Set Up Credit Check

Do the setup tasks, such as making sure the customer record meets requirements, verifying customer account setup, and so on.

-

Make sure the customer record exists in Oracle Financials, and make sure the billing account for the customer meets these requirements.

-

Is active.

-

Has an established credit line.

-

Make sure the Include in Credit Check option for the account contains a check mark.

-

Set these attributes on the account.

-

Credit Limit

-

Credit Currency

-

Order Amount Limit

-

-

-

Verify the customer account setup.

-

Make sure you have the privileges that you need to administer Order Management.

-

Go to the Setup and Maintenance work area, then go to the task:

-

Offering: Financials

-

Functional Area: Customers

-

Task: Create Customer

-

-

On the Create Organization Customer page, in the Organization Information area, search for the customer account you must verify.

-

Click Profile History, then verify the attributes that affect credit, such as Credit Line and Credit Currency.

To get details about how to do these set ups, see Oracle Credit Management User Guide.

-

Automatically do credit check in Order Management. You must enable the Credit Management in Oracle Receivables feature.

-

Use Credit Management in Oracle Financials to enable the customer for credit check, set up the customer credit profile, and so on.

-

-

-

Optional. Enable the Credit Management in Receivables feature.

Enable the AR_CREDIT_MGMT lookup code. Use the Manage Standard Lookups page in the Setup and Maintenance work area.

-

Set up these parameters.

-

Activate Credit Check on Order Submit

-

Credit Check Failure at Order Submit

For details, see Manage Order Management Parameters.

-

-

Optional. Set up credit check so it happens during order fulfillment.

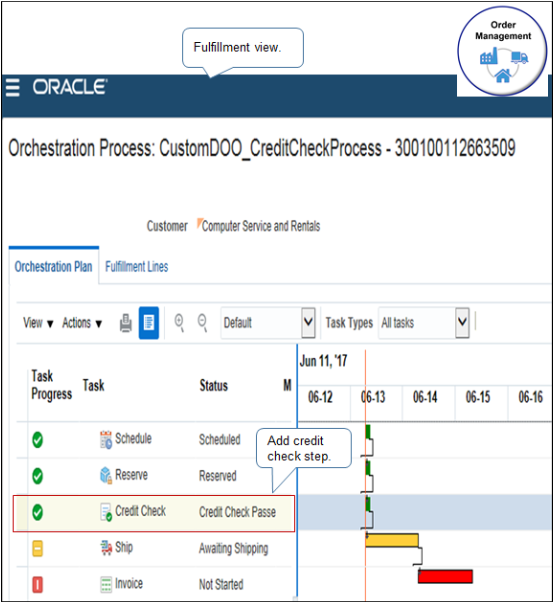

Set Up Credit Check to Happen During Order Fulfillment

In some situations, order fulfillment might require days to complete because of a variety of factors. For example:

-

Inventory is out of stock for the item and requires several days to replenish.

-

The credit that's available for a customer might decrease during this time because the customer continues to make other purchases.

You can add a credit check step at any point in the orchestration process. For example, to happen immediately before shipping. Use this functionality to make sure the credit check is accurate and up to date so you don't ship an item when customer credit no longer covers the purchase amount.

For example, you can add a credit check step to an orchestration process immediately after the Reserve step, and immediately before the Ship step.

Here are the values you set for the credit check step you add.

|

Attribute |

Value |

|---|---|

|

Step Name |

Enter text that describes the step, such as Credit Check. |

|

Task Type |

DOO_CreditCheck |

|

Task |

DOO_CreditCheck |

|

Service |

Create Credit Check Request |

If credit check fails when you run it from the DOO_CreditCheck task, then credit check sets the task to an error state, stops processing order lines, and pauses the orchestration process. To recover, you must set up the Recover Errors scheduled process. Attempting to release a hold won't resume processing.

If you add a credit check step to an orchestration process, and if the orchestration process already checked credit for the sales order before order submit, then Order Management examines the expiration date of the credit check.

-

If the current date happens after the expiration date. Order Management does the credit check.

-

If the current date happens on or before the expiration date. Order Management doesn't do the credit check.

For details, see Set Up Orchestration Processes.