Understanding Tax Types and Tax Codes in SuiteTax

The tax calculation engine assigned to a nexus must have corresponding tax codes with information on tax rates and the transactions to which the tax applies. These must be mapped to the tax codes and tax types in NetSuite.

When tax is calculated on a transaction, the tax details include a summary of tax amounts for each tax type and tax code.

Creating Tax Types in SuiteTax

A tax type is associated with a nexus, and tells the system where to post the tax amounts on the balance sheet. For each nexus, you must assign at least one account in your general ledger for posting tax.

A tax type does not impact the tax calculation process. More specifically, it determines how the calculated tax amount impacts the transaction. For example, tax type defines how the calculated tax amount impacts the transaction total, the gross amount, and others.

The default balance sheet account to which NetSuite posts tax collected on sales transactions or tax paid on purchases is the Tax Liability account. By default, tax types use tax control accounts for posting tax amounts. You can remove this restriction of you want to use a different account in your chart of accounts as your posting account for tax.

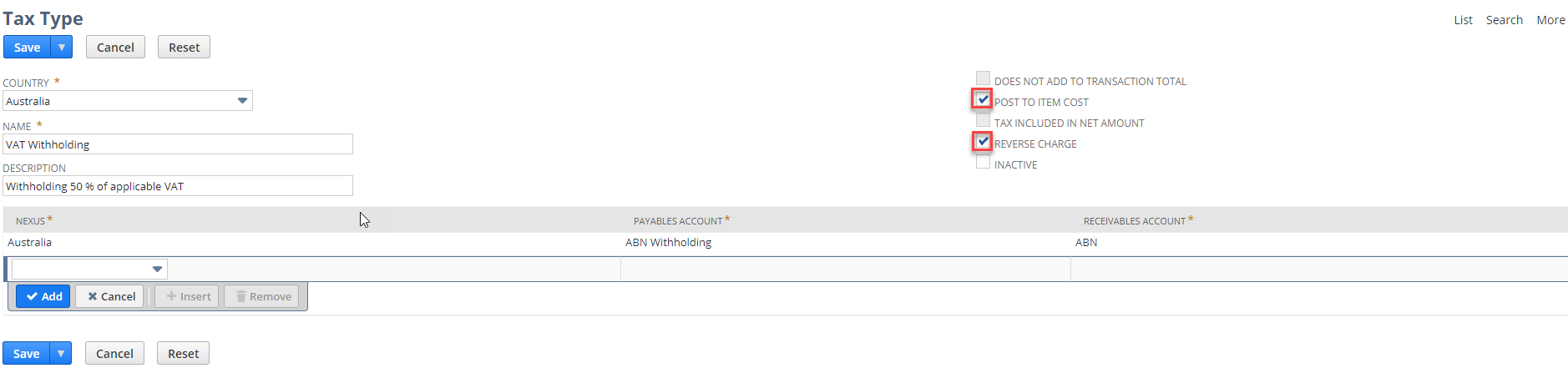

To create a tax type:

-

Go to Setup > Tax > Tax Types > New (Administrator).

-

Select the country that you are making a tax type for. Only countries where a nexus has been created are available for selection in the list.

-

Enter a name for this tax type.

-

Enter a description for this tax type.

-

If applicable, set a special property for the tax type.

Note:You can set only one of these properties per tax type. After saving the tax type record, you can no longer change the special tax type properties on edit mode.

Note:All of the following special tax type properties support both journal entries and expense reports.

-

Does Not Add To Transaction Total - Check this box for special tax types that don't impact the transaction total, such as withholding tax. Tax types with this property can be used on sales and purchase transactions. Tax totals from tax types that have this property set are always positive and don't influence the transaction total.

-

Post To Item Cost - Check this box if the tax amounts for the tax type should be added to the related item cost. Tax types with this property can be used on purchase transactions only. Tax amounts for tax types that have this property set are added to the item amount at the general ledger and costing level. This tax type is used for non-deductible input tax.

-

Tax Included in Net Amount - Check this box for special tax types where the tax amount is included in the item price. Tax types with this property can be used on sales and purchase transactions. Tax amounts for tax types that have this property set are added to the tax total on the transaction summary box, but are not added to the item gross amount and to the transaction total. This tax type isn't the same as tax-inclusive pricing. This tax type is used to support the Brazilian taxes determination, for example "Imposto sobre a Circulação de Mercadorias e Serviços (ICMS)".

-

Reverse Charge - Check this box if reverse charge applies to transactions that have this tax type. Tax types with this property can be used on purchase transactions only. Tax amounts for tax types that have this property set are added to the tax total on the transaction summary box, but are not added to the transaction total. On purchases, reverse charge tax types generate offsetting lines for both sales and purchase tax accounts in your general ledger.

If you are creating a non-claimable reverse charge, check both Reverse Charge and Post to Item Cost boxes. For more information, see Non-claimable Reverse Charge Tax Type.

-

-

Check the Inactive box if you don't want this tax type to be available for use in lists and transactions.

-

Add nexuses and assign tax accounts for each nexus by performing the following steps:

-

In the Nexus column, select a nexus.

-

In the Payables Account column, select an account to which taxes on sales transactions for the nexus should be posted.

-

In the Receivables Account column, select an account to which taxes on purchase transactions for the nexus should be posted.

-

Click Add.

-

Repeat the substeps under Step 7 for each nexus that you want to associate with this tax type.

-

-

Click Save.

Reverse Charge

To learn more about how to manage non-claimable (non-deductible) taxes in SuiteTax, see Partial Deductible and Reverse Charge VAT in SuiteTax.

Reverse Charge is a tax type which moves the responsibility for reporting VAT from the seller to the buyer of goods or services. When you apply a reverse charge to a transaction, the buyer reports both input VAT and output VAT to their domestic tax authority. As a result, the reverse charge is neutral, but the tax authorities have full oversight of the transactions. In some countries, if the buyer is liable to pay the VAT on behalf of the seller, it must be clearly stated on the invoice.

For example, a buyer (receiver) in a member EU state purchases a product from a seller (supplier) in another member state for 1000 euro. The receiver pays the output VAT of 20% to their local tax authority (government). At the same time, if they are fully eligible, they claim the input VAT of 200 euro. The result is a neutral balance.

To set the Reverse Charge property in SuiteTax, see Creating Tax Types in SuiteTax.

Non-claimable Reverse Charge Tax Type

Reverse charges are not always neutral depending on whether a business has full VAT recovery or not. Partially exempt businesses pay the output VAT to their tax authority on behalf of the foreign seller, but they can't claim the input VAT from their tax authority. For that reason, it is necessary to create a tax type where both the reverse charge mechanism and the partial exemption of a business are taken into consideration.

The Non-claimable reverse charge tax type supports non-claimable tax deductions on reverse charge tax types. To do this, select both the Post to Item Cost and Reverse Charge properties when creating a new Tax Type record.

The combination of both properties is allowed only when you create the tax type for the first time. These settings can't be edited later.

For more information on how to create a tax type including non-claimable reverse charge types, see Creating Tax Types in SuiteTax.

Creating Tax Codes in SuiteTax

When creating a tax code record, a tax type is required. After saving a tax code record, its tax type can no longer be changed.

To create a tax code:

-

Go to Setup > Tax > Tax Codes > New (Administrator).

-

Enter a name for this tax code.

-

Enter a description for this tax code.

-

Select the tax type for this tax code. You can create a new tax type at Setup > Accounting > Taxes > Tax Types > New. For more information, see Creating Tax Types in SuiteTax.

-

Check the Inactive box if you don't want this tax code to be available for use in lists and transactions.

-

Click Save.