Working With the Balance Location Costing Group Accounts Page

Use the following procedure to balance location costing groups.

To use the Balance Location Costing Group Accounts Page:

-

Identify the start date.

-

NetSuite finds the most recent Balance Location Costing Group Account (BLCGA) date.

-

NetSuite checks for unadjusted transactions dated on or before that date.

-

If unadjusted transactions exist, NetSuite uses the BLCGA date before the earliest unadjusted transaction, then adds one day to set the new BLCGA date.

-

If unadjusted transaction don't exist, the previous BLCGA date plus one day becomes the new BLCGA date.

-

-

Calculate item variances.

NetSuite calculates the variance for each item in each location by comparing Group Average Cost x Quantity to the location account value of the item (based on transaction activity within the date range).

-

Create journal entries.

Note:NetSuite follows the preference to post the journal entries if you run the BLCGA for a date in a close period.

If the As of Date is in an open period, resulting journal adjustments consider the cumulative variances of previous BLCGA runs in closed periods.

Create one journal entry for each item, book, and subsidiary to balance all accounts within the location costing group.

-

Create one journal entry for the asset summarized values.

-

Create one journal entry for the in-transit summarized values.

Note that the amount for each fulfillment variance is linked to the journal entry.

-

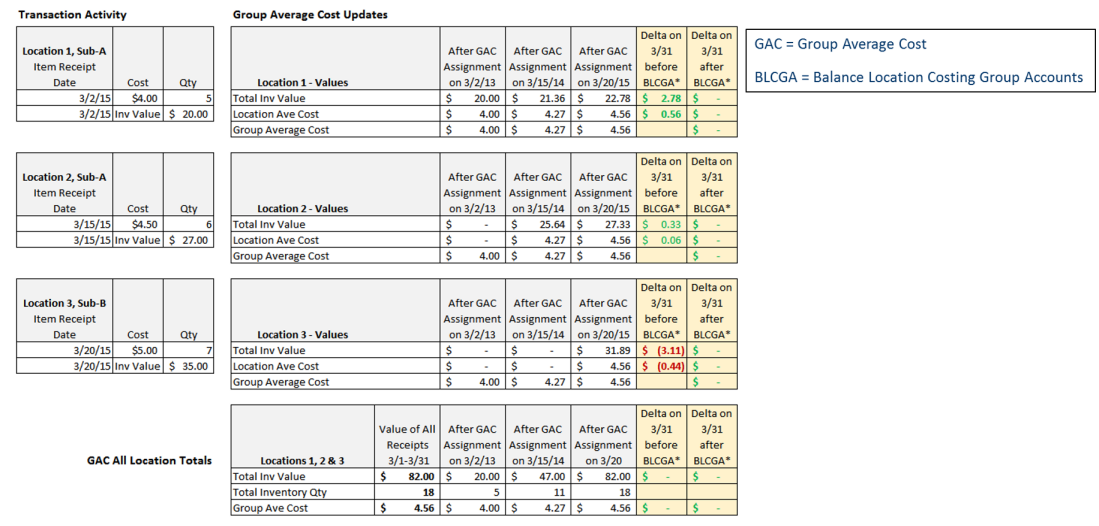

Example

-

3/2/15 - Received a quantity of five in Location 1 (Subsidiary A).

Upon receipt, the item cost is calculated as follows:

Total value for all locations divided by total quantity for all locations, or ($20 / 5) = $4.

This average cost of $4 then carries over to location 2 and location 3, even though they haven't received the item yet.

-

3/15/15 - Received a quantity of six at cost of $4.50 in Location 2 (Subsidiary A).

After those six are received, the quantity is added to the five previously received on 3/2 for a total quantity of eleven. The average cost for the group is calculated as (total value location 1 + total value location 2) divided by total quantity at all locations.

($20 + $27) / (5 + 6) = $4.27 is the new group average cost. This average cost for the group populates for the item in all locations in the group.

-

3/20/15 - Received a quantity of seven at cost of $5.00 in Location 3 (Subsidiary B).

When these seven are received, they're added to the previous eleven for a new total quantity of eighteen. The group average cost is calculated as (total value location 1 + total value location 2 + total value location 3). This amount is divided by the total quantity for all locations.

($20 + $27 + 35) / (5 + 6 + 7) = $4.56 is the new group average cost. This average cost for the group populates for the item in all locations in the group.

The discrepancy arises when you try to multiply the quantity on hand at a single location by the group average cost. Although the amount balances out across all locations, a single location can show an amount higher or lower than is accurate. This is portrayed in the next to the last column in the image below.

The Balance Location Costing Group Accounts page creates an adjustment for each location to account for group average fluctuations. Note that the final column in the preceding table shows the balance after the adjustment is run.

Balance Location Costing Group Accounts Processing Notes

Note the following about processing adjustments with the Balance Location Costing Group Accounts (BLCGA) page:

-

You should use the Balance Location Costing Group Accounts page at the end of every period.

-

Run times are longer when group average cost items are included on backdated inventory transactions.

-

For the date range between the BLCGA As Of date and the date of the oldest unadjusted transaction, all accounting periods should be open.

-

Accounting periods should be unlocked for all subsidiaries with locations in the selected location costing group.

-

For NetSuite OneWorld, one adjustment is created for each subsidiary.

-

All locations within the subsidiary or location costing group are processed. You can't exclude locations from the adjustment to keep all locations within a subsidiary or location costing group in sync.

-

If you use the Include In-Transit Value in Group Average Cost Calculations preference, note the following. The BLCGA includes both in-transit values and quantities, in addition to the location asset value and location quantity. These are combined to calculate a total quantity and total value for all locations within the location costing group. When the BLCGA is processed, for each location, separate adjustments post to the general ledger for the location value and the in-transit value. For more information about the Include In-Transit Value in Group Average Cost Calculations preference, see Items/Transactions Accounting Preferences.

If inventory costing is running or scheduled, this can affect the results of BLCGA inventory adjustments and balances. NetSuite warns you when inventory costing calculations are pending or currently in progress. The warning means some transactions might not be included in the account adjustments created by the BLCGA process. This results in problems with financial reports and account reconciliations.