Exporting Goods and Services under India GST

In India, exporting goods and services counts as a zero-rated supply. That means GST isn’t charged on any kind of export (goods or services).

The following are treated as zero-rated supplies under India GST.

-

Export of goods or services, or both.

-

Supply of goods or services, or both to SEZ (Special Economic Zones).

If you export zero-rated goods, you can claim a refund in the following ways:

-

Export goods or services, or both without paying IGST under an LUT (Letter of Undertaking) or Bond. If you meet the conditions, you can claim a refund of unused input tax credit.

-

Export goods or services, or both with IGST payment and no need for an LUT or Bond. If you meet the conditions, you can claim a refund of the tax paid.

The India Localization SuiteTax Engine SuiteApp lets you assign an export type to a sales transaction with goods, services, or both. The SuiteApp calculates GST based on the export type.

If you export goods or services under an LUT or Bond, you can create and assign LUT or Bond Detail records to your export transactions.

On sales transactions, if you set Export Type to With LUT or Bond, IGST isn't calculated. However, for tax exemption, the invoice must be approved. If the invoice is not approved, tax is still calculated even if you use an LUT or Bond.

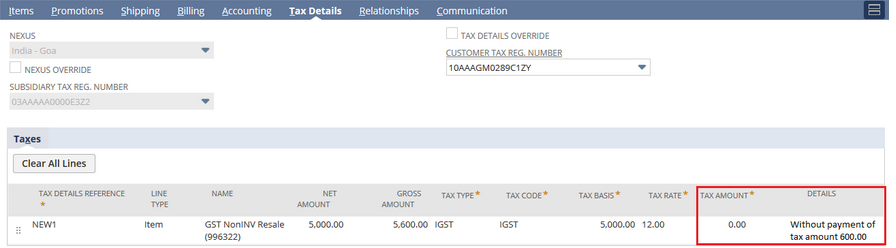

On the Tax Details subtab, the Tax Amount column displays zero, and the Details column displays Without payment of tax amount.

The transaction’s total IGST amount must be within the LUT bond's remaining value, or you won’t be able to save the record.

Following is an example of tax details without IGST payment.

If you export without an LUT or Bond, you can set up the SuiteApp to automatically create a journal entry with the transaction. This journal entry supports the reverse charge for the tax you paid on the exported goods or services.

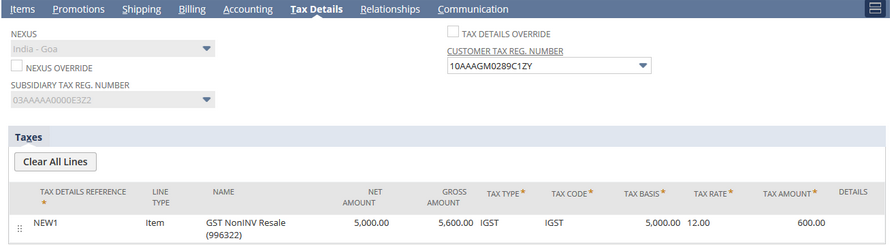

On sales transactions, if you set Export Type to Without LUT or Bond, IGST is calculated. The SuiteApp calculates IGST creates a journal entry for the transaction.

If you enable the Auto-Generate Adjustment Journal for Export feature, the SuiteApp automatically creates an adjustment journal after the transaction is created. To enable this feature, see Automatically Generating Journal Entries for Export.

Following is an example of tax details with IGST payment.

To know more information about how to set up the India Localization SuiteTax Engine SuiteApp to handle export of goods or services under India GST, read the following topics:

-

For information about exporting goods or services with an LUT or Bond, see Setting up LUT or Bond Details.

-

For information about exporting goods or services with payment of tax and without an LUT or Bond, see Automatically Generating Journal Entries for Export.

-

For information about setting your preferred export option for sales transactions, see Applying India GST on Sales Transactions.