

F%A |

Based on the value of this field, the corresponding additional/flat amount field has one of the following functions: % – A percentage to replace the tax rate from the table. A – An amount to be added to the tax computed from the table. F – An amount to replace the tax computed from the table. X – An additional amount added to the standard exemption amount, deducted (exempt) from the annualized gross to determine taxable pay. Y – An amount to override the standard exemption amount to be subtracted from the annualized gross prior to the tax calculations. |

Setting up an Employee W-4 Form (for the year 2020 and later)

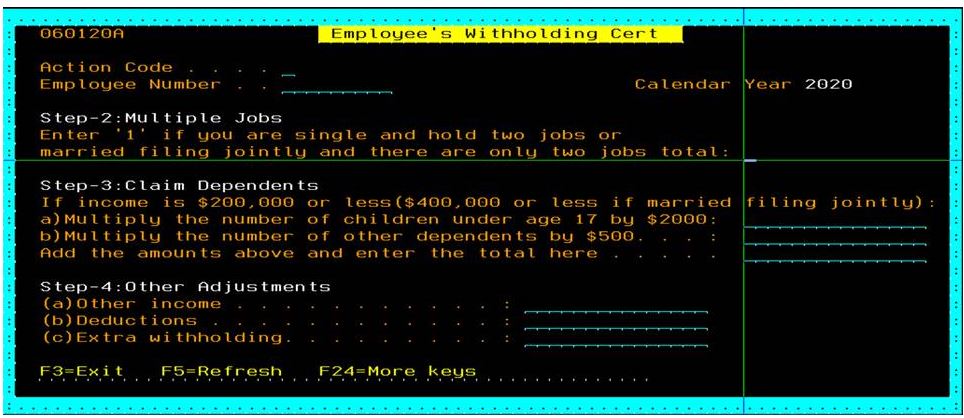

The IRS Form W-4, Employee's Withholding Allowance (060120A) is the program that employees use to enter information needed for the IRS W-4 Form.

Employees can enter information in W-4 forms, and review and edit the information if required. The IRS Form W-4 provides a tab each for Name and Address, and also provides the IRS Withholding Calculator. The system saves the values that an employee enters in the W-4 Form.

Updating Employee Details in the W-4 Form

In the Processing Options Revisions page, if the calendar year option for the W-4 form is 2021 or any later year, the system displays the new W-4 (Tax Withholding/Overrides) window.

To update the employee details in the W-4 Form:

On the Tax Withholding/Overrides page, enter a value in the Employee Number field. The system then displays the employee details (Employee Tax ID, Marital Status, Tax Area, and so on).

Enter the Tax rates if required.

Select F5.

The system displays the Employee Withholding Certificate with the following options:

Action Code: I Displays employee information.

Employee Number: Displays the employee number whose withholding is displayed

Calendar Year: Displays the calendar year for the withholding certificate.

Multiple Job or Spouse Works:

Enter a value in this field if the employee holds more than one job or if the employee's spouse files jointly with the employee.

Claim Dependents:

If you have dependents, complete the fields in the Claim Dependents section in the IRS Form W-4.

a) Multiply the no. of children under age 17 by $2,000: Enter the amount generated by multiplying the number of children under the age of 17 by $2,000.

b) Multiply the Number of other dependents by $500: Enter the amount generated by multiplying the number of other dependents who are not qualifying children under the age of 17 by $500.

c) Add the amounts and end the total here: Enter the sum of the above two amounts.

Other Adjustments:

a) Other Income: Enter the income for the year in which withholding is not expected on income.

b) Deductions: Enter the deductions other than the standard deduction that will not have withholding.

c) Extra Withholding: Enter the amount to be withheld in addition to the calculated withholding. This value could also be a flat withholding amount if the employee completely bypasses the calculated amount. The authority assigned to each element is determined by the tier code of the tax authority. Whether the amount is to be an additional amount or a flat withholding is specified in the employee's master file record.

Setting up an Employee Who Is an Active Participant in a Retirement Plan

Miscellaneous information that the government requires on the W-2 form also includes the category for the employee that is an active participant in a retirement plan.

