Verifying Company Information

You verify company information to ensure accuracy when you process company names, addresses, and tax information for governmental reporting purposes.

If your organization contains several companies that are under one parent company, and all of the child companies have the same corporate tax ID, you can update the W-2 information for the parent company and report information for all child companies under the parent company.

You verify that tax area information is set up for any tax that your company or employees have paid over the year. If tax area information is not accurate, you might not be reporting information correctly on year-end forms.

Setting up next numbers for W-2 forms instructs the system to assign control numbers, which creates an audit trail for your W-2 forms.

Verifying company information includes the following tasks:

Verifying company names and addresses

Setting up employer information (UDC 07/CT)

Verifying railroad tax information

Updating year-end information to a parent company

Verifying tax area information

Setting up next numbers for W-2 forms

Setting up kind of employer (UDC 07/KE)

Verifying Company Names and Addresses

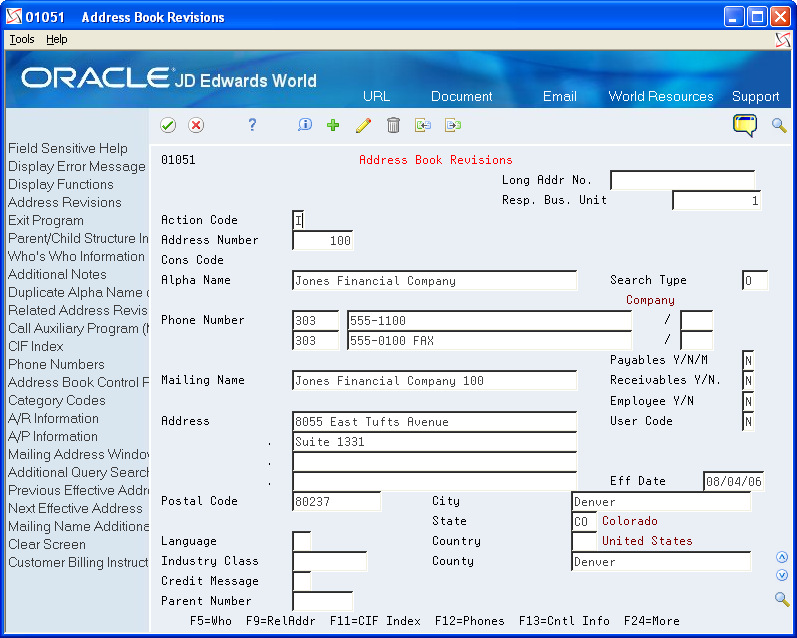

To compile the information that you report to state and federal government agencies, the system uses company names and addresses from the Address Book record. Before you build the W-2/1099 workfile, verify that company names and addresses are set up properly for year-end reporting.

The system prints the company name, the first two address lines (for electronic filing) or the last three nonblank address lines (for printed forms), and the city, state, and postal code fields. The system can print a maximum of 30 characters per line on the printed forms and includes a maximum of 22 characters per line in the electronic file. The information that prints on these lines is as follows:

Name

Address

For electronic filing, the first two address lines (up to 22 characters per line)

For forms, the last three nonblank address lines (up to 30 characters per line)

City, state, and postal code

The company address that prints on year-end forms includes the last three nonblank lines of the company's address. The address that the system generates for electronic filing includes the first two lines of a company's address. To ensure that address information is complete on both the printed forms and electronic filing year-end information, JD Edwards World recommends that you enter all of the necessary address information using the format above. If you are not processing electronic filing, you can use up to three lines to enter a street address. However, if you plan to file electronically in the future, you might need to change the address to avoid reporting incomplete information in the electronic file.

Navigation

From Address Book (G01), choose Address Book Revisions

The following illustrates the company address information for year-end purposes:

Setting Up Employer Information

Ensure that you set up the following five fields for employer contact information for the EFW2 and EFW2C:

Employer Contact Name

Employer Contact Phone Number

Employer Contact Phone Extension

Employer Contact Fax Number

Employer Contact E-Mail/Internet

You use UDC 07/CT to set up this information. The Code field must contain the 5-digit company number and the Description field must contain the full 8-digit Address Book Number, including leading zeros, if applicable.

