Example of a Decision in a Dynamic Process

Explore with an example how you can use a decision in a dynamic process.

Suppose you’re a customer service manager of a credit card company. You decide the credit card interest rates for potential customers. However, interest rates on credit cards aren’t arbitrarily set. Typically, banks set interest rates based on the risk a customer poses. A lower credit risk qualifies a customer for lower interest rate. A customer’s credit score and debt-to-income ratio are deciding factors. A high credit score and low debt-to-income ratio indicate that the customer has handled credit well in the past and is likely to pay new credit on time.

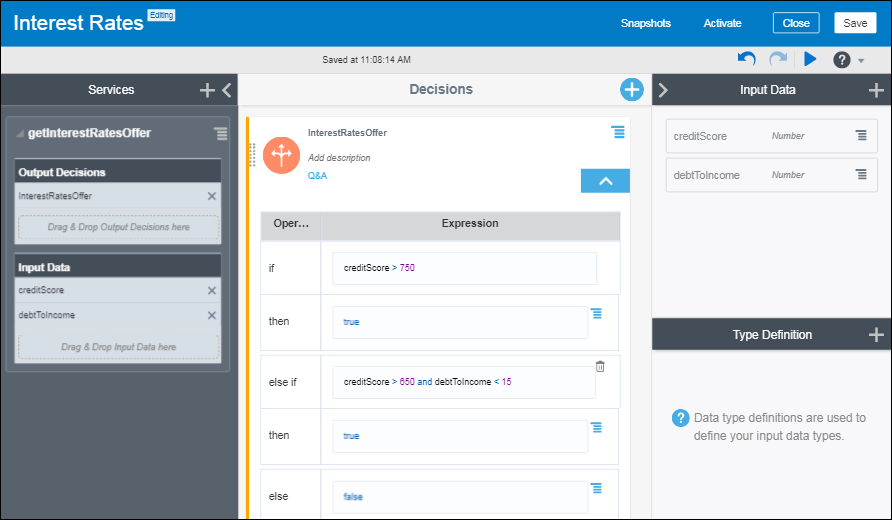

You need a decision model that decides based on the two deciding factors – credit score and debt-to-income ratio - if a potential customer can get a low interest rate offer.

The main artifacts that you create for implementing the example are:

- A dynamic process CreditCard that houses the various activities that the user has to complete while applying for a credit card.

- A decision model InterestRates that defines the rules that determine if the customer is eligible for a low interest rate offer.

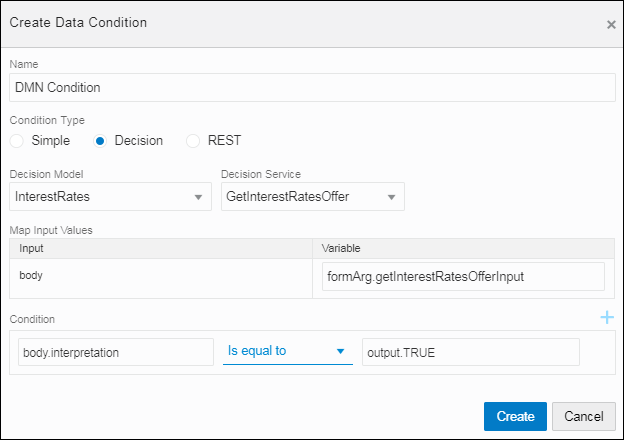

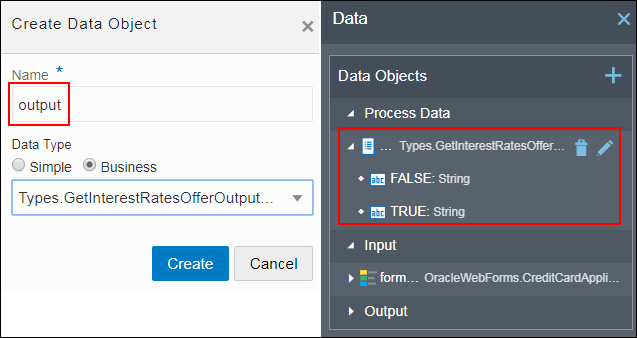

- An activity Offer within the dynamic process that gets activated in runtime if the decision's outcome or result is TRUE.

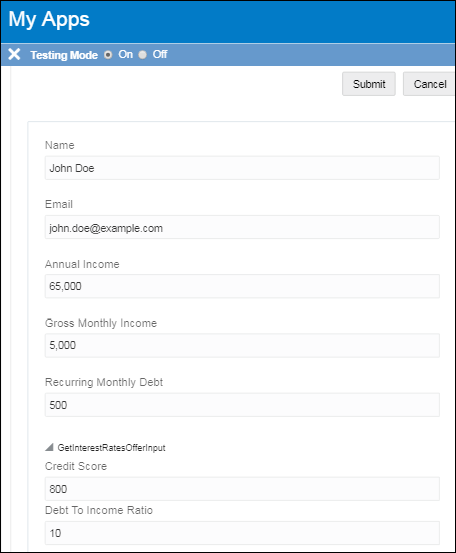

- A form CreditCardApplicationForm where among other details such as customer name and email, you enter values that are used as input values for the InterestRates decision model.

Before you begin, review the main steps for using a decision in a dynamic process. See Configure a Decision Sentry in a Dynamic Process.

You've successfully defined a decision sentry in a dynamic process.