Example Journal Data Calculation

- Create a TRCS application if applicable. See, Creating a Tax Reporting Application

- Navigate to Dimension editor (see, Working with Dimensions). Select the account TRCS_TARFCurrentPayable and attach the attribute TAR_Difference for posting the balancing amount. Perform refresh database.

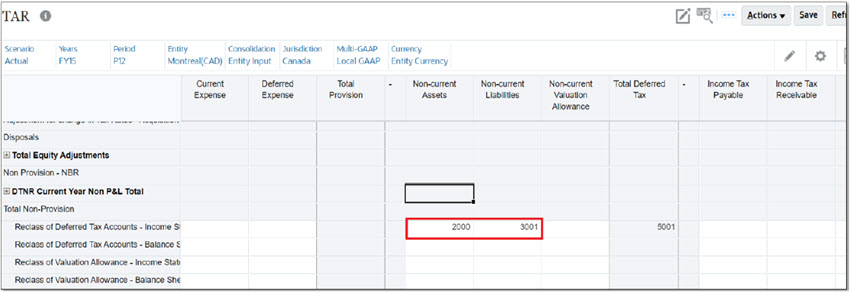

- For Actual, FY15, P12, FLE201-Montreal make manual adjustment for Non Current Assets

and Non- current liabilities.

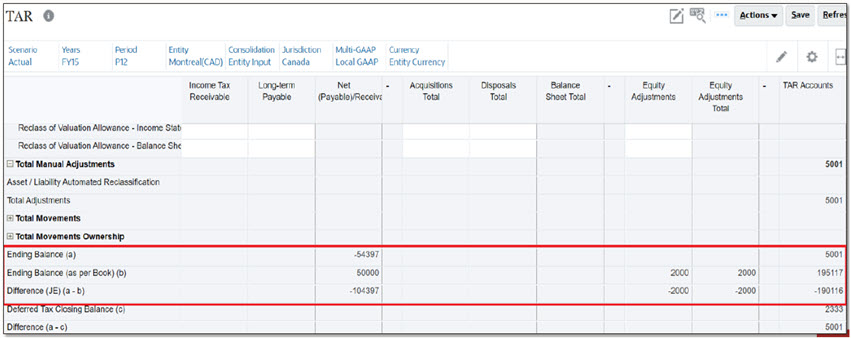

- Perform Consolidation in Consol Cube for Actual, FY15, P12, FLE201. Make sure there

is a difference between Ending Balance and Ending Balance as per book against the

TAR Account.

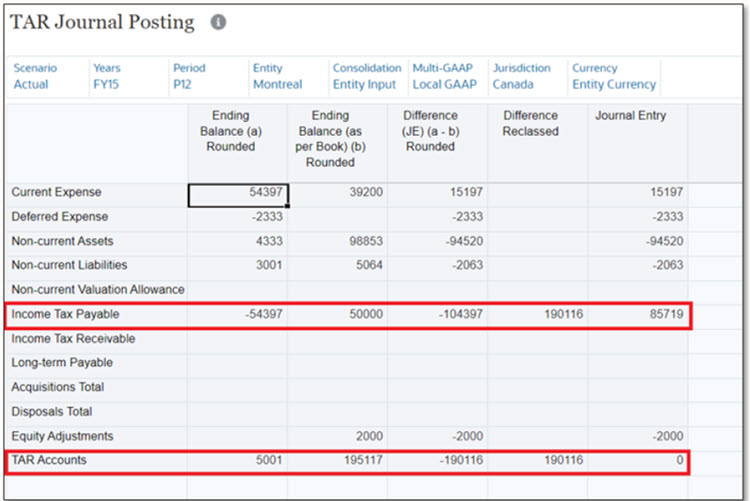

- Navigate to TAR Journal Posting form and validate all the values are rounded off and

the TAR Difference is getting added to income tax payable account.

Example: Difference between Ending Balance Rounded and Ending Balance as per book in TAR is posted to Current Tax Payable in the TAR Journal Posting Form

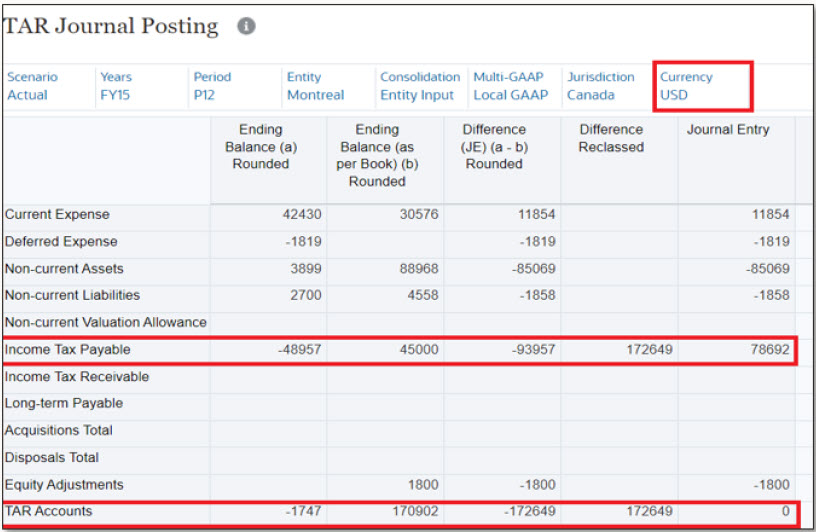

- Perform translation with reporting currency as USD. Post translation we should the see difference in Ending balance and Ending Balance as per book with rates applied.

- Navigate to TAR Journal Posting form and validate all the values are translated and

rounded off and the TAR Difference is getting added to income tax payable account.

Example: Perform Translation to USD_Reporting to ensure the rates are applied properly and the difference between Ending Balance and Ending Balance as Per book are added to Current Tax Payable in the TAR Journal Posting form and journal entry are adding to zero.