Guideline

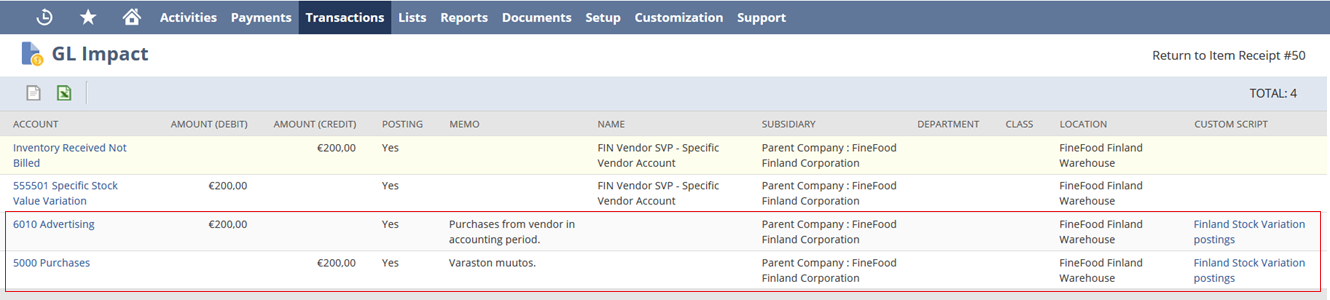

Upon saving a respective transaction, there is an additional posting made in the GL:

DEBIT: expense account marked in COA as 'Default Account for Purchases within Fiscal Year' or that on the Vendor record (the latter takes precedence).

CREDIT (Item Receipt, Bill, Item Fulfillment): account marked in COA as 'Default Account for Stock Variation Postings', or that selected in 'Stock Value Variation account' defined for the respective Inventory Asset account (the latter takes precedence).

CREDIT (Work Order Issue, Work Order Completion): account marked in COA as 'Default Account for WIP Variance', or that selected in 'Stock Value Variation account' defined for the respective Inventory Asset account (the latter takes precedence).

From the table below you can see the mandatory postings of an inventory item from being received, used (can be skipped), and sold. The marked lines are generated through the Stock Value Variation script.

|

Sr No |

Transaction/ |

Debit |

Credit |

||

|---|---|---|---|---|---|

|

|

|

Account |

Description |

Account |

Description |

|

1 |

Item receipt 1: Purchase |

4000 |

Default Purchases expense account on CoA or Vendor specific purchases account |

2889 |

Accrued purchases |

|

2 |

Vendor Bill |

2889 |

Accrued purchases |

2871 |

Accounts Payable |

|

3 |

Item receipt 2: Inventory asset |

1501 |

Item asset account (Component) |

4400 |

Default Stock Value variation account on CoA or Asset Account specific Stock Value variation account |

|

4 |

Issue Component 1, components used deducted from inventory |

4400 |

Default Stock Value variation account |

1501 |

Item asset account |

|

5 |

Issue Component 2, components transferred to Work in Progress |

1511 |

Work In Progress asset account of assembly item |

3610 |

Component items stock value variation account |

|

6 |

Manufacturing cost of assembly item (Labour/machine cost from cost template) |

1511 |

Work In Progress asset account of assembly item |

3610 |

Component items stock value variation account (According to cost item account settings) |

|

7 |

Assembly completion 1. Change in WIP |

3610 |

Component items stock value variation account |

1511 |

Work In Progress asset account of assembly item |

|

8 |

Assembly completion 2. Change in Finished goods |

1521 |

Finished products stock value (Asset) |

3600 |

Finished and semifinished products stock value variation account |

|

9 |

Item Fulfillment |

3600 |

Finished and semifinished product stock value variation account (COGS account of sold goods) |

1521 |

Inventory Asset (Item asset account) |

|

10 |

Sales (Invoice) |

1701 |

Accounts Receivable, default from customer |

3000 |

Income Account of Item |