Calculating Recast without Credits

Tax credits are not included for the recast calculation.

To enable this feature (see also: Enabling Application Features):

- Select Transition Tax Credits checkbox under Pillar Two (Global and Local Top-up Tax).

- Click Enable.

After you enable the feature:

- Scenario Dimension (see: Scenario Dimension): The following custom attributes are created to

identify the year of transition and source scenario:

- PillarTwoTransitionTaxCreditsYear: By default, lists all the years available in the application

- PillarTwoTransitionTaxCreditsSourceScenario:

- By deault, lists all the scenario members avaialble in the application

- No assignment indicates source scenario is same as target scenario

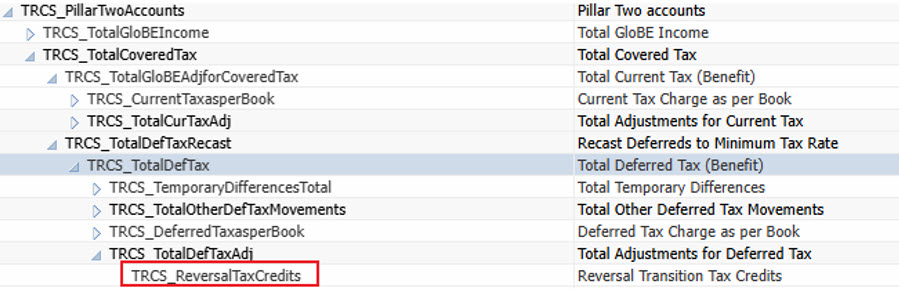

- Account Dimension (see: Account Dimension): The following new metadata member to hold the

reversal of transitional tax credits amounts is created:

TRCS_ReversalTaxCredits.

How the Calculation works

- Pulls the credits available from Tax credits schedule based on the transition tax credits year configured for the Scenario

- Do not recast the amount in covered tax

Example Usecase

The below configuration indicates that Transition year for taxcredits is FY20 and no assignment of Transition Source Scenario indicates that source is itself that is, "Actual".

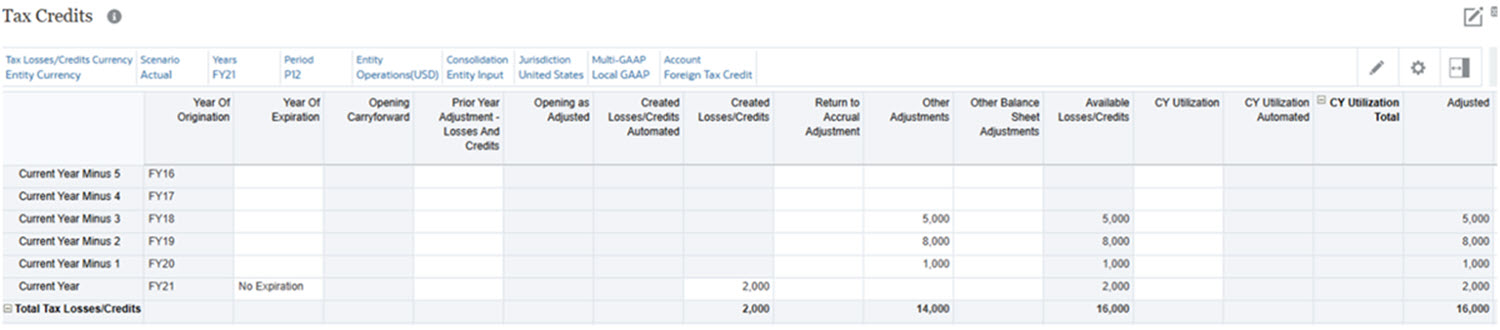

Tax Credits

From the screenshot below, the available tax credits post transition year that is, FY20 is 3000$ is expected to be posted to covered tax.

Note that the Tax credits entered in these movements "TRCS_TLCOtherAdj (Other Adjustments)","TRCS_TLCUtilizationTotal (CY Utilization Total)" and "TRCS_TLCExpirationTotal (Expiration Total)" sum is copied to covered tax based on the Transition year.

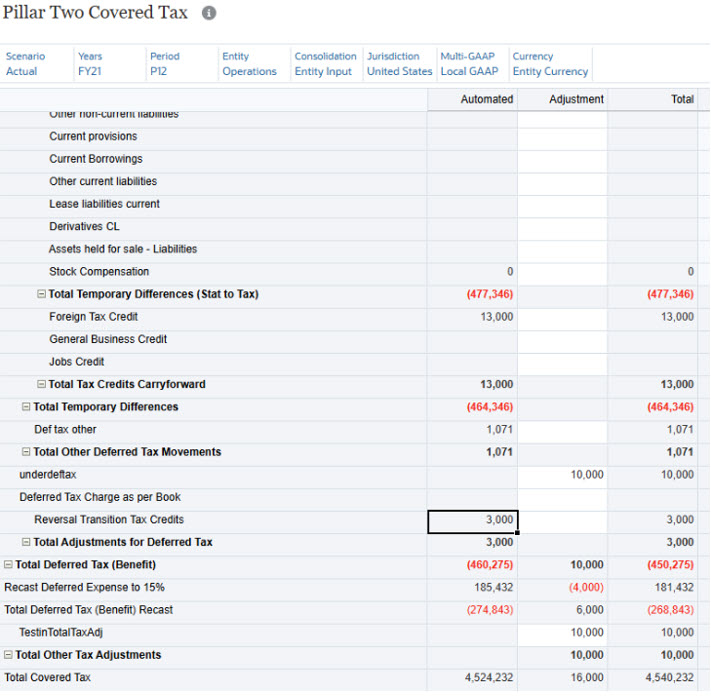

Covered Tax

Reversal Transition Tax Credits populates the credit amounts post transition year and is excluded from calculating recast on it.