Consolidation Process

Consolidation is the process of gathering data from descendant entities and aggregating the data to parent entities.

Tax Reporting provides pre-built calculation scripts to handle consolidation and translation. In addition, the system provides pre-built scripts and member formulas for some of the standard calculation processes. For example, these rules are provided by default:

- Consolidate

- Consolidate_CbCR

- Force Consolidate

- Translate

- Translate_CbCR

- Force Translate

The consolidation process includes the following calculations:

- Opening Balance Calculation

- RTA (Return to Accrual) Calculation

- Tax Losses/Credits Calculation

- Tax Automation

- National Tax

- Regional Tax

- ETR

- TAR

- Country by Country, if enabled

- Currency Translation

- Ownership Calculations (see also, Recomputing Ownership Data

Consolidation Process

After you enter or load data into base-level or parent tax calculation entities, calculate and adjust data, you run a consolidation to aggregate the data throughout the organization. You launch the Consolidation process from forms that run the consolidation rules for the specified scenario, period, and entity as follows:

- Users enter child entity data through manual input, data load, or adjustments in the entity’s functional currency. The data is stored at the Entity Input member of the Consolidation dimension. During consolidation, the system runs the default calculation rules to fully calculate the Entity Input member and change the status to OK.

- The system processes these steps dependent on the Parent Entity:

- The system first translates the Entity Total data, including both Entity Input and Entity Consolidation (applicable only to parent entity), to the currency of its parent.

- The system then processes the translated data by applying the percent consolidation (PCON) as related to its parent, and stores the result at the Proportion member of the Consolidation dimension.

- The summation of Entity Proportion data and Elimination data is stored in the Contribution member of the Consolidation dimension.

- The system then aggregates the Contribution data of all child entities of a Parent entity. The system stores the consolidated result at the Parent entity’s Entity Consolidation member. The status of the parent entity changes to OK.

Translation Process

The translation process is run as required to convert data from the child entity currency to the parent entity currency. If the child and parent entity use the same currency, the translation process is not run.

An entity can only belong to one parent. After you select the parent entity into which the dependent entities consolidate, the required processes run automatically:

- The system runs calculation rules for all descendants of the entity.

- If the data for the child entity and the data for the parent entity are in different currencies, the system translates data based on the exchange rate.

- The consolidation process begins.

Note:

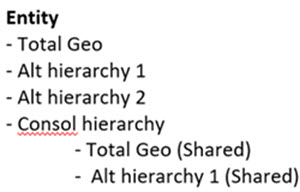

To run consolidation for multiple entity hierarchies, create a new hierarchy and share the top members of the hierarchies you want to consolidate at once under this new consolidation hierarchy. Run consolidation from there.For example:

You then have to run consolidation using "Consol hierarchy".