In order for the system to add all of the Employer Contact information to the RE record on the EFW2 and EFW2C workfile, you must add a Company Number record for all Employer Home Company numbers within these work files.

Verifying Railroad Tax Information

For companies that are subject to railroad taxation, verify that the setup of railroad tax information meets tax regulations.

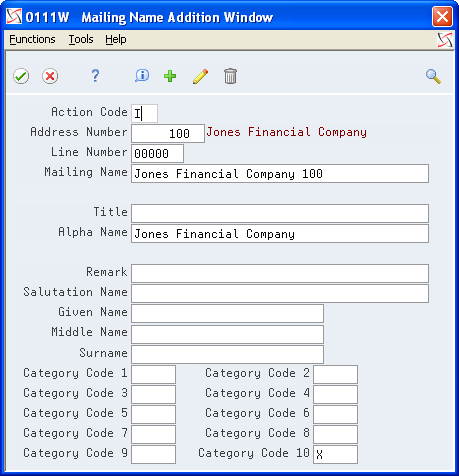

An X in category code 10 on the Mailing Name Addition Window designates companies that are subject to railroad taxation (tier I and tier II). The X displays on the employer record of the electronic file and identifies special taxation requirements to the IRS.

Before You Begin

Add X to UDC 01/WT, if necessary.

To verify railroad tax information

Navigation

From Address Book (G01), choose Address Book Revisions

On Address Book Revisions, locate the company.

Choose Who's Who Information (F5).

On Who's Who, enter 5 in the following field next to the company name:

Option

On Mailing Name Addition Window, complete the following field and click Change:

Category Code 10

The X must be in the first position of this field.

Updating Year-End Information to a Parent Company

If your organization contains several companies that are under one parent company, and all of the child companies have the same corporate tax ID, you can update W-2 information and report it under the parent company. When you update multiple companies under a parent company, an employee who worked in more than one child company receives only one W-2.

You must summarize by the parent company. For example, suppose that the parent company is 00001 and the child company is 00050. You must summarize year-end information for both companies to company 00001. The W-2 forms for employees who work for either company display the name and tax ID of company 00001.

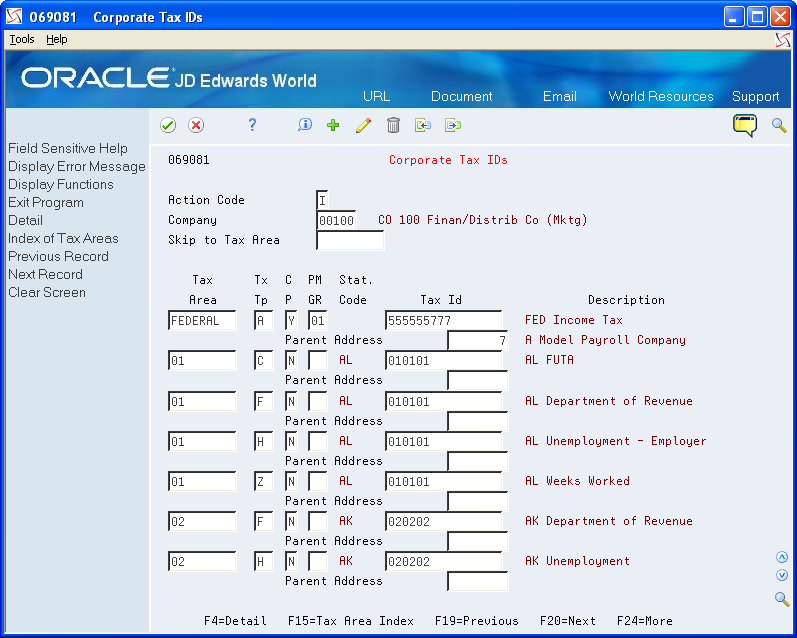

For W-2 reporting purposes, the Federal A corporate tax ID number cannot contain punctuation or spaces. If dashes exist in the Federal A corporate tax ID, remove them. Then correct employee history records that have the erroneous Corporate Tax ID information by following the steps to update payroll history integrity.

