Overview of Integrating Order Management with Accounts Receivable

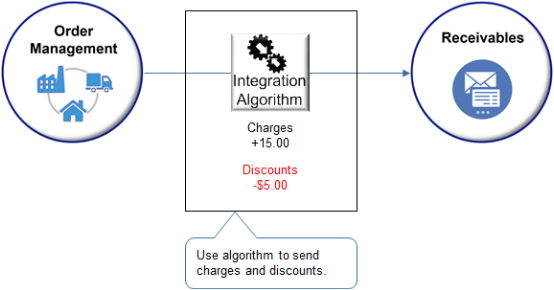

Get an overview of how you can specify the way Order Management sends charges and charge lines to Oracle Accounts Receivable.

Set up the predefined Integration Algorithm for Sales Order Charges so it sends the values to Accounts Receivable that receivables needs to calculate various charges, such as how to calculate tax on the shipping charge of a shipping line.

Accounts Receivable uses only a single, one-time charge for your item. It combines all other charges into a single freight charge on the invoice header, and it doesn't tax any of these charges. If you need to tax them, then you must include each charge as a separate item in Order Management, and send each charge to Accounts Receivable as a separate line. As an alternative, you can use Integration Algorithm for Sales Order Charges and a service mapping. This chapter describes how to use the algorithm and the mapping.

For example, tax rules on freight might vary according to region or to details on the sales order. Determining tax manually might delay order fulfillment, introduce unnecessary tax, or result in an invoice error. Instead, you can:

- Specify one or more shipping charges for an order line to automate calculating tax, such as sending freight charges to Receivables to calculate the tax amount for freight.

- Calculate freight tax in Oracle Pricing, send it to Order Management, then display it on an order line in Order Management.

- Use the integration algorithm to help achieve tax compliance, minimize sales order exceptions, and improve accuracy for your billing.

Shipping Charges

In some prior updates, Order Management sent secondary charges, including freight charges, to Receivables. Receivables added the secondary charges together, then displayed them as a single freight charge on the invoice header. Receivables couldn't apply a tax on this single charge because it might need to tax individual charges at different tax rates, and some of these charges might not be taxable. Order Management can now send the shipping charge on a separate charge line.

-

This feature adds a new charge line for each shipping charge for each item. For example, if the sales order contains three items, and if each item includes a shipping charge, then the invoice will contain six lines. Order Management will ship three lines, and the other three lines will contain freight charges.

-

The charge line will include the item number and the description that you set up in the Product Information Management work area. To relate each freight charge to the shippable line, you can override the Description attribute and TranslatedDescription attribute so they reference the correct shippable item.

-

If you override an attribute in the algorithm, then you must include the attribute in the Sources tab and the Services tab of the entity you're modifying in the service mapping.

-

As an option, you can also modify discount lines.

-

Make sure you set up the item in Product Information Management.

Shipping Example

Assume your fulfillment line has two shipping charges.

- $30 charge for shipping and handling

- $10 charge for insurance

Order Management will send each of these shipping charges separately to Receivables with the Line Type attribute set to Freight.

The Import AutoInvoice scheduled process combines these two shipping charges together with a value of $40 in the Freight attribute on the invoice header, and Receivables doesn't calculate tax on the shipping charge. For details, see Update Intercompany Receivables Invoice Import Details.

To capture shipping charges as revenue and calculate tax on them:

- You must update the service mapping from LINE_TYPE = FREIGHT to LINE_TYPE = LINE.

- If you want to have each shipping charge as a separate item, then you must also update the Inventory Item Id for each item.

- Import AutoInvoice will create a separate invoice line for each shipping charge in Receivables, and Receivables will calculate the amount and tax for each charge on two separate invoice lines.

Net Amount

Order Management sends only the total amount for each shipping charge to Receivables. It doesn't send discounts regardless of how you set the Send Discount Details to Billing Systems parameter. For details, see Manage Order Management Parameters.

Assume your fulfillment line has a quantity of 5, a $10 shipping charge, and a $2 discount. The total amount is $50 (5 multiplied by $10), and the discount is $10 (5 multiplied by $2). Order Management will send a $40 shipping charge to Receivables ($50 minus $10).

Examples of Integrating with Accounts Receivable

For an example, see Use Integration Algorithms to Implement Complex Logic.

For details about managing order numbers that you import when you integrate with Receivables, see Keep Your Order Number When You Import.