Field Mapping for Mexico (Mexico Compliance SuiteApp)

If you are using the Mexico Localization SuiteApp, see Mexico Localization Field Mapping.

The Mexico Tax Administration Service (SAT) requires fields with specific values to be included in the Mexico Electronic Accounting File.

The Audit Files Field Mapping feature enables you to map standard NetSuite fields to categories required by tax authorities. The mapped values will be included in the generated tax audit files after they are saved in the system.

This feature is included in the Tax Audit Files SuiteApp, and can be used in accounts with a Mexico nexus or subsidiary.

Read the following topics for more information:

Mapping Account Group Codes for Mexico Chart of Accounts

The Mexico Chart of Accounts audit file must include the account group codes defined by SAT.

You can map the accounts assigned to your Mexico subsidiary to SAT-defined group codes using CSV import.

Accounts without an assigned SAT group code will not be included in the Mexico Electronic Accounting File.

To map group codes for Mexico accounts using CSV import:

-

For the list of valid SAT group code values, download the CSV template for Mexico SAT Account Grouping from the NetSuite File Cabinet. You can also use the template as a reference when you format the CSV file for import.

-

Go to Documents > File > File Cabinet.

-

On the file cabinet, go to SuiteBundles > Bundle 47492 > Tax Audit Files CSV Templates.

-

Click MX Account Group Codes template.csv to download the file.

-

Save the template on your computer.

-

-

Create a saved search of the subsidiary's accounts. You can export the results to a CSV file, which you can edit and use for Mexico Account Group Code CSV import.

-

Go to Lists > Search > Saved Searches > New.

-

Click Account.

-

On the Criteria subtab, set the filter for subsidiary and select your Mexico subsidiary.

-

On the Results subtab, set the results to only include the Internal ID and Name columns.

-

Click Preview.

-

On the results page, click the icon for Export - CSV.

-

Save the CSV file with account search results.

-

-

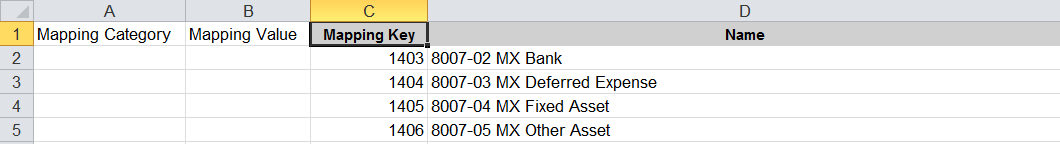

Open the CSV file of the account search from Step 2. For automatic field mapping during CSV import, edit the file so that the column headers match the columns in the CSV template (from Step 1).

-

Add two columns for Mapping Category and Mapping Value.

-

Replace the column header for Internal ID with Mapping Key.

-

-

Using the same CSV file above, specify values for the Mapping Category and Mapping Value cells for each account.

-

Mapping Category - Enter MX SAT: Account Grouping.

-

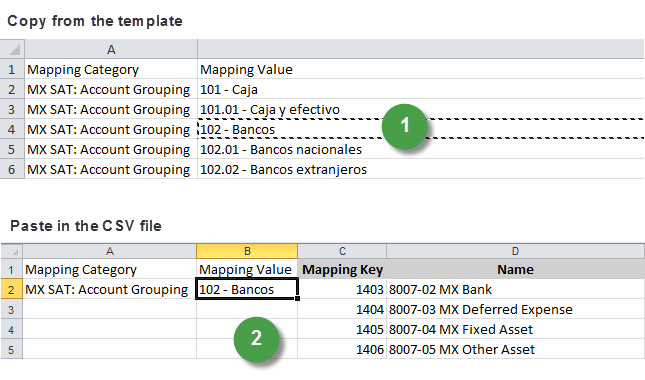

Mapping Value - Enter the group code value. To make sure that you are entering the correct values, copy the SAT group code values listed in the template that you downloaded in Step 1, and paste the exact value in the Mapping Value column of the CSV file.

1

The SAT group codes are listed in the template that you downloaded in Step 1. Look for the appropriate group code in the Mapping Value column of the template and copy the value.

2

In the CSV file with account internal IDs, paste the exact value copied from the template in the appropriate cell in the Mapping Value column.

-

-

Save the CSV file with accounts and group code information.

-

Import the saved CSV file to NetSuite. Go to Setup > Import/Export > Import CSV Records. Select the following options for CSV import:

-

Import Type = Custom Records

-

Record Type = TAF Mapping

-

Character Encoding = Western (Windows 1252)

For more information on importing CSV files, see Importing CSV Files with the Import Assistant.

-

-

Verify if the record submitted using CSV import is mapped correctly.

-

Go to Setup > Tax Audit Files > Audit Files Field Mapping.

-

Select MX SAT: Account Grouping in the Category field.

-

In the Subsidiary field, select your Mexico subsidiary.

-

In the Account Type field, select an account type. Verify the accounts under each account type.

-

Mapping Bank Accounts and Payment Methods for Mexico Journal Entries

The Mexico Journal audit file must include SAT-defined values for bank accounts and payment methods. You can map these NetSuite standard fields to categories required by SAT on the Audit Files Field Mapping page.

To map standard NetSuite fields to required categories for Mexico Journal:

-

Go to Setup > Tax Audit Files > Audit Files Field Mapping.

-

In the Category field, select which fields to map.

The following field mapping options are available for Mexico Journal:

-

MX SAT: Bank - Maps bank accounts, including those added to vendor and employee records, to SAT-defined bank categories.

-

MX SAT: Payment Method - Maps payment methods to SAT-defined categories.

-

-

For MX SAT: Bank, select a subsidiary in the Subsidiary field.

-

Map the fields by specifying a value on the right column.

-

Click Save.