Working with Deferred Tax Proof

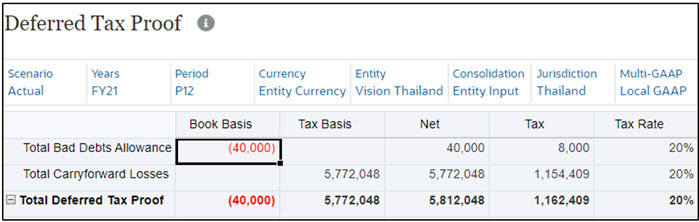

The Deferred Tax Proof is designed to bring together the Book and Tax basis and difference of Book Assets and Liabilities. The tax effect is calculated, and tax rate is determined. This schedule substantiates the Balance Sheet approach and is designed to agree with the tax calculations in the Deferred Tax Rollforward.