Integrating BAI, SWIFT MT940, and CAMT.053 Format Bank File Transactions

When loading bank file data, you create a data source associated with the bank file source system. Data Integration converts the BAI, SWIFT MT940, or CAMT.053 file formats to CSV format for loading into Transaction Matching. The CSV load file can be viewed in the Transaction Matching Jobs results.

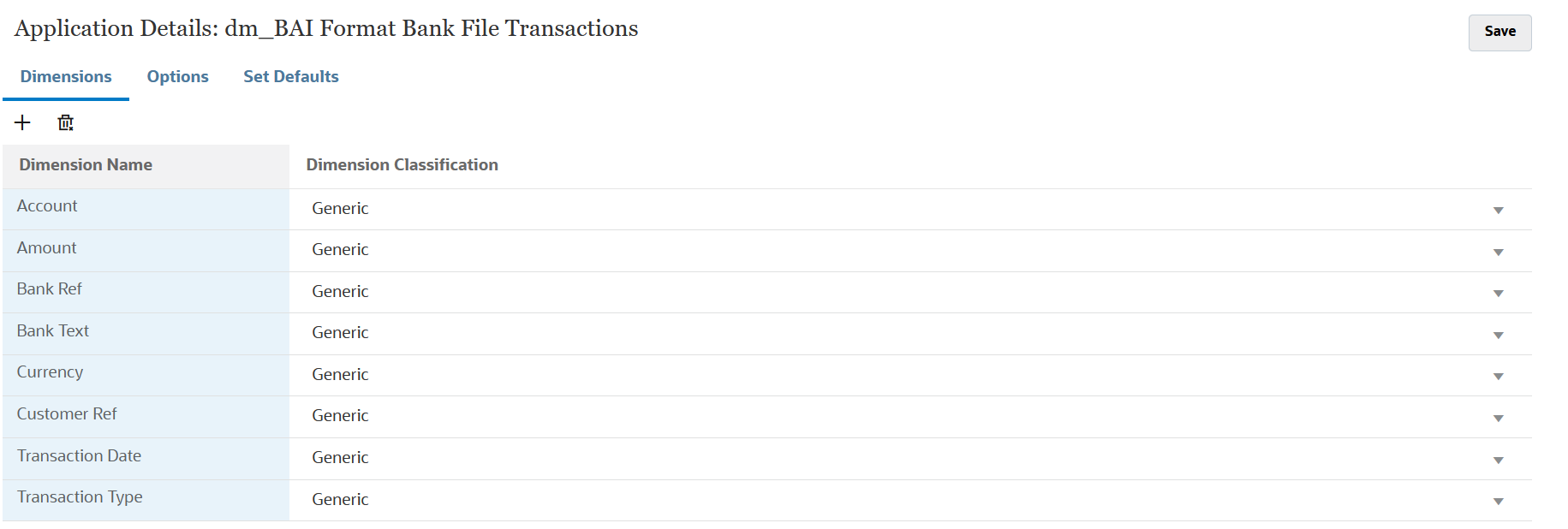

The source application for BAI Format Bank File Transactions has the following pre-defined constant columns and headers:

- Account

- Amount

- Transaction Type

- Currency

- Transaction Date

- Bank Reference

- Customer Reference

- Bank Text

- Bank Text2, Bank Text3, and Bank Text4

- FundsType1, FundsType2 and FundsType3: If Funds Type is V (date equal value), then copies the following two date fields into FundsType1 and FundsType2 - as is from the , Optionally, if Funds Type is S, then copy the next three fields into FundsType1, FundsType2, and FundsType3 - as is.

