Returns and Refunds

Sales associates can use SuiteCommerce InStore (SCIS) to process returns and issue refunds to customers. When SCIS processes a return, NetSuite generates a customer return transaction and a credit memo. These transaction records are created in addition to the original sales transaction created when the item was purchased.

Administrators can track activity by viewing transaction records, customer records, or sales reports in NetSuite. Returns and credit memos are associated with customer records. Sales associates and store managers can view transaction and customer activity in SCIS.

Returns

Refunds

Return Types

Using SCIS, sales associates can process two types of returns:

-

Validated Returns

-

Unvalidated Returns

Validated Returns

In a validated return, the sales associate can verify the details of a purchase by reviewing the original transaction. Validated returns can reduce fraud and mistakes because they enable the associate to confirm the purchase was made through the retailer. As long as SCIS has access to the original transaction, it can process validated returns for items purchased in the store, through a NetSuite commerce website, or through other connected sources. The customer's timeline will include purchases from those connected sources.

Associates can find the transaction in SCIS by:

-

Scanning the customer's copy of the receipt.

-

Entering the transaction ID from the receipt into the Search Bar.

-

Searching for the customer and reviewing their Customer Profile timeline.

-

Reviewing the Transaction History list.

To return a serial or lot numbered item, associates must use the validated return process.

SCIS and NetSuite Processing for Validated Returns

SCIS works with NetSuite record processing to verify details and generate a credit memo for the refund. The processing maintains the integrity of the original transaction record while documenting the changes produced from the return. The internal steps are:

-

Locate the original transaction record.

-

Generate the credit memo.

-

Save the items and item quantities returned.

The last step is an SCIS process to control the items and quantities eligible for return. It's used to maintain the integrity of the transaction record.

Promotions and Manual Verification of Return Quantities

Promotions that were in effect when the original transaction occurred can impact the SCIS item-quantity verification process. This automatic process reviews the original transaction and any previous returns made against the original to control the quantities shown as eligible for return.

If the original transaction included a promotion, SCIS can't verify the item quantity originally purchased or previously returned.

If Original Transaction Included a Promotion

If the original transaction included one or more promotions that were in effect on the transaction date, and the promotion has ended, SCIS can't control the quantity of items eligible for return.

This limitation is part of an SCIS return process that protects the integrity of the original transaction record in NetSuite. The process used to protect the original isn't compatible with certain NetSuite processes.

Because SCIS can't control the return quantity if a promotion was in effect, a customer could return more of an item than was originally purchased. For example, if a customer bought three hats on promotion, but now wants to return them, SCIS won't automatically limit the return to only three hats. The sales associate must verify the eligible quantities before proceeding with the return.

Promotion Alerts

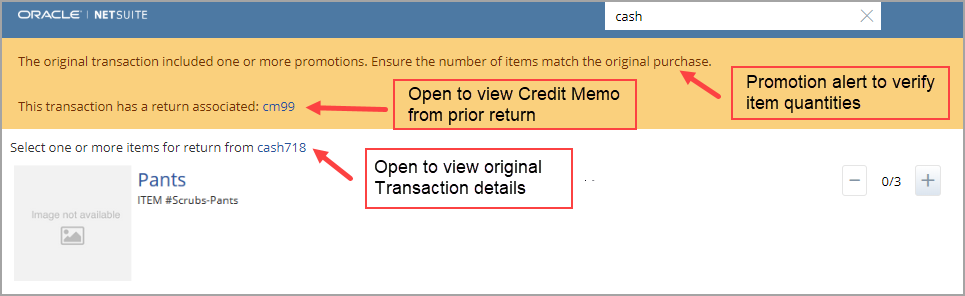

To reduce the chance of a sales associate accepting an incorrect return quantity, SCIS reviews the transaction at the start of a return to see if it included a promotion. If SCIS finds that a promotion was in effect, an alert displays on the Returns page.

The alert instructs the associate to verify that quantities returned are less than or equal to the original transaction and any previous returns.

If there are previous returns against the original, these are shown as Credit Memo links that the associate can click to see the details.

If Original Transaction Didn't Include a Promotion

If the original transaction didn't include a promotion, SCIS will automatically control the quantities eligible for return. The sales associate doesn't need to verify the quantity details.

Unvalidated Returns

This return type doesn't require the sales associate to find the original transaction. Instead, the associate scans the returned item to determine the refund amount. This method can be quicker than a validated return, but it's more prone to fraud.

Your store might have procedures you must follow when making unvalidated returns.

Working with Return Reasons

Sales associates can select a return reason before submitting an item return transaction. Return Reasons is a custom list installed by SCIS. The custom list includes values you can modify, or you can add more.

If a return reason isn't selected, the text Return Reason appears on the transaction in NetSuite.

To modify or add return reasons:

-

Go to Commerce > InStore > Return Reasons.

-

Add to or modify the return reason list:

-

Click New SCIS Return Reasons (List) to add a new value to the list.

-

Click Edit next to an existing value to change the name or modify filter settings.

-

-

Click the Filters subtab, and then select the Location, Website, and Subsidiary where you want these settings to apply. You can select more than one value in each box.

Note:By default, the filters are set to apply to all locations, websites, and subsidiaries.

-

Click Save.

Refunding a Return

A refund occurs as part of the return process. Sales associates can use any payment method available in SCIS for returns, including a split tender refund, using more than one payment method on the same return transaction. The refund amount is displayed in NetSuite on the Customer Refund transaction page.

