Working with P&L Approach

Tax Automation

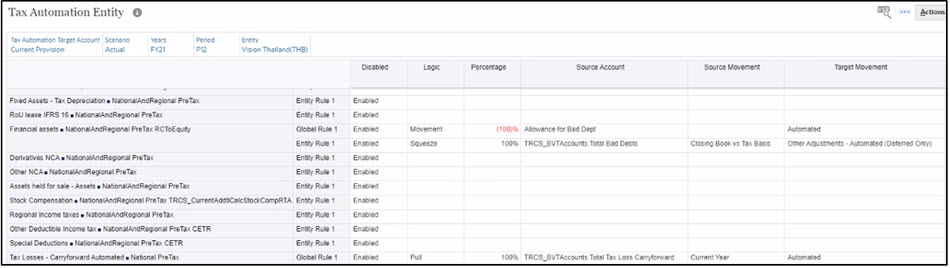

Tax Automation rules can be configured to calculate the current year "Movement" or the change in balance for Book Assets and Liabilities based on the balances in the Trial Balance in accordance with the P&L approach (Figure 3 Global Rule 1, Financial Assets). An additional rule can be configured to "Squeeze" or set the closing temporary difference balance to the closing difference from the Book versus Tax Total Bad Debts (Figure 3 Entity Rule 1 Financial Assets).

Tax Automation rules can be configured to "Pull" the balance for Tax Losses/Credits analyzed in the Book versus Tax format (Fig 3 Global Rule 1, Tax Losses Carryforward).

Figure 3: Tax Automation Rules – Financial Assets and Tax Loss Carryforward

Tax Automation Results

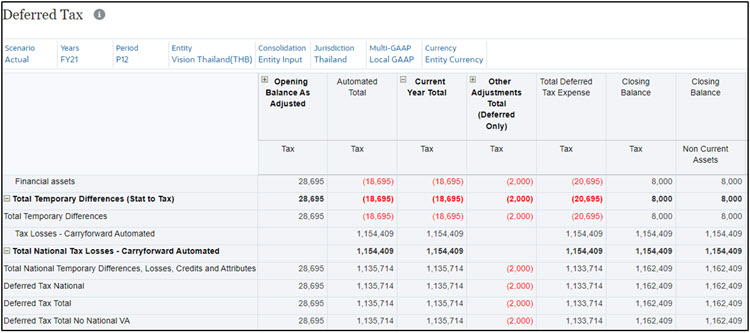

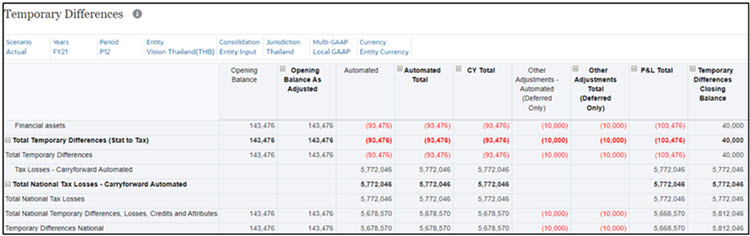

Figure 4 Temporary Differences and Figure 5 Deferred Tax

The Global 1 Tax Automation Rule processed on Financial Assets show Current Year movement of (93,476) posted to the Current Year Automated movement because of the "Movement" rule. The Entity 1 automation processed on Financial Assets show Other Adjustment Automated of (10,000) as a result of the "Squeeze" rule processed with a target movement that was selected in the Entity 1 rule.

The Global 1 Tax Automation Rule processed on Tax Losses Carryforward show Current Year movement of (5,772,046) posted to the Current Year Automated movement because of the "Pull" rule.

Figure 4: Temporary Differences

Figure 5: Deferred Tax