Using Multi-Book Accounting

Please contact your sales or account representative to find out how to get the Full Multi-Book Accounting feature. The assistance of NetSuite Professional Services or a Multi-Book authorized partner is required to implement this feature. You should consider contacting NetSuite Professional Services or a Multi-Book authorized partner for assistance in setting up the Adjustment-Only Books feature, even though it isn't required.

Multi-Book Accounting, including the Adjustment-Only Books feature, is available only in NetSuite OneWorld.

The Full Multi-Book Accounting feature lets you maintain multiple sets of financial records in parallel to support various accounting and reporting standards.

The Full Multi-Book Accounting feature is enabled by NetSuite Professional Services. You can clear the Full Multi-Book Accounting box on the Enable Features page if both of the following conditions exist. 1) There are no secondary accounting books. 2) No other Full Multi-Book Accounting features are enabled.

Terminology

Multi-book accounting introduces some new terms to the NetSuite vocabulary:

-

Primary book: The accounting book record as it's before you enable the Multi-Book Accounting feature. When you enable multi-book accounting, the primary book becomes visible as separate from other accounting books. It's automatically configured and activated. The primary book is the daily operational book where your business transactions are recorded and viewed.

-

Secondary books: Any accounting books that aren't the primary book. Secondary accounting books may differ from the primary book in several ways. They can use a different subsidiary base currency, post to different accounts for the same transaction, or have different accounting rules.

-

Book-generic: Records that are created and shared across all books. Examples of book-generic records are entity records and CRM records. Other book-generic records may also have book-specific attributes. Examples of book-generic records with book-specific attributes are items, sales orders, sales invoices, and vendor bills.

-

Book-specific: Records that are created for only one book. Book-specific records include the following:

-

Book-specific journal entries and intercompany journal entries

-

Revenue commitment and reclassification journal entries

-

Revenue and expense allocation

-

Revenue recognition and expense amortization schedules

-

Fixed asset depreciation schedules and journal entries

-

-

Chart of accounts mapping: Permits different account values to be used for transactions in secondary accounting books from those used in the primary book. This creates different account balances and usage for the secondary book. Unless chart of accounts mapping is configured, all accounting books use the same accounts for transactions.

