Asset Transfer to Another Book Across Ledgers

Transfer assets from one book to another and generate intercompany entries between the two books when required. Descriptive and depreciation details are moved to the newly transferred asset automatically for continuity and audit.

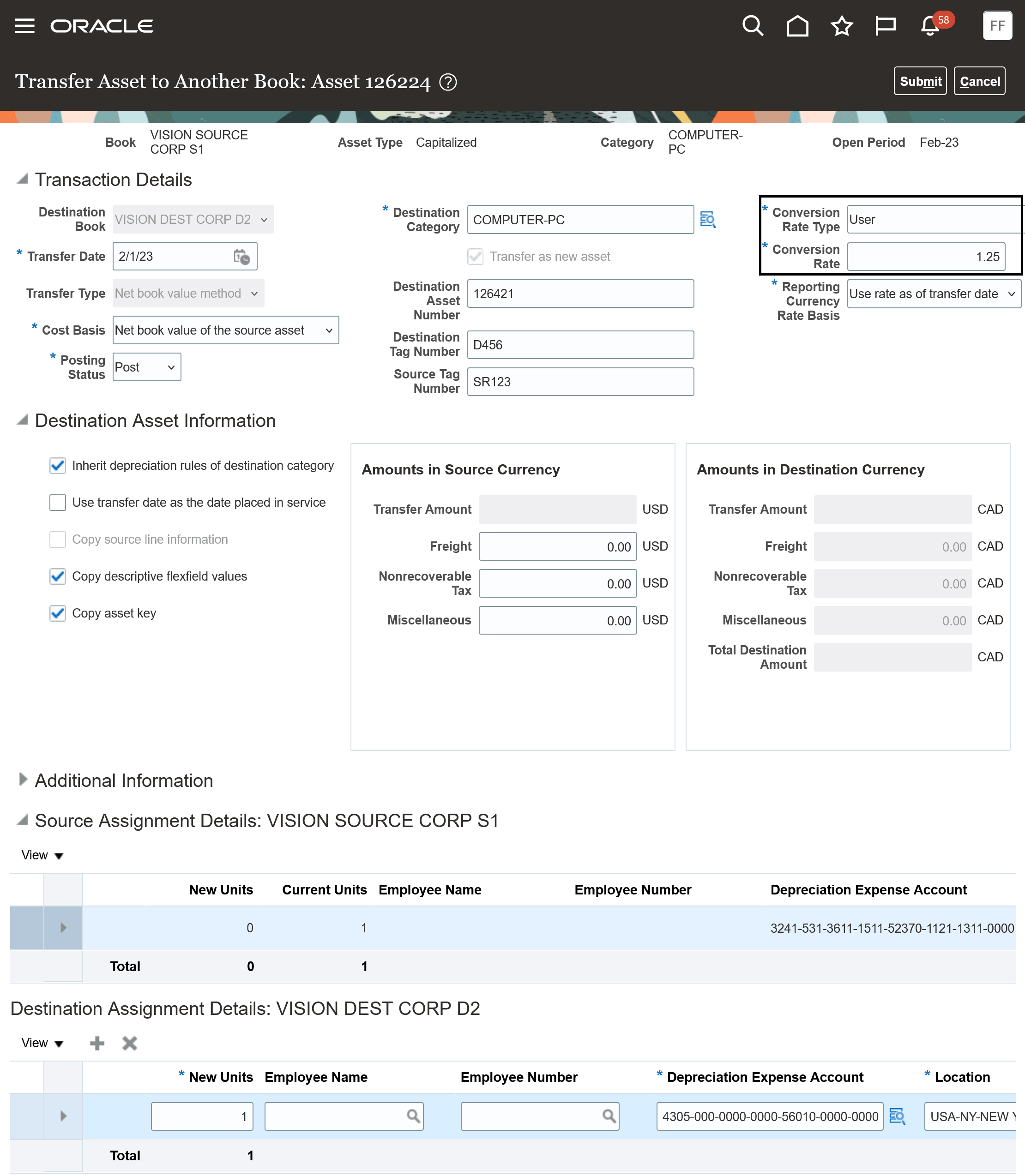

This feature enables you to seamlessly transfer a fixed asset from one entity, location, or employee to another, across different asset books. Both the originating (source) and receiving (destination) books must be part of the same ledger through release 25B. From release 25C onwards the asset books can be part of different ledgers. The valuation, depreciation rules, and other specifics of the destination asset are governed by the transaction rules you specify.

The application generates independently balanced accounting entries in the source book to close out asset balances, and a separate set of balanced entries in the destination book to initiate the opening balances.

This process automates the recording of intercompany entries for transfers involving different balancing segment values, eliminating the need for manual General Ledger entries. By doing so, it reduces the burden of manually reconciling these entries in Oracle Assets.

Only the Net book value method transfer type is allowed for transfers across ledgers, because this asset transfer is treated as a related party sale.

In this case, the transfer is documented as a specific book transfer retirement transaction in the source book and as a unique transfer-in addition in the destination book.

During the transfer, you can use the following cost basis types to determine the cost and accumulated depreciation in the destination book.

- Cost and reserve of the source asset: The destination asset balances are initialized with the cost and reserve amount of the source asset.

- Net book value of the source asset: The destination asset cost is initialized with the net book value of the source asset. The depreciation reserve is initialized to zero.

- Transfer amount: The destination asset cost is initialized with a user-entered transfer amount. The depreciation reserve is initialized to zero.

To transfer multiple assets to another book, use the Fixed Asset Mass Transfer Import file-based data import template or Transfer Asset to Another Book integrated spreadsheet.

Currency Conversion

When transferring an asset between primary books with different currencies, you must provide a currency conversion rate to convert the amount from the source book’s currency to the destination book’s currency.

- Conversion Rate Type: Select a rate type defined in General Ledger.

- Conversion Rate: Enter a rate if the rate type is User.

When the destination book’s ledger uses the same reporting currency as the source book ledger, the Reporting Currency Rate Basis can be one of the following:-

- Use historical rate – Source book reporting currency amount is copied to destination book.

- Use rate as of transfer date – Conversion rate on the transfer date is used to convert the source book reporting currency amount to the destination book.

When the destination book’s ledger has a different reporting currency than the source book ledger, the Reporting Currency Rate Basis must be ‘Use rate as of transfer date’.

Enter the following details to calculate the cost.

- Conversion Rate Type: Select the rate type defined in General Ledger.

- Conversion Rate: Enter this rate if the rate type is User.

- Reporting Currency Rate Basis: Enter this rate to specify how the reporting currency amount is calculated for the destination book.

Subledger Rules and Accounting

Configurable Oracle Subledger Accounting (SLA) rules and mapping sets allow you to customize your intercompany journal line rules for the transfer between books transactions. A new predefined journal entry rule set is available for the Book Transfer event class, which has Intercompany Receivables and Intercompany Payables journal lines. The natural accounts for these can be setup as AR Intercompany account and AP Intercompany account in the source and destination book setup. You need to use either the CSV Export and Import or Book Setup REST API to enter both of these accounts.

Accounting Example

In this example, the asset Asset was transferred with a cost basis of Net book value of the source asset. The original cost of the asset was $22,000.00, with depreciation reserve of $ 5866.67 and the net book value of $ 16,133.33. This asset was transferred from company 3241 to company 4305

Source Book Accounting

| Date | Event | Account | Class |

Accounted Debit (USD) |

Accounted Credit (USD) |

|---|---|---|---|---|---|

| 5/31/23 | Book Transfer |

3241-000-41210-0000-0000 |

NBV Retired | 16,133.33 | |

| 5/31/23 | Book Transfer | 3241-000-41210-0000-0000 | Cost | 22,000.00 | |

| 5/31/23 | Book Transfer | 3241-000-40116-0000-4305 | Receivable | 16,133.33 | |

| 5/31/23 | Book Transfer | 3241-000-17490-0000-0000 | Accumulated Depreciation | 5,866.67 | |

| 5/31/23 | Book Transfer | 3241-000-56025-0000-0000 | Proceeds of sale | 16,133.33 | |

| Total | 38,133.33 | 38,133.33 |

Destination Book Accounting

The asset in the destination book was created with a cost of $16133.33 cost and zero reserve using Net book value of the source asset as the cost basis. The intercompany segment was populated to 3241 to indicate the source entity.

| Date | Event | Account | Class |

Accounted Debit (USD) |

Accounted |

|---|---|---|---|---|---|

| 5/31/23 | Book Transfer | 4305-000-17400-0000-0000 | Cost | 16,133.33 | |

| 5/31/23 | Book Transfer | 4305-000-40116-0000-3241 | Accounts Payable | 16,133.33 | |

| Total | Total | 16,133.33 | 16,133.33 |

The business benefit includes:

- Streamlines asset management by seamlessly transferring assets between books, either within the same ledger or across different ledgers.

- Generates Intercompany entries automatically.

- Ensures continuity and accuracy by transferring descriptive and depreciation details to the newly transferred asset, eliminating the need for manual retirement and addition transactions in separate books.

- Enhances efficiency, reduces errors, and supports smoother audit trails.

