Creating a Dummy Tax Code

With the Denmark Localization SuiteApp, it's possible to create a dummy tax code.

To create a dummy tax code:

-

Go to Setup > Accounting > Tax codes > New.

-

Select a country.

-

In the Tax Code field, enter EC-DUMMY-DK for Denmark.

-

In the Description field, you can enter that this tax code placeholder is used with Automatic EU Tax Code Selection for EC Sales feature.

-

In the Rate field, enter 0.00.

-

From the Subsidiaries list, select all subsidiaries in Denmark (pressing Ctrl).

-

From the Tax Agency list, select Tax Agency DK.

-

From the Tax Type list, select VAT.

-

From the Available On list, select Sales Transactions.

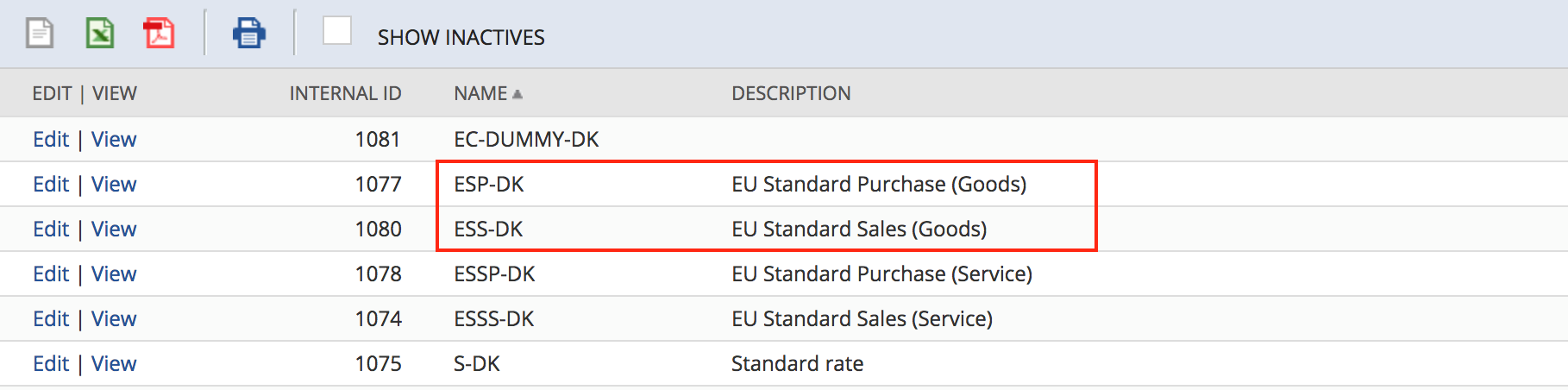

If it's required to use Notional VAT or to set up reverse charges, the default ES-DK tax code for EU standard sales/purchases for goods must be split into two. One tax code must be set for sales and one for purchases, as the setup would only apply on the purchase side. The tax codes must be set up as follows:

The Available On field must be set to Sales Transactions and Purchase Transactions accordingly.