General Architecture

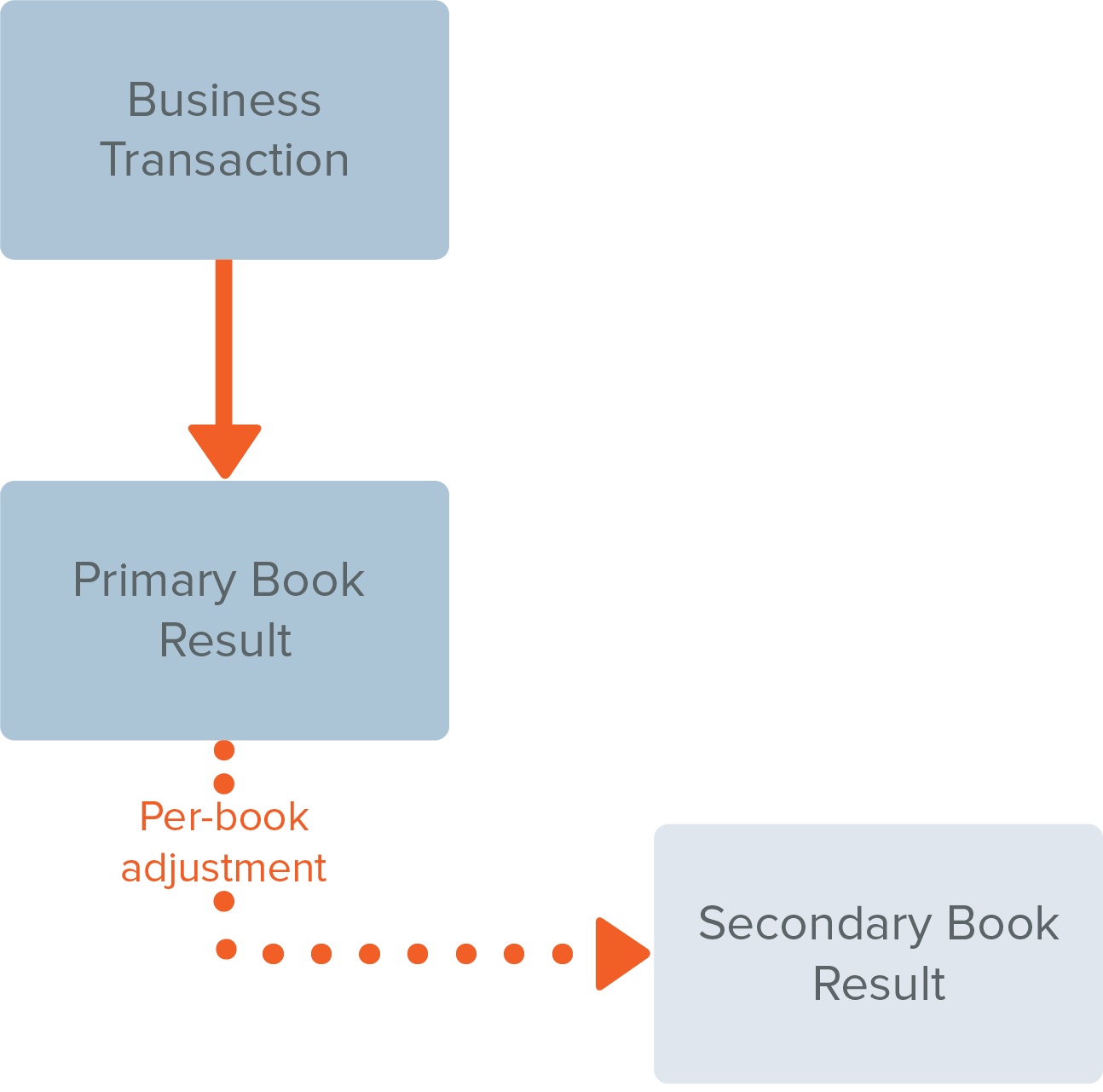

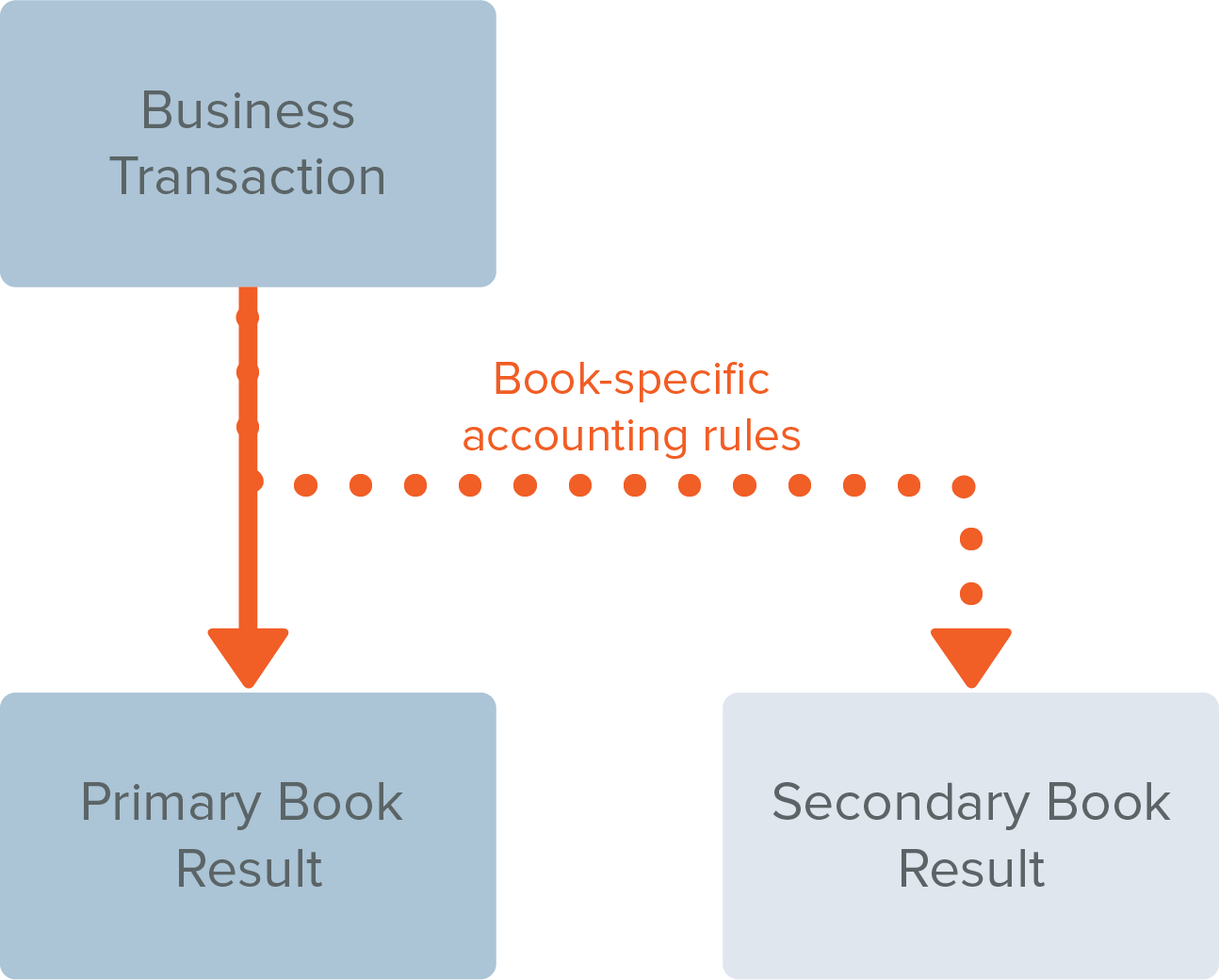

The Full Multi-Book Accounting feature provides two distinct but complementary methods to generate secondary book financial results:

-

Manual adjustments using book-specific journal entries. For more information, see Journal Entries in Multi-Book Accounting.

-

Accounting rules to automate the financial results of shared business transactions. The optional additional features Chart of Accounts Mapping, Foreign Currency Management, and Revenue and Expense Management enable the automated accounting rules. See the following topics for more information about these features:

The Fixed Assets Management SuiteApp also has an add-on to support multi-book accounting. For more information, see Multi-Book Accounting for Fixed Assets Management.

These methods may be used separately or in combination.

Changes in the User Interface

When Multi-Book Accounting is enabled, there is no change in the user interface for book-generic records unless the record also has book-specific attributes. The primary book record attributes retain their current locations to ensure backward compatibility.

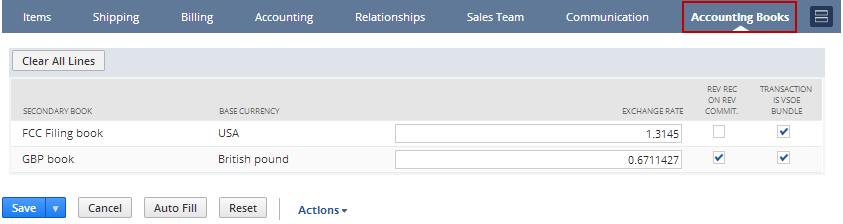

For most book-generic records with book-specific attributes, the secondary book information is on the Accounting Books subtab. The screenshot below shows the Accounting Books subtab for a sales order.

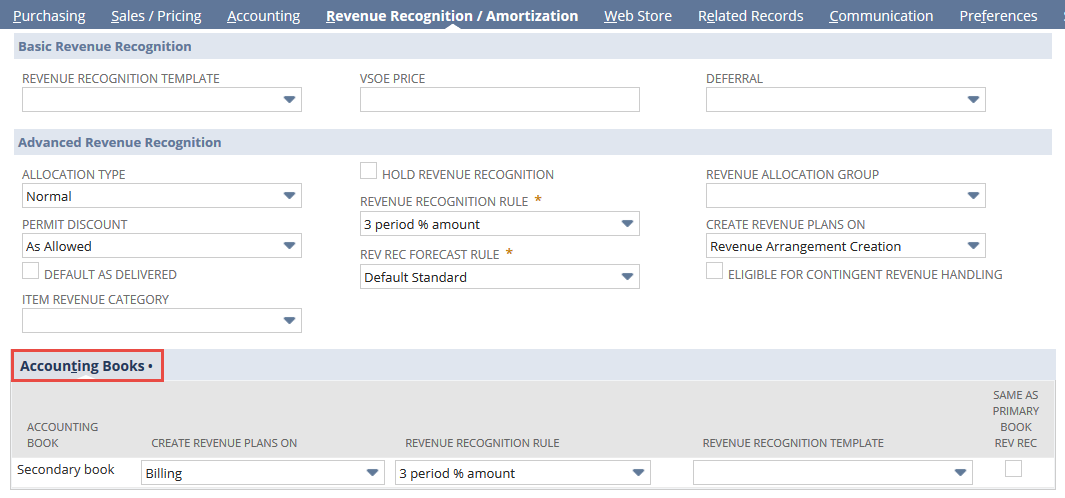

For item records, the book-specific attributes are on the Revenue Recognition / Amortization subtab in an Accounting Books subtab as shown below. This subtab is added only when revenue recognition or amortization features are enabled.

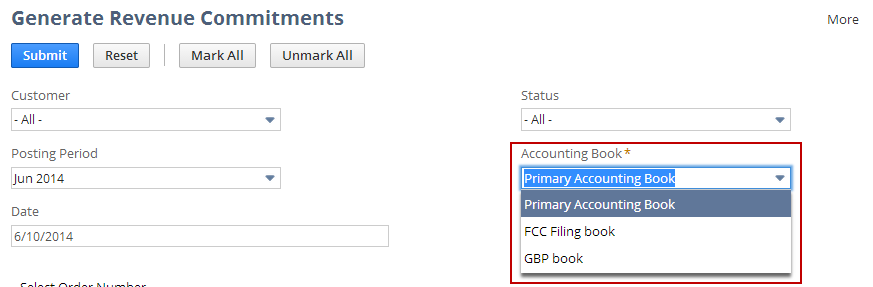

Book-specific records include a required Accounting Book list as shown below.

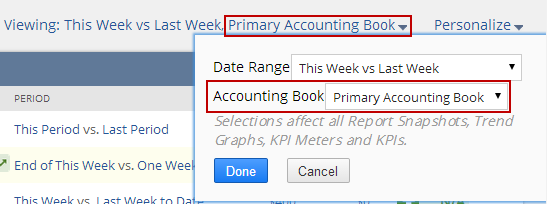

The portlet settings at the top of the Home page include an Accounting Book list. This lets you select both the Date Range and the Accounting Book for your reports and KPIs. The new settings link and popup are shown below.

The GL Impact page includes an Accounting Book filter so that you can view and export the general ledger impact for all accounting books or for individual accounting books. This page also contains information to indicate the associated accounting book and corresponding subsidiary base currency of each GL impact line.

Reports and searches that rely on book-specific records or accounting attributes include an Accounting Book footer filter. For more information, see Reports, KPIs, and Saved Searches in Multi-Book Accounting.

Related Topics

- Planning for Multi-Book Accounting

- Enabling Multi-Book Accounting Features

- Adding Accounting Books

- Adding a New Subsidiary to an Active Book

- Roles and Data Access for Multi-Book Accounting

- Book-Generic and Book-Specific Records

- Multi-Book Accounting Overview

- Multi-Book Accounting

- Adjustment-Only Books Overview

- Restricting Role Access to Accounting Books