To set up an employee who is an active participant in a retirement plan

Navigation

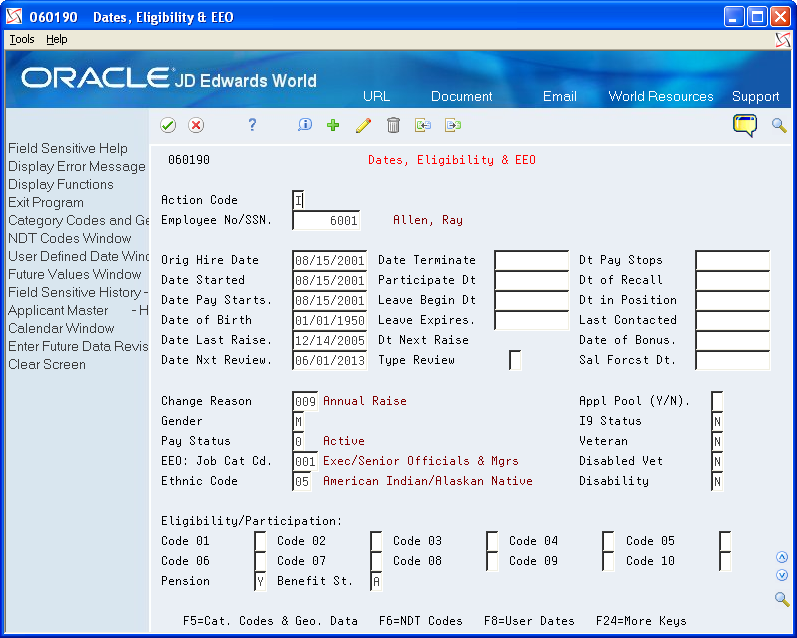

From Additional Employee Data & Reports (G07111), choose Dates, Eligibility & EEO

On Dates, Eligibility and EEO, locate the employee.

Enter Y in the following field:

Pension

Field |

Explanation |

|---|---|

Pension |

A code that specifies whether the employee is eligible to participate in the company's retirement plan. When you process W-2 information for employees, the code that you enter in this field determines whether the system places an X, indicating employee eligibility, in the Retirement plan box of the employee's W-2 form. |

Setting up Employees Who Work in Multiple States

When an employee works in more than one state, you can print one or two states per W-2 form. When you select one state per form, the employee receives a W-2 for each state. If you choose to print federal information on only one of the W-2 forms, you must specify the W-2 on which you want this information to print. The system uses the employee's base state to determine the W-2 on which to print federal information.

When you create the year-end workfile, the system determines the employee's base state by using values that are set up in various parts of the Payroll system.

Setting up employees who work in multiple states includes the following tasks:

Set up the resident state as the base state

Set up a state other than the resident state as the base state

Setting up the Resident State as the Base State

You set up the resident state as the base state when you want to print federal tax information on the W-2 that identifies the employee's resident tax area as the base state.

The system uses the resident tax area code that is in the Employee Master table (F060116) as the employee's resident tax area.

If the employee has no wages or tax for his or her resident tax area, the system uses the last state record in the W-2 workfile as the base state. This is the record with the highest-numbered GeoCode in the Payroll Tax Calculation System.

To set up the resident state as the base state

Navigation

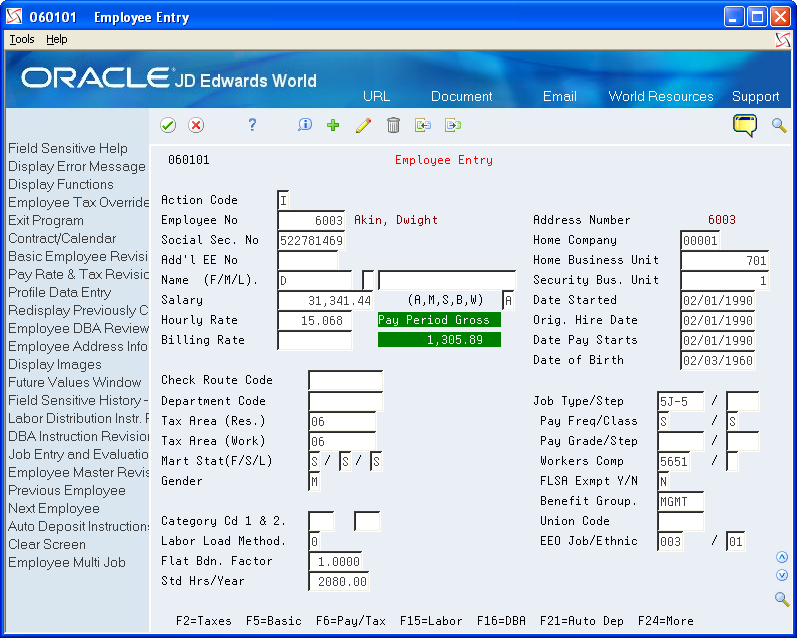

From Employee Information (G0711), choose Employee Entry

On Employee Entry, locate the employee.

