Rate Component Cross Reference Information

All information related to a rate component, including general ledger information, characteristics and eligibility rules, will be copied.

Special logic exists for merged rate components that reference other rate components. This includes the cross reference collection and the eligibility criteria.

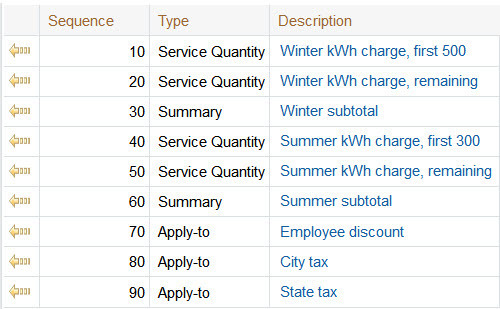

This logic is difficult to explain succinctly, so we'll use an example. Imagine that the Merge From rate components look as follows:

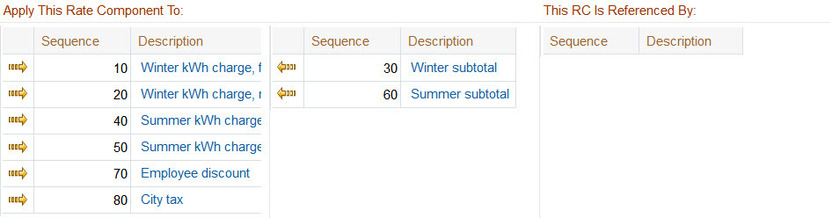

The Rate Component - Cross Reference tab for the merge from rate version shows the following cross-reference information for the State tax rate component:

-

Service Quantity (0 to 300 kWh Step)

-

Service Quantity (300 to max)

-

State tax

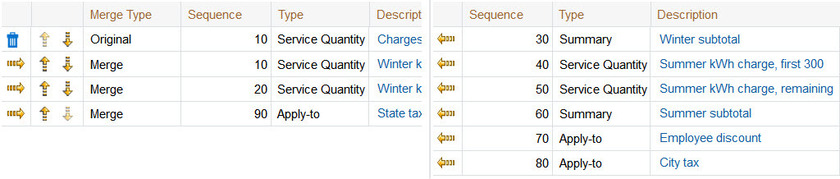

Also, assume that the original rate version already contains a rate component with a sequence number of one of the merging rate components.

After saving, the second service quantity rate component is renumbered and the State tax rate component will reflect the renumbering in the cross-reference and will not include the rate components that were not copied.

Here is the view on the merge page after saving:

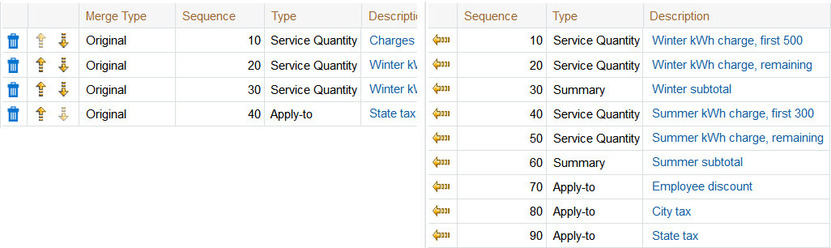

If you navigate to the Rate Component - Cross Reference tab for the merged rate version for the State tax rate component, it looks as follows:

If any rate component refers to another rate component in the eligibility criteria, the sequence number of the eligibility criteria is also adjusted accordingly.

You will be warned by the system when you copy a rate component that has cross-references to other rate components that are not being copied.