Cash Basis Accounting Method for Payables and Receivables Subledgers

Use the cash basis accounting method to generate accounting entries only for events where cash is exchanged in Oracle Payables and Receivables subledgers. This ensures that cash payments and receipts are properly accounted for, while non-cash events are processed without impacting ledger balances.

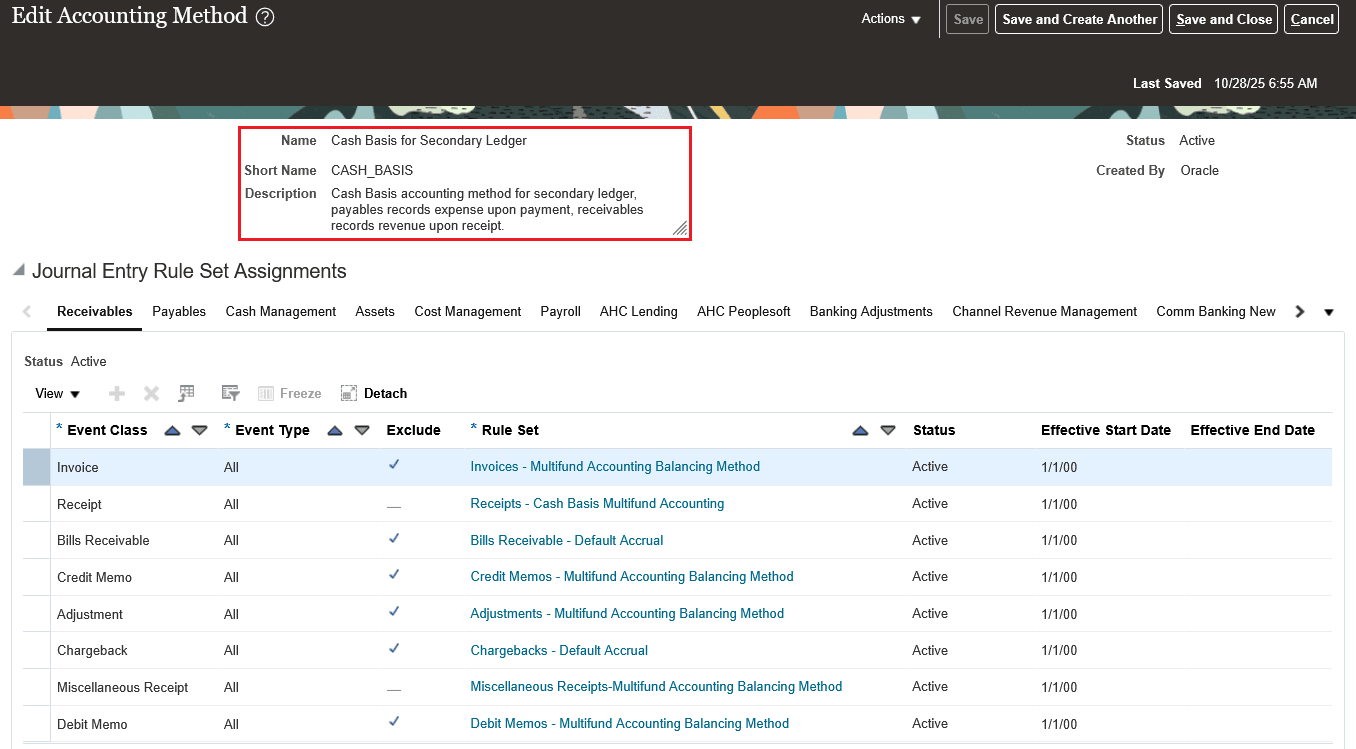

Cash basis accounting representation addresses the demand for real-time insights into liquidity and simplifies the accounting process for public sector organizations where cash transactions are the primary indicator of financial performance. The following accounting method is now available to help public sector and other organizations fulfill their cash basis accounting requirements -

| Accounting Method Name | Accounting Method Description |

|---|---|

| Cash Basis for Secondary Ledger | Cash Basis accounting method for secondary ledger, payables records expense upon payment, receivables records revenue upon receipt. |

This feature provides a standardized approach to recognizing expenses in Payables upon payment and revenue in Receivables upon receipt, focusing on true cash movement rather than accrual timing. Designed specifically for use with secondary ledgers only, the accounting method ensures that reporting needs for public sector and other applicable customers are met efficiently and accurately. For customers who require cash basis accounting in their primary ledger, the recommended practice is to implement the clearing account approach, as detailed in the updated Cash Basis Accounting White Paper, to maintain compliance and auditability.

NOTE: The Cash Basis for Secondary Ledger accounting method leverages the 25D feature - Accounting Event Exclusion for Adjustment-Only Accounting Method Representation to exclude specific transaction events from accounting based on cash basis accounting conventions. So, enabling this feature is a pre-requisite to uptake cash basis in secondary ledgers, refer the release documentation for steps to enable the feature.

Cash Basis for Secondary Ledger Accounting Method

Business benefits

Ensures accuracy and compliance for cash-based reporting, minimizing the risk of errors or discrepancies and reducing administrative burden, especially for small businesses or entities which do not require accrual accounting.

Steps to Enable and Configure

This feature is dependent on the 25D Financials feature Accounting Event Exclusion for Adjustment-Only Accounting Method Representation.

As a pre-requisite, the Accounting Event Exclusion for Adjustment-Only Accounting Method Representation feature must be enabled to use the Cash Basis Accounting Method for Secondary Ledger. Refer the release documentation for steps to enable the feature.

Tips And Considerations

- You must ensure that you associate the Cash Basis for Secondary Ledger accounting method to a secondary ledger only.

- Associating this accounting method to a primary ledger can have serious downstream impacts. For example, it may create incompatibility with certain subledgers, such as Project Management, especially when Payables Invoice or Cost/Receipt accounting events are excluded from accounting.

Key Resources

Review the updated Cash Basis Accounting White Paper for detailed guidance on cash basis accounting implementation specific use cases.

Access Requirements

No new access requirements.