Creating the Year-End Workfile

After you set up the workfile, you must create the workfile. You create the year-end workfile to gather the information that is necessary to print government forms, audit reports, and year-end reports, and to create the electronic file that you send to the SSA.

When you create the workfile, the system also prints a report of the negative amounts that are in the workfiles. This report specifies the employee number, company number, PDBA code, tax area, tax type, and amount. You must correct these negative amounts and then rerun the workfile build. The workfile build does not create a W-2 for an employee with a negative amount. The IRS and SSA do not allow you to report negative amounts.

If you did not assign special handling code tables to the electronic file fields, a warning message prompts you to do so.

The system generates the Negative Dollar Integrity report (R06730) that displays any negative wage and tax errors. If no negative wages or tax errors exist, the system prints only a report cover page.

The system creates the following employee-level records when you process 499R-2, 1099, and W-2 forms:

F06730 is a single federal control record that contains the U.S. federal taxes.

F06731 is a state (territory) control record that contains state and local taxes.

F06732 is a special handling record that depends on the special handling table setup.

The system creates the W2LIBxxx library and workfiles (where xxx is the ID number). This unique, permanent library contains the employee detail tables. The company summary tables are in the production library. The system uses these tables to produce year-end forms. Each time that you build a workfile, the system creates a library that remains on the system until you purge it. In addition, the system generates permanent summary control tables in the production library.

After you build the workfile, you might want to review your work before you begin printing audit reports and year-end forms.

Assigning Special Handling Code Tables for more information about special handling code tables

Reviewing Year-End Version Information for information about reviewing the workfile build

Setting Up the Year-End Workfile Setting Up the Year-End Workfile.

If a company has both regular and Puerto Rico employees, you need to consider:

If there is one, or just a few Puerto Rican employees in the build, remove the employees from the build and file separately on paper. Submit the electronic file for the remaining employees.

If there are multiple Puerto Rican employees in the build, build two separate workfiles, even if it is the same company and Tax ID. One build for the non-Puerto Rican employees and one build for the Puerto Rican employees. You will have two separate electronic files for the same company and same Tax ID.

What You Should Know About

Tax Area Information Setup |

Description |

|---|---|

For Ohio tax type M records |

It is critical that you are aware of the description in the Tax Type Description field in the Tax Area Information program (P069012) on the Tax and Insurance menu (G0744). The system uses these descriptions for:

|

To create the year-end workfile

Navigation

From Year End Processing (G07247), choose Build W-2/1099 Workfiles

On the first Build W-2/1099 Workfiles screen, complete the steps for setting up your year-end workfile.

On the second Build W-2/1099 Workfiles screen, choose Submit Job (F6).

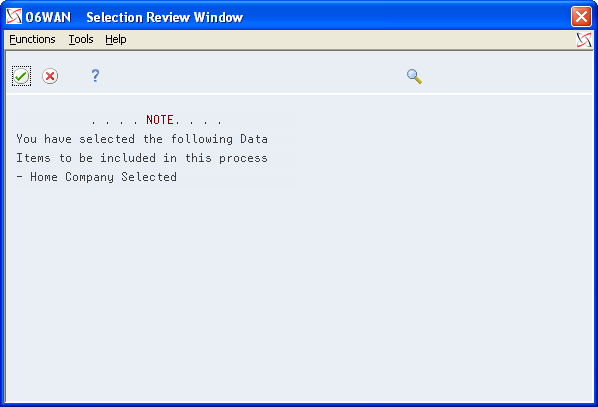

If you choose selection criteria, the system displays the Selection Review Window, which displays the criteria that you chose.

Choose Continue Processing.

Processing Options

Data Selection for Build W-2/1099 Workfiles

If you do not choose specific companies or tax IDs, the workfile build process uses the DREAM Writer data selection for that version and selects the appropriate records. The data selection is based on information in the Employee Master table.

Data Sequence for Build W-2/1099 Workfiles

The system always sequences records in the year-end workfile by address book number. Do not change the data sequencing on the W-2 Workfile Build DREAM Writer version. For the other steps of year-end processing, you can change the data sequence of reports and forms.