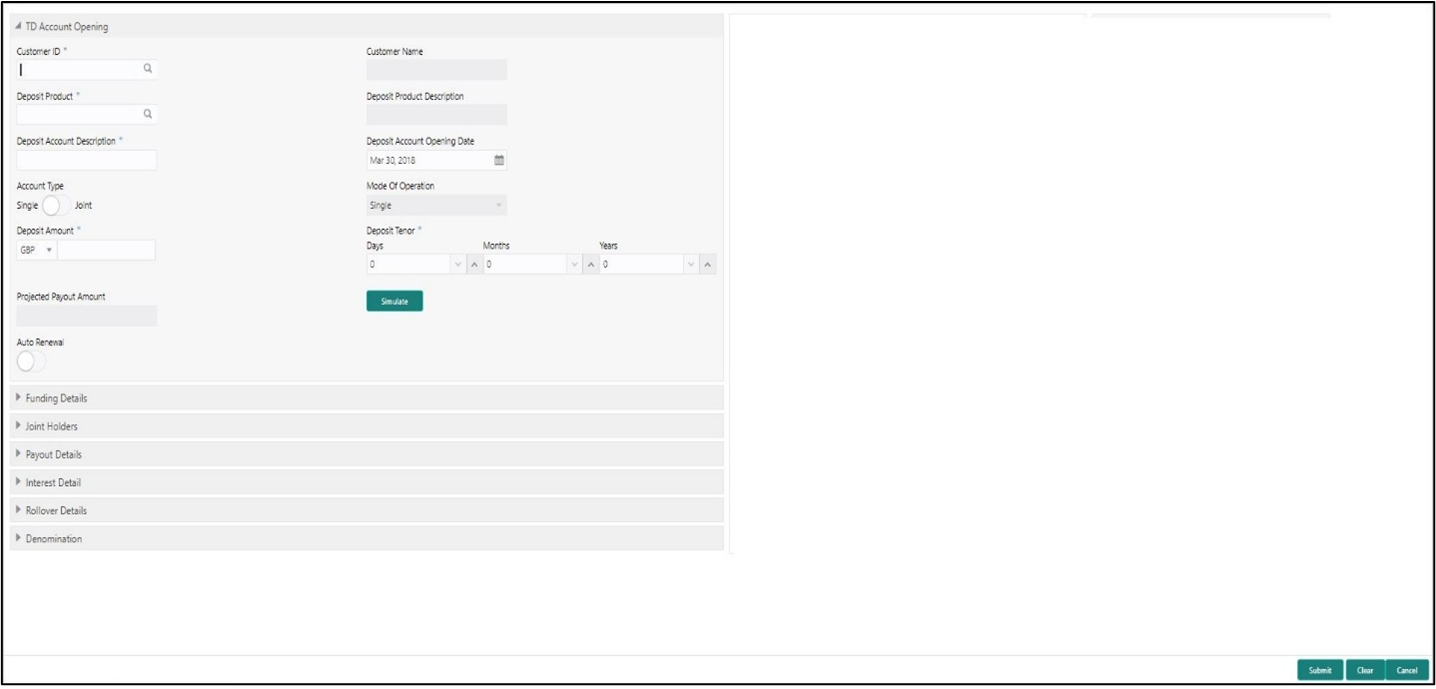

9.1 TD Account Opening

The Teller can use the TD Account Opening screen to open a term deposit account.

The following details are necessary to open a term deposit account:

-

Deposit details

-

Funding details

-

Joint Holder details

-

Payout details

-

Rollover details

To open a term deposit account:

- Add Funding Details

The Funding Details data segment is used to add the details of the pay-by option for the TD. - Add Joint Holders Details

The Joint Holders data segment is used to add the details of the joint holders for the TD. - Add Payout Details

The Payout Details data segment is used to add the details of the maturity payment for the TD. - Add Interest Details

The Interest Detail data segment is used to add the details of the interest for the TD. - Add Rollover Details

The Rollover Details data segment is used to add the parameters for auto-renewal of the TD account.

Parent topic: Term Deposit Transactions