Steps to Enable and Configure

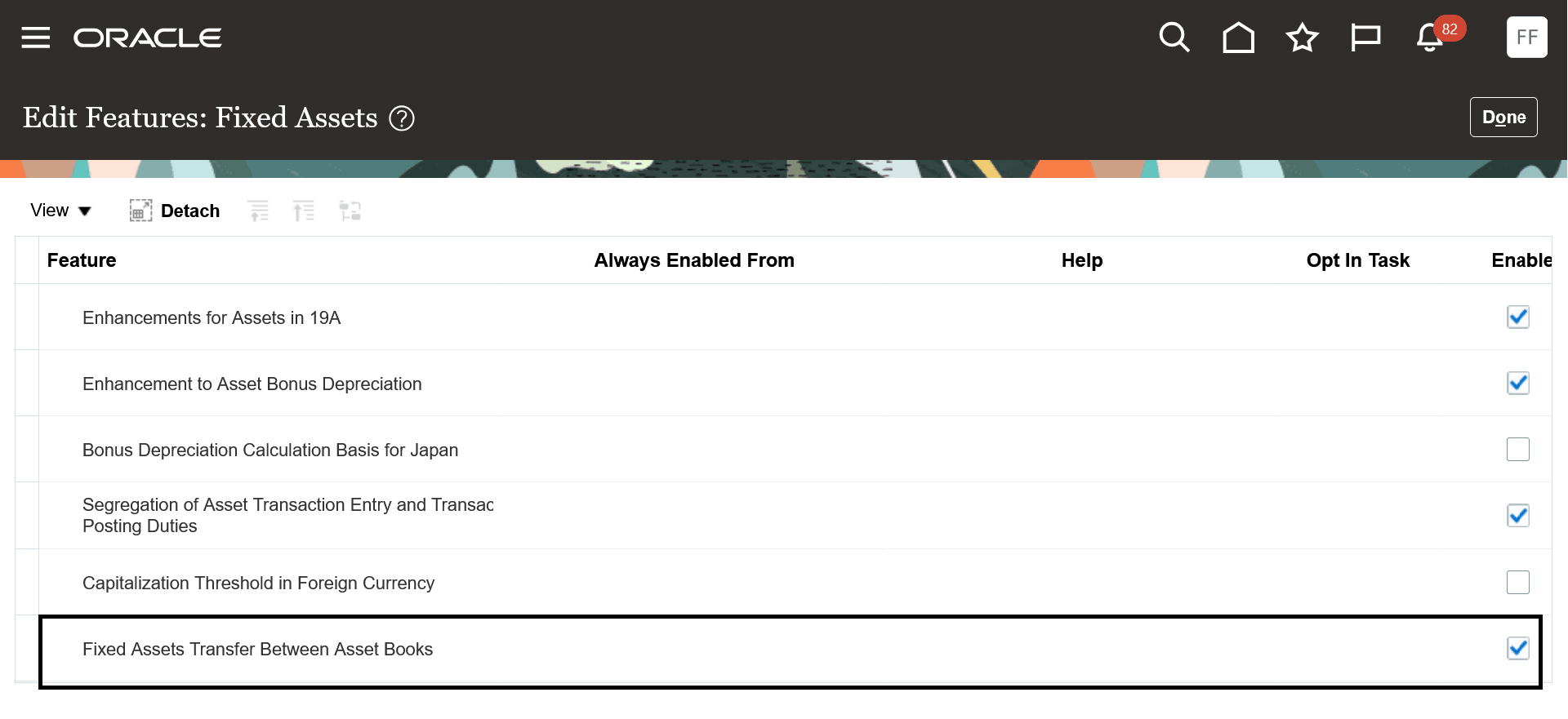

Use the Opt In UI to enable this feature. For instructions, refer to the Optional Uptake of New Features section of this document.

Offering: Financials No Longer Optional From: Update 26A

Use the opt-in for Fixed Assets Transfer Between Asset Books in Financials to enable this feature. From release 26A the feature will be no longer optional to enable.

Offering: Financials No Longer Optional From: Update 26A

- Use the opt-in for Fixed Assets Transfer Between Asset Books in Financials to enable this feature.

- Setup and Maintenance > Financials > Change Feature Opt In > Fixed Assets> Edit Feature > Fixed Assets Transfer Between Asset Books feature in Financials.

