Annual Online Investment Goods Register Process

Run the process after all your yearly asset invoices are fully processed and corresponding asset additions and cost adjustments are created in your Assets system.

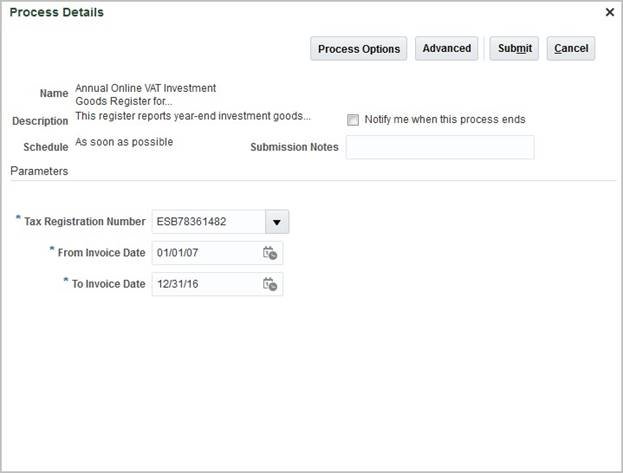

This image shows the Goods Register process submission page:

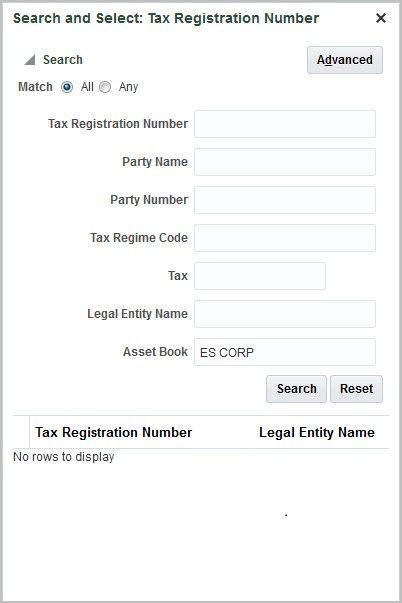

You can query the tax registration number from the list of values that give you the flexibility to filter using several fields including the name of your legal entity and your asset book.

This image shows the sample image for the Goods Register process:

An asset invoice is eligible to be reported if:

- Asset invoice date is within ‘From Invoice Date’ and ‘To Invoice Date’.

- Asset belongs to one of the two types: 10 years, 5 years

- Asset level override value is NOT ‘No’. Here, a NULL value doesn’t mean No.

The process selects and lists all the required information in an XML format. You can edit and modify the XML file before submitting it to the Tax Authority.

You can convert the XML file to excel format. Here is an example:

Part 1

This table shows an example that converts the XML file to excel format.

| ns3:NIF | ns3:Ejercicio | ns3:Periodo | ns3:NombreRazon2 | ns3:NIF3 |

|---|---|---|---|---|

| SYS12122 | 2007 | 0A | 3M Health Care_FIN | FR123456789012 |

| SYS12122 | 2008 | 0A | 3M Health Care_FIN | FR123456789012 |

| SYS12122 | 2007 | 0A | 3M Health Care_FIN | FR123456789012 |

| SYS12122 | 2008 | 0A | 3M Health Care_FIN | FR123456789012 |

| SYS12122 | 2015 | 0A | 3M Health Care_FIN | FR123456789012 |

| SYS12122 | 2007 | 0A | 3M Health Care_FIN | FR123456789012 |

| SYS12122 | 2016 | 0A | 3M Health Care_FIN | FR123456789012 |

| SYS12122 | 2015 | 0A | 3M Health Care_FIN | FR123456789012 |

| SYS12122 | 2016 | 0A | 3M Health Care_FIN | FR123456789012 |

| SYS12122 | 2010 | 0A | 3M Health Care_FIN | FR123456789012 |

Part 2

Here are the additonal columns in the excel file:

This table shows the additional columns in the example that converts the XML file to excel format.

| ns3:NumSerieFactu raEmisor | ns3:FechaExpedicionFac turaEmisor | ns3:Identificaci onBien | ns3:FechaInicioUt ilizacion | ns3:AssetNu mber |

|---|---|---|---|---|

| SII1-INV-2007-1 | 19-10-2007 | SII1-1 | 31-10-2007 | 125379 |

| SII1-INV-2008-1 | 24-10-2008 | SII1-1 | 31-10-2007 | 125379 |

| SII104-INV-2007-1 | 23-10-2007 | SII104-1 | 31-10-2006 | 125380 |

| SII104-INV-2008-1 | 23-10-2008 | SII104-1 | 31-10-2006 | 125380 |

| SII104-INV-2015-1 | 23-10-2015 | SII104-1 | 31-10-2006 | 125380 |

| SII104-INV-2007-01 | 23-10-2007 | SII1040-1 | 31-10-2006 | 125399 |

| T-IGR-181017-3 | 18-10-2016 | IGR | 31-12-2015 | 125375 |

| SII-IGR-INV-001 | 16-12-2015 | SII 1 | 31-12-2015 | 125369 |

| T-IGR-181017-4 | 18-10-2016 | IGR 12 | 31-12-2015 | 125376 |

| SII102-INV-2010-1 | 19-10-2010 | SII102-1 | 31-10-2010 | 125378 |

Part 3

Here are the extended columns in the excel file:

This table shows the extended columns in the example that converts the XML file to excel format.

| ns3:InvoiceLineTaxableAmount | ns3:InvoiceLineTaxAmount | ns3:TaxRecoveryPercentage |

|---|---|---|

| 900 | 189 | 80 |

| 900 | 189 | 70 |

| 100 | 21 | 80 |

| 12,98 | 2,7258 | 70 |

| 680 | 142,8 | 70 |

| 100 | 21 | 80 |

| 1000 | 210 | 50 |

| 1100 | 231 | 100 |

| 2000 | 420 | 50 |

| 1000 | 210 | 85 |