Reviewing Journal Data

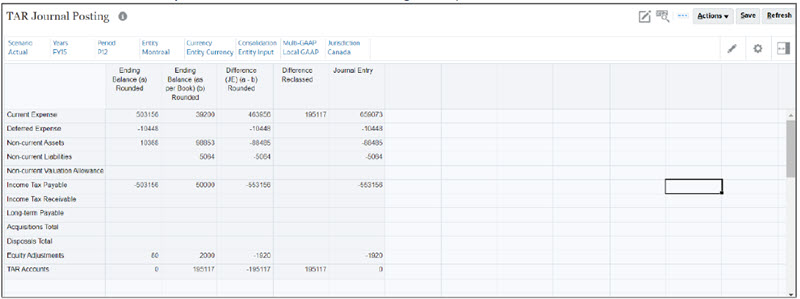

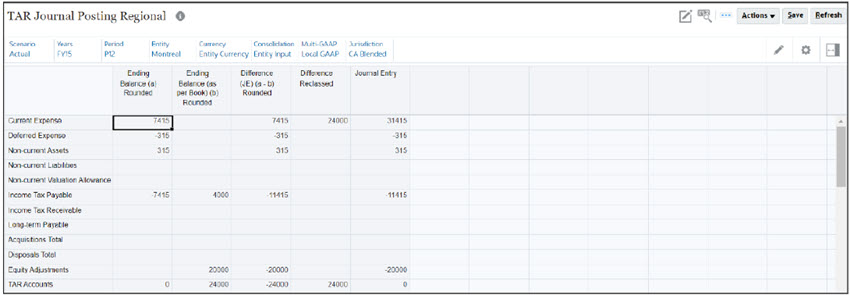

Journal data calculation is completely automated to post Journal entries to general ledger. With this new capability, you have a balanced Journal by automatically adding the difference between the ending balance and the ending balance as per book account to either the system accounts or custom accounts under the Tax Account RollForward (TAR) account hierarchy using the attribute (TAR_Difference).

Journal Data Calculation involves rounding off TAR Accounts (see, Working with TAR Automation and TAR Automation Book Balance) and adding the TAR difference to TAR accounts hierarchy based on the attribute.

Note:

Journal Data calculation is available at Parent Entity and Parent Tax Calc enabled entity.As part of the Journal data preparation, the following 2 forms are available out of the box:

- TAR Journal Posting (Tax Provision National -> TAR. Click on the

TAR Journal Posting tab at the bottom to open the TAR Journal Posting

form).

- TAR Journal Posting Regional (Tax Provision Regional -> TAR Regional.

Click on the TAR Journal Posting Regional tab at the bottom to open the TAR

Journal Posting Regional form).

Metadata

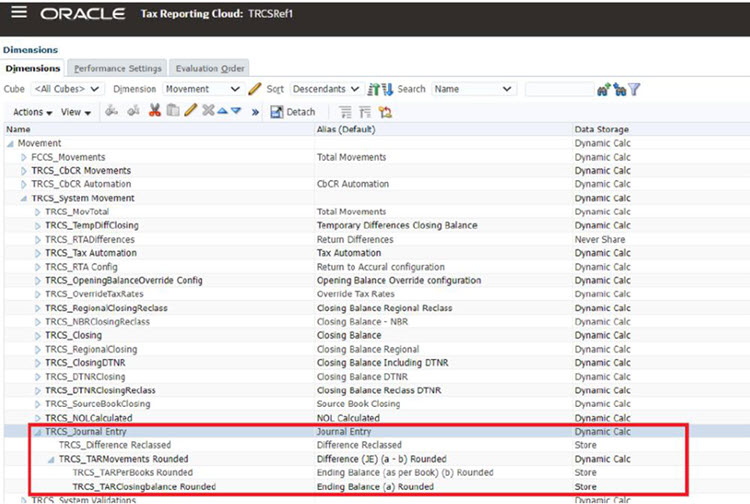

- Navigate to Dimension. Select Movement dimension. See, Movement Dimension

- A new hierarchy (TRCS_System Movement -> TRCS_Journal Entry) is created in Movement dimension.

- The following members are added at the parent (TRCS_Journal Entry ) level:

- TRCS_Difference Reclassed

- TRCS_TARmOVEMENTS Rounded

- TRCS_TARPerBooks Rounded

- TRCS_TARClosingbalance Rounded

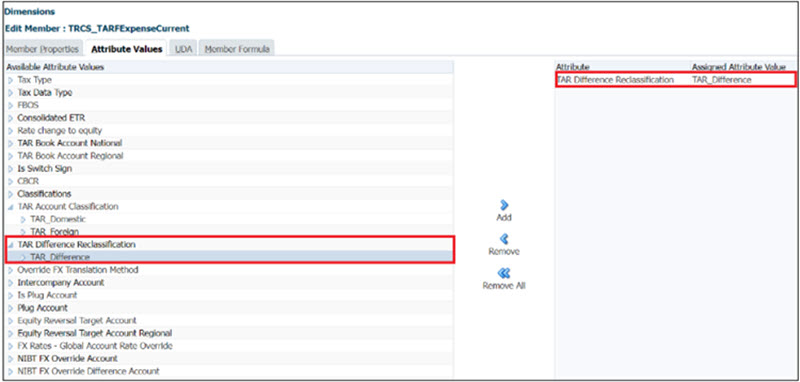

You can attach the attribute TAR_Difference only to one Base member.

Note:

You can also attach the attribute to custom base members created under TRCS_TARFAccounts.If the TAR_Difference attribute is attached to multiple accounts only the first account (only calculated internally by the system) is considered for calculation.