Touchless Mobile Expenses

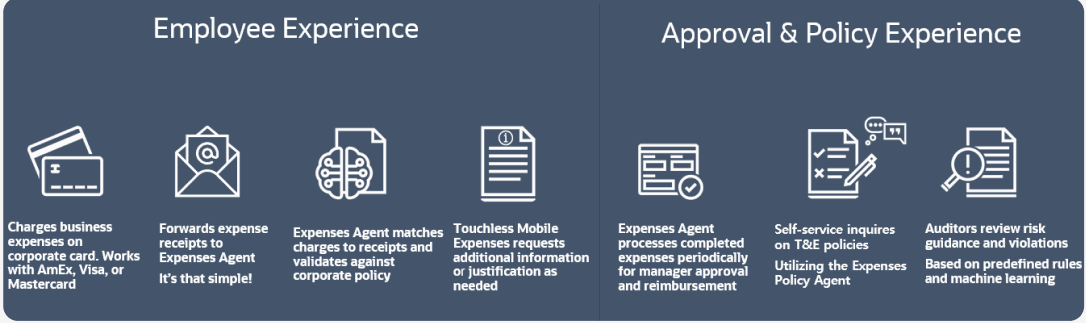

Touchless Mobile Expenses with the Redwood responsive experience is a new approach for expense management to reduce manual expense entry, ensure compliance, and accelerate reimbursement. Employees simply forward receipts, and Oracle Expenses Agent automatically matches them to corporate card charges to submit and process expenses with minimal manual effort.

Touchless Mobile Expenses

Traditional expense reporting and processing are often manual, requiring employees to log into a mobile app or desktop to provide details or upload receipts, making expense reporting time-consuming and tedious.

With Touchless, employees simply charge reimbursable business expenses to their corporate cards, forward the receipts (in any format or language) to Oracle. Oracle Expenses Agent automatically matches the forwarded receipts to the corresponding corporate card charges and prepares the expenses for automatic submission. This eliminates the manual effort of attaching receipts to expenses. Employees are only prompted for additional information when necessary per company policy or in case of a policy violation.

The expenses are validated against corporate expense policies, and the employee is asked for additional information or a justification if needed. At any time, employees can inquire about policies and procedures, improving compliance and reducing the need for manual policy-based audits. Completed expenses are automatically submitted for approvals. There's no need for employees to manually create and submit expense reports. As approvers receive expenses sooner for review, expense reimbursements are done with minimal or no manual intervention.

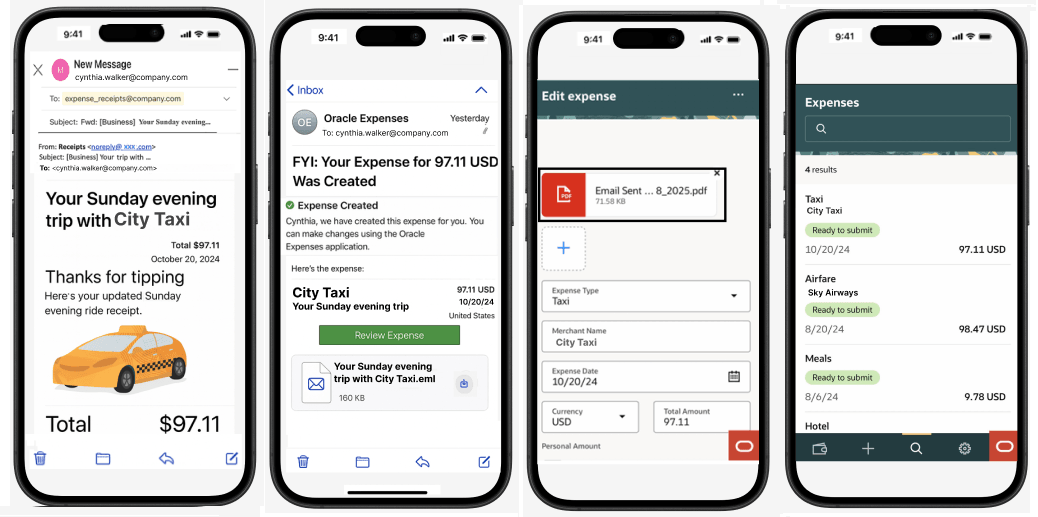

Expense Based on Forwarded Email Receipt

Touchless Mobile Expenses can be used with any corporate cards globally including AmEx, Visa, and Mastercard. If your company does not issue corporate cards, Touchless Mobile Expenses will still work for your organization. Employees can forward receipts for cash purchases or charges incurred on their personal credit cards. Touchless Mobile Expenses handles theses transactions as cash reimbursement.

NOTE: Touchless now works with any corporate card vendor which previously was available only for J.P. Morgan corporate cards.

Touchless Mobile Expenses uses the Document IO (Doc IO) agent for receipt processing. Doc IO's use of generative AI provides increased accuracy and intelligent matching with enhanced recognition of receipts for credit card charges. The agent helps organizations improve efficiency by automatically capturing and generating documents across a wide range of transactions regardless of electronic channels, document standards, formats, or languages. For example, the agent can ingest images, formatted documents such as PDFs, or electronic documents in different languages.

Business Benefits:

The Oracle Expenses Agent automates most of the tasks, engaging the employee, their manager, and the auditor only when necessary. The main benefits include:

Reduced Manual Work:

Employees no longer need to manually create expenses, select expense types, provide repetitive information from lengthy lists, or attach receipts.

Streamlined Process:

Employees simply need to forward the receipts to the Oracle Expenses Agent, such as a taxi receipt email or a photo of a paper receipt for a cash expense. The agent intelligently matches forwarded receipts to existing corporate card charges based on either the initial authorization or the charge settlement file. If no matching corporate card expenses exist, receipt becomes the basis of new expenses.

Employees receive near real-time mobile notifications whenever expenses are created based on corporate card transactions . The agent then validates each expense against corporate policies to determine whether it is complete and ready for approval or requires additional information. If further input is needed, employees are prompted to provide the specific missing information from the application. For example, the employee may be required to provide meal attendee details or a justification for high spending. Once expenses are approved and audited, employees receive reimbursement directly to the corporate card provider or to the employee’s bank account.

Faster Reimbursements:

Employees benefit from automated processes that reduce effort and accelerate reimbursements. By eliminating manual tasks and automating receipt matching and expense preparation, delays in submissions are avoided. Managers receive expenses promptly, once they are complete and ready. Additionally, organizations can choose to automatically approve routine expenses on behalf of managers, streamlining the reimbursement process.

The overall quality and accuracy of expenses improve through automated creation and submission.

Consistent Policy Enforcement:

Expense managers also establish expense policy and audit rules that get applied throughout the expense process. Touchless Expenses ensures that corporate expense policies are followed throughout the expense process.

The auditor experience is significantly enhanced by reducing the time spent clearing piled-up expenses and performing spot checks based on predefined rules or random selection. Such tasks previously led to delayed reimbursements, employee frustration, and potential policy violations being overlooked. Auditors now mainly review high-risk expenses and take appropriate actions.

In upcoming releases, employees will be able to provide any additional required information using messaging, without logging in to the application. Additionally, stay tuned for multiple enhancements to agent-based auditing.

Here's the demo of these capabilities:

Steps to Enable and Configure

Use the Opt In UI to enable this feature. For instructions, refer to the Optional Uptake of New Features section of this document.

Offering: Financials

- Request Enablement:

-

To express your interest as an early adopter, follow the instructions in the ERP Resource Center announcement post.

-

Use the Opt In UI to enable this feature. For instructions, refer to the Optional Uptake of New Features section of this document.

-

- Prerequisites:

- If your enterprise is new to Oracle Expenses and has not completed the implementation process, please review the Implementing Expenses section of Getting Started with Your Financials Implementation before enabling Touchless Expenses.

- Enable Business Units:

Touchless Mobile Expenses is currently in controlled availability and requires promotion codes.

Once you receive and enter the promotion code to opt in to the feature, follow these steps to enable Touchless Expenses for individual business units:

-

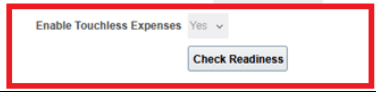

- In the Setup and Maintenance work area, on the Corporate Options for Expense Report tab of the Manage Expense System Options for Expenses, select the business unit for which Touchless Expenses needs to be enabled.

- Check the readiness for enabling Touchless Expenses:

- If the status reads "This business unit is ready to enable Touchless Expenses", set Enable Touchless Expenses to Yes.

- If the status reads "This business unit is not ready to enable Touchless Expenses. Download the report for details", download the readiness report for details. Follow the instructions in the report to update the configurations and setups required to make the business unit eligible for Touchless Expenses.

Touchless Readiness

Touchless Mobile Expenses can be enabled at the individual business unit level, allowing for a phased or incremental rollout based on your organization’s needs. When you select a business unit for enablement, the application provides a readiness assessment, highlighting any required actions or configurations that need to be adjusted.

NOTE: If Touchless Mobile Expenses is enabled for a business unit, it can't be disabled afterward.

Tips And Considerations

- Configuration Review and Streamlining Business Processes:

Reviewing your configurations, such as the list of your expense types, before moving to Touchless will help you maximize the benefits of touchless expense processing for your organization. For example, reducing the number of granular expense types, such as having separate types for Breakfast, Lunch, or Dinner, and consolidating them into a single type like Meals can significantly improve the touchless matching. Simplified expense types enable the system to more easily and accurately map receipts and corporate card charges to the appropriate category without requiring employee input. This reduces exceptions and manual intervention, resulting in a smoother and faster reimbursement process.

- Receipt Handling:

Key to Touchless Mobile Expenses is forwarding receipts to the Oracle Expenses Agent for processing, eliminating the need to separately log into an application to manually attach receipts. The agent associates the receipts with corporate credit card charges.

- Report Level Changes:

With Touchless, expense reports are created automatically, shifting the focus from managing expense reports to simply managing expenses. To maintain a fully touchless experience, it is encouraged that employees enable automatic submission and don't separately create expense reports. As a result, business processes that depend on providing the below options at the expense report level should be reconsidered as these options are not applicable:

-

- Attaching expense receipts at the expense report level

-

Associating spend authorizations at the expense report level

- Delegate Support:

If employees in your organization use the delegate feature to manage expenses, then both the delegate and delegator must be Touchless users.

- "Overdue" Email Notifications:

Touchless Expenses users will receive "Overdue" email notifications to help ensure timely submission of their corporate card expenses and avoid late payment fees. These notifications are triggered when expenses have not been submitted within 21 days or within the company-configured time period (as defined by 'Enable Corporate Card Transaction Age Limit' setting, located under Manage Expenses System Options and within Corporate Options for Expense Report). Notifications are sent out weekly and continue until all overdue expenses are submitted.

Weekly notification timing is based on auto-submission settings:

-

- If the employee’s auto-submission is enabled, then they will receive an email two business days prior to auto-submission.

-

If the employee’s auto-submission is not enabled, but BU level auto-submit is enabled, then the notification will be sent two business days prior to the BU level auto-submission day.

-

If above scenarios are not present, then the notification is sent out on Tuesday.

- Other Considerations:

-

Some options are not yet available in Touchless: split allocations, manual application of cash advances, and advanced mileage options including eligibility rules and add-on rates. You may proceed with enabling Touchless Expenses after disabling these options. However, it is recommended that you first ensure any existing expense reports using these options are brought to a reimbursed or paid status before proceeding. This helps ensure a smooth transition and avoids processing issues.

-

Additionally, employees will be able to update some expense information only using the desktop, including projects and tasks, full segment values of expense accounts, detailed attendee information, expense itemizations, per diem, advanced expense policy configurations, and associating spend authorization to an expense.

These capabilities will be introduced in Touchless on mobile in upcoming releases. Stay tuned for upcoming releases for holistic Oracle Expenses Agent that enables a touchless employee experience and ensures compliance with corporate expense policies by orchestrating the expense management lifecycle.

-

-

Oracle Partnered Corporate Cards:

Customers using Oracle-partnered corporate cards continue to receive added advantages, including real-time expense creation and authorization. When users incur charges on their corporate card, corresponding expenses are instantaneously created even before the final settled charge arrives. For non-partnered corporate cards, the expenses are typically created when the settlement files are received periodically from card service providers.

NOTE: To enroll in the partnered J.P. Morgan corporate card program and to establish connectivity between J.P. Morgan and Oracle Fusion Expenses, follow the section - Steps to Enable in the What's new for Update 23D: Touchless Expenses with J.P. Morgan Corporate Cards.

Key Resources

- Implementing Expenses section of Getting Started with Your Financials Implementation

- Steps Your Administrator Takes to Receive Transaction Files from a Card Issuer

- Upload VISA, MasterCard, and Diner’s Club Corporate Card Transaction Files

- What's New for 25C : Expense Policy Inquiry Using Expenses Policy Agent for Touchless Expenses with J.P. Morgan Corporate Cards

Access Requirements

You’ll need the Application Implementation Consultant role to enable and configure this feature. In addition, if you are using a J.P. Morgan corporate card, you’ll need the Financial Application Administrator job role to establish connectivity and to review all related predefined and automatically configured Functional Setup Manager tasks.