Reversing Balancing Segment Intersegment Lines

You can select different InterSegment Due To and Due From accounts when you set up the balancing by segments process. If you do, your Balance Sheet Total Assets and Total Liabilities & Net Assets may appear to increase. This is because the balancing process produces adjustment transactions in both intersegment accounts, and these won't offset each other within their respective accounts. There are two solutions to prevent this situation:

-

Select the same account for both the Intersegment Due To and Intersegment Due From accounts. When set up this way, the adjustment transactions automatically balance, as one balancing transaction is a debit, and one is its corresponding credit.

-

Use different Intersegment Due To and Due From accounts, and use the Enable Intersegment Elimination preference.

If you use the Enable Intersegment Elimination preference, NetSuite will automatically balance the adjustment transactions in the Intersegment Due To and Due From accounts in an Elimination value (for example, a fund for intersegment elimination) which you create and select.

If you plan to use this preference, you should create a value within your balancing segments which will be used only for this purpose.

To set up intersegment elimination:

-

Go to Setup > Accounting > Preferences > Accounting Preferences (Administrator) and click the Balancing Segments subtab.

-

Check the Enable Intersegment Elimination box.

-

In the Segments subtab, select an Elimination Value for each balancing segment.

Note:When the Enable Intersegment Elimination box is checked, you must select an elimination value for your balancing segments. You can change the elimination value to another one later if needed.

When you run the balancing by segments process, NetSuite will create intersegment elimination transactions in this fund. These elimination transactions balance the Intersegment transactions created in your due to and due from accounts. Your consolidated statements will then display the correct consolidated figures

Intersegment elimination only affects intersegment lines which NetSuite creates for balancing by segments, and not any manually created lines. You must manually balance any of these postings.

Intersegment Elimination Example:

You use one balancing segment called 'Fund,' with values 'Operating,' 'A,' and 'B.' Before the balancing by segments process is run, the company records an invoice and two associated bills. The GL impact is:

|

GL Impact Bill 1 |

|||||

|---|---|---|---|---|---|

|

Account |

Amount (Debit) |

Amount (Credit) |

Name |

Subsidiary |

Fund |

|

2000 Accounts Payable |

|

$100.00 |

US Vendor |

Parent Company |

Operating |

|

6130 Miscellaneous Expense |

$40.00 |

|

|

Parent Company |

A |

|

6130 Miscellaneous Expense |

$60.00 |

|

|

Parent Company |

B |

|

GL Impact Bill 2 |

|||||

|---|---|---|---|---|---|

|

Account |

Amount (Debit) |

Amount (Credit) |

Name |

Subsidiary |

Fund |

|

2000 Accounts Payable |

|

$200.00 |

US Vendor |

Parent Company |

Operating |

|

6130 Miscellaneous Expense |

$100.00 |

|

|

Parent Company |

A |

|

6130 Miscellaneous Expense |

$100.00 |

|

|

Parent Company |

B |

|

GL Impact Invoice |

|||||

|---|---|---|---|---|---|

|

Account |

Amount (Debit) |

Amount (Credit) |

Name |

Subsidiary |

Fund |

|

1100 Accounts Receivable |

$150.00 |

|

Customer A |

Parent Company |

Operating |

|

4000 Sales |

|

$70.00 |

Customer A |

Parent Company |

A |

|

4000 Sales |

|

$80.00 |

Customer A |

Parent Company |

B |

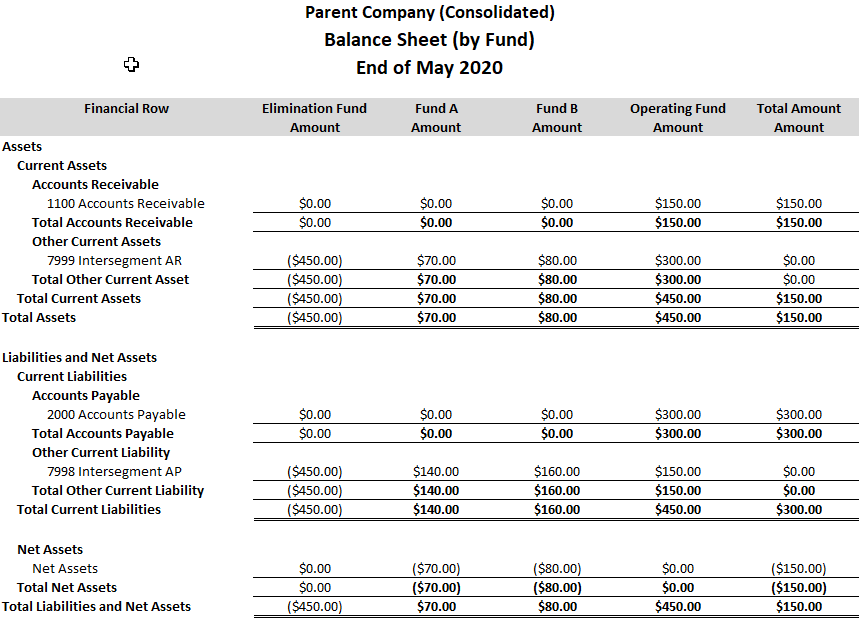

The balance sheet by segment will be:

When you run the balancing by segments process with Intersegment Due To Account 'Intersegment AP' and Intersegment Due From Account 'Intersegment AR', NetSuite creates the following balancing segments journal:

|

GL Impact Balancing Segments Journal |

|||||

|---|---|---|---|---|---|

|

Account |

Amount (Debit) |

Amount (Credit) |

Posting |

Subsidiary |

Fund |

|

7998 Intersegment AP |

$0.00 |

$140.00 |

Yes |

Parent Company |

A |

|

7998 Intersegment AP |

$0.00 |

$160.00 |

Yes |

Parent Company |

B |

|

7999 Intersegment AR |

$300.00 |

$0.00 |

Yes |

Parent Company |

Operating |

|

7998 Intersegment AP |

$0.00 |

$150.00 |

Yes |

Parent Company |

Operating |

|

7999 Intersegment AR |

$70.00 |

$0.00 |

Yes |

Parent Company |

A |

|

7999 Intersegment AR |

$80.00 |

$0.00 |

Yes |

Parent Company |

B |

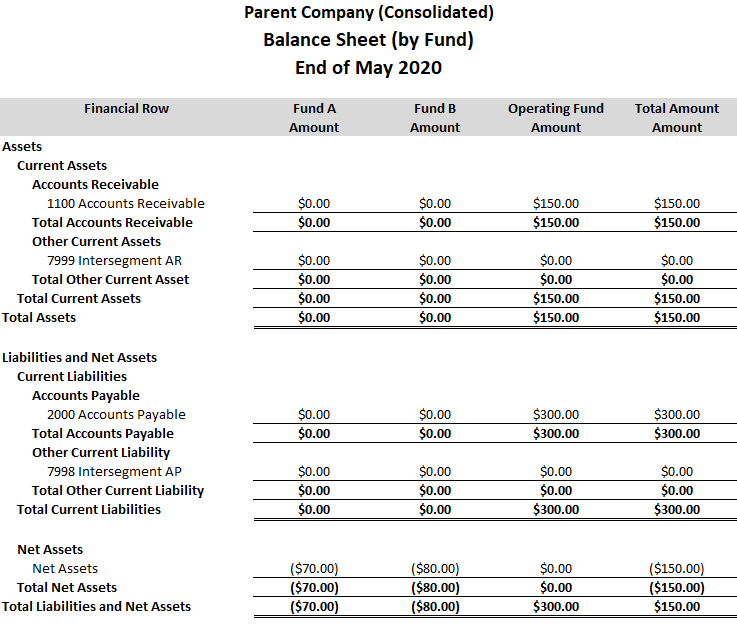

The balance sheet then appears as follows. The Total Assets and Total Liabilities & Net Assets have increased because of the unbalanced Intersegment values in the Intersegment AP and Intersegment AR accounts.

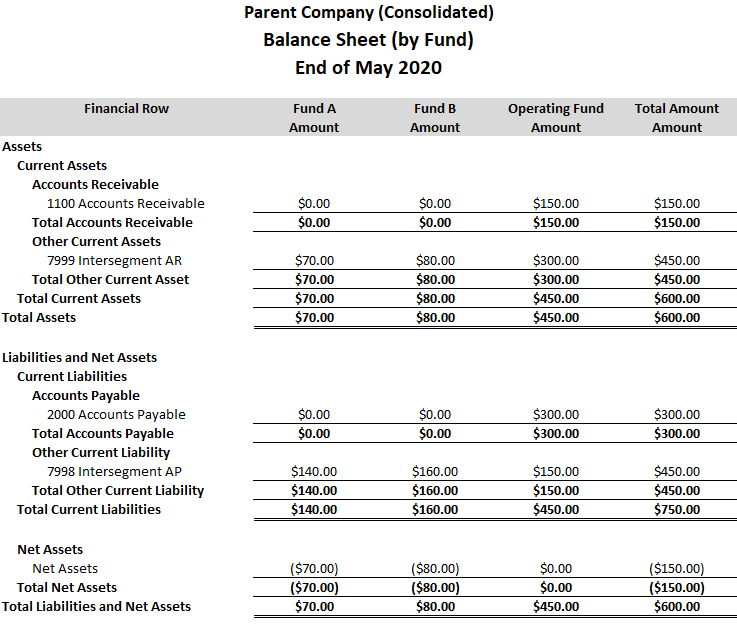

If you use intersegment elimination, when you run the balancing by segments process, NetSuite auto-reverses the balancing lines in the balancing journal, by posting to elimination transactions to the elimination value. The GL impact is:

|

GL Impact Elimination Journal |

|||||

|---|---|---|---|---|---|

|

Account |

Amount (Debit) |

Amount (Credit) |

Posting |

Subsidiary |

Fund |

|

7998 Intersegment AP |

$450.00 |

$0.00 |

Yes |

Parent Company |

Elimination Fund |

|

7999 Intersegment AR |

$0.00 |

$450.00 |

Yes |

Parent Company |

Elimination Fund |

The final balance sheet now appears with its correct Total Assets and Total Liabilities & Net Assets: