Using Tax Automation with Fixed Assets

Tax Automation enables you to copy supplemental data such as Fixed Assets into the provisioning system automatically, rather than having to manually add the data. You set up rules on the Tax Automation form, and values are calculated and copied when a Consolidation is performed. The results of the movement are displayed on any form that has the specified destination account and movement members.

Tax Automation logic is executed as part of the Consolidation process.

Note:

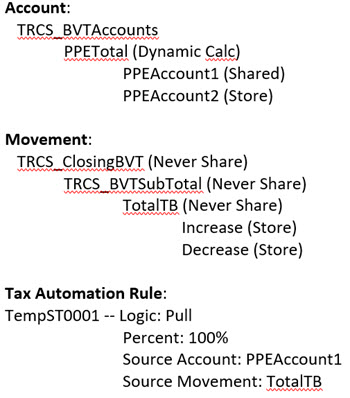

If you have created shared accounts under TRCS_BVTAccounts hierarchy, then while creating Tax Automation Rule you cannot use parent movement as a source movement. For example:

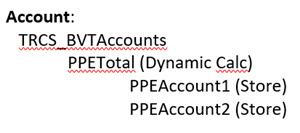

In the above example, the Tax Automation Rule is reading from a parent source movement for the source shared account which is not recomended. In this case, to have Tax Automation working, you must have the primary instance of PPEAccount1 under TRCS_BVTAccounts. For example:

You can set tax automation for National or Regional accounts.

To apply Tax Automation Rules to Fixed Assets:

- From the Home page, select Library, and then Data Entry.

- Under Forms, expand Tax Administration, and then select the appropriate Tax Automation form:

Table 11-9 Tax Automation Forms

Tax Automation Tab Selection Form Description Tax Automation

Tax Automation

Domicile Rules

Tax Automation Domicile

Global tax automation rules (apply to all entities under a Domicile)

Domicile Region Rules

Tax Automation Domicile Reg

Global tax automation rules (apply to all entities under a Domicile Region)

Entity Rules

Tax Automation Entity

Tax automation rules for specific Entities

Entity Rules Regional

Tax Automation Entity Reg

Global tax automation rules (apply to all Entities regardless of Domicile)

Entity and Region Rules (Regional Only)

Tax Automation Entity All Reg

Tax automation rules for specific Entity (apply to all Regions)

Global Rules

Tax Automation Global

Global tax automation rules (apply to all Entities regardless of Domicile)

Global Rules Regional

Tax Automation Global Reg

Regional global tax automation rules (apply to all Entities regardless of Domicile region)

- On the selected Tax Automation form, select the rule parameters:

- Under Disabled, leave as Enabled; otherwise, the rule will be ignored during Consolidation.

- Under Logic, click in the cell to activate the Entities dialog box, and then select the logic method to be applied to the source account and source movement.:

- Pull takes the specified percentage of the source account and source movement, and puts it in the intersection.

Note:

The Opening Balance, Opening Balance Adjustment and Opening Remapped cannot be pulled. - Movement takes the difference between the current period amount of the Source account and the last period of the prior year's amount of the Source account, and applies that amount to the Destination account.

- Squeeze- The value at the intersection of the source Account and source Movement must equal the end balance in Temporary Differences for the target Account when squeezing from the book or any supplemental schedules.

Squeeze from supplemental schedule (such as Fixed Assets)

Example 1: Fixed Assets:

-

Source Account/Movement = -8110 (The intersection of Book Basis minus Tax Basis for Property and Related Plant, and Current Year Movement)

-

Ending Balance Temporary Differences for target Account/Movement = -8110

Note:

If any other Movements for the target account are populated on Temporary Differences, they will be "squeezed out" (subtracted) so that the ending balance remains the value of the Source Account/Movement. -

Example 2: Fixed Assets

-

Source Account/Movement = -8110 (The intersection of Book Basis minus Tax Basis for Property and Related Plant, and Current Year Movement)

-

Opening Balance Adjusted on Temporary Differences for target Account = 1000

-

Ending Balance Temporary Differences for target Account/Movement remains at = -8110.

-

The Difference between the Opening Balance Adjustment 1000 and P&L Total Movement -9100 still equals -8110

-

Squeeze when source data is Book Data:

-

When no source or target Movement is specified in Tax Automation, the source Movement defaults to TB Closing and the target movement defaults to Automated (Current Year). A valid Source book account must be specified.

-

The value will display in Temporary Differences in Movement Automated and the Ending Balance = Source Book Account value.

-

- Pull takes the specified percentage of the source account and source movement, and puts it in the intersection.

- Under Percentage, enter the percentage of the Source Account that is to be calculated as a decimal.. For example, enter 100% as 1, or 50% as .5.

- Click in the Source Account cell, and select the Source from the Search dialog box.

- Click in the Source Movement cell, and select the source of the movement, such as Trial Balance Close or Disposals.

- Under Target Movement, select the destination movement for the calculated value:

- Automated

- Equity Automated

- Other Adjustments - Automated (Deferred Only)

- Click Save, and then Close.