Creating Exemption Certificates

The SuiteTax Engine provides support for tracking the tax exemptions allowed by respective US states. Exemption certificates are taken into account for tax determination. After the SuiteTax Engine is installed, you can enter customers' exemption certificates.

To create an exemption certificate:

-

Go to Setup > SuiteTax Engine > US Exemption Certificates.

-

Click New Certificate.

-

On the US Exemption Certificate page, fill in mandatory fields:

-

Customer

-

State

-

Certificate number

-

at least one Validity date

-

Subsidiary (only OneWorld accounts)

Note:You can create an exemption certificate only for active customers with at least one US tax registration on the entity record.

-

-

You can upload a copy of the certificate by clicking the Attachment button and adding a note.

-

In the Items section, the Apply To All Items box is checked by default, meaning that the exemption certificate applies to all items (blanket certificate). If you want the exemption certificate to apply only to specified items, clear the box and add the respective items by:

-

using an item saved search

-

copying items from another existing certificate for this customer

-

selecting items manually from the list

Note:There must be at least one item selected, or the Apply to all items (blanket certificate) box must be checked to save the record.

-

-

Click Save.

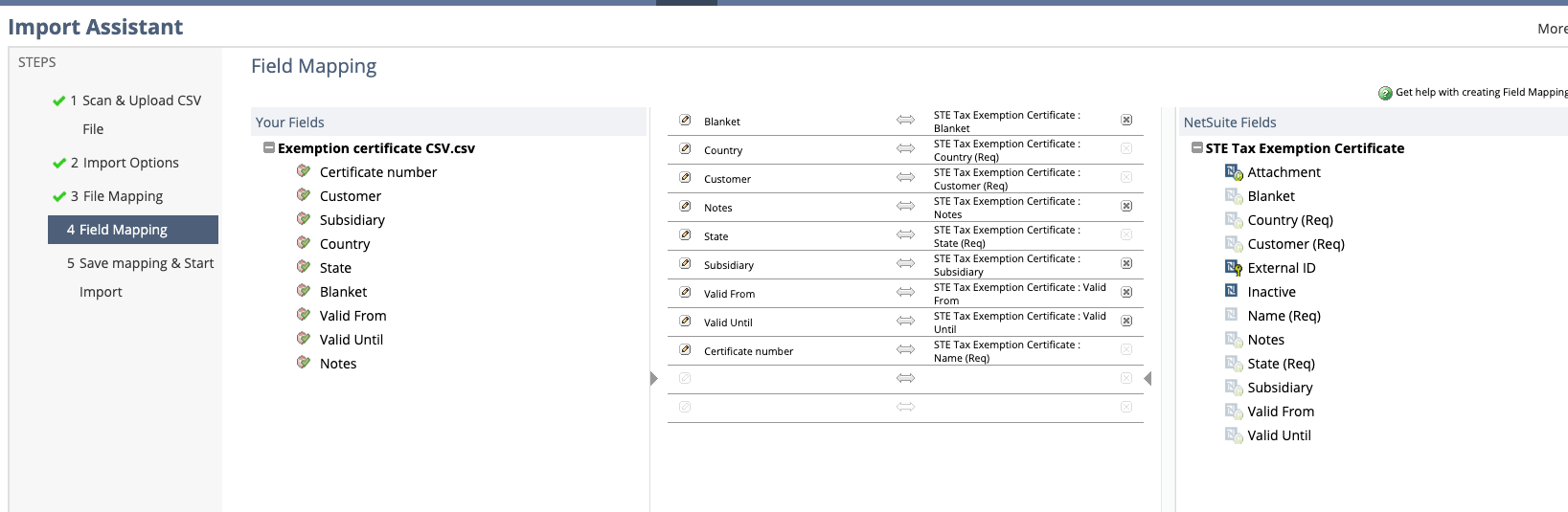

Importing Exemption Certificates as CSV

You can import your existing exemption certificates into NetSuite as a CSV file. For more information about CSV imports, see Guidelines for CSV Import Files.

To import an exemption certificate as CSV:

-

Go to Setup > Import/Export > Import CSV Records.

-

In the Import Type field, select Custom Records.

-

In the Record Type field, select STE Tax Exemption Certificate.

-

For instructions to import files with CSV, see Importing CSV Files with the Import Assistant.

-

While completing the fourth step of the import with the Import Assistant, ensure you specify the mapping for the following fields in the file you are importing:

-

Certificate number.

-

Customer. In the Customer field, enter the Customer's name.

-

Subsidiary. In the Subsidiary field, enter the Subsidiary's internal ID.

-

Country. In the Country field, enter "US", and not "United States".

-

State. In the State field, enter a state code. For example, "CA" for California.

-

Blanket. In the Blanket field, enter a "T" for "true", if you want to apply a blanket certificate for all your sales.

-

Valid From and Valid To. Fill in at least one of the Valid From and Valid Until fields.

-

Notes. It isn't required to fill in this field.

-