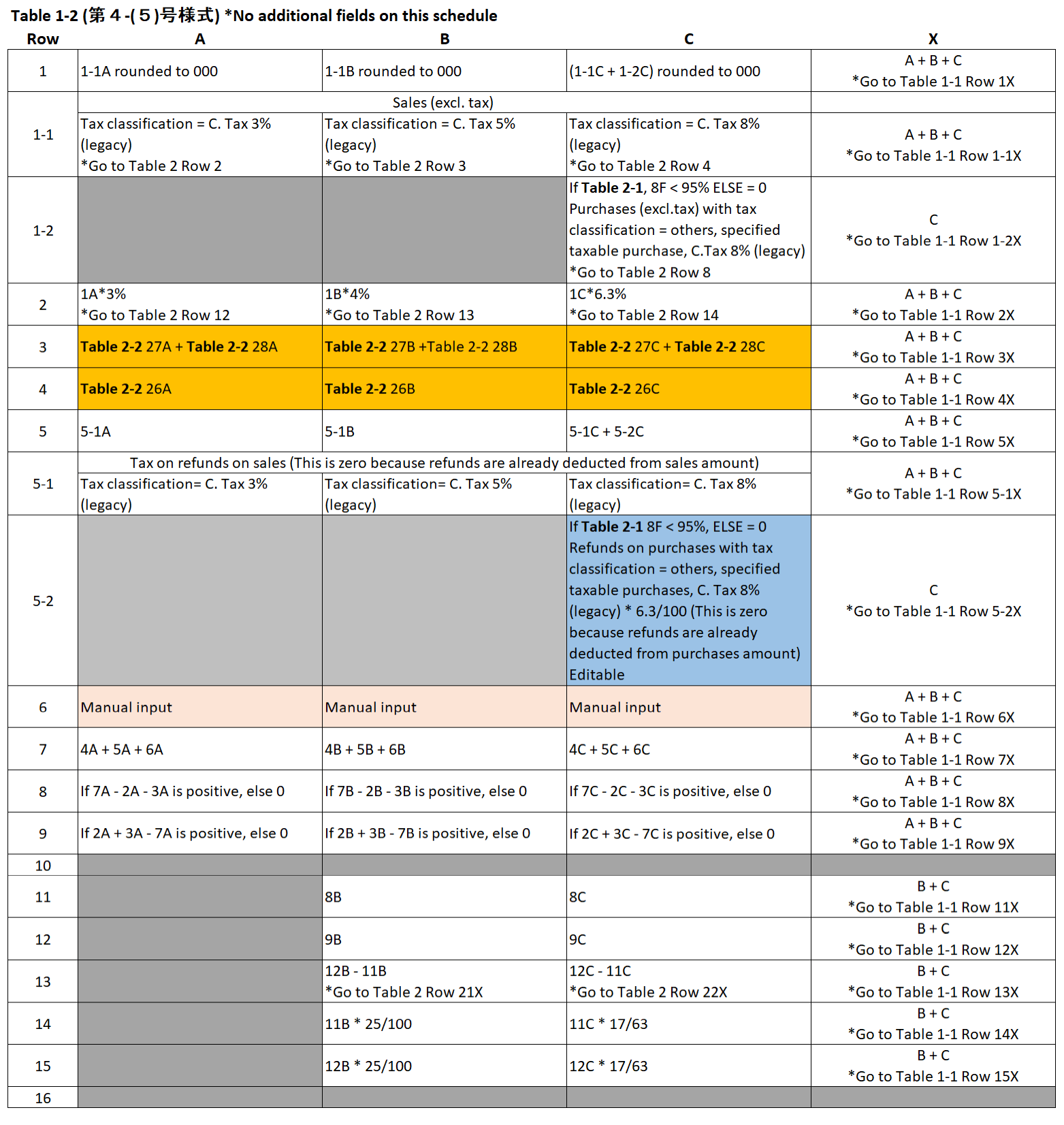

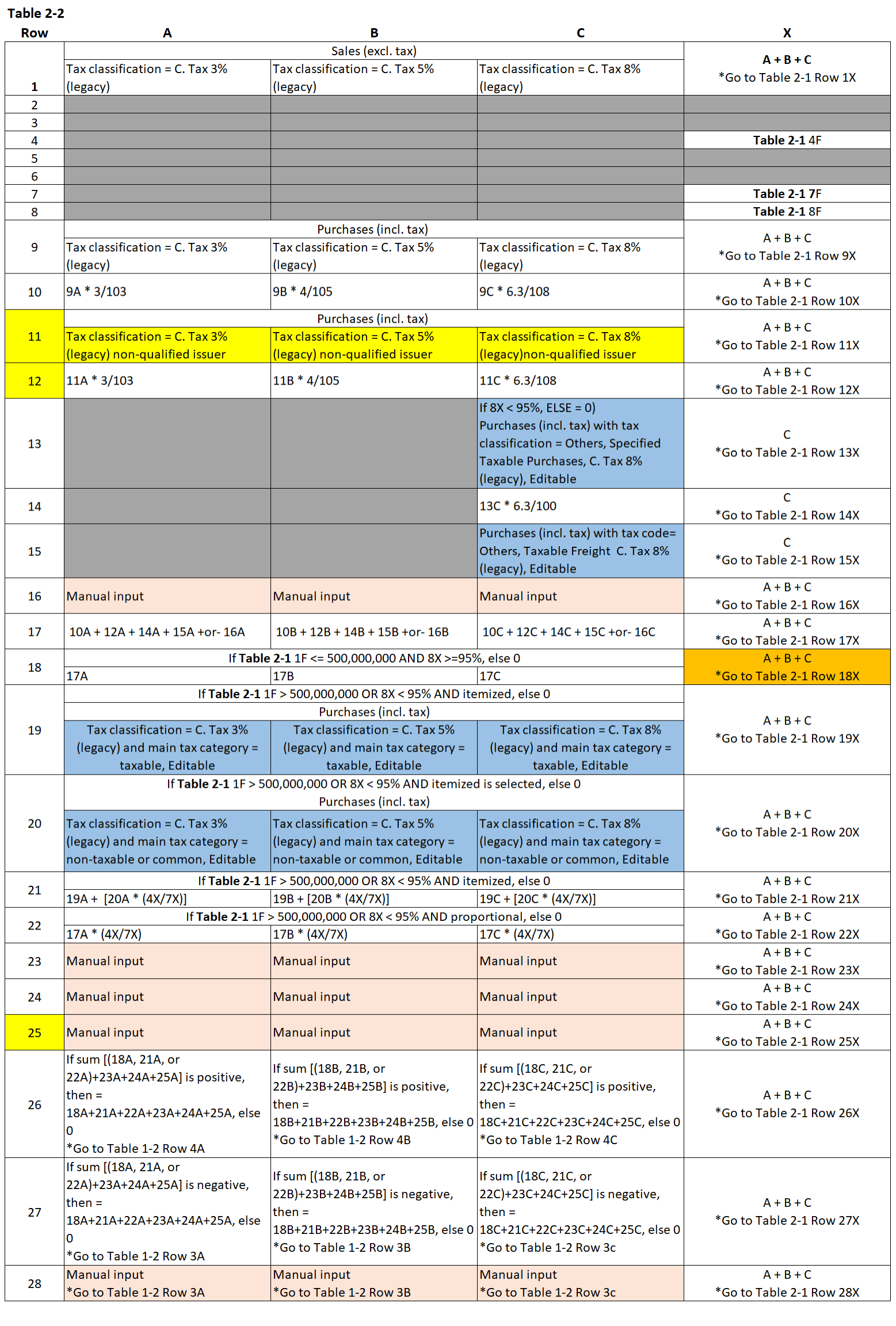

What goes into each box - Japan Consumption Tax Form

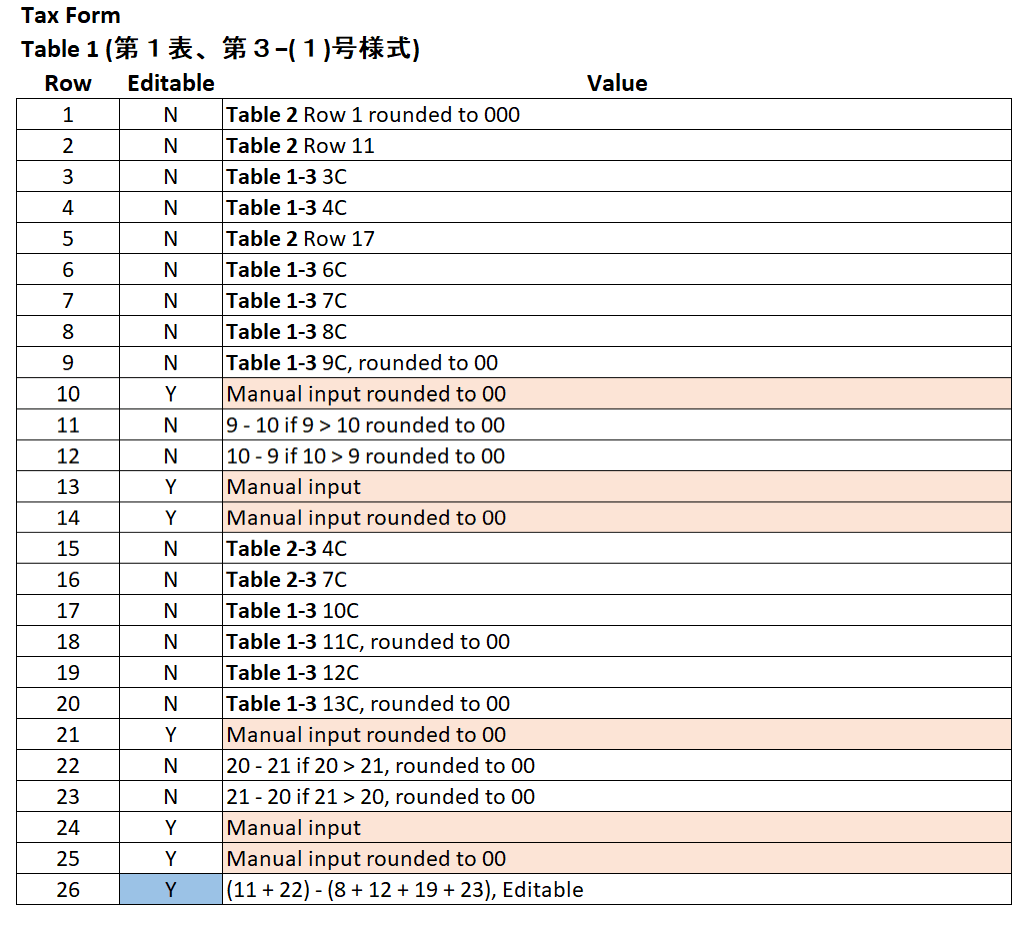

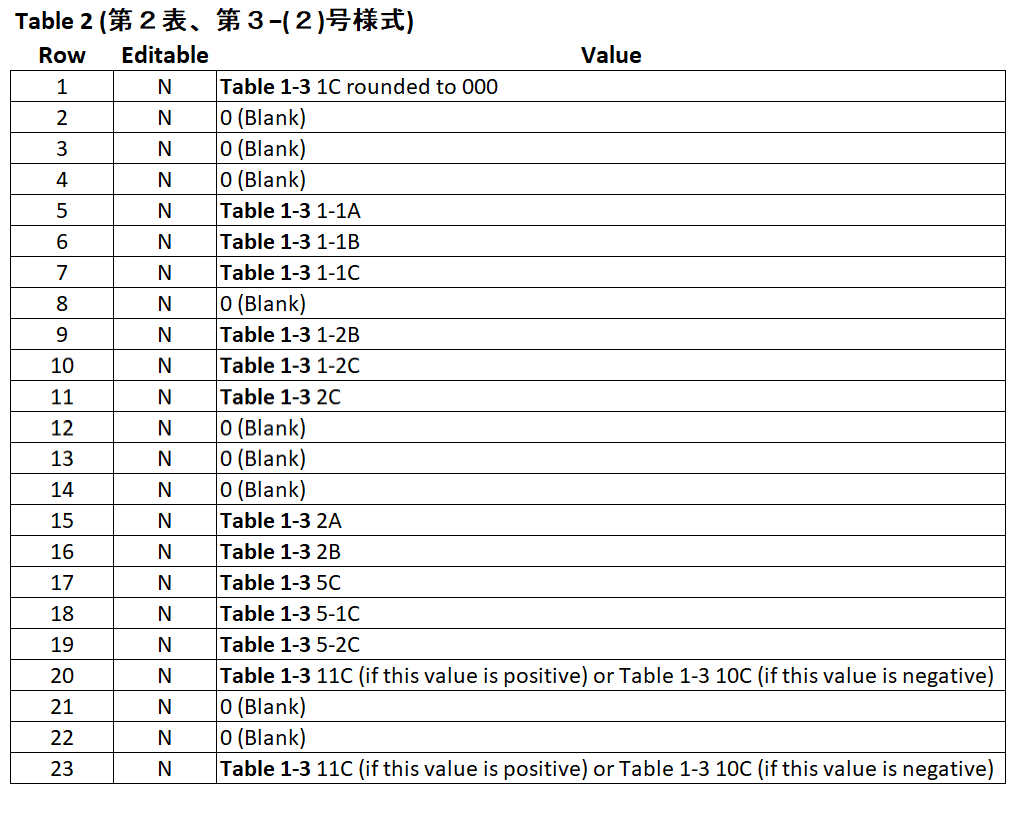

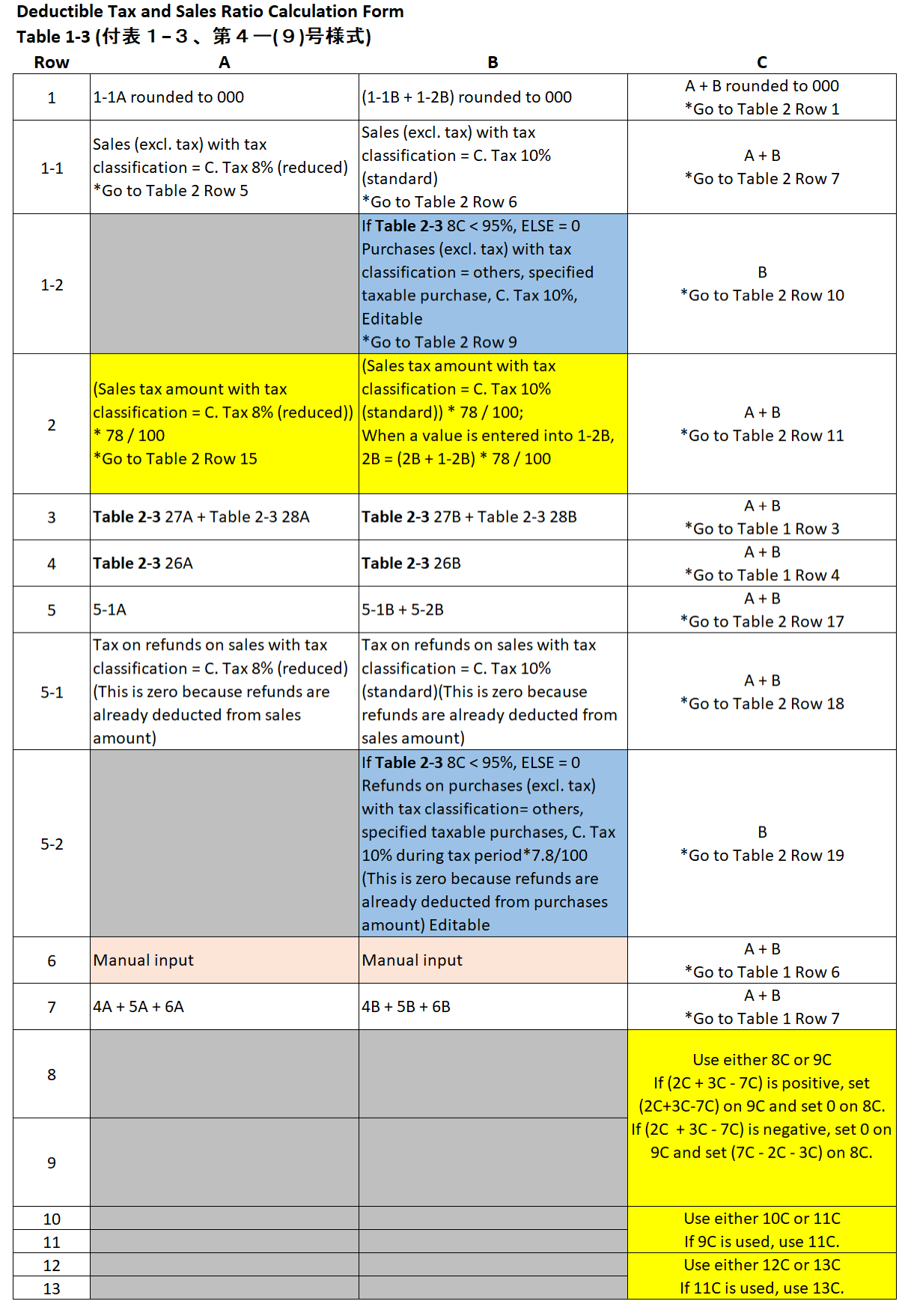

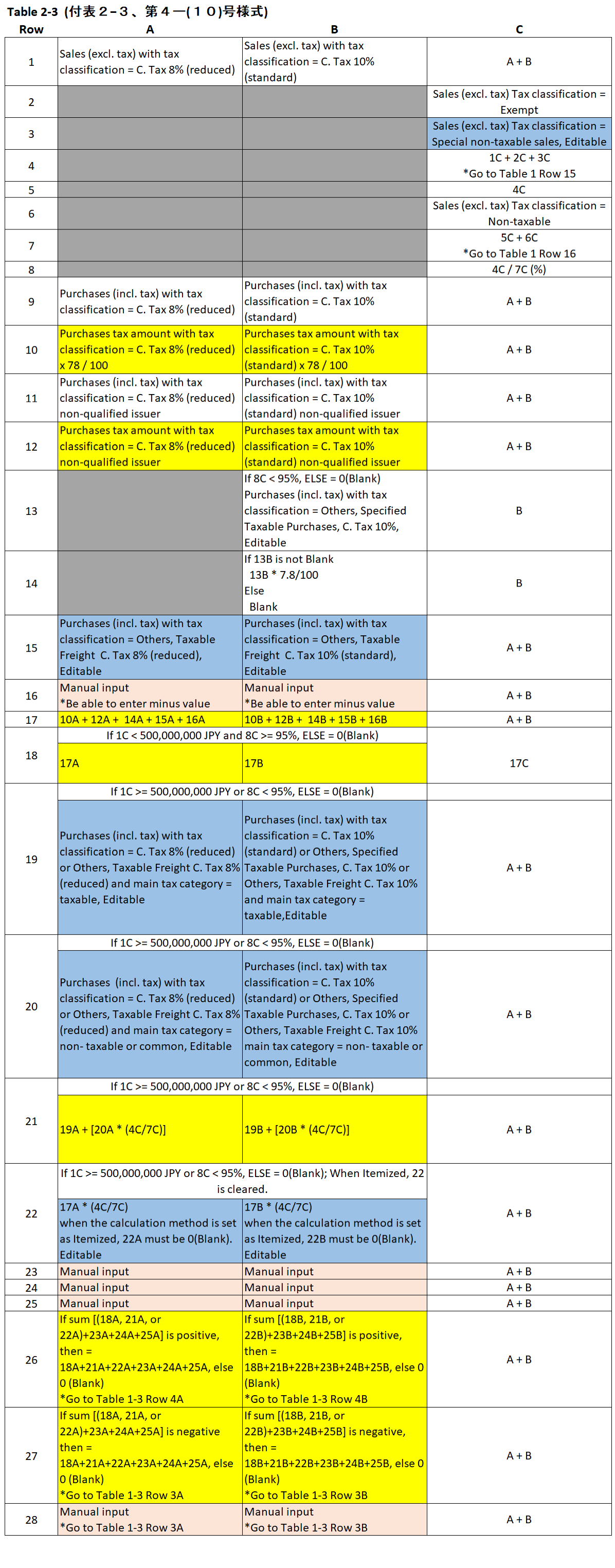

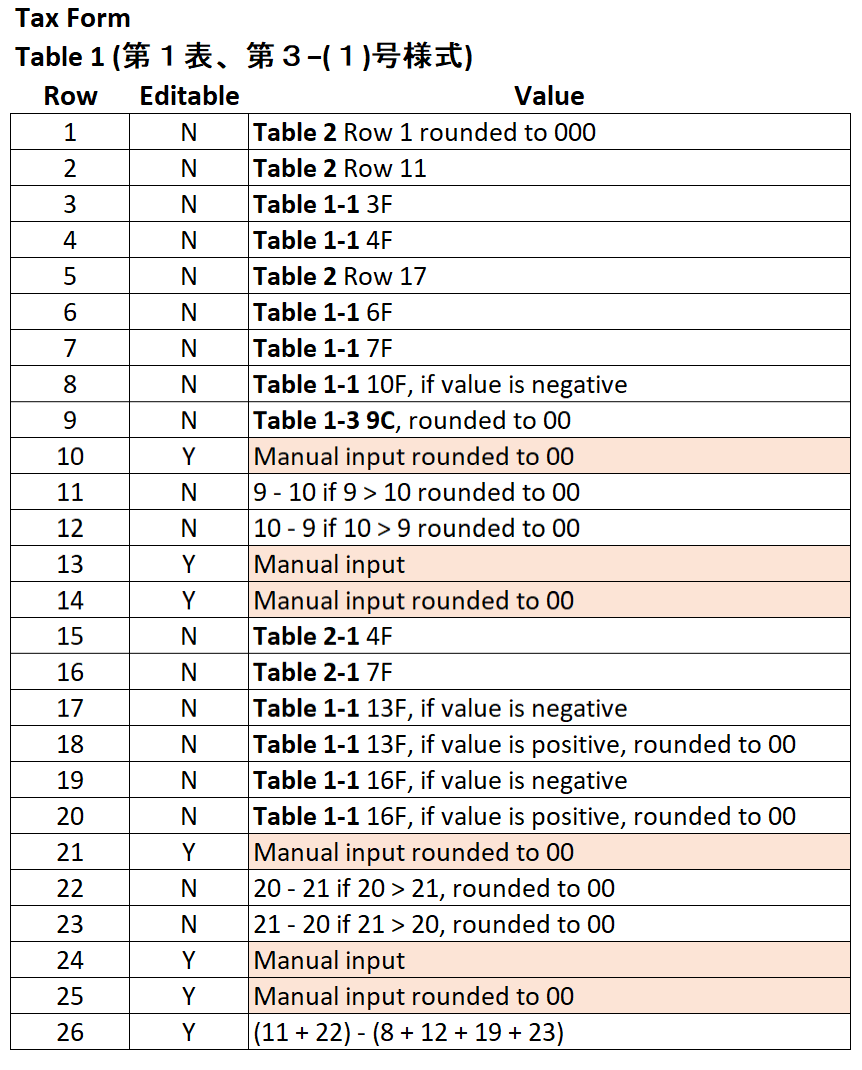

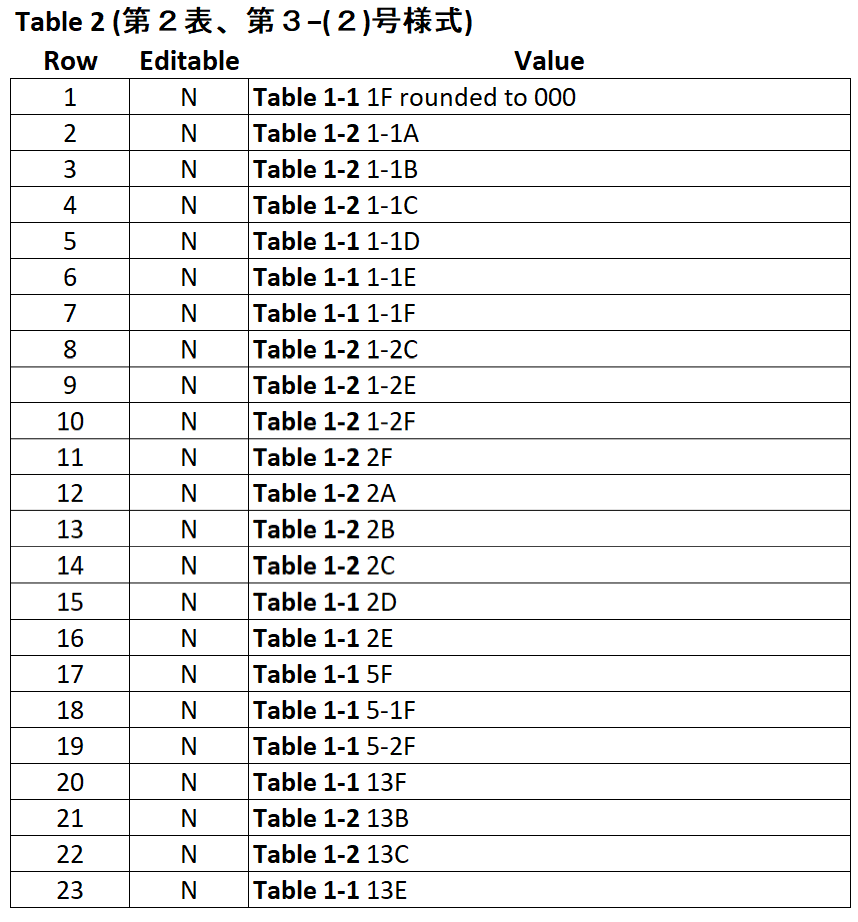

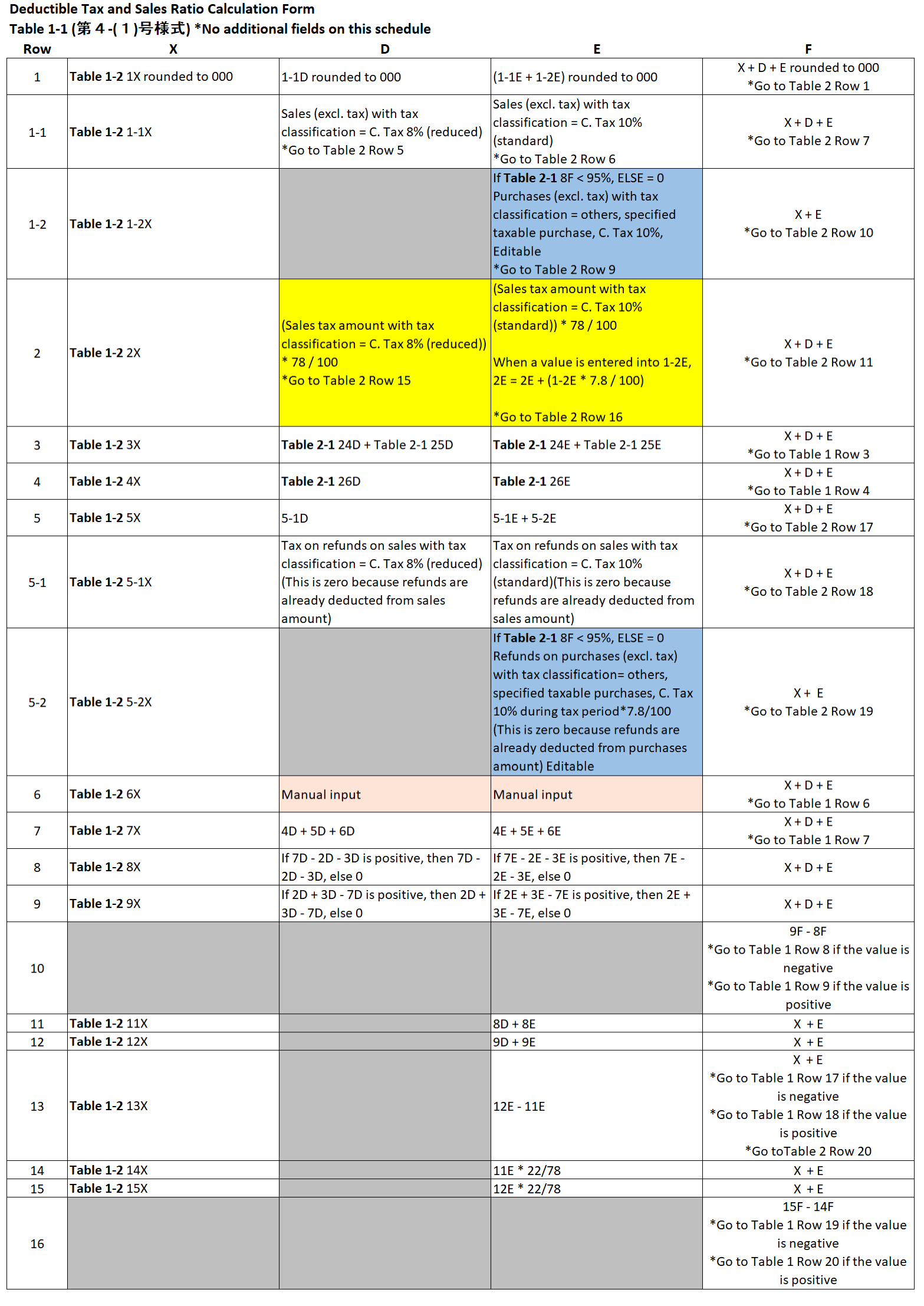

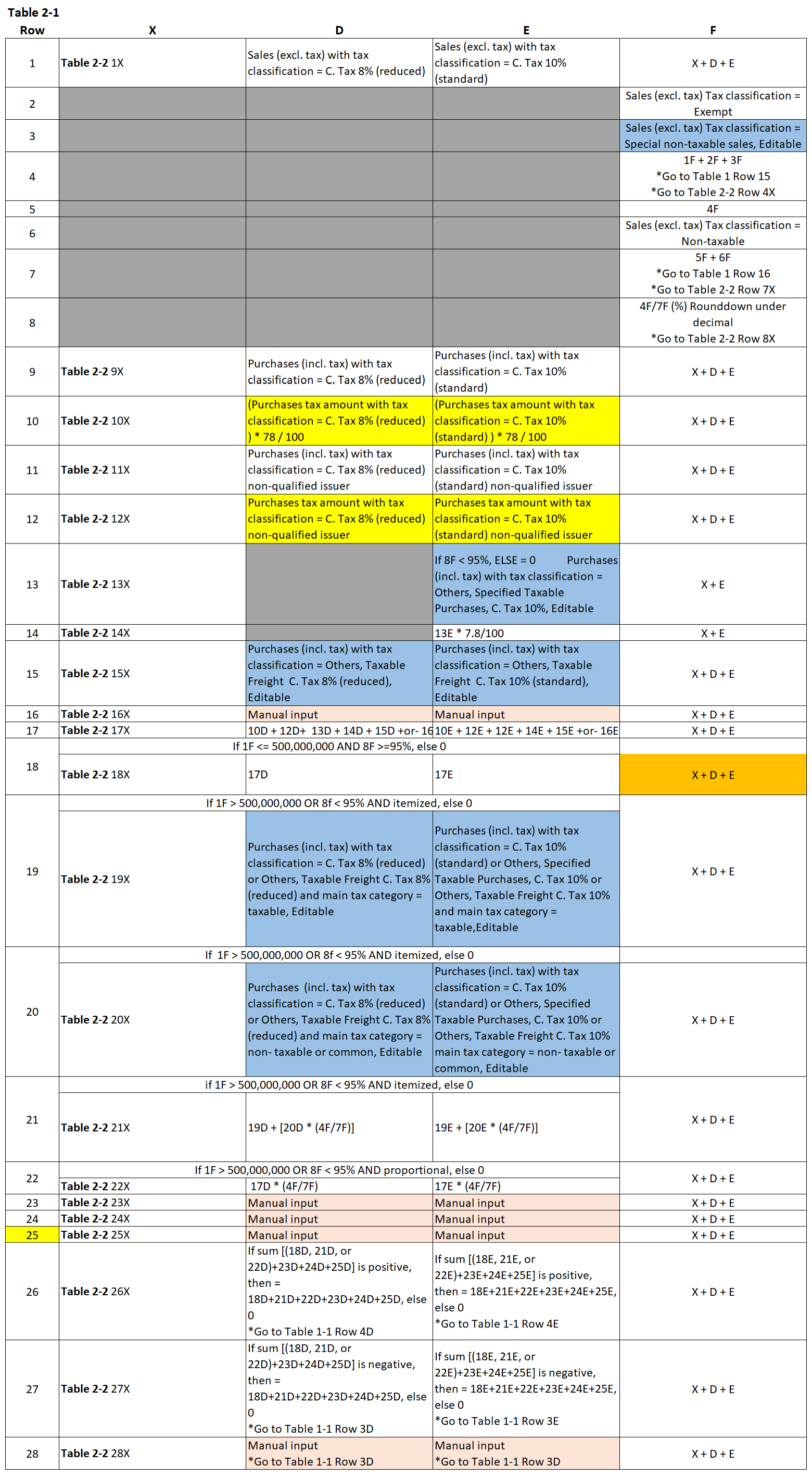

To understand the values that go into each box of the Japan Consumption Tax Form, refer to the tables.

The main tax form consists of:

-

2 subtabs for main tables

-

4 subtabs for appendices on deductible purchase tax and taxable sales ratio calculation for old tax rate

-

2 subtabs for appendices on deductible purchase tax and taxable sales ratio calculation for current tax rate

These appendices integrate the automatic calculation of deductible purchase tax and taxable sales ratio.

If you selected the option, Print Current Standard Rate and Reduced Rate Only, these tables are displayed.

If you selected the option, Print Including Previous Rate, these tables are displayed.

Related Topics

- Japan Consumption Tax Form

- Japan Consumption Tax Overview

- Setting Up Consumption Tax - Japan

- Setting Tax Rounding Methods - Japan

- Selecting Precision Settings - Japan

- Deductible Purchase Tax for Japan

- Japan Consumption Tax Reports

- Tax Accounting Overview

- Enabling and Setting Up Taxation Features

- Advanced Taxes

- Creating Tax Codes - Other Nexuses