Account In-transit Inventory for Inbound Purchase Orders using INCO Terms

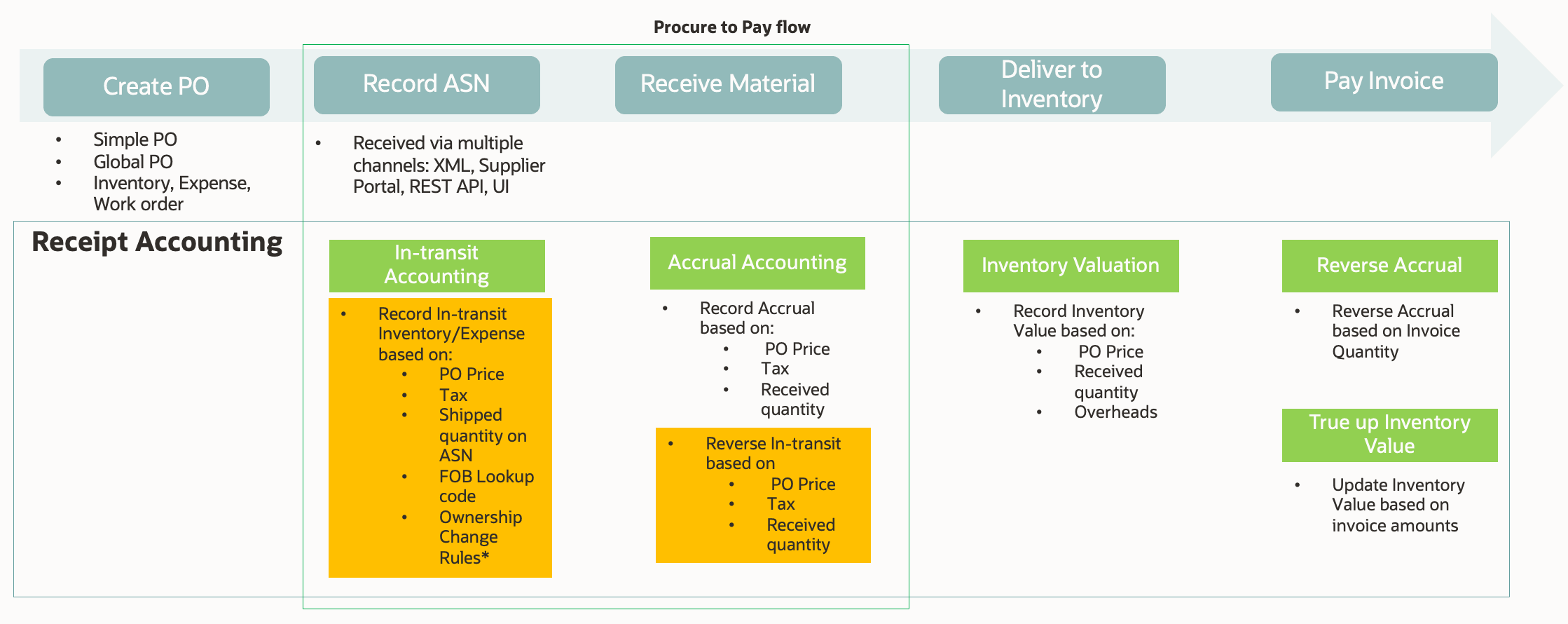

Generate in-transit accounting for the inbound purchase order shipments using an ASN in standard purchasing and global procurement flows. Here's a visual representation of where recording and accounting in-transit value fits in the overall procure to pay receipt accounting flow.

In-transit Inventory Accounting in Procure to Pay Flow

- The new Record In-transit Inventory and Expense for External Purchases schedule process computes the in-transit value and creates new transactions and distributions for recording in-transit inventory or expense for purchase order based shipments

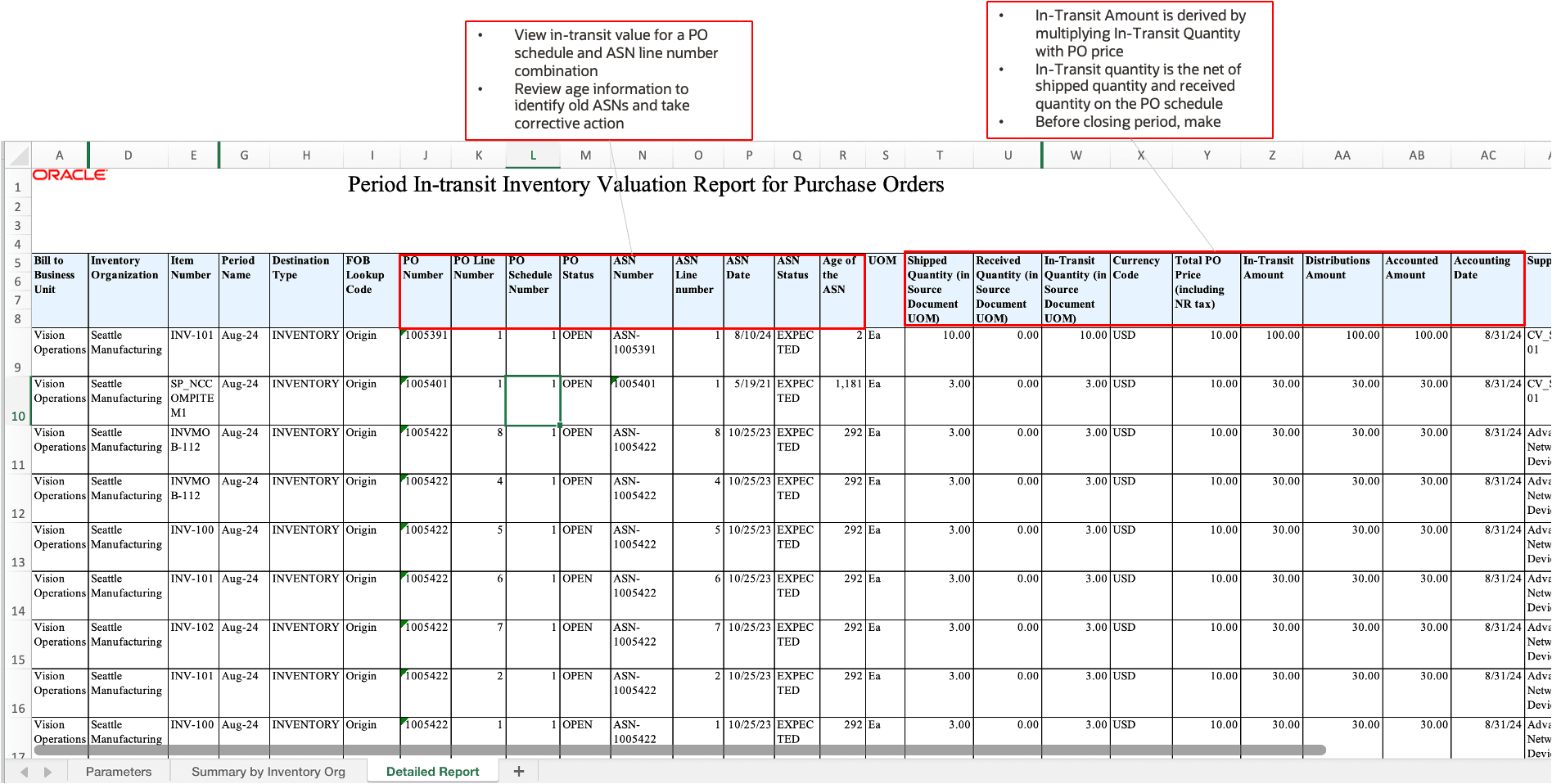

- This process considers the following information to compute in-transit value for each purchase order schedule and shipment line combination:

- ASN Data: All valid ASNs in expected or partially received status for open purchase orders.

- Purchase Order: All open purchase orders for accrue at receipt purchases (except consignment).

- The in-transit amount is computed by multiplying the net shipment quantity with the PO price + nonrecoverable tax.

- Net shipment quantity is equal to shipment quantity on the ASN minus receipt quantity for the purchase order schedule.

- Transactions and accounting distributions are created for each purchase order schedule and ASN shipment line combination.

- The in-transit inventory or expense is reversed by the next run of the process when goods are received.

- Valid ASNs are determined based on the In-transit Valuation Ownership Change Rules set up by you for each FOB lookup code.

Accounting Flow

In-Transit Accounting in Procure to Pay Flow

The following are some of the new functional capabilities introduced as part of this feature:

- The Record In-transit Inventory and Expense for External Purchases process helps in automating a completely manual period end process for estimating in-transit inventory or expense at period end with one click of a button.

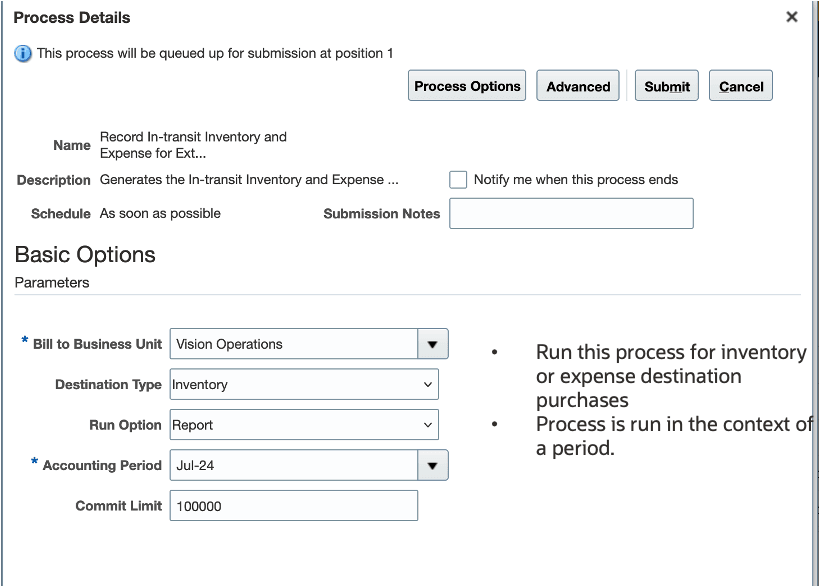

Record In-transit Inventory and Expense for External Purchases

- The process can be run from the Scheduled Processes work area or the Receipt Accounting work area in the Report mode or the Accounting mode:

- Report mode lets you view in-transit value at any point of time based on latest and greatest purchase order and shipment information and not create accounting distributions. This helps you in avoiding additional transactions and distributions in cases where shipments and receipts are likely to be recoded in the same accounting period.

- Accounting mode also creates new set of transactions and distributions every time the process is run.

- New In-transit Valuation Ownership Change Rules can be set up using REST API for each FOB lookup code to determine which event (ASN or Receipt) is considered as an ownership change event for recording in-transit inventory or expense.

- The FOB lookup code set up on the purchase order is automatically defaulted on the ASN shipment line and users can override this before submitting the ASN.

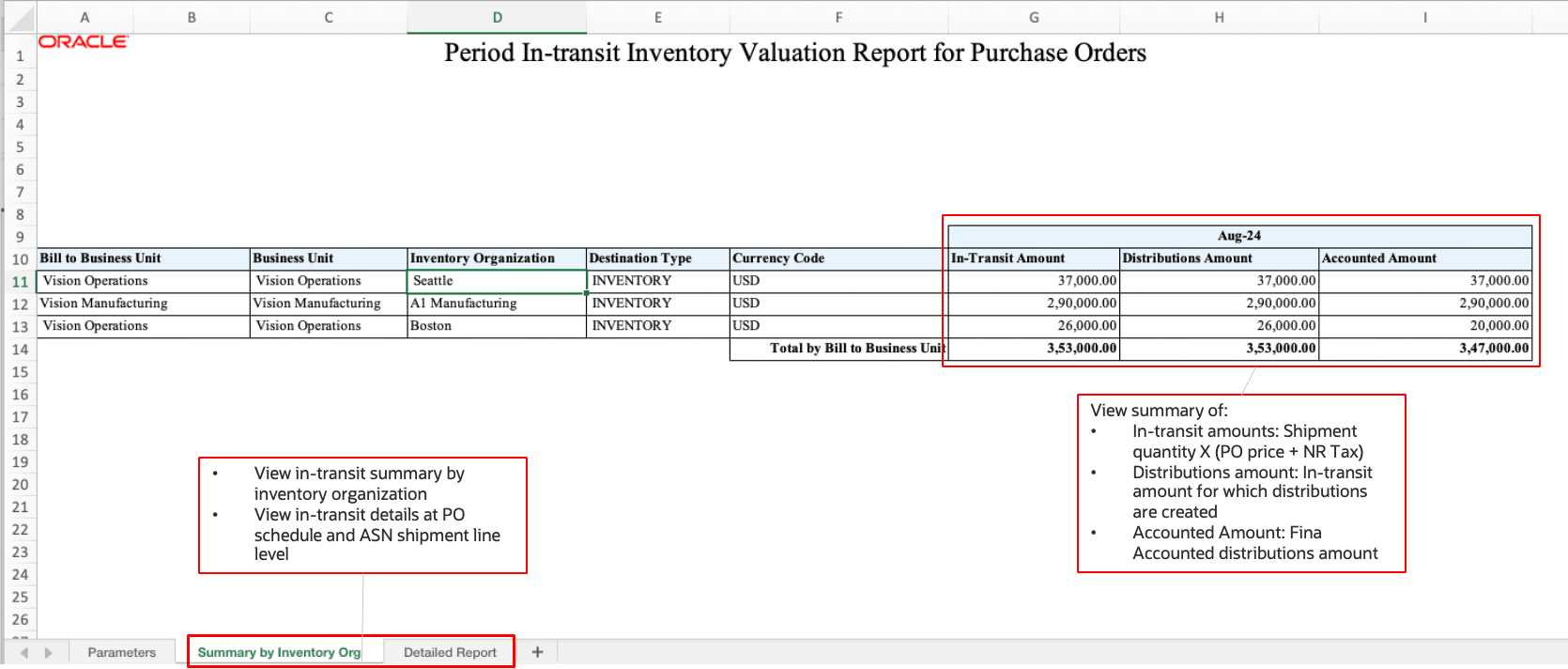

- The process automatically generates a Period In-transit Inventory Valuation Report for Purchase Orders, which can be used to view:

- Summary in-transit value by inventory organization

- Detailed in-transit information for each purchase order schedule and shipment line

-

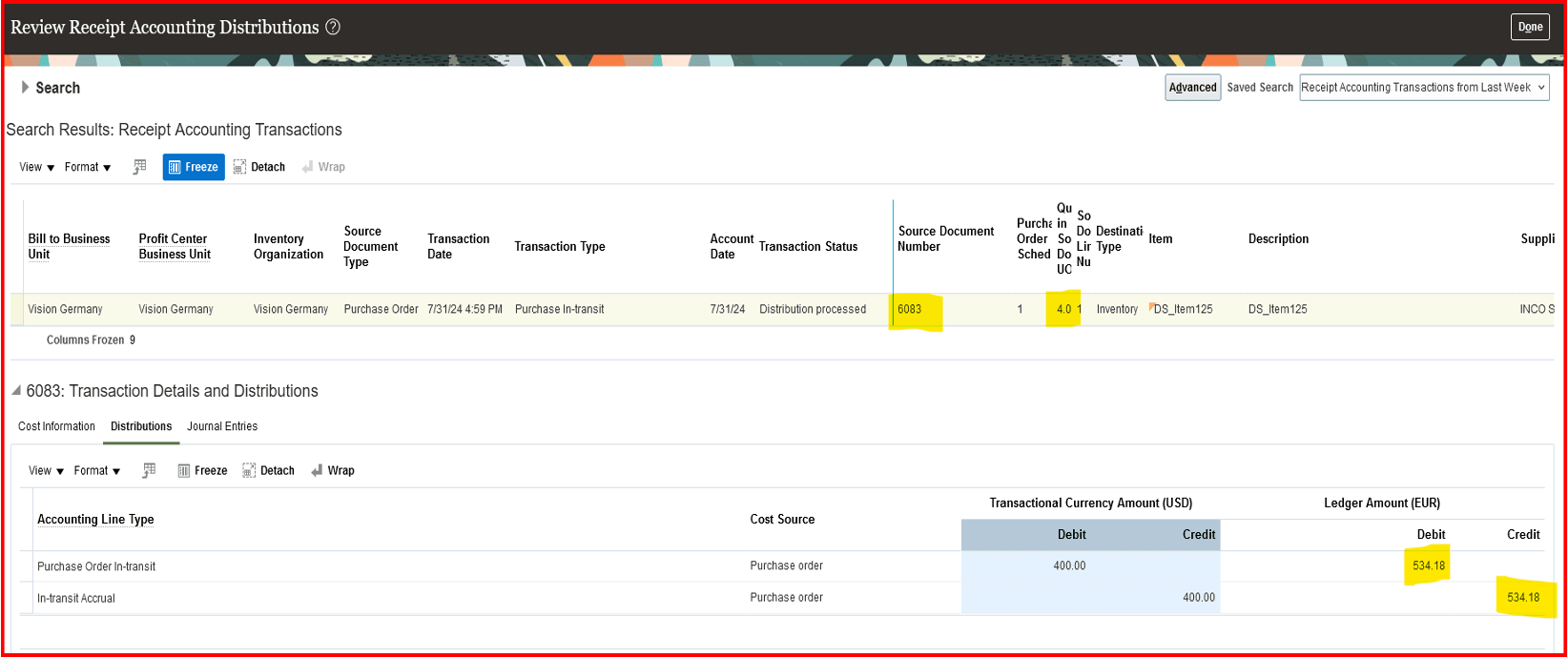

The process automatically creates transactions and accounting distributions that can be viewed on the Review Receipt Accounting Distributions page. You can view such transactions by searching for purchase order number or ASN number.

Review Receipt Accounting Distributions for In-Transit

-

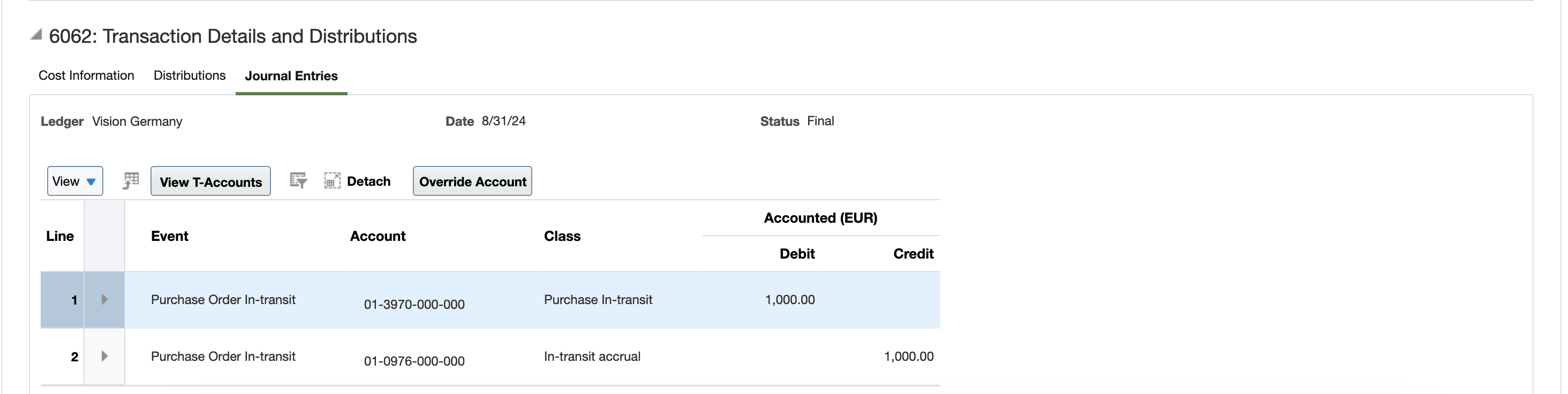

Journal entries are created using the Create Accounting process and can be view in the journal entries tab of the Review Receipt Accounting Distributions page

Journal Entries for Purchase Order In-transit

Steps to Enable

- Set up In-transit Valuation Ownership Change Rules using REST API introduced for this purpose. Here's a sample payload:

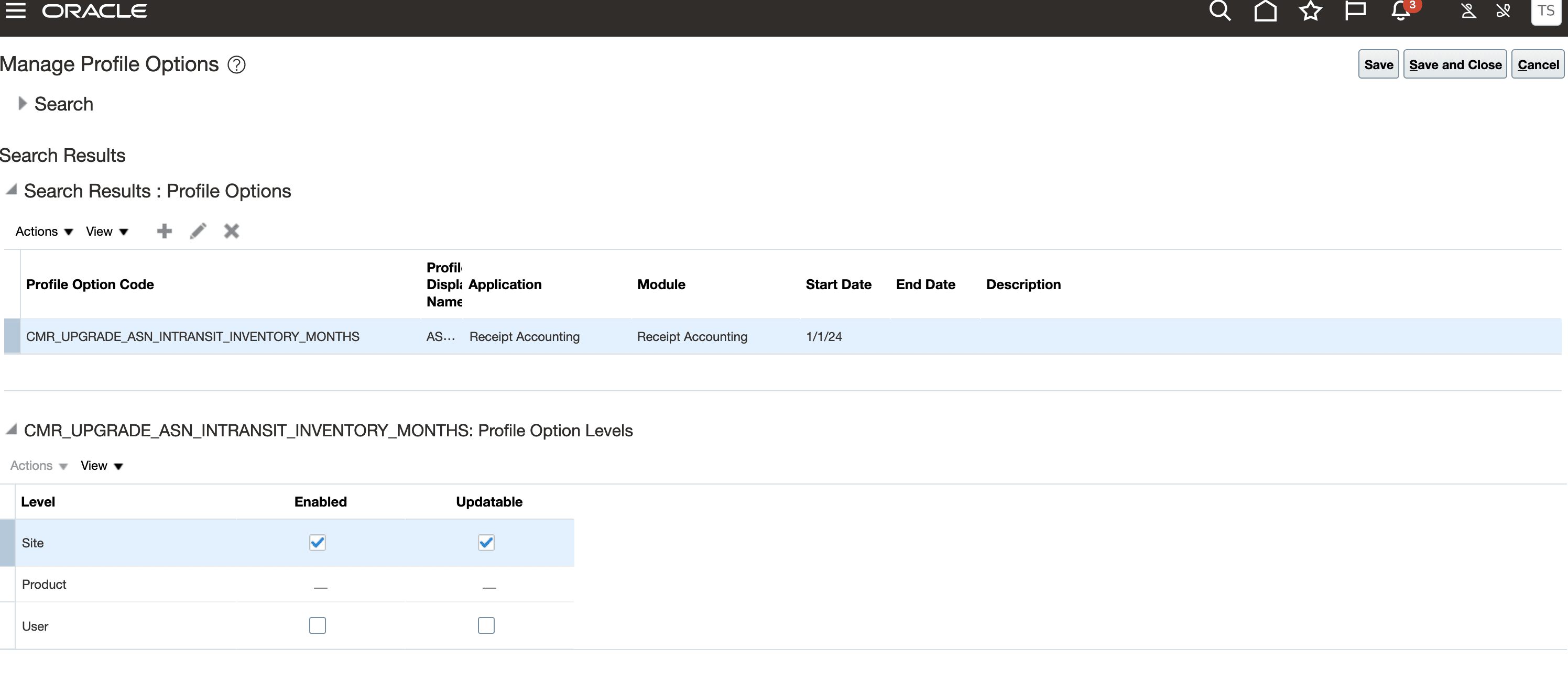

{"FOBLookupCode": “CIF,"OwnershipChange": “ASN”} - Optionally, create and set up a one-time profile option CMR_UPGRADE_ASN_INTRANSIT_INVENTORY_MONTHS under Receipt Accounting application and module to consider open ASNs for a different time period than the default of 3 months when running this process for the first time. You can provide any value between 1 and 12. Any value greater than 12 months or a junk value provided by the user is ignored and the process considers the default as 3 months. See tips and considerations for more details. The profile can be set up based on the below steps:

- Create new profile option in the Manage Profile Options page:

Create a new profile option

- Search the profile option on the Manage Receipt Accounting Profile Options page and provide a value between 1 and 12

Set up profile option value

Tips And Considerations

-

Important: When you run this process for the first time, by default, the process picks up expected or partially received ASNs created in the previous 3 accounting periods for all open purchase orders that accrue at receipt. For example, if you run this process on November 12th, ASNs created from the beginning of August accounting period are considered for in-transit valuation computation, distribution creation, and accounting. You may change this default before running this process for the first time by using the CMR_UPGRADE_ASN_INTRANSIT_INVENTORY_MONTHS profile option to configure more or less number of accounting periods for which open ASNs should be considered. This profile option isn't considered after the process is run for the first time.

-

Important: Considerations for configuring ownership change rules using REST API:

- Set up ownership change rules for each FOB lookup code expected to be used on the purchase order and ASN.

- The process will fail if it doesn't find at least one ownership change rule for an FOB lookup code used on the purchase order and ASN.

- Any ASNs with FOB lookup codes not configured in In-transit Ownership Change Rules are ignored by the process and aren't picked up by subsequent runs of the process.

- You can configure each FOB lookup code to have an ownership change of either ASN or Receipt. The Record In-transit Inventory and Expense for External Purchases process determines valid ASNs for in-transit computation and accounting that have an FOB lookup code configured with ASN as the ownership change event. Any ASNs that have FOB lookup code with ownership change event set to Receipt are ignored and no in-transit is created for such ASNs.

- FOB lookup codes are defined in procurement setup and can be entered in Purchase Order header.

- With update 24C, FOB lookup code is defaulted from purchase order to ASN shipment line and you can override it by using any of the ASN entry methods.

-

Important: Running the Record In-Transit Inventory and Expense for External Purchases process:

- You can run the process on demand multiple times during the month to have an up to date view of in-transit valuation.

- We recommend not to run this process in the Accounting mode on a schedule.

- The process is always run in the context of an accounting period. After the first run, the process must be run in a gapless fashion, period after period.

- You can't run this process for a previous period if this process has been run in a later period in the Accounting mode.

- Running the process in the Report mode generates in-transit data and doesn't create distributions. This is useful for customers who want to perform in-transit accounting for external purchases only at the end of the month but want a near real-time view of in-transit value.

- Running the process in the Accounting mode creates in-transit transactions and accounting distributions in Receipt Accounting. Accounting date for these transactions is always derived as the last date of the period.

- The process automatically triggers the Period In-Transit Inventory Valuation Report for Purchase Orders for the period for which the process is run. You can also run the report separately for current or prior period directly from the Scheduled Processes work area.

- Using an ASN is a prerequisite for this process. In addition, you must receive against the ASN to ensure that any quantity received reverses the in-transit originally booked against the ASN when the process is run later.

- If there are retroactive price updates after in-transit is recorded but before receipt, additional distributions are created for in-transit amount based on shipment quantity and delta price change on the purchase order.

- You can close (closed for receiving, closed for invoicing, closed, final close) the purchase order to also reverse in-transit amounts if you aren't expecting any further receipts against an ASN in expected or partially received status.

-

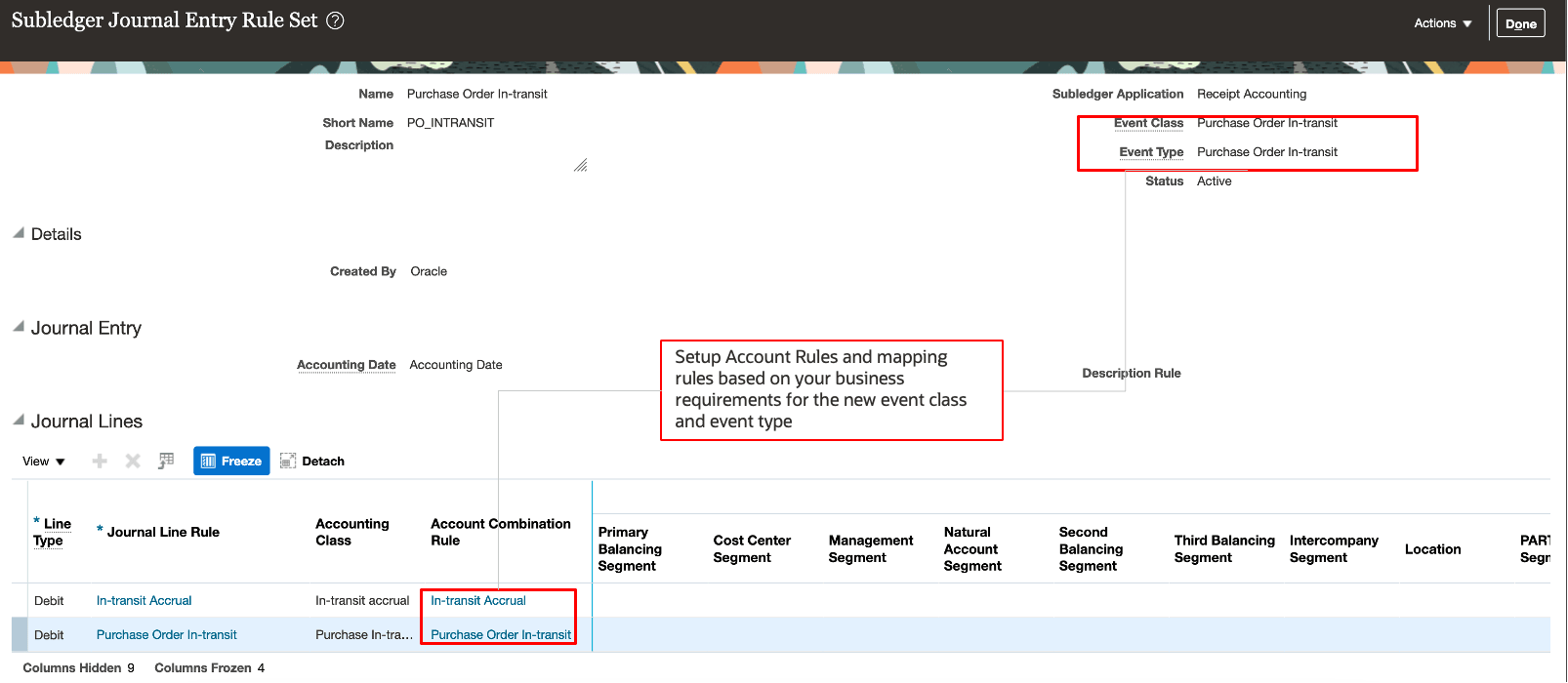

Ensure that the subledger accounting setup (mapping sets, account rules) is complete for the new event type. You can modify the seeded mapping set and account combination rules based on your business requirements

Journal Entry Rule Set for Purchase In-transit

-

Period close best practices:

- You must run the process in the Accounting mode at least once at the end of the period to ensure that in-transit value is correctly accounted as of the end of the period.

- You must review any aged in-transit amounts and take necessary action to clear (by receiving remaining quantity or closing the PO).

- Before closing the period make sure that in-transit amount is equal to distributions amount which is equal to the accounted amount to avoid reconciliation issues.

- If in-transit amount isn't equal to distributions amount, run this process in the Accounting mode.

- If distributions amount isn't equal to accounted amount, make sure to run the Create Accounting process and ensure that there are no accounting errors.

- You can also run the Run Receipt Accounting Period End Validation process to identify any open items before closing the period:

- Uninterfaced In-transit Shipment Count: The count of ASN shipment lines that haven't been processed for in-transit valuation.

- Unaccounted In-transit PO Count: The count of ASN shipment lines for which distributions haven't been created.

- Pending In-transit Reversals Count: The count of receipts against ASNs that haven't been processed to reverse in-transit accounting to the extent of receipt quantity.

- The Record In-transit Inventory and Expense for External Purchases schedule process wasn't run in the Accounting mode for the period.

Key Resources

- Oracle Fusion Cloud SCM: Using Supply Chain Cost Management, available on the Oracle Help Center.

- REST API for Oracle Fusion Cloud SCM Guide, available on the Oracle Help Center: Purchase Order In-transit Ownership Change Rules.

Access Requirements

Users who are assigned a configured job role that contains this privilege can access this feature:

- Record In-Transit Inventory and Expense for External Purchases (CMR_RECORD_INTRANSIT_INVENTORY_PURCHSE_ORDER_PRIV)