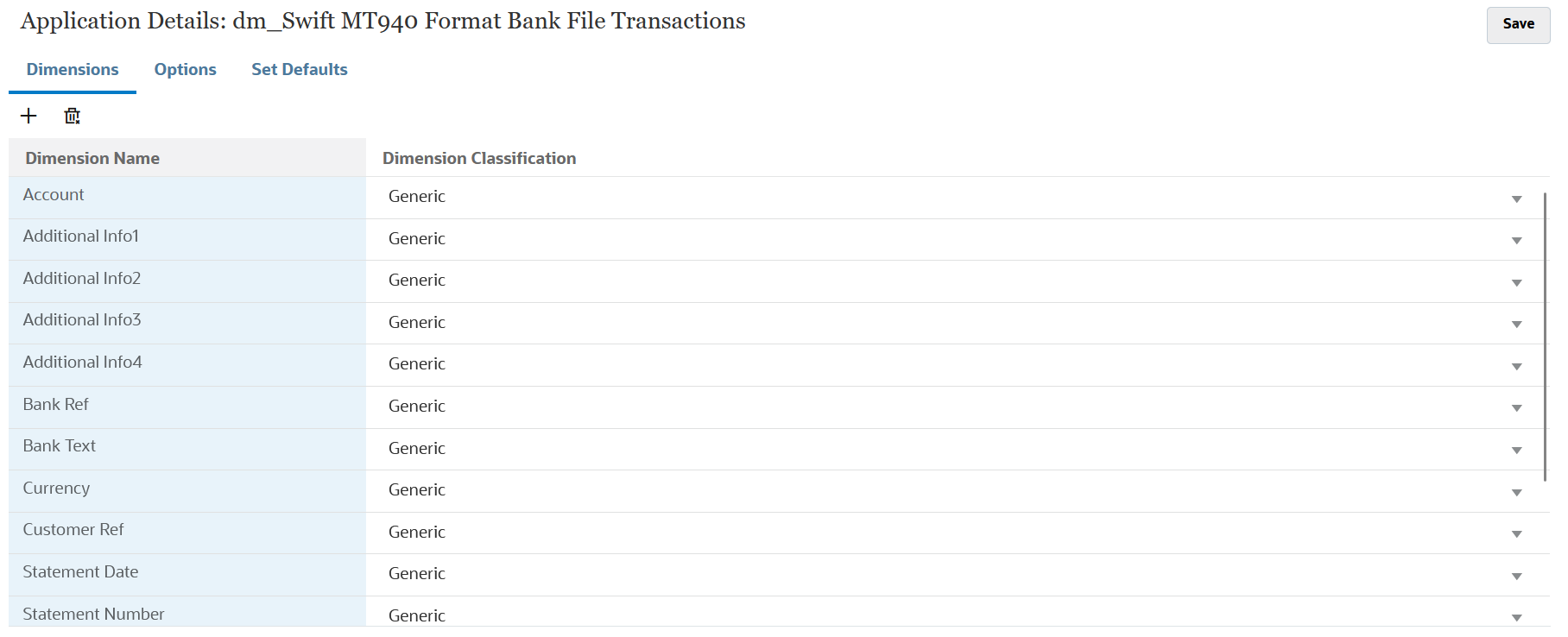

The source application for a Swift MT940 Format Bank File Transactions has the following pre-defined constant fields:

Table 17-3 Swift MT940 Fields and Descriptions

| Field | Description | |

|---|---|---|

| Transaction Reference Number | ||

| StatementIdentification | Unique identification to unambiguously identify the account statement. | |

| CreateDate | Date on which the statement was created. | |

| StatementFromDate | Date on which the period starts, for which the account statement is issued. | |

| StatementToDate | Date on which the period ends, for which the account statement is issued. | |

| Account | Account Unambiguous identification of the account to which credit and debit entries are made. | |

| Amount | Amount of money in the cash entry. | |

| Currency | Currency code of the currency in which the cash entry was made. | |

| Closing Balance | ||

| Currency | ||

| Transaction Date | ||

| Transaction Type | ||

| Currency | ||

| Statement Date | ||

| Statement Number | ||

| Amount | ||

| Customer Reference | ||

| Bank Reference | ||

| Bank Text | ||

| Bank Text2, Bank Text3, and Bank Text4 |

When using BAI format files, the Bank Text column above supports a maximum of 300 characters. If your description in the Bank Text column exceeds more than 300 characters, the Bank Text1, Bank Text2, and Bank Text 3 columns are used to store additional text up to a maximum of 1,200 characters for all Bank Text columns (Bank Text, Bank Text1, Bank Text2, and Bank Text 3). |