Enter the code for the employee's resident state in the following field:

Tax Area (Res.)

Field |

Explanation |

|---|---|

Tax Area (Res.) |

A code that identifies a geographical location and the tax authorities for the employee's residence. Authorities include both employee and employer statutory requirements. In Payroll Tax Calculation System payroll-number tax terminology, this code is synonymous with GeoCode. Refer to Payroll Tax Calculation System's Master GeoCode List for valid codes for your locations. Screen-specific information You can use either the two-digit state code or the nine-digit locality code. It is recommended that you use the two-digit state code if no state or city code is required. |

Setting up a State Other Than the Resident State as the Base State

You need to set up a state other than the employee's resident state as the base state when tax laws require you to print federal information on a year-end form for a state other than the employee's resident state.

For example, suppose that an employee works for company 707 in Ohio and New Jersey in 2024, but the employee moves to New York in January of 2024 and continues to work for company 707. You update the employee's master record to show New York as the resident state.

When you process year-end information, you must override the employee's current resident state information because all work for 2022 was in states other than the resident state.

Before You Begin

Add the tax areas to the UDC table for the appropriate states. The tax area code must be the two-digit Postal Code. For example, to specify the tax area for New Jersey, you enter tax area 31 to UDC 07/SC.

Because you must enter the numeric Postal Code for any state that you enter in the Home State field, you might have more than one entry per state in UDC 07/SC. You do not need to complete the second description of UDC 07/SC for any codes that you use to set up a state other than the resident state as the base state.

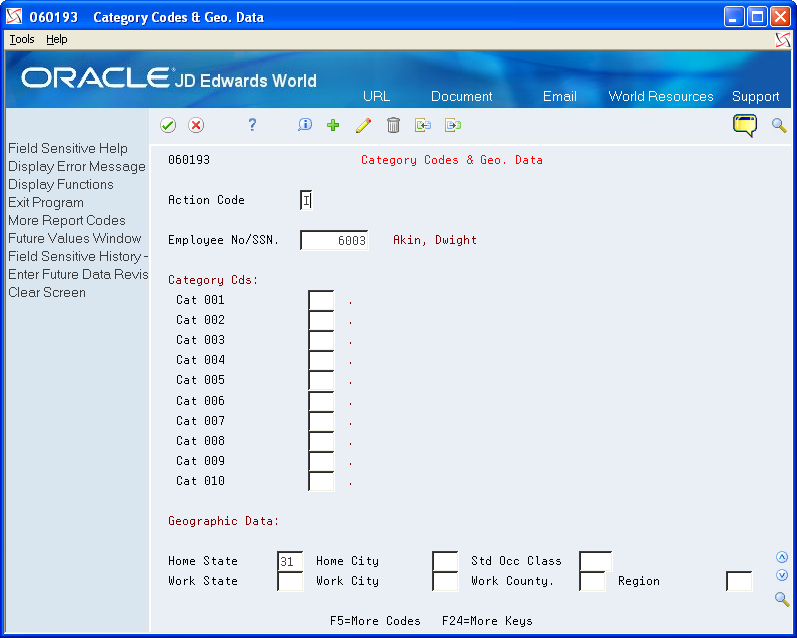

To set up a state other than the resident state as the base state

Navigation

From Additional Employee Data & Reports (G07111), choose Category Codes & Geo. Data

On Category Codes & Geo. Data, locate the employee.

Complete the following field:

Home State

Field |

Explanation |

|---|---|

Home State |

The employee's home state for tax reporting purposes. This code designates the state in which the employee resides. Note: For W-2 reporting, use the numeric value that is equivalent to the designated state. For example: 06 - Colorado, 05 - California. Otherwise, the system produces undesirable report results. If you leave this field blank, the system uses the value in the Tax Area (Resident) field on Pay and Tax Information as the employee's resident (base) state. |

Setting up Employees Who Work in Puerto Rico

If your organization has employees who work in Puerto Rico during the year, you must create 499R-2 forms for tax reporting purposes when you process year-end information. To set up employees who work in Puerto Rico correctly, you must set them up as statutory employees. Additionally, you must assign the proper tax area and tax method. By assigning the correct tax method, the history records the system creates during the payroll process include the appropriate tax history type. The payroll system generates 499R-2 forms for Puerto Rican employees, using the tax history type.

