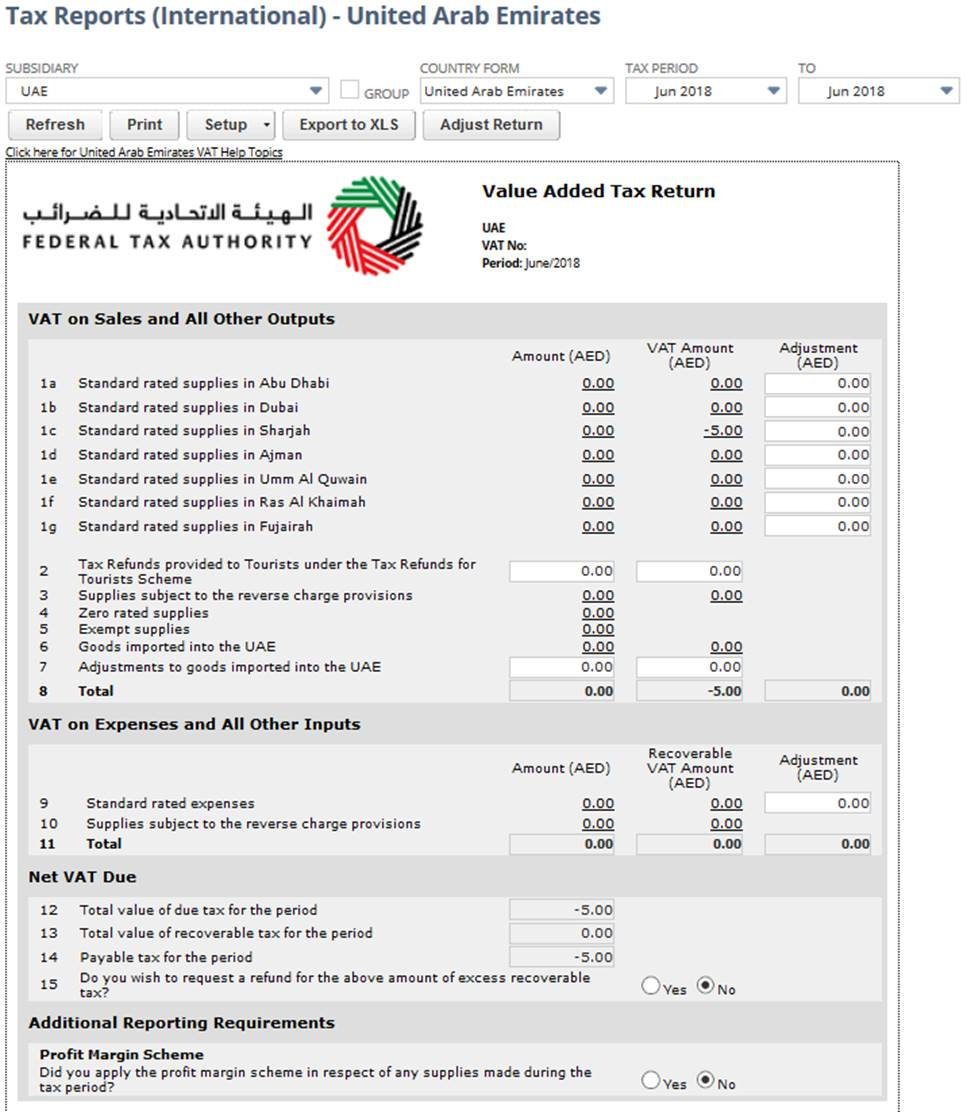

United Arab Emirates VAT Report

If you have a United Arab Emirates subsidiary and nexus and you have the International Tax Reports SuiteApp installed in your NetSuite account, you can generate the United Arab Emirates VAT Report from Reports > VAT/GST > Tax Reports (International). The International Tax Reports SuiteApp enables you to generate the United Arab Emirates VAT Report in PDF and XLS formats.

NetSuite gets the values in the report from your transactions, but some boxes in the forms may require you to enter data manually. it's important that you save a PDF file of the report for your own records because NetSuite doesn't manually save entered data. For information, see Generating VAT/GST Reports.

You should review all the values in the report. You can click the values in the boxes of the VAT report to view drilldown details. To understand how NetSuite uses the tax codes to get the values for the United Arab Emirates VAT report, see What goes into each box - United Arab Emirates Report.

The NetSuite VAT/GST tax form is designed to look like the official tax form for ease of use, but it'sn't intended to be printed out for submission to the tax agency.

Making Adjustments on a VAT Return for UAE

In certain cases, you may need to increase or decrease VAT on sales or purchases and VAT liability. For example, you may need to reclaim tax already paid on sales that are now bad debts. There may also be events that render sales as taxable or not taxable, or events that render VAT on purchases as creditable or not, which require you to adjust the tax amounts on your VAT return.

The ability to adjust your VAT return within NetSuite is important if you intend to use the XML files generated by NetSuite for electronic tax filing.

For each adjustment that you make on the VAT report, you don't have to manually create an adjustment journal entry. NetSuite automatically creates the journal entry for you.