n |

| FundsType1, FundsType2 and FundsType3 | If Funds Type is V (date equal value), then copies the next two date fields into FundsType1 and FundsType2 - as is, Optionally, if Funds Type is S, then copy the following three fields into FundsType1, FundsType2, and FundsType3 - as is. | |

| Additional Info1 | ||

| Additional Info2 | ||

| Additional Info3 |

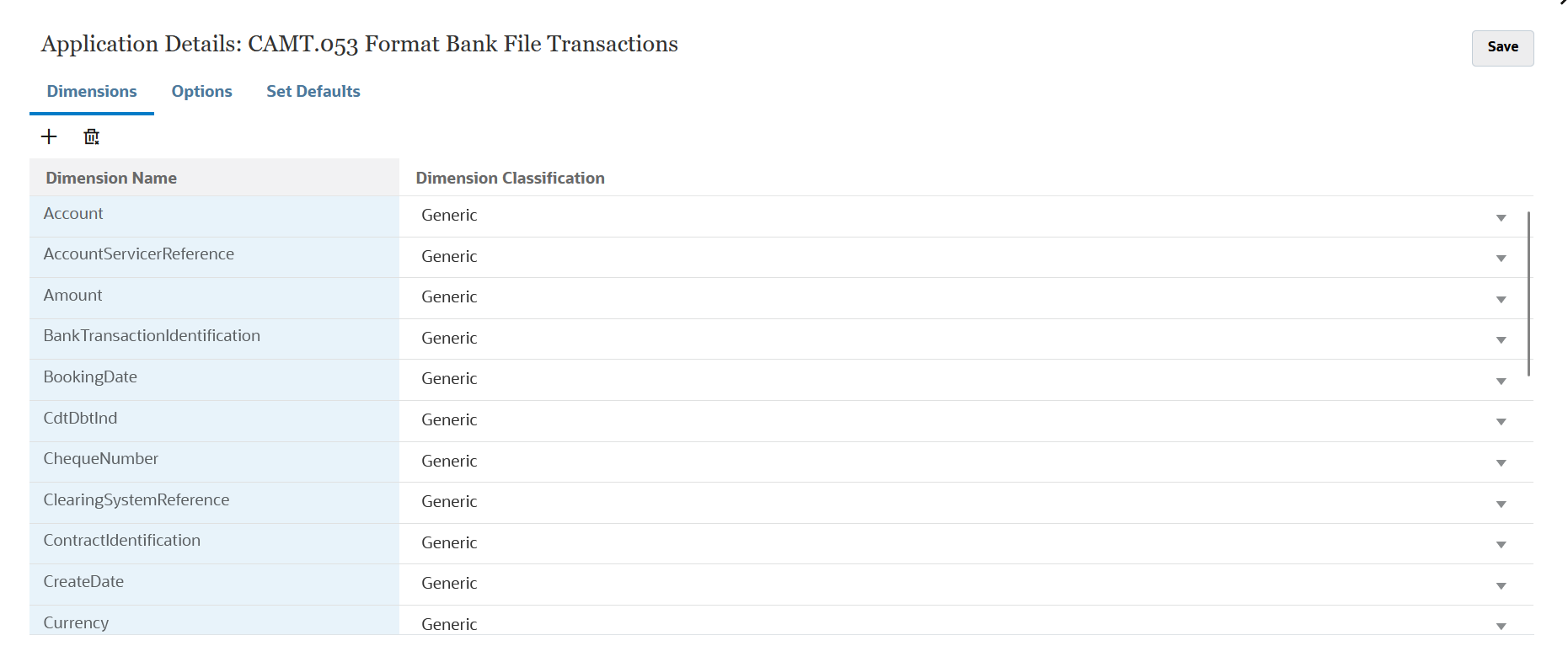

The source application for CAMT.053 Format Bank File Transactions file has the following pre-defined constant columns and headers:

Table 17-4 CAMT.053 Format Bank Transaction Field Descriptions

| Field | Description (based on ISO definitions) | CAMT.053 TAG |

|---|---|---|

| StatementIdentification | Unique identification to unambiguously identify the account statement. | <Stmt> <Id> |

| CreateDate | Date at which the statement was created. | <Stmt> <CreDtTm> |

| StatementFromDate | Date at which the period starts, for which the account statement is issued. | <Stmt> <FrToDt> <FrDtTm> |

| StatementToDate | Date which the period ends, for which the account statement is issued. | <Stmt> <FrToDt> <ToDtTm> |

| Account | Unambiguous identification of the account to which credit and debit entries are made. | <Stmt> <Acct> <Id> <Othr> <Id> or <Stmt> <Acct> <Id> <IBAN> |

| AccountOwner | Party that legally owns the account | <Stmt> <Acct> <Ownr> |

| Amount | Amount of money in the cash entry. | <Stmt> <Acct> <Ntry> <NtryDtls> <TxDtls> <Amt Ccy="ISO Currency Code"> or <Stmt> <Acct> <Ntry> <Amt Ccy="ISO Currency Code"> |

| Currency | Currency code of the currency in which the cash entry was made. | <Stmt> <Acct> <Ntry> <NtryDtls> <TxDtls> <Amt Ccy="ISO Currency Code"> or <Stmt> <Acct> <Ntry> <Amt Ccy="ISO Currency Code"> |

| CdtDbtInd | Credit Debit Indicator | <Stmt> <Acct> <Ntry> <NtryDtls> <TxDtls>

<NtryDtls> <TxDtls> <CdtDbtInd> or <Stmt> <Acct>

<Ntry> <CdtDbtInd>

Except for batch bookings, the <TxDtls> tag is mandatory. The bank statement may not contain detailed transaction information for batch bookings because of the sensitive nature of the data. |

| BookingDate | Date and time when an entry is posted to an account on the account servicer's books. | <Stmt> <Acct> <Ntry> <BookgDt> <Dt> |

| ValueDate | Date and time at which assets become available to the account owner in case of a credit entry, or cease to be available to the account owner in case of a debit entry. | <Stmt> <Acct> <Ntry> <ValDt> <Dt> |

| EntryRef | Unique reference for the entry | <Stmt> <Acct> <Ntry> <NtryRef> |

| AccountServicerReference | Unique reference as assigned by the account servicing institution to unambiguously identify the entry | <Stmt> <Acct> <Ntry> <AcctSvcrRef> or <Stmt> <Acct> <Ntry> <NtryDtls> <TxDtls> <Refs> <AcctSvcrRef> |

| DomainCode | Part of Bank Transaction Code. It specifies the business area of the underlying transaction. | <Stmt> <Acct> <Ntry> <NtryDtls> <TxDtls> <BkTxCd> <Domn> <Cd> or <Stmt> <Acct> <Ntry> <BkTxCd> <Domn> <Cd> |

| FamilyCode | Specifies the family within a domain. | <Stmt> <Acct> <Ntry> <NtryDtls> <TxDtls> <BkTxCd> <Domn> <Fmly> <Cd> or <Stmt> <Acct> <Ntry> <BkTxCd> <Domn> <Fmly> <Cd> |

| SubFamilyCode | Specifies the sub-product family within a specific family. | <Stmt> <Acct> <Ntry> <NtryDtls> <TxDtls> <BkTxCd> <Domn> <Fmly> <SubFmlyCd> or <Stmt> <Acct> <Ntry> <BkTxCd> <Domn> <Fmly> <SubFmlyCd> |