If the sales associate chooses to refund cash, the refund is provided from the cash drawer. If the original payment was made with only one credit card, and the payment provider supports referenced refunds, the sales associate doesn't need to use the payment device to process the return.

A Credit Memo is always created to capture information from return transactions. If the customer wants a refund in cash or by credit card, the credit memo is closed out at the time of the refund.

By default, refunds and exchanges can only occur if the accounting period in which the transaction took place has a Status of Open. To allow refunds and exchanges for a Closed period, see Permit Refunds or Exchanges for Transactions in Closed Accounting Periods.

Split Tender Refunds

Sales associates can provide a refund using more than one payment type, such as cash and credit card.

For example, a customer returns a set of items totaling $100. The sales associate wants to refund $25 in cash and $75 to a credit card. In SCIS, the sales associate clicks Refund Cash to enter the cash amount, and then clicks Refund Credit Card to enter the remaining amount. The refund transaction isn't complete until the total amount is entered.

After the refund is submitted in SCIS, a credit memo is created in NetSuite to capture the data from the return. The credit memo is linked to the original sales transaction in the SCIS Returns Credit Memo field on the Related Records Subtab.

Refund by Credit Memo

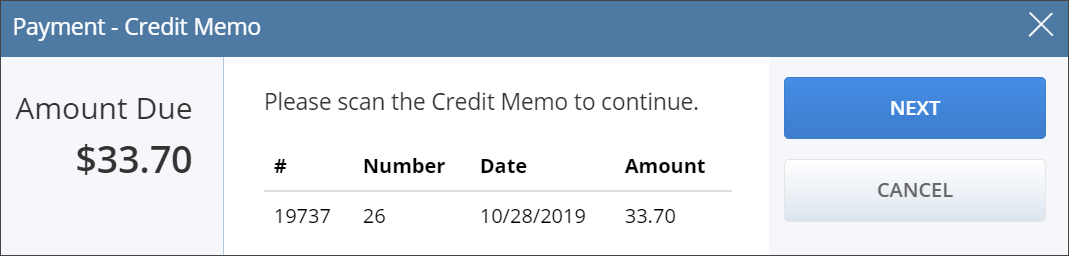

When choosing how to refund a customer, the sales associate can apply the refund to a credit memo. This type of refund is an alternative to providing refunds in cash or to a credit card. The customer can use the credit memo later to pay for a future transaction. NetSuite saves the refund as a credit memo on the customer record. The customer's return receipt includes a credit memo identifier for the refund amount.

To redeem a credit memo for a transaction, the sales associate chooses Other Payment and then Credit Memo. The associate can scan the receipt or select manual entry to choose from a list. If they select manual, SCIS displays the credit memos available to the customer.

A credit memo can't be used as payment unless it's associated with a customer record. If a credit memo is required for refund of a purchase made using the Default Customer record, the sales associate must create a new customer record. For more information, see Default Customer.

Credit Memos Not Valid for Sales Orders

Sales associates can't accept a credit memo as payment for any transaction that generates a sales order. NetSuite creates sales orders for SCIS transactions that have items for shipping or pick up in-store. SCIS displays an alert if a sales associate tries to use a credit memo as payment for a sales order. The transaction can't proceed until the associate selects a different payment method.

Refund by Exchange

Rather than receive a cash/credit card refund or a credit memo, a customer can request an item exchange. When processing an exchange, NetSuite creates an invoice for the new order and uses the return credit memo to adjust the balance due.

To perform an exchange, the sales associate adds the exchange item to the cart during the return. The exchange item can be the same as the return item. The balance due or refund due to complete the exchange depends on the following factors:

-

If the total of the exchange is more than the total of the return, then a balance is due.

-

If the total of the exchange is equal to the total of the return, then no balance or refund is due.

-

If the total of the exchange is less than the total of the return, then a refund is due.

If no balance or refund is due, the associate can tap End Transaction to finish the exchange.

Sales associates can't perform exchanges that include an item for shipping or pickup.

For example, a customer can't exchange an item they've already purchased for an item that will be shipped or picked up in-store. Instead, the associate must first complete a return transaction and then enter a sales transaction for the shipping or pickup item.

Supported Refund Use Cases

The following table shows customer refund scenarios based on payments received using a PIN pad device. Note that the Payment Network Reference ID (PNREF) is a unique identifier assigned to a transaction payment.

Sales associates can only process a referenced refund when the original sales transaction has one credit/debit card payment method. After the payment is approved, the payment provider sets a PNREF to it. When the refund takes place, SCIS uses the PNREF to send the refund directly to the credit/debit account. In this case, the sales associate doesn't need to use the payment device to complete the refund.

If the original payment was submitted with more than one credit/debit card, then to process the refund, the sales associate must use the payment device to swipe or enter each card associated with the original payment and select the amounts to be refunded.

|

Payment Received from Customer in SCIS with payment device |

Sales Transaction Automatically Created in NetSuite |

Number of Items Purchased |

Number of Items Returned |

Split Refund (With PNREF) |

Split Refund (Without PNREF) |

|---|---|---|---|---|---|

|

One credit/debit card |

Cash Sale |

1 |

1 |

OK |

OK |

|

One credit/debit card |

Invoice |

1 |

1 |

OK |

OK |

|

One credit/debit card |

Cash Sale |

2 |

1 |

OK |

OK |

|

One credit/debit card |

Invoice |

2 |

1 |

OK |

OK |

|

Multiple credit/debit cards (Split Payment) |

Invoice |

1 |

1 |

Not Supported |

OK |

|

Multiple credit/debit cards (Split Payment) |

Invoice |

2 |

1 |

Not Supported |

OK |