Working with PDBA History Integrity about updating employee history information

To update year-end information to a parent company

Navigation

From Taxes & Insurance (G0744), choose Corporate Tax IDs

On Corporate Tax IDs, for the Federal A tax area record of the parent company and all child companies, enter the address number for the parent company in the following field in the detail area:

Parent Address

Click Change.

Field |

Explanation |

|---|---|

Parent Address |

The Address Book number of the parent company. The system uses this number to associate a particular address with a parent company or location. For example: Subsidiaries to parent companies Branches to a home office Job sites to a general contractor If you leave this field blank on an entry screen, the system supplies the primary address from the Address Number field. This address must exist in the Address Book Master table (F0101) for validation purposes. Screen-specific information For payroll year-end reporting, to report multiple companies with the same tax ID under one parent company, enter the address number for the parent (reporting) company for all child companies as well as for the parent company. |

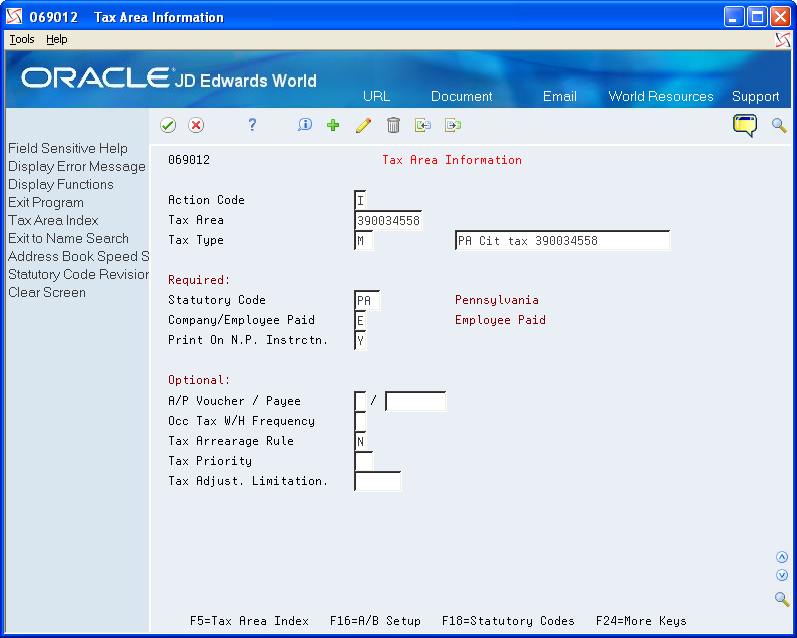

Verifying Tax Area Information

Before you build the workfile, verify that the statutory codes and descriptions for the state and local tax areas are accurate. The system uses this information and prints it in two boxes on the W-2:

State (box 15) displays the statutory code that you assign to the state F tax area. These codes are in UDC 07/SC.

Locality name (box 20) displays the local tax area description. Eight characters appear for standard and two-part laser forms. Fifteen characters appear for four-part laser forms.

Verifying tax area information includes the following tasks:

Verify tax area information for Box 15

Verify tax area information for Box 20

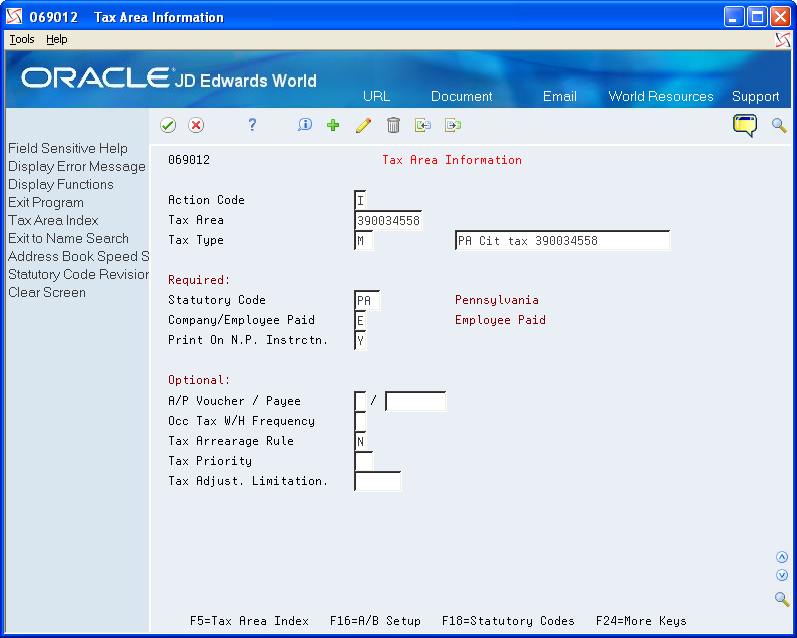

To verify tax area information for Box 15

Navigation

From Taxes & Insurance (G0744), choose Tax Area Information

On Tax Area Information, locate the tax area and tax type.

Review the value in the following field:

Statutory Code

To verify tax area information for Box 20

Navigation

From Taxes & Insurance (G0744), choose Tax Area Information

On Tax Area Information, locate the tax area and tax type.

Review the value in the following field, which is next to the Tax Type field, but does not contain a label:

Description

Field |

Explanation |

|---|---|

Tax Area |

A code that identifies a geographical location and the tax authorities for the employee's worksite. Authorities include both employee and employer statutory requirements. In Payroll Tax Calculation System payroll-number tax terminology, this code is synonymous with GeoCode. Refer to Payroll Tax Calculation System's Master GeoCode List for valid codes for your locations. |

Tax Type |

A user defined code (07/TX) that identifies the type of payroll tax being processed. Refer to the associated user defined code records for the current descriptions of these codes. The values and meanings associated with this user defined code are preset by JD Edwards World. You should not alter the values or their meanings. Screen-specific information For Canadian provincial tax types: Set up tax type CF for every tax area even if there is no provincial tax because wage history is maintained by province. For U.S. state tax types: Set up tax type C, Federal Unemployment Insurance (FUI) for each state because the FUI rate might vary from state to state. Use the 2 character statutory code for the state. You must have the tax type Z, weeks worked, whenever you have tax type H, state unemployment. Some states require weeks worked to be reported with state unemployment. For U.S. local tax areas: Local tax areas use all 9 digits of the GeoCode tax area. You should define a 3 character statutory code. For U.S. Earned Income Credit (EIC) For Tax Type B, the EIC prints on the check, advice, or payslip. The system subtracts this tax amount from the total deductions at the bottom of the paystub. |

Statutory Code |

This code specifies the two-character or three-character state or locality code that prints on statutory reports such as W-2 and 941. For example, on W-2 and 941 forms, instead of printing 06, which might be the taxing authority for the state of Colorado, the system prints the statutory code CO. Enter an alpha code from UDC table 07/SC. Screen-specific information If you leave this field blank, the system uses the default value Federal. The statutory code field is left blank for all federal taxes. The second description is not a GeoCode. JD Edwards World recommends not changing this description because it is used for W-2 and T-4 reporting. |

Setting Up School District Codes (UDC 07/SS)

School District Codes UDC is used to populate the value in the W-2 form for the School District Number (SCDC) in Box-20 when reporting school district withholding. The system displays the first six characters of the school district name followed by the four-digit school district code in the W-2 form. If the school district code is not set up in 07/SS UDC, then the system prints only the school district code in Box-20.

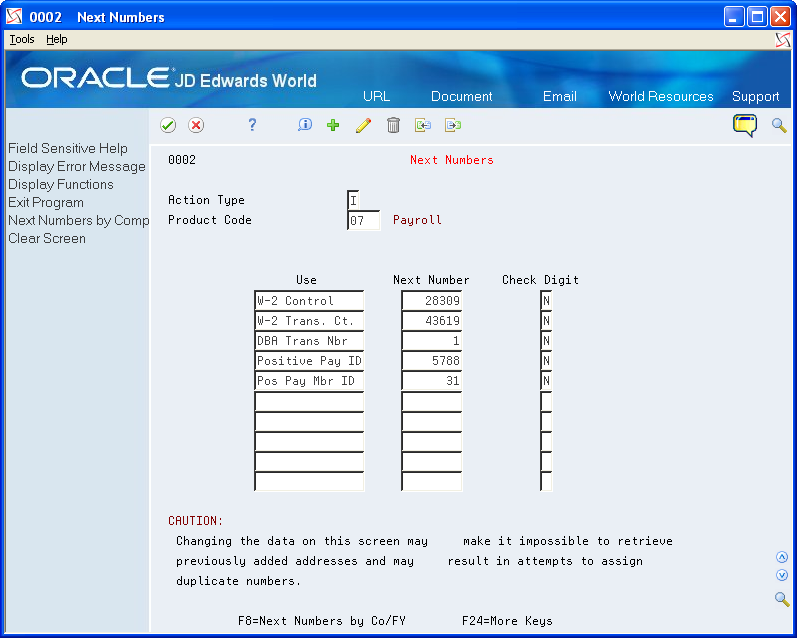

Setting up Next Numbers for W-2 Forms

Setting up next numbers for W-2 forms instructs the system to assign individual control numbers to each W-2. This action creates an audit trail for your W-2 forms. Before you begin year-end processing, verify that next numbers exist for system 07 for the following fields:

W-2 Control

W-2 Transaction Count

To set up next numbers for W-2 forms

Navigation

From General Systems (G00), choose Next Numbers

On Next Numbers, to locate next numbers for a system, complete the following field.

System Code

Review the values in the following fields:

Use

Next Number

Check Digit

Field |

Explanation |

|---|---|

Use |

A description that explains how the next number is used. |

Next Number |

The number that the system uses next when assigning numbers. Next numbers can be used for voucher numbers, invoice numbers, journal entry numbers, employee numbers, address numbers, contract numbers, and sequential W-2 forms. You must use the next number types already established, unless custom programming has been provided. |

Check Digit |

A code that specifies whether the system adds a number to the end of each next number assigned. For example, if you are using check digits and the next number is 2, the system will add a check digit such as 7, making the last two numbers 27. Check digits provide a method of randomly incrementing numbers to prevent the assignment of transposed numbers. In this example, the system would never assign next number 72 while check digits are activated. Valid codes are: Y – Yes, add a check digit to this next number N – No, do not add a check digit |

Setting Up Kind of Employer (UDC 07/KE)

You need to set up UDC 07/KE to determine the Kind of Employer for each company that you are running through year-end processing. This is necessary information for the W-3 form. If none of these apply, do not set up the company in this UDC. The program will correctly check the box None Apply on the form.

Code |

Description |

Description 2 |

|---|---|---|

00001 |

F |

Federal Government |

00007 |

S |

State or Local Government Employer |

00050 |

T |

State or Local Tax Exempt Employer |

00100 |

Y |

Tax Exempt Employer |

Setting Up Special Handling Code (UDC 06/S2)

You need to set up UDC 06/S2 to report the total amount of qualified sick and family leave wages paid to an employee under the FFCRA.

FFCRA wages can be manually adjusted in the W2 review application.

Code |

Abbreviation |

Description 2 |

|---|---|---|

C1 |

FSLW-511 |

Federal sick leave wagessubject to the limit of $511per day limit |

C2 |

FSLW-200 |

Federal sick leave wagessubject to the limit of $200per day limit |

C3 |

FEFLW |

Federal emergency familyleave wages |