| Proprietary | Bank transaction code in a proprietary form, as defined by the issuer. | <Stmt> <Acct> <Ntry> <NtryDtls> <TxDtls> <BkTxCd> <Prtry> <cd> or <Stmt> <Acct> <Ntry> <BkTxCd> <Prtry> <cd> |

| ReversalIndicator | Indicates whether or not the entry is the result of a reversal. This element should only be present if the entry is the result of a reversal. | <Stmt> <Acct> <Ntry> <RvslInd> |

| BankTransactionIdentification | Unique identification that can be used for reconciliation, tracking or to link tasks relating to the transaction on the interbank level. | <Stmt> <Acct> <Ntry> <NtryDtls> <TxDtls> <Refs> <TxId> |

| EndToEndIdentification | Unique identification, as assigned by the initiating party, to unambiguously identify the transaction. | <Stmt> <Acct> <Ntry> <NtryDtls> <TxDtls> <Refs> <EndToEndId> |

| ChequeNumber | Unique and unambiguous identifier for a cheque as assigned by the agent. | <Stmt> <Acct> <Ntry> <NtryDtls> <TxDtls> <Refs> <ChqNb> |

| InstructionIdentification | Unique identification, which is a point to point reference that can be used between the instructing party and the instructed party to refer to the individual instruction. | <Stmt> <Acct> <Ntry> <NtryDtls> <TxDtls> <Refs> <InstrId> |

| PaymentInformationIdentification | Unique identification, as assigned by a sending party, to unambiguously identify the payment information group within the message. | <Stmt> <Acct> <Ntry> <NtryDtls> <TxDtls> <Refs> <PmtInfId> |

| MandateIdentification | Unique identification, as assigned by the creditor, to unambiguously identify the mandate. | <Stmt> <Acct> <Ntry> <NtryDtls> <TxDtls> <Refs> <MndtId> |

| ClearingSystemReference | Unique reference, as assigned by a clearing system, to unambiguously identify the instruction. | <Stmt> <Acct> <Ntry> <NtryDtls> <TxDtls> <Refs> <ClrSysRef> |

| SourceCurrency | Currency from which an amount is to be converted in a currency conversion. | <Stmt> <Acct> <Ntry> <NtryDtls> <TxDtls> <AmtDtls> <TxAmt> <CcyXchg> <SrcCcy> or <Stmt> <Acct> <Ntry> <NtryDtls> <TxDtls> <AmtDtls> <InstdAmt> <CcyXchg> <SrcCcy> |

| TargetCurrency | Currency into which an amount is to be converted in a currency conversion. | <Stmt> <Acct> <Ntry> <NtryDtls> <TxDtls> <AmtDtls> <TxAmt> <CcyXchg> <TrgtCcy> or <Stmt> <Acct> <Ntry> <NtryDtls> <TxDtls> <AmtDtls> <InstdAmt> <CcyXchg> <TrgtCcy> |

| UnitCurrency | Currency in which the rate of exchange is expressed in a currency exchange. In the example, 1GBP = xxxCUR, the unit currency is GBP. | <Stmt> <Acct> <Ntry> <NtryDtls> <TxDtls> <AmtDtls> <TxAmt> <CcyXchg> <UnitCcy> or <Stmt> <Acct> <Ntry> <NtryDtls> <TxDtls> <AmtDtls> <InstdAmt> <CcyXchg> <UnitCcy> |

| ExchangeRate | Factor used to convert an amount from one currency into another. This reflects the price at which one currency was bought with another currency. Usage: ExchangeRate expresses the ratio between UnitCurrency and QuotedCurrency (ExchangeRate = UnitCurrency/QuotedCurrency). | <Stmt> <Acct> <Ntry> <NtryDtls> <TxDtls> <AmtDtls> <TxAmt> <CcyXchg> <XchgRate> or <Stmt> <Acct> <Ntry> <NtryDtls> <TxDtls> <AmtDtls> <InstdAmt> <CcyXchg> <XchgRate> |

| ContractIdentification | Unique identification to unambiguously identify the foreign exchange contract | <Stmt> <Acct> <Ntry> <NtryDtls> <TxDtls> <AmtDtls> <TxAmt> <CcyXchg> <CtrctId> or <Stmt> <Acct> <Ntry> <NtryDtls> <TxDtls> <AmtDtls> <InstdAmt> <CcyXchg> <CtrctId> |

| QuotationDate | Date and time at which an exchange rate is quoted. | <Stmt> <Acct> <Ntry> <NtryDtls> <TxDtls> <AmtDtls> <TxAmt> <CcyXchg> <QtnDt> or <Stmt> <Acct> <Ntry> <NtryDtls> <TxDtls> <AmtDtls> <InstdAmt> <CcyXchg> <QtnDt> |

| ReturnReasonCode | Specifies the reason for the return, as per SWIFT external codes. | <Stmt> <Acct> <Ntry> <NtryDtls> <TxDtls> <RtrInf> <Rsn> <Code> |

| ReturnReasonProprietary | Specifies the reason for the return, in a proprietary form. | <Stmt> <Acct> <Ntry> <NtryDtls> <TxDtls> <RtrInf> <Rsn> <Prtry> |

| Originator | Name of the party that issues the return. | <Stmt> <Acct> <Ntry> <NtryDtls> <TxDtls> <RtrInf> <Orgtr> <Nm> |

| OrgnlBkTxCdDomain | Part of the Original Bank Transaction Code. It specifies the business area of the underlying transaction. | <Stmt> <Acct> <Ntry> <NtryDtls> <TxDtls> <RtrInf> <OrgnlBkTxCd> <Domn> <Cd> |

| OrgnlBkTxCdFamily | Specifies the family within a domain of the Original Bank Transaction Code. | <Stmt> <Acct> <Ntry> <NtryDtls> <TxDtls> <RtrInf> <OrgnlBkTxCd> <Domn> <Fmly> <Cd> |

| OrgnlBkTxCdSubFamily | Specifies the sub-product family within a specific family of the Original Bank Transaction Code. | <Stmt> <Acct> <Ntry> <NtryDtls> <TxDtls> <RtrInf> <OrgnlBkTxCd> <Domn> <Fmly> <SubFmlyCd> |

| OrgnlBkTxCdProprietary | Original Bank transaction code in a proprietary form, as defined by the issuer | <Stmt> <Acct> <Ntry> <NtryDtls> <TxDtls> <RtrInf> <OrgnlBkTxCd> <Prtry> <Cd> |

| InitiatingParty | Party that initiated the payment that is reported in the entry. | <Stmt> <Ntry> <NtryDtls> <TxDtls> <RltdPties> <InitgPty> <Pty> <Nm> |

| Creditor | Party to which an amount of money is due | <Stmt> <Ntry> <NtryDtls> <TxDtls> <RltdPties> <Cdtr> <Pty> <Nm> |

| CreditorAccount | Unambiguous identification of the account of the creditor to which a credit entry has been posted as a result of the payment transaction | <Stmt> <Ntry> <NtryDtls> <TxDtls> <RltdPties> <CdtrAcct> <Id> <IBAN> or <Stmt> <Ntry> <NtryDtls> <TxDtls> <RltdPties> <CdtrAcct> <Id> <Othr> <Id> |

| UltimateCreditor | Ultimate party to which an amount of money is due | <Stmt> <Ntry> <NtryDtls> <TxDtls> <RltdPties> <UltmtCdtr> <Pty> <Nm> |

| Debtor | Party that owes an amount of money to the (ultimate) creditor. | <Stmt> <Ntry> <NtryDtls> <TxDtls> <RltdPties> <Dbtr> <Pty> <Nm> |

| DebtorAccount | Unambiguous identification of the account of the debtor | <Stmt> <Ntry> <NtryDtls> <TxDtls> <RltdPties> <DbtrAcct> <Id> <IBAN> or <Stmt> <Ntry> <NtryDtls> <TxDtls> <RltdPties> <DbtrAcct> <Id> <Othr> <id> |

| UltimateDebtor | Ultimate party that owes an amount of money to the (ultimate) creditor | <Stmt> <Ntry> <NtryDtls> <TxDtls> <RltdPties> <UltmtDbtr> <Pty> <Nm> |

| TradingParty | Party that plays an active role in planning and executing the transactions that create or liquidate investments of the investors assets, or that move the investor's assets from one investment to another. | <Stmt> <Ntry> <NtryDtls> <TxDtls> <RltdPties> <TradgPty> <Pty> <Nm> |

| RemittanceInformation | Information supplied to enable the matching/reconciliation of an entry with the items that the payment is intended to settle, such as commercial invoices in an accounts receivable system, in an unstructured form. | <Stmt> <Acct> <Ntry> <NtryDtls> <TxDtls> <RmtInf> <Ustrd> |

| AdditionalRemittanceInformation | Additional information, in free text form, to complement the structured remittance information | <Stmt> <Ntry> <NtryDtls> <TxDtls> <RmtInf> <Strd> <AddtlRmtInf> |

| CreditorReferenceInformation | Reference information provided by the creditor to allow the identification of the underlying documents. | <Stmt> <Ntry> <NtryDtls> <TxDtls> <RmtInf> <Strd> <CdtrRefInf> <Ref> |

| CreditorReferenceInformationCode | Type of creditor reference, in a coded form | <Stmt> <Ntry> <NtryDtls> <TxDtls> <RmtInf> <Strd> <CdtrRefInf> <Tp> <CdOrPrtry> <Cd> |

| CreditorReferenceInformationPrtry | Creditor reference type, in a proprietary form | <Stmt> <Ntry> <NtryDtls> <TxDtls> <RmtInf> <Strd> <CdtrRefInf> <Tp> <CdOrPrtry> <Prtry> |

| Invoicee | Identification of the party to whom an invoice is issued, when it is different from the debtor or ultimate debtor | <Stmt> <Ntry> <NtryDtls> <TxDtls> <RmtInf> <Strd> <Invcee> <Nm> |

| Invoicer | Identification of the organisation issuing the invoice, when it is different from the creditor or ultimate creditor | <Stmt> <Ntry> <NtryDtls> <TxDtls> <RmtInf> <Strd> <Invcr> <Nm> |

| ReferredDocumentInformation | Provides the identification and the content of the referred document | <Stmt> <Ntry> <NtryDtls> <TxDtls> <RmtInf> <Strd> <RfrdDocInf> <Nb> |

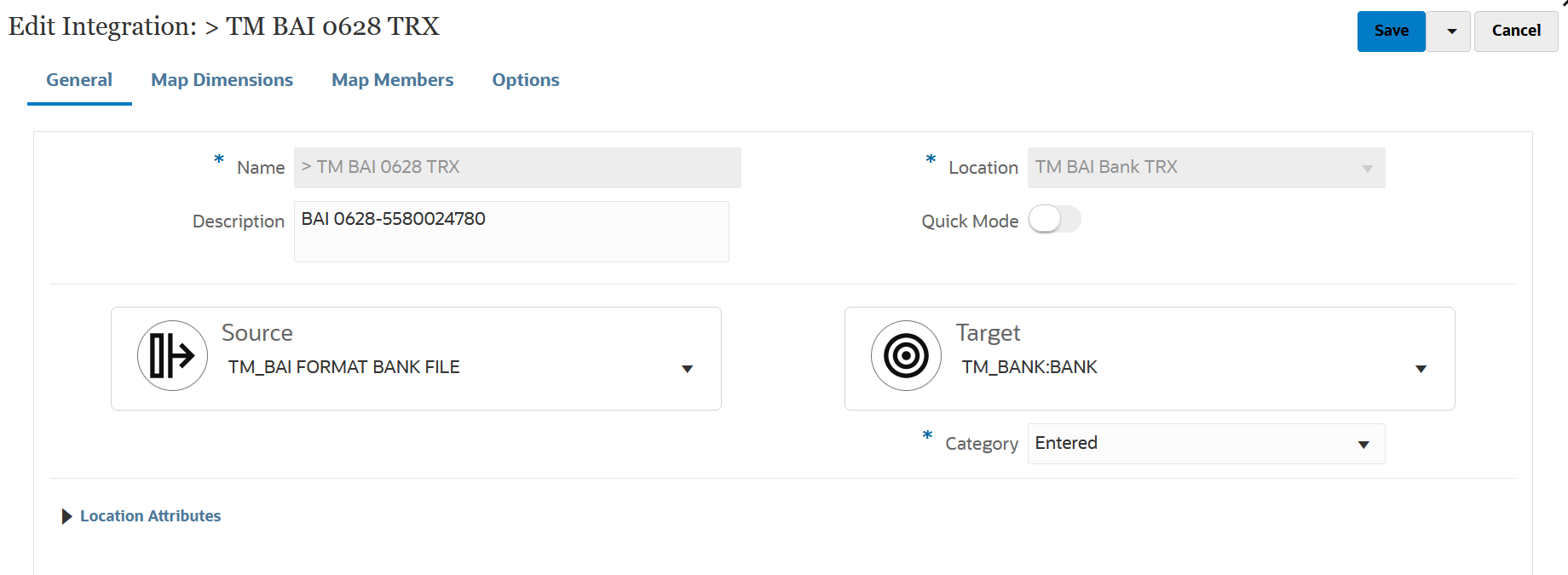

To add a BAI, SWIFT MT940, or CAMT.053 Format Bank File Transactions application:

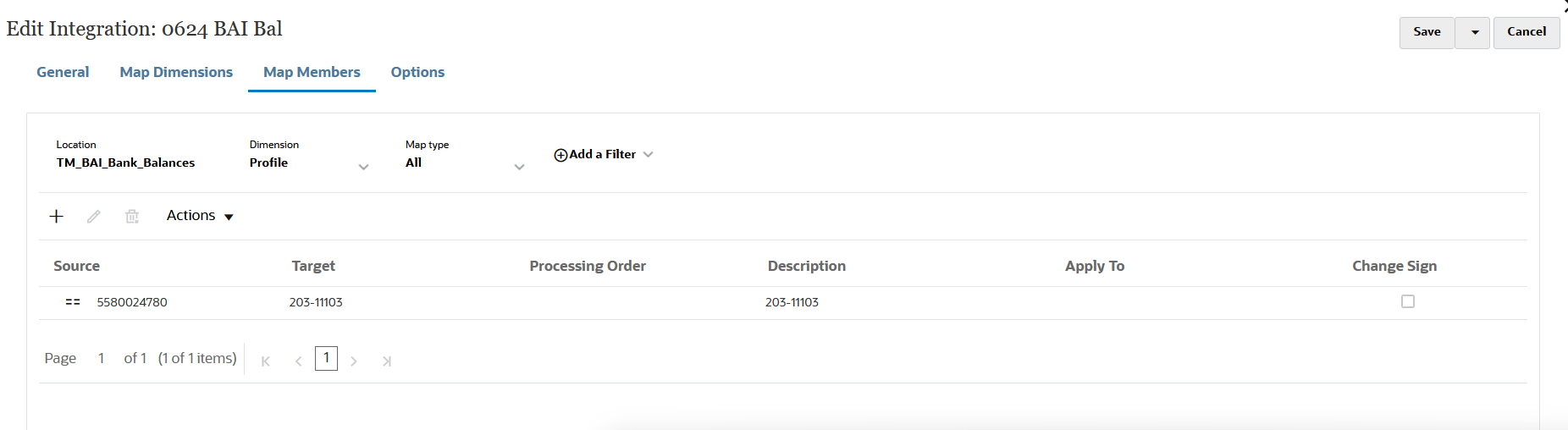

/

/