Creating the Year-End Workfile for processing Puerto Rico employees

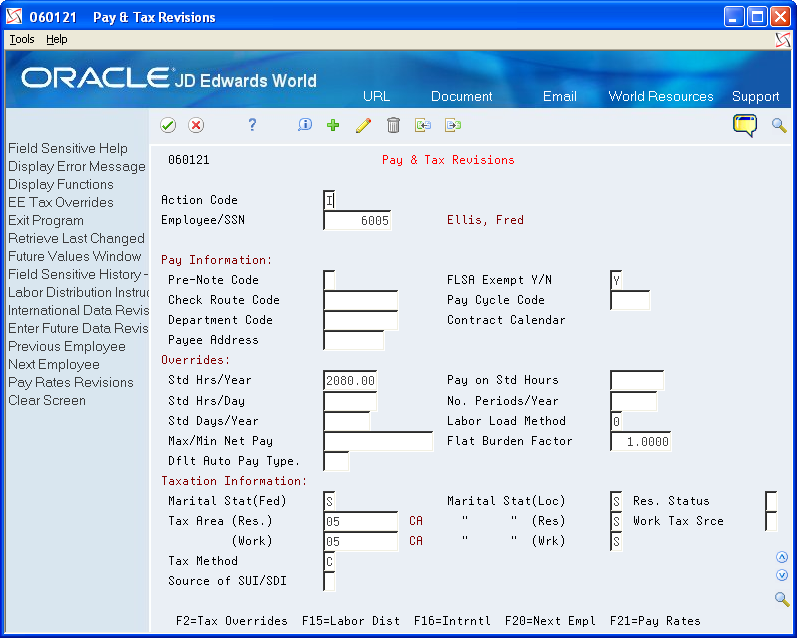

To set up employees who work in Puerto Rico

Navigation

From Additional Employee Data & Reports (G07111), choose Pay & Tax Revisions

On Pay & Tax Revisions, locate the employee.

Enter R in the following field:

Tax Method

Enter 72 in the following fields:

Tax Area (Res.)

Tax Area (Work)

Click OK.

Setting up Contract and Pension Employees

To generate the appropriate 1099 forms at year end, you must set up tax method information for pension and contract employees before you process pay information from the entire year. By assigning the correct tax method to an employee, the history records the system creates during the payroll process include the appropriate tax history type. The Payroll system generates 1099-R forms for pension employees and 1099-MISC forms for contract employees, using the tax history type.

To set up contract and pension employees

Navigation

From Additional Employee Data & Reports (G07111), choose Pay & Tax Revisions

On Pay & Tax Information, locate the employee.

For pension employees, enter P in the following field:

Tax Method

For contract employees, enter C in the following field:

Tax Method

Click OK.

Field |

Explanation |

|---|---|

Tax Method |

A code that indicates to the Payroll Tax Calculation System how to calculate certain taxes. The codes are contained in user defined code table 07/TM. |

Verifying Employee Social Security Numbers

For you to legally employ individuals in the United States, they must provide the employer with a valid Social Security Number. The Social Security Administration (SSA) offers several methods for you to verify that the Social Security Numbers your employees provide to you are valid. You can provide the SSA with a list of employees and their Social Security Numbers via phone, fax, or electronic file.

You can use the Employee Verification Service (EVS) program (P06780) to create a file that includes all of the information that the SSA needs in order to validate employee Social Security Numbers.

After you send your electronic file to the SSA, they verify the information and return the file to you. If the SSA determines that any of the employee Social Security Numbers are invalid, those records indicate that they are invalid. You must then follow up with the employee and the SSA to rectify the situation.

You do not have to complete this process for year-end processing. However, the SSA does not accept year-end information for employees who do not have a valid Social Security Number. Therefore, we recommend that you run this process regularly to ensure that all employees have valid Social Security Numbers before you report year-end information. Contact your Employer Service Liaison Officer at the SSA for additional information about verifying employee Social Security Numbers.

Navigation

From W-2/1099 Setup menu (G072472), choose Build EVS File for SSA