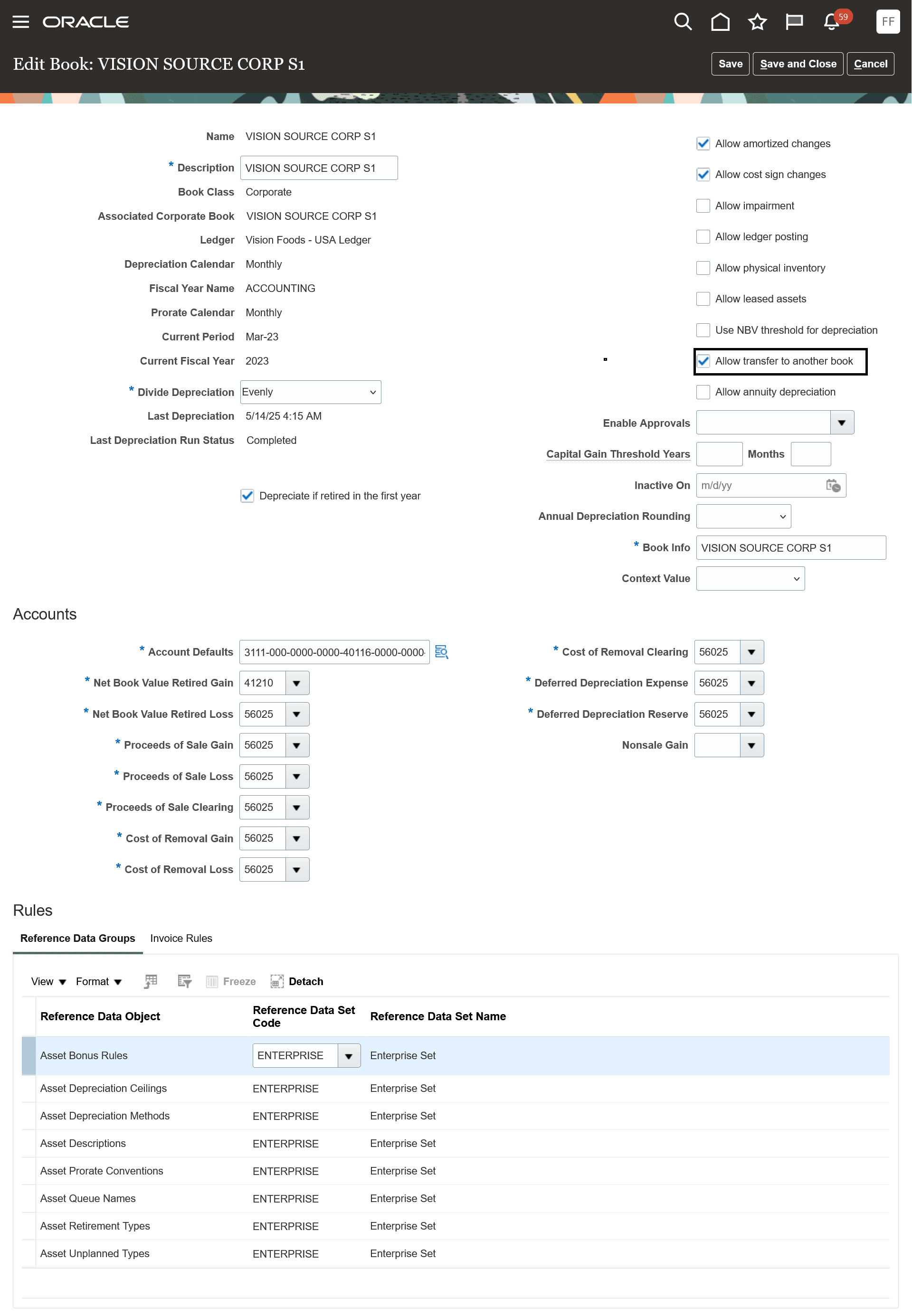

Setup and Maintenance-> Manage Asset Books -> Enable the ' Allow transfer to another book' option

