Specify Tax-Determinant Values While Shopping

You can now override the default values for tax-determinant attributes while shopping in the Responsive Self Service Procurement application. For example, you can override the taxation country at the header level or the tax classification code at the line level. You can also override the values while editing a requisition as part of the approval process.

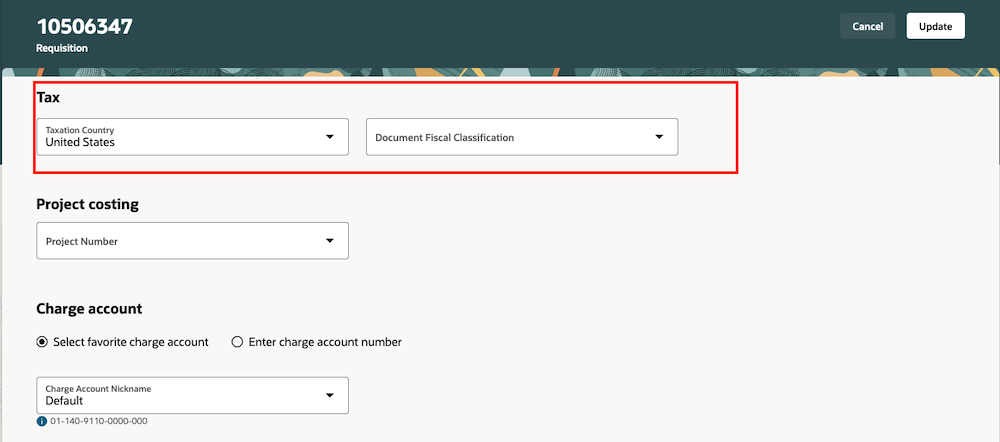

Override Values for Tax-Determinant Attributes at the Header Level

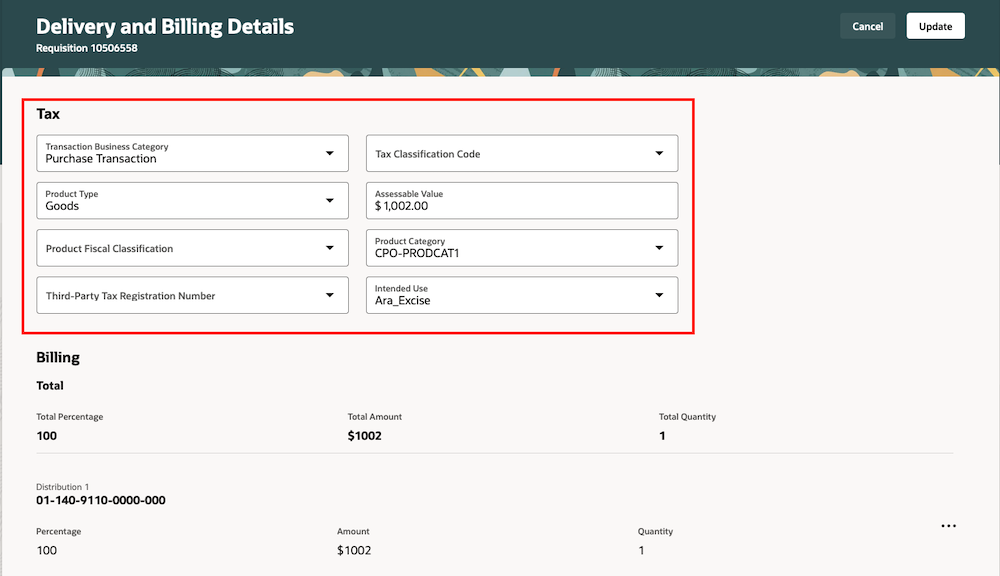

Override Values for Tax-Determinant Attributes at the Line Level

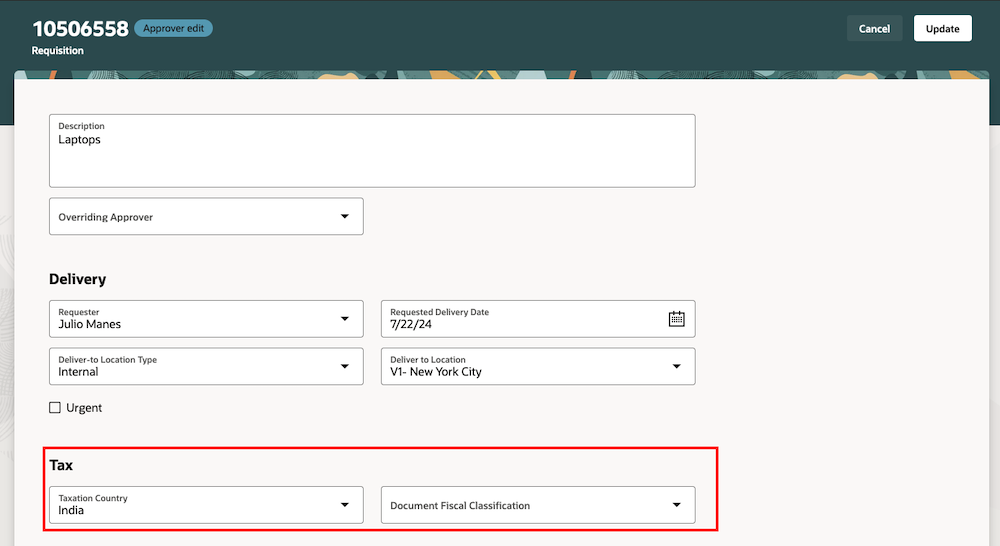

Override Values for Tax-Determinant Attributes While Editing a Requisition during an Approval Process

Using the feature, you can manually select values for tax-determinant attributes and selectively choose which of them will be displayed.

-

Tax computation is automatic and correct: users can manually select values for tax-determinant attributes to meet their different use cases, which in turn ensures tax computation is correct.

-

Ease of providing tax values: you can selectively choose which tax-determinant attributes will be displayed. This means users only have to work with the attributes that they need.

Steps to Enable

Use the Opt In UI to enable this feature. For instructions, refer to the Optional Uptake of New Features section of this document.

Offering: Procurement

-

If you want to use the Specify Tax-Determinant Values While Shopping feature, then you must opt in to its parent feature: Procure Goods and Services Using the Responsive Self Service Procurement Application. If you’ve already opted into this parent feature, then you don’t have to opt in again.

-

By default, the tax regions are hidden at both the header and line levels. You have to customize the page and make the region and desired fields visible.

-

You can either display all or choose which of the tax-determinant attributes should be displayed.

Tips And Considerations

- These tax-determinant attributes aren't available in this release:

- First-Party Tax Registration Number

- Location of Final Discharge

- User-defined Fiscal Classification

- You can add conditions to the display of the tax-determinant attributes. For example, you can choose to display the tax classification code only for certain taxation countries or requisitioning business units.

- Tax-determinant attributes don't affect tax computation for internal material transfers (IMT) lines.

Key Resources

- To know more about how to use the Responsive Self Service Procurement application, refer to the Procure Goods and Services Using the Responsive Self Service Procurement Application readiness training.

- To know how to provide the required privileges to your requesters to use your own configured role instead of the Requisition Self Service User role, refer to the How You Configure Roles for the Responsive Self Service Procurement Application topic.

- For more information on extending Redwood pages, refer to the Extending Redwood Pages Using Visual Builder Studio (VBS) feature, available in the Oracle Fusion Cloud HCM Common What's New, update 23D.

Access Requirements

Users who are assigned a configured job role that contains this privilege can access this feature:

- Manage Requisition with the Responsive Self Service Procurement Application (POR_MANAGE_REQ_WITH_PWA_PRIV).

This privilege was available prior to this update.

This privilege isn’t required if you have opted in to the Enable the Responsive Version as the Default Self Service Procurement Application feature to access the Responsive Self Service Procurement application.