Account Interorganization Shipments as Cost-Derived Transactions and Value Them Using the Periodic Average Cost for the Current Period

If you're using the periodic average cost method, the internal transfer shipments or internal drop shipments will now be accounted as cost-derived transactions. These transactions are valued using the periodic average cost of the current period at the source organization. The destination organization in the business flow continues to be at the transfer price. For transfers across profit center business units, the transfer price will be calculated as per the financial flow agreement. For transfers within profit center business units, which are cost based, the source for the cost in the destination node will be the prior period average cost or opening periodic average cost of the shipping or source organization.

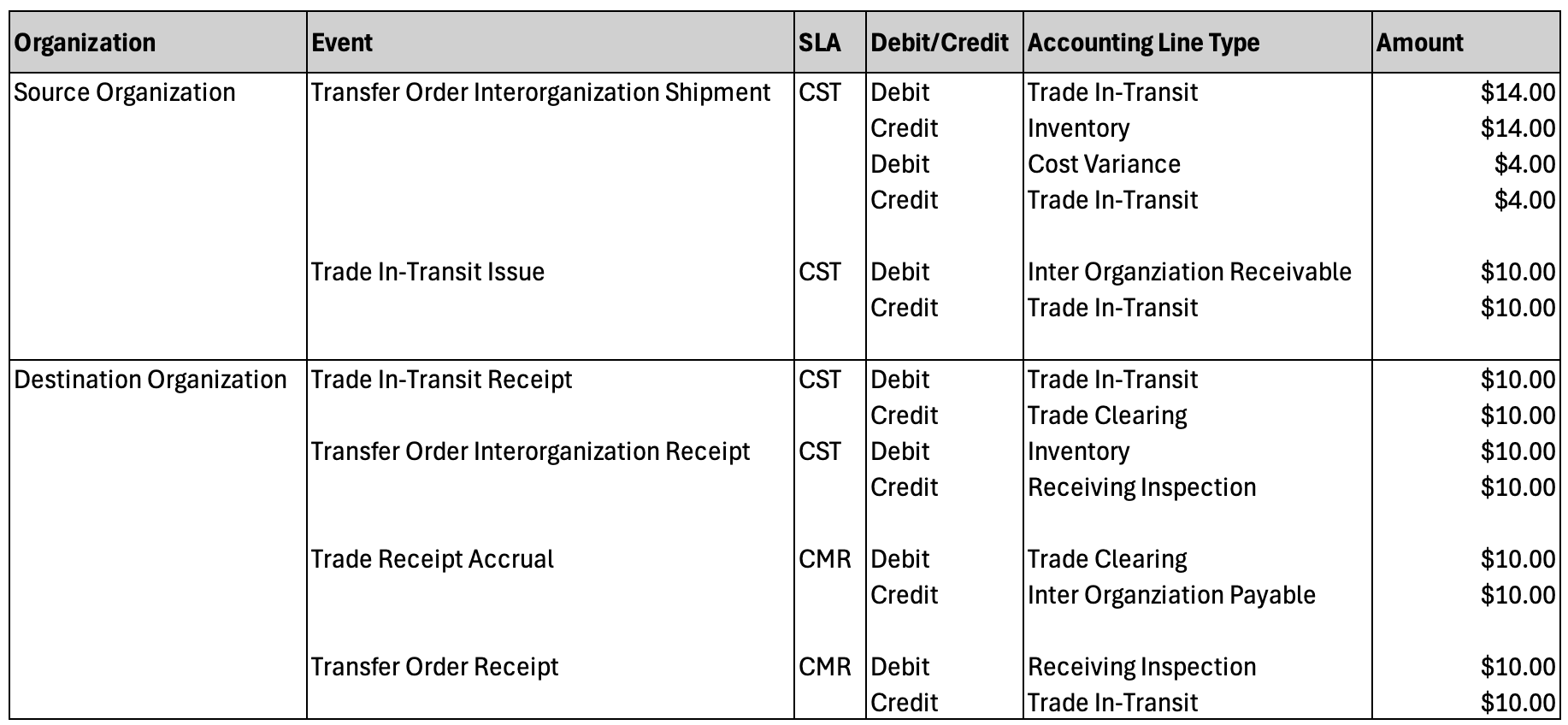

Cost variance will be booked for the difference between the prior period average cost or opening period average cost and the current period average cost in the source organization.

Here's an illustration of how transfer transactions will be cost processed with this feature.

| Source Organization | Cost |

|---|---|

| Prior Period Average Cost | $10.00 |

| Current Period Average Cost | $14.00 |

Table with accounting distributions in source and destination organizations.

If any opening periodic cost adjustment exists before the transfer is performed, then the same will be used for transfer pricing or as cost in the destination node.

Accurate and consistent inventory valuation across organizations, while maintaining high performance and avoiding iterative cost processing.

Steps to Enable and Configure

Use the Opt In UI to enable this feature. For instructions, refer to the Optional Uptake of New Features section of this document.

Offering: Manufacturing and Supply Chain Materials Management

Tips And Considerations

- Prior period average cost or updated opening period average cost, whichever is available at the time of processing transfer transactions, will be used for creating due from and due to accounting in the destination organization.

- Enabling this opt-in starting from a new period will ensure a seamless processing of the transfers with new logic.

- If the original transfer issue transaction is processed as cost owned, then return receipt will also be processed as cost owned.

- Only direct transfers within inventory organization will be processed as cost derived.

- Only if transfer issue and return receipt are in same period they will be treated as cost derived.

Key Resources

- Oracle Fusion Cloud SCM: Implementing Manufacturing and Supply Chain Materials Management guide, available on the Oracle Help Center.

- Oracle Fusion Cloud SCM: Using Supply Chain Cost Management guide, available on the Oracle Help Center.

Access Requirements

Users who are assigned a configured job role that contains these privileges can access this feature:

- Review Cost Distribution (CST_REVIEW_COST_DISTRIBUTIONS)

- Review Cost Distribution by Web Service (CST_REVIEW_COST_DISTRIBUTIONS_WEB_SERVICE_PRIV)