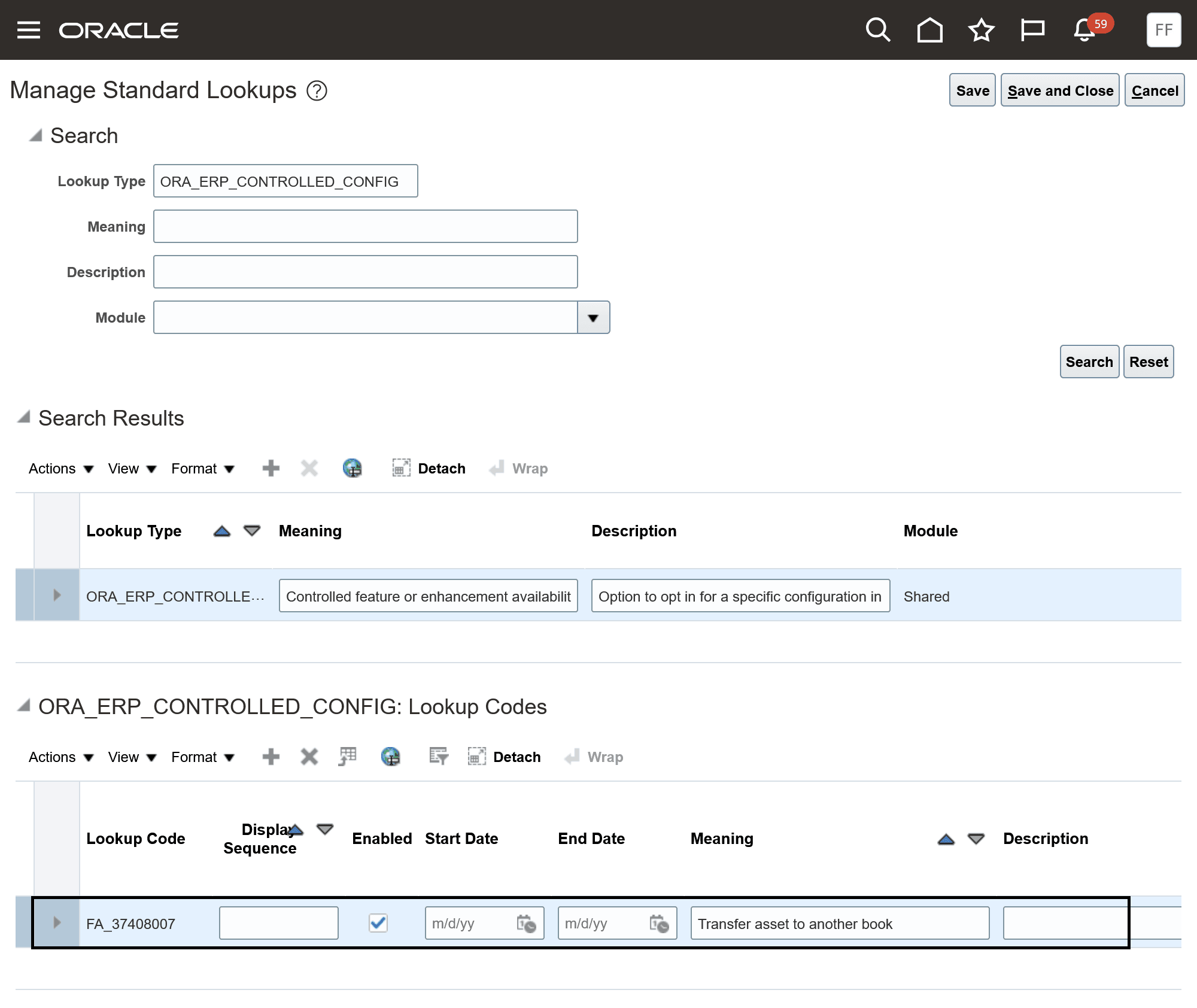

Enable the lookup to transfer asset across ledgers

- In Setup and Maintenance, search and go to the "Manage Standard Lookups" task.

- Search for the lookup type - 'ORA_ERP_CONTROLLED_CONFIG'.

- Enter "FA_37408007" as the lookup code.

Tips And Considerations

- To continue with the source asset’s life and depreciation rules, don’t select the “Inherit depreciation rules of destination category" option.

- In the source book, there is no gain or loss when the asset is transferred at net book value. A gain or loss occurs only if the asset is transferred at an amount different from its net book value.

- The Periodic Mass Copy process doesn't copy the asset transfer between books transaction in the corporate book to the tax book and must be entered individually in each of the tax books.

- If the source corporate book has more tax books than the destination book, you must manually retire the asset in the tax books that don't have a corresponding destination book. Conversely, if the destination book has tax books without a matching source book, you must perform a direct asset addition in those destination tax books.

- If the number of reporting currency books isn’t the same in the source and destination books, use the Net book value method transfer type.

- Use the conversion rate to convert the transfer amount, freight , nonrecoverable tax , and miscellaneous amounts in the source book to the destination book. You can't enter the destination transfer amount, freight , non recoverable tax , and miscellaneous amounts in the destination book directly. The Destination Transfer Amount, Destination Freight Amount, Destination Nonrecoverable Tax Amount, and Destination Miscellaneous Amount columns(Columns AE to AH) in Book Transfer worksheet of the Fixed Asset Mass Transfers file-based data import template are for future use.

- Only full transfer of assets is allowed and partial transfers aren't allowed.

- You can’t transfer a group asset to another book. You can transfer member assets only after they are removed from the group asset and become standalone assets. You can then transfer the standalone asset in the source book to the destination book.

Key Resources

- This feature originated from the Idea Labs on Oracle Cloud Customer Connect: Idea 540334

- Transfer Asset to Another Book (Doc ID KB179258 )

Access Requirements

The predefined Asset Accountant and Asset Accounting Manager job roles have access to this feature. A new functional privilege called ‘Transfer Fixed Asset to Another Asset Book’ and data security policy ‘Transfer Fixed Asset to Another Book’ were added.