Managing Your Cash Drawers

This section assumes you are familiar with the concepts described in The Lifecycle Of A Deposit Control and The Lifecycle Of A Tender Control.

There are many ways to handle the daily management of tenders received via cash drawers. It really depends on how your organization works. To help you understand the potential of the system, we'll continue the example started above.

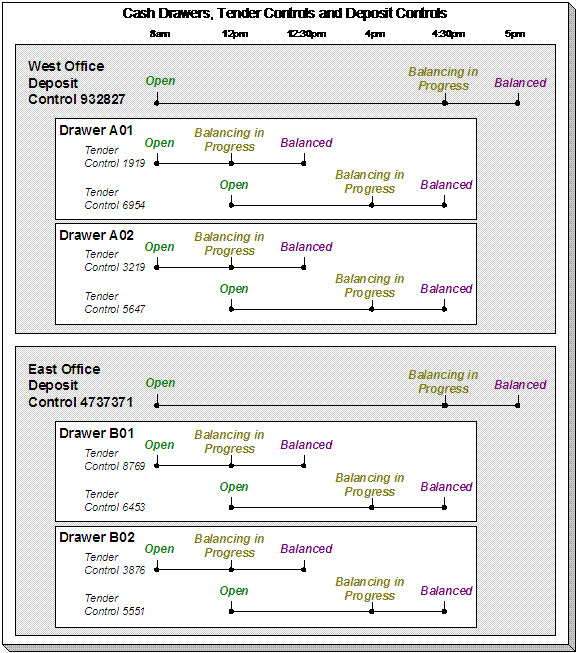

Assume that the cash drawers in your western office are balanced and deposited independently from those in your eastern office. We'll assume that both offices follows the same daily routine:

- Load fresh drawers first thing in the morning. Each drawer contains a starting balance of $150.00. Note: the drawer's tender control's starting balance defaults from its tender source.

- At 10 am, the cashier turns in funds to the chief cashier and continues to receive additional tenders.

- At 12 noon, each drawer is pulled and balanced by a supervisor.

- By 12:30 pm, the tender controls are balanced.

- At 4 pm, the cashiering stations are closed. Each drawer is pulled and balanced by a supervisor.

- By 4:30 pm, the tender controls are balanced.

- At 5 pm, the deposit control is balanced and funds are ready to be deposited at the bank.

Given this, the following diagram illustrates the deposit controls and tender controls used by each office on a given day.

The following concepts are illustrated above:

- An Open deposit control must exist before you can create a tender control. And an Open

tender control must exist before you can create a tender. From a business process standpoint,

this means:

- A supervisor would create a deposit control at the start of the day (8 am in the above illustration).

- Each cashier would create a tender control when they start a drawer and reference the deposit control created by the supervisor.

- During the day, the cashier can turn-in moneys to the chief cashier. These turn-in events are recorded in the system as they play a part in the ultimate balancing of the drawer. Refer to Turn Ins for more information.

- At some point, the contents of a drawer can be pulled and balanced. If additional tenders can be received in a drawer, a new tender control must be created for the drawer. Refer to Balancing By Tender Type for more information.

- At the end of the day, the supervisor checks to make certain that all tender controls linked to the deposit control are Balanced. After this has been done, the supervisor indicates the deposit amount on the deposit control and changes it to Balanced. Notice that in the above illustration each deposit control references four tender controls.

Alternate currency payments. If your organization accepts payments in alternate currencies, that is, a currency other than the account's currency; a supervisor would create a deposit control for each such currency. Likewise, the cashier would create a tender control for each such currency.

Refer to Alternate Currency Payments for more information.

- Typically, a cash drawer has one tender control Open at any point in time (meaning that the tenders being received are being linked to a specific tender control). However, this is not a hard rule. If you want, you may have multiple tender controls Open at any point for a specific cash drawer (for example, if multiple cashiers can work the same drawer during the day but take their drawer with them).

- Typically, a specific cashier puts tenders into a specific tender control. However, this is not a hard rule. On a tender control, you can define if it's limited to a specific operator OR if any operator can link tenders to it.

- When you're ready to balance a drawer, you change the tender control to Balancing in Progress. This prevents new tenders from being added to the tender control. If the cashier can continue to receive tenders, they must create another tender control. In the above example, all drawers are balanced at 12 noon by a supervisor while the cashier continues to take payments.

- When the tender control is balanced, you change its state to Balanced. This prevents any changes to the tender control or its tenders.

- All tender controls exist in respect of a deposit control (in fact, the deposit control must be created before the tender control). This way, a supervisor can check the state of the related drawers throughout the day. Notice that the state transition of a deposit control is identical to that of the tender control (refer to The Lifecycle Of A Deposit Control and The Lifecycle Of A Tender Control). There is only a temporal difference. Notice that the deposit control stays open throughout the day while any number of tender controls are being opened and balanced.

Multiple deposits in a day. While the above example illustrates a single deposit per office per day, it is quite possible to have multiple deposit controls on any given day.

Turns ins. The above example did not illustrate the fact that a cashier can turn-in moneys during the day without having to balance the drawer. Refer to Turn Ins for more information.