Defining a Recognition Treatment Rule

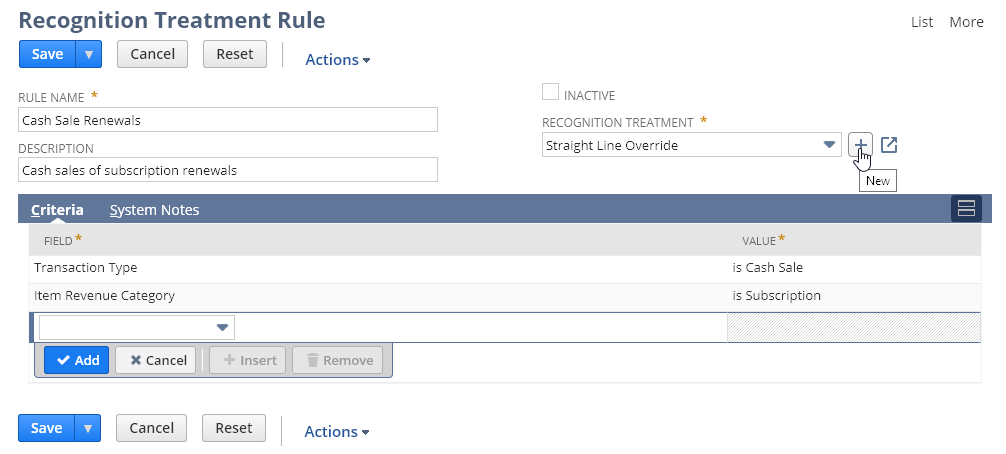

You define recognition treatment rules on the Recognition Treatment Rule page. Each rule specifies the recognition treatment to apply to a revenue element when it matches the criteria.

The rule criteria consist of a set of attributes of a revenue element or its linked item record. Each recognition treatment rule must have a unique set of criteria.

During revenue arrangement creation, a lookup process compares each revenue element to the recognition treatment rules in order of rule priority. When the process finds a matching rule, it applies the recognition treatment for that rule to the element and evaluation ends. If a revenue element doesn't match any recognition treatment rule, recognition attribute values are derived from the source item.

To define a recognition treatment rule:

-

Go to Setup > Accounting > Recognition Treatment Rules > New.

-

In the Rule Name field, enter a unique name for the rule.

Your rule name should include enough information for you to identify it in a list if you need to change the priority of your rules. You can include symbols in addition to letters and numbers.

-

In the Description field, enter a short description of the rule. The description is optional.

-

Select the Recognition Treatment to apply when this rule matches a revenue element.

If the recognition treatment you want to use doesn't appear in the list, click the plus icon

to create a new recognition treatment. For information, see Creating a Recognition Treatment.

to create a new recognition treatment. For information, see Creating a Recognition Treatment. -

Check the Inactive box to disable the rule.

-

In the Criteria subtab, select the fields and values that must match for the rule to apply the recognition treatment to a revenue element.

Unless you include a field and value, the field isn't considered for matching.

-

Accounting Book - Multi-select list. The accounting book associated with the source and revenue element. This field is available only when the Multi-Book Accounting feature is enabled. For information, see Using Multi-Book Accounting.

-

Class - Multi-select list. The class associated with the source and revenue element.

-

Custom Field (transaction line-level only) - The name of the custom field associated with the source and the element line on the revenue arrangement. When creating a custom field, make sure it applies to both the source and the revenue arrangement in the Applies To tab.

Note:Custom fields appear only on the revenue element line on the arrangement, not on the revenue element record itself.

-

Custom Segment (transaction line-level only) - Multi-select list. The name of the custom segment associated with the source and revenue element. When creating a custom segment, make sure it applies to both the source and the revenue arrangement in the Transaction Columns subtab. You must either check the GL Impact on the segment, create a revenue recognition field map, or do both for the treatment to apply to an element.

Note:Custom segments aren't supported on subscriptions.

-

Date - Date. Refers to the date on the revenue arrangement.

-

Department - Multi-select list. The department associated with the source and revenue element.

-

Item Revenue Category - Multi-select list. The item revenue category of the item in the revenue element.

-

Location - Multi-select list. The location associated with the source and revenue element.

-

Source Type - Multi-select list. The type of source for the revenue element. Transaction Line is always an option. Other options depend on the features enabled in your account.

-

Subsidiary - Multi-select list. The subsidiary associated with the source and revenue element.

-

Transaction Type - Multi-select list. The type of transaction the source is. Options include

-

Sales Orders

-

Invoices (not created from sales orders)

-

Cash Sales

-

Cash Refunds

-

Return Authorizations

-

Credit Memos

You can use this field without including a Source Type. Transaction type refers only to transaction lines.

The treatment lookup process doesn't consider revenue elements that are sourced from journal entries.

-

-

-

When you've added all criteria needed to apply the recognition treatment, click Save.

Supported Custom Field and Custom Segment Types

The following custom field types are supported. Custom fields with these types can appear as an option in the Criteria subtab.

-

Checkbox

-

Currency

-

Date

-

Decimal Number

-

Email

-

Free-Form Text

-

Integer Number

-

List/Record

-

Text Area

Only List/Record custom segment types are supported.

Class, Department, and Location Behavior

If you use per-line classes, departments, or locations (CDL), you can customize source transaction forms to display CDL at the header and line level. When CDL is populated at the source header level and no CDL fields exist at the source line level, the header-level CDL is propagated to the arrangement header. In this case, the recognition treatment defined by the rule whose criteria match the header-level CDL value is applied to all revenue elements in the arrangement.

However, if CDL fields exist at both the header and line level, the line-level CDL always takes precedence. For example, if the source header-level CDL is populated but the source line-level CDL field exists and is blank, the arrangement header and line-level CDL fields will be blank, and related treatments can't be evaluated. To enable per-line CDL, see Using Per-Line Classifications.

Priority of Recognition Treatment Rules

After you create your recognition treatment rules, review their priority. The order you create them in sets their initial priority. The first recognition treatment rule you create takes precedence over the next one you create, and so on. For instructions, see Prioritizing Recognition Treatment Rules.