Split Privileged Declaration Lines for Manufactured Goods Exiting Foreign Trade Zone

This feature streamlines the accurate reporting and duty management of privileged foreign goods used in manufacturing within a Foreign Trade Zone (FTZ). For example, when importing component items — some with a privileged foreign status — these component items are subject to duties and taxes at the time of FTZ entry, rather than upon release for free circulation.

Upon entry of all components into the FTZ, a trade incentive program inventory is generated, regardless of their zone status. Specific data is automatically copied from the entry declaration to the inventory record, according to your Data Configuration settings (with an Association Type of Entry Line to Inventory). Using Global Trade Management (GTM), you can estimate potential duties for privileged foreign goods by running the "Estimate Duties & Taxes" action.

After manufacturing the finished good (e.g., a table lamp), you can move it into free circulation and pay applicable duties only on the finished good. Since duties for privileged foreign components have already been paid, this feature enables you to split the declaration lines on the exit declaration for the components which are privileged foreign.

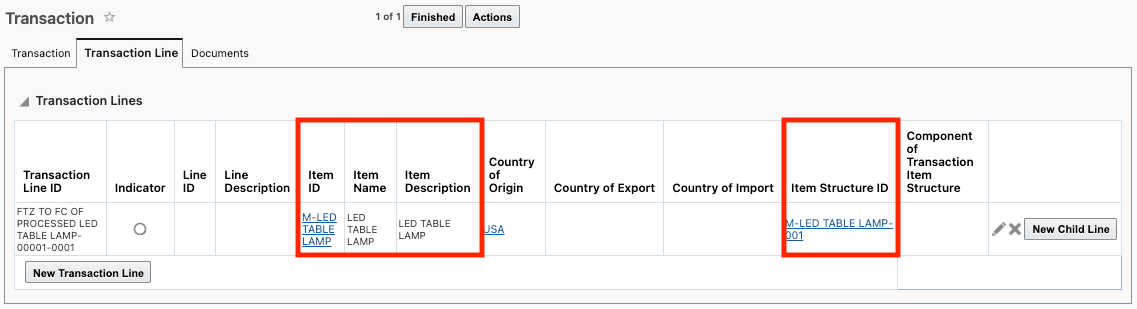

A trade transaction models the finished good, such as a table lamp, with Item ID: M-LED TABLE LAMP and Item Structure ID: M-LED TABLE LAMP-001 — as it is released into free circulation.

Trade Transaction Line - Finished Good

You can then create an exit declaration for the trade transaction. Because each declaration line references its originating trade transaction line via the Reference Lines grid on the declaration line, GTM can utilize the trade item structure from the trade transaction line during reconciliation. When you execute the "Perform Entry/Exit Recording" action to reconcile the exit declaration and lines with inventories, the following occurs:

- GTM identifies privileged foreign component items used in the finished good by referencing the zone statuses defined in the gtm.tip.privilegedZoneStatuses property and matching to inventory records. Separate lines are created for each inventory record in a privileged foreign zone status.

- Prorated duties and related information are copied to the newly split lines.

- The value of the privileged components is deducted from the finished good’s value.

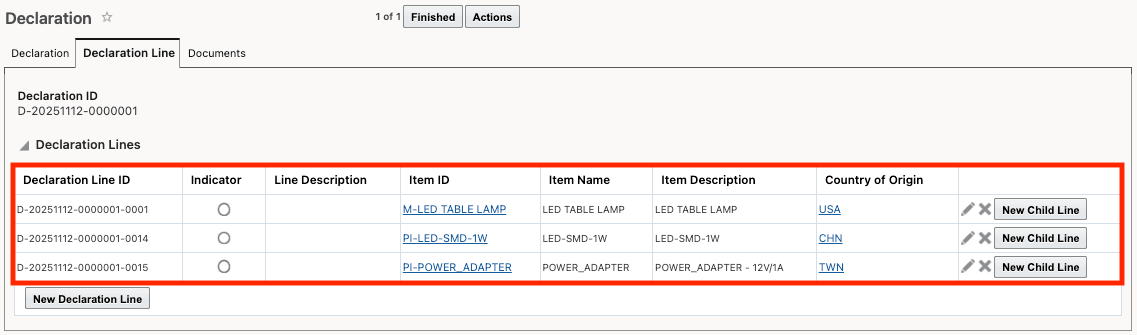

For example, your exit declaration will have three lines:

- A finished good line for Item ID: M-LED TABLE LAMP

- A split line for a privileged foreign component with Item ID: PI-LED-SMD-1W

- A split line for a privileged foreign component with Item ID: PI-POWER_ADAPTER

Declaration Line - Finished Good and Privileged Foreign Lines

After the declaration lines are split, you can perform duty and tax calculations for the finished good.

Business Benefit: This feature enables accurate and compliant duty reporting for privileged foreign goods used in manufacturing within a Foreign Trade Zone (FTZ). By allowing you to split declaration lines on the exit declaration, you can correctly account for components that have already incurred duties (with privileged foreign status) separately from those that have not. This ensures you avoid double-paying duties on components already assessed when they entered the FTZ and accurately pay duties only on the remaining content or value in the finished good.

Steps to Enable and Configure

You don't need to do anything to enable this feature.

Key Resources

For more information on trade incentive programs, refer to the GTM How To/Configuration topic called "Trade Incentive Programs".