Expense Amortization Schedules in Multi-Book Accounting

Please contact your sales or account representative to find out how to get the Full Multi-Book Accounting feature. The assistance of NetSuite Professional Services or a Multi-Book authorized partner is required to implement this feature. You should consider contacting NetSuite Professional Services or a Multi-Book authorized partner for assistance in setting up the Adjustment-Only Books feature, even though it isn't required.

Multi-Book Accounting, including the Adjustment-Only Books feature, is available only in NetSuite OneWorld.

Amortization schedules are book-specific. They're derived from amortization templates. You can create different templates to comply with different country and industry-specific rules.

The Revenue Recognition / Amortization subtab of the item record has an Accounting Books subtab so that you can select different templates for the item for secondary accounting books. The templates for the primary book are in the main Revenue Recognition / Amortization subtab. The templates selected on the item record are the default for the item. They may be changed when the transactions such as vendor bills are created.

The Accounting Books subtab on the item record also includes a box labeled Same as Primary Book Amortization. It's checked by default and template values for the primary book appear as the values for the secondary books. To select different templates for the default for the secondary books, clear the box. This enables the lists for the templates in the Accounting Books subtab. You may choose to not associate a template by default by selecting the blank option in the list.

The Same as Primary Book Amortization setting applies only to the default values. If you change the amortization schedule of a vendor bill or vendor credit in the primary book, the change doesn't apply to the secondary book values.

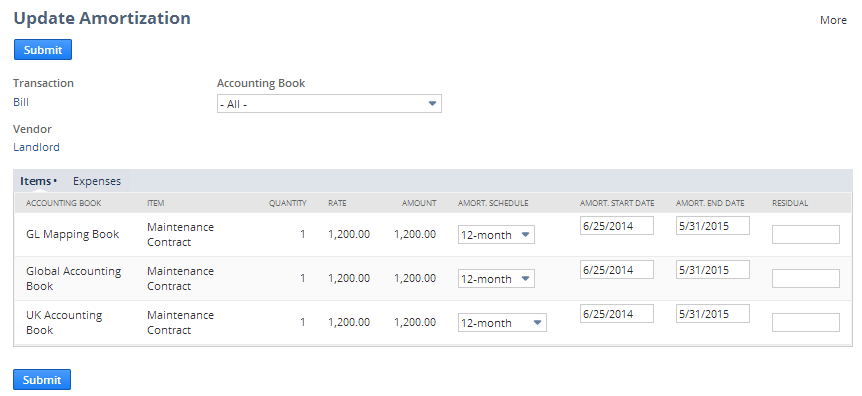

Vendor bills and vendor credits include a button labeled Update Amortization. It's available when you view the saved transaction record. Click it to open the Update Amortization page. On this page you can change the amortization schedule, its start and end dates, and check or clear the Residual box for secondary accounting books. It's the only way to modify the schedules in secondary books. An example of the Update Expense Amortization page is shown below.

The Expense and Item subtabs from the vendor bill or credit also appear on the Update Expense Amortization page, so that you can update amortization schedules with different source types. Amortization schedules sourced from the Expense subtab don't have a default amortization schedule value. This is because the default is derived from the item record and no item is attached to the Expense subtab.

When Chart of Accounts Mapping is used, the account source for mapping expense amortization transactions may be either the item or the transaction form. For more information, see Revenue Recognition and Expense Amortization with Chart of Accounts Mapping.