Important Things to Note:

-

The adjustment journal entry is posted automatically, even if the Require Approvals on Journal Entries preference is enabled in your account.

-

The posting date for the adjustment journal entry is the last day of the selected tax period.

-

Adjustment journals are not included in the saved reports for Sales by Tax Code or Purchase by Tax Code, but they're included in the VAT drilldown report.

-

If you need to reverse the automatically created tax adjustment journal, you must manually edit the journal and enter the reversal date. This ensures that the VAT report drilldown report is correct.

To adjust a VAT return for UAE:

-

Go to Reports > VAT/GST > Tax Reports (International).

-

Select the UAE in the Subsidiary field.

-

Select United Arab Emirates in the Country Form field.

-

Select the tax period.

-

Click Refresh to display the report.

-

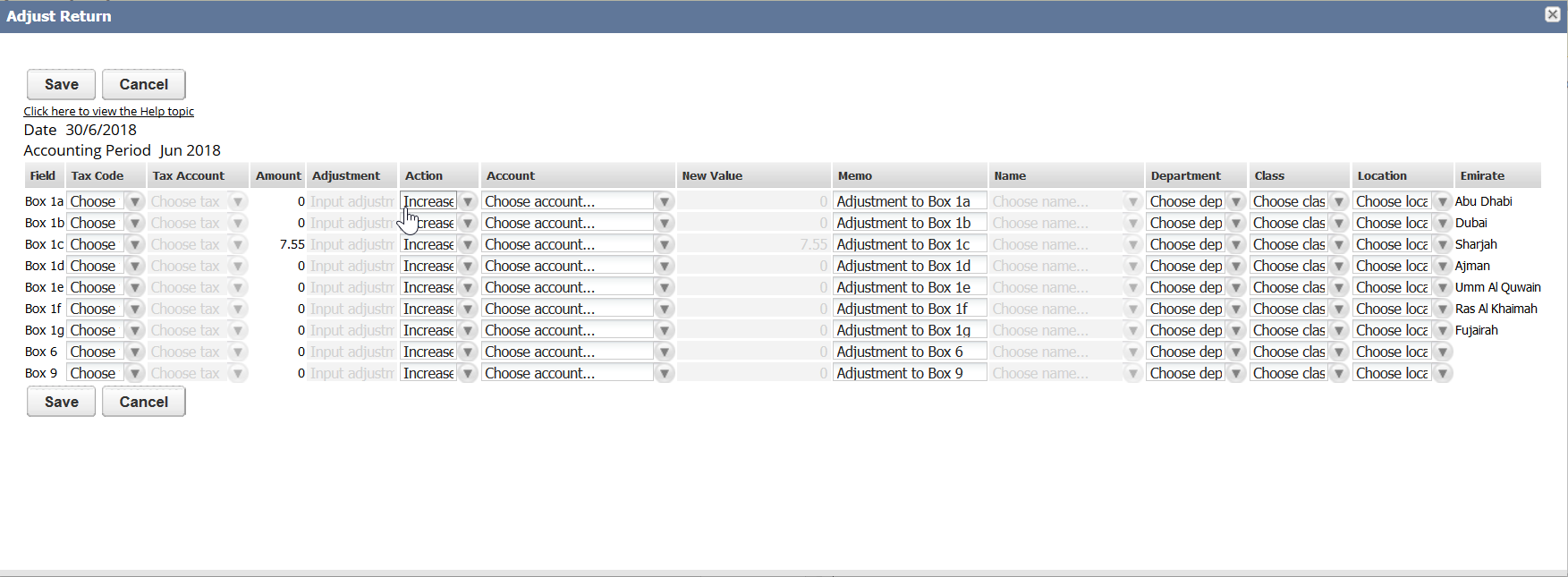

Click Adjust Return to open the Adjust Return page.

Only values for tax amounts will be available for adjustment. The page doesn't display fields or boxes for net amounts, notional amounts, or boxes that derive values from other boxes (for example, sum of box 1 and 2).

Important:NetSuite displays an alert message if you click Adjust Return for a tax period that is already closed. If you want to make an adjustment for that period, you must reopen the period. Remember to close the period after the adjustment has been made. In any case, you can still click the Generate XML button even if your tax period is open.

-

For each VAT form field or box that you want to adjust:

-

Tax Code - Select the tax code that you want to associate with this adjustment. Only tax codes relevant to the particular box or field are available for selection, provided the tax rate isn't 0%.

-

Tax Control Account - This field automatically displays the tax control account based on the field or box being adjusted. You can change this if necessary.

-

Amount - Enter the amount of the adjustment to make (enter a positive number)

-

In the Action field, select Increase or Decrease to specify if you're increasing or decreasing the value. The New Value field automatically shows the adjusted amount.

-

In the Memo field, accept the default text or enter new text to describe the adjustment on the journal entry.

-

Select a name to associate with the journal entry.

-

If Departments, Classes, or Locations are enabled in your NetSuite account, select the department, class, or location to categorize the journal entry. (An asterisk indicates that the field is mandatory.)

-

Click Save. NetSuite applies the adjustments to the VAT report and creates a journal entry for each adjusted tax amount.

-

Example of Adjust Return Page for UAE