Cash Advances

A cash advance is an advance payment to an employee that covers incidental expenses while traveling or during the course of business.

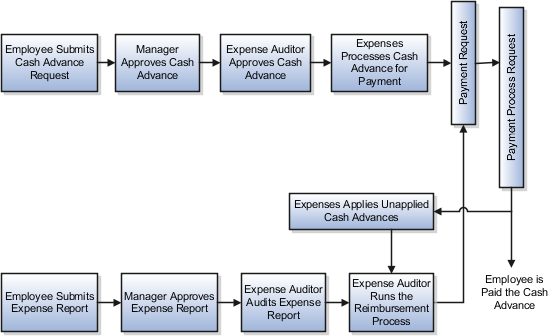

The cash advance process includes the following actions:

-

Submitting a cash advance request

-

Approving the cash advance request

-

Requesting a payment request

-

Submitting an expense report

-

Approving the expense report

-

Running the reimbursement process

-

Applying any unapplied cash advances

The following figure illustrates the cash advance and expense report flows.

Employee Submits a Cash Advance Request

Approvers Approve the Cash Advance Request

The employee submits the cash advance request to his manager for approval. If the manager approves the request, Expenses sends it to the expense auditor for approval.

If either the manager or the expense auditor rejects the cash advance request, Expenses returns the request to the employee.

If the expense auditor approves the cash advance request, he specifies a date by which the cash advance must be applied to the employee's report.

Expenses Requests a Payment Request

After required approvals, Expenses sends a payment request for the cash advance to Oracle Payables. For cash advances, Payables automatically uses the pay alone feature to create a separate cash advance payment for each invoice. Oracle Payments then processes the payment request and deposits the amount requested into the employee's primary bank account based on the payment method specified for the business unit. Expenses Cash Advance Clearing Account records outstanding cash advances that haven't been applied to an employee's expense report.

Employee Submits an Expense Report

After incurring business expenses, the employee creates and submits an expense report to his manager for approval.

Approvers Approve the Expense Report

If the manager rejects the expense report, he returns it to the employee. If the manager approves the expense report, he sends it to the expense auditor for approval.

The expense auditor audits the expense report. If the expense auditor rejects the expense report, he returns it to the employee.

Expense Auditor Runs the Reimbursement Process

After the expense report is approved, the expense auditor runs the Process Expense Reimbursement process. When the process applies the unapplied cash advance amounts to the report, it clears the Cash Advance Clearing Account. The process then charges the expense to the applicable expense account. The process then sends a payment request for the reimbursement to Payables, which sends a payment process request to Oracle Payments.

Expenses Applies Any Unapplied Cash Advances

Expenses automatically applies available cash advances to the approved expense report on or after the due date. Payments processes the payment process request and the employee receives payment for the expense report amount minus the cash advance amount. Any unused cash advance amounts are applied to the next expense report or refunded to the company by the employee.