Non-reimbursable Expenses

When entering an expense report, you can mark a line item as Non-reimbursable. This function may be useful when an employee is required to enter an expense receipt but shouldn't be reimbursed for the amount. This may be necessary if employee expenses are paid using a third party or shouldn't be reimbursed by the company.

For example, an employee may be required to enter an expense report with a receipt for a meal to bill the amount to a client. Because the employee used a company credit card to pay for the meal, the expensed amount shouldn't be reimbursed to the employee. Expenses that are paid with a corporate credit card are marked as non-reimbursable if the credit card bill is paid by the company.

If you didn't use non-reimbursable expenses prior to NetSuite 18.2, they're no longer available. If you used non-reimbursable expenses prior to NetSuite 18.2, you can choose disable the availability when entering expense reports. For more information about tracking non-reimbursable expenses paid by a corporate credit card, see Corporate Card Expenses.

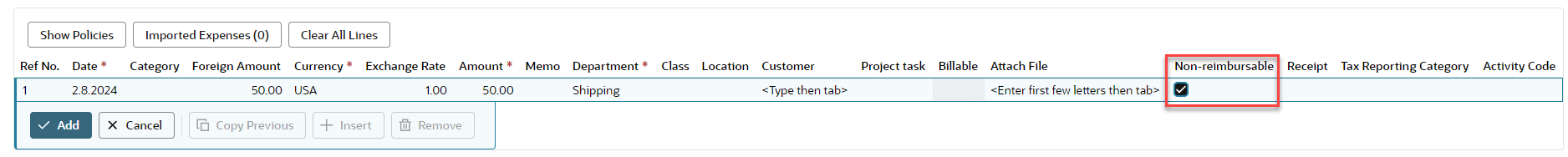

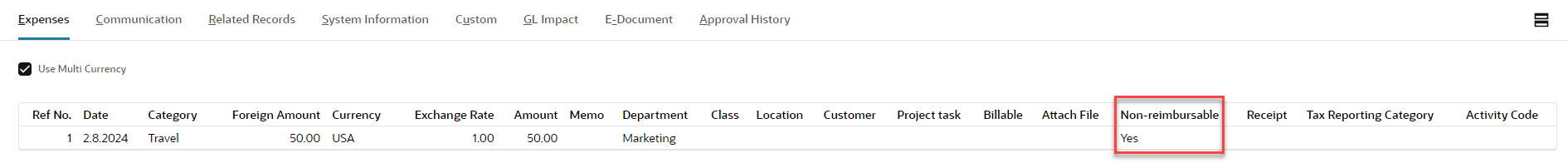

To mark an expense as non-reimbursable, on the Expenses subtab of the expense report, check the box in the Non-reimbursable column.

The employee can enter one line on the expense report for the meal and mark it as both Billable and Non-reimbursable. For any line marked Non-reimbursable, the employee won't be reimbursed for the amount on that line.

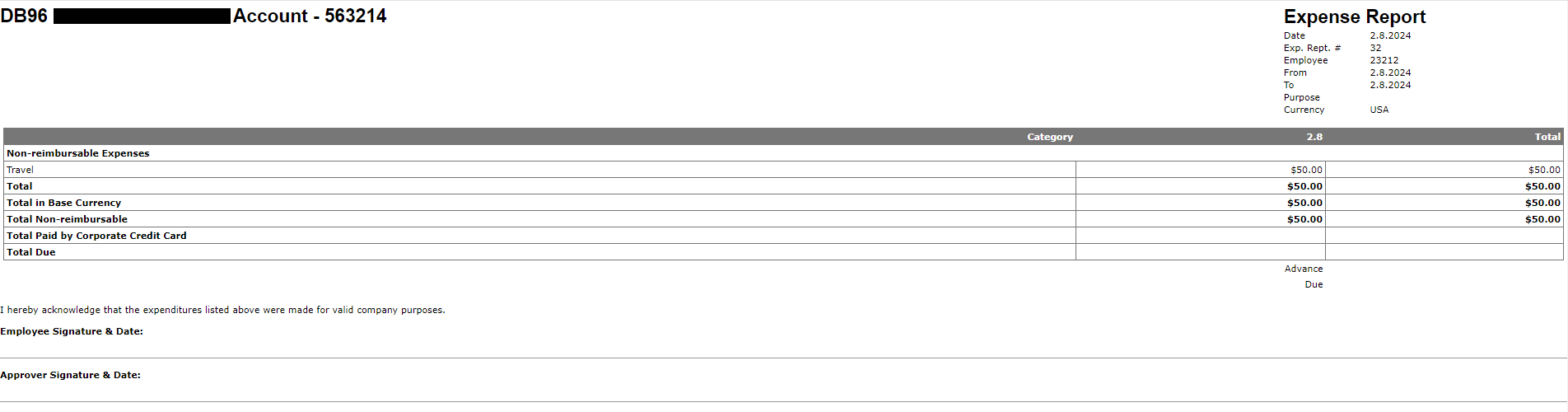

Expenses marked as non-reimbursable appear on expense reports and expense report receipts. However, they aren't payable to the employee and aren't included in the amount due on expense reports.

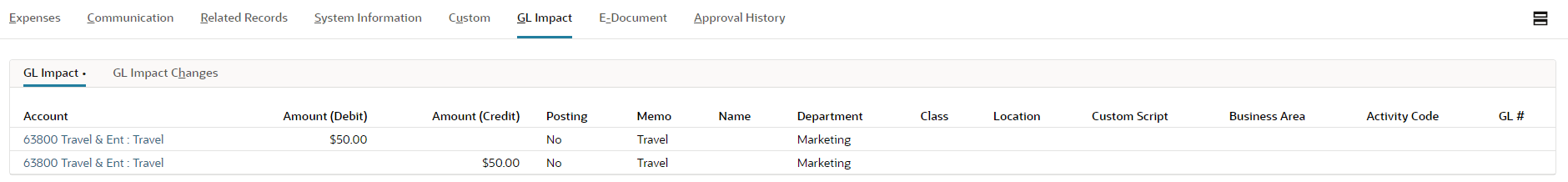

A non-reimbursable expense has no general ledger impact. An expense marked as non-reimbursable has both a debit and credit entry for the associated account canceling out any impact to your ledger accounts.

When the expense report is printed, amounts are categorized as Reimbursable or Non-reimbursable and subtotaled for each.

The Non-reimbursable box can be hidden by customizing the form. The box is